- Home

- »

- Advanced Interior Materials

- »

-

Port Equipment Market Size & Share, Industry Report, 2030GVR Report cover

![Port Equipment Market Size, Share & Trends Report]()

Port Equipment Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Operation (Conventional, Autonomous), By Power (Diesel, Electric, Hybrid), By Equipment Type (Heavy Forklifts, Reach Stackers, Container Handlers) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Port Equipment Market Size & Trends

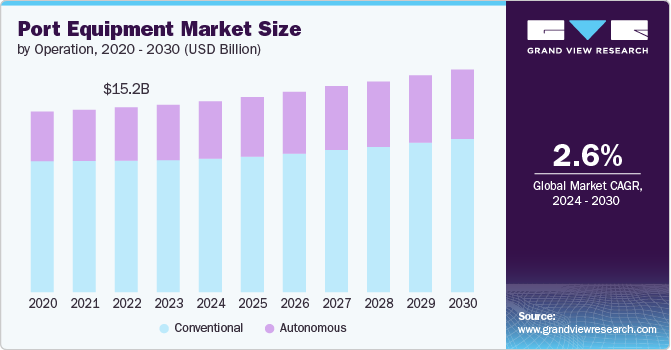

The global port equipment market size was estimated at USD 15.71 billion in 2024 and is projected to reach USD 19.00 billion by 2030, growing at a CAGR of 3.5% from 2025 to 2030. The exponential increase in global trade necessitates the expansion and efficiency of port operations.

Key Market Trends & Insights

- Asia Pacific region dominated the market and accounted for 38.2% in 2023.

- China port equipment market held a significant share in the Asia Pacific port equipment market.

- Based on operation, the conventional port equipment segment accounted for 71.3% of the global revenue share in 2024.

- Based on power, diesel power port equipment segment accounted for 63.7% of the global revenue share in 2024.

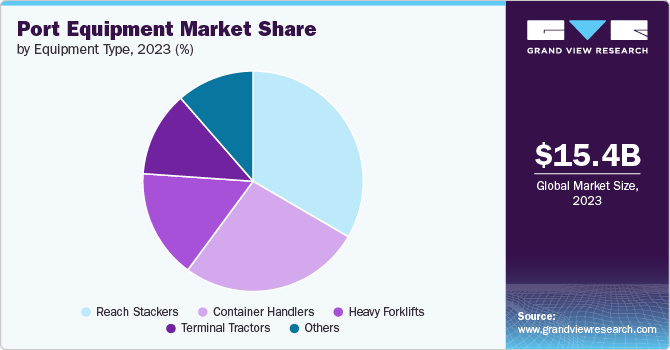

- Based on equipment type, the reach stackers segment accounted for 32.9% of the global revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.71 Billion

- 2030 Projected Market Size: USD 19.00 Billion

- CAGR (2025-2030): 3.5%

- Asia Pacific: Largest market in 2024

As international trade volumes grow, there is a pressing demand for modern, efficient, and automated port equipment to handle cargo with greater speed and accuracy. This development mandate ports to upgrade their equipment and infrastructure to remain competitive, driving the market for advanced handling machinery.

As international trade volumes grow, there is a pressing demand for modern, efficient, and automated port equipment to handle cargo with greater speed and accuracy. This development mandate ports to upgrade their equipment and infrastructure to remain competitive, driving the market for advanced handling machinery. Furthermore, surge in maritime traffic and the consequent need for environmental sustainability within port operations is expected to drive the port equipment market. Ports worldwide are increasingly investing in “green” equipment that reduces emissions and energy consumption to comply with international environmental regulations and standards. This shift towards sustainability is not only a response to regulatory pressures but also to growing environmental awareness and the demand for cleaner operations in the maritime industry. This trend is fueling the demand for electric and hybrid equipment, leading to innovation and growth in the port equipment market.

The technological advancements are significantly propelling the port equipment market. Innovations such as automation, electrification, and digitalization enhance operational efficiency, safety, and sustainability in port operations. Automated equipment reduces human error and workforce costs, while electrification helps ports reduce carbon footprints, aligning with global environmental goals. Furthermore, digitalization, through the Internet of Things (IoT) and blockchain, improves logistics, tracking, and management of cargo, ensuring smoother and faster operations. These advancements meet the increasing demands for cargo handling capacity and efficiency, thus driving market growth.

Market Concentration & Characteristics

The port equipment market exhibits a moderately fragmented competitive landscape, characterized by a blend of established global manufacturers and emerging regional players. Leading companies such as Konecranes, Cargotec (Kalmar), Liebherr Group, ZPMC, and Hyster-Yale Group maintain strong positions through comprehensive product portfolios and extensive international operations. At the same time, regional and local manufacturers play a crucial role by catering to country-specific operational needs and ensuring compliance with local safety and environmental standards.

Market growth is largely driven by increasing global trade volumes, the expansion and modernization of port infrastructure, and stricter regulatory requirements aimed at improving operational efficiency and environmental sustainability. Governments and port authorities are increasingly mandating the adoption of cleaner, more efficient port handling systems, including electrified and automated equipment, thereby stimulating demand and innovation.

Technological advancements are a major force shaping the port equipment market. Innovations such as automated guided vehicles (AGVs), remote-controlled cranes, electrification of equipment, and integration of IoT and data analytics are significantly enhancing operational efficiency, safety, and environmental performance. These technologies allow port operators to optimize throughput, reduce emissions, and improve adaptability to fluctuating cargo volumes.

Regionally, Asia Pacific holds a dominant share of the port equipment market, driven by heavy investment in port expansion and modernization in economies such as China, India, and Southeast Asia. Europe follows with a focus on automation and green port initiatives aligned with sustainability goals. North America also contributes significantly, supported by infrastructure renewal efforts and a growing emphasis on decarbonizing port operations.

Drivers, Opportunities & Restraints

The increase in public-private partnerships, along with enhanced legal frameworks, is significantly propelling the port equipment market forward. These collaborations leverage both public oversight and private sector efficiencies, enabling rapid infrastructure development and modernization. This synergy between the public and private sectors, underpinned by strong legal frameworks, is setting the stage for a thriving market in port equipment.

However, the port equipment market is constrained by several factors. High initial investment and maintenance costs limit market entry and expansion, as acquiring advanced machinery requires substantial financial resources. Moreover, stringent environmental regulations and policies governing emissions and operations pose compliance challenges, slowing down implementation of new technologies. In addition, the market faces limitations due to the dependency on global trade volumes; any downturn in global trade can negatively impact demand for port equipment, further restraining market growth.

The global port equipment market is positioned for significant growth, driven by increasing global trade, the expansion of port infrastructure, and the rising adoption of automated technologies for efficient cargo handling. These factors collectively create opportunities for manufacturers and service providers in selling advanced equipment and offering maintenance services. Moreover, the push towards sustainability and the electrification of port machinery further opens avenues for innovation and market expansion in this sector.

Operation Insights

The conventional port equipment segment led the market and accounted for 71.3% of the global revenue share in 2024, due to its long-standing reliability, wide availability, and comprehensive service networks. These systems have been a backbone for port operations, proving their effectiveness in handling cargo efficiently. Moreover, many ports are established with these systems integrated, making the transition to newer technologies significant in terms of both cost and operational downtime, thereby favoring the continued preference for conventional equipment.

The autonomous port equipment market is witnessing high demand driven by its high efficiency and reliability. The autonomous port equipment market is revolutionizing global trade and logistics. By introducing self-operating machinery, like autonomous cranes and vehicles, ports are becoming more efficient, reducing loading and unloading times dramatically. This leads to lower operational costs and enhanced safety, as the risk of human error is minimized. The integration of such technology ensures that ports can handle the increasing global trade volume, contributing to more streamlined and sustainable supply chains.

Power Insights

Diesel power port equipment segment accounted for 63.7% of the global port equipment market revenue share in 2024. Diesel-powered port equipment dominates the market due to its robust performance and reliability. These equipment offer superior torque and efficiency, especially under heavy loads and constant use, which is typical in port operations. In addition, diesel engines have a longer lifespan compared to their electric counterparts and are often favored for their ease of fueling and maintenance.

Electrically powered port equipment in global port equipment plays a crucial role in the loading and unloading of cargo. The significance of electrically powered port equipment lies in its contribution to enhancing operational efficiency and reducing environmental impact. By replacing traditional diesel-powered machinery, electric options substantially lower greenhouse gas emissions and air pollutants. This shift not only improves air quality for communities surrounding ports but also aligns with global sustainability goals. Furthermore, electric equipment tends to have lower operating costs, and low maintenance requirement and can increase the throughput of cargo handling, making ports more competitive and efficient.

Equipment Type Insights

The reach stackers equipment type segment accounted for 32.9% of the global port equipment market revenue share in 2024. Reach stackers play a crucial role in global port equipment by providing an efficient and flexible solution for container handling and storage. They are vital for logistics operations, allowing ports to maximize space utilization and improve cargo flow. Their ability to stack containers in various configurations, coupled with their mobility, speed, and versatility, significantly enhances productivity. This makes reach stackers indispensable for meeting the burgeoning demands of international trade and cargo movement, ensuring ports operate smoothly and efficiently.

The terminal tractors port equipment are widely employed in high volume cargo handling requirements. Terminal tractors play a critical role in port operations, serving as the backbone for efficient cargo movement. They are primarily used for moving cargo containers quickly between ship-to-shore cranes and container storage or for loading onto trucks and trains. This specialized equipment significantly reduces handling times, increasing overall profitability of port. Their robust design and maneuverability enable the safe and rapid transportation of heavy loads, making them indispensable in the smooth functioning of port logistics and supply chain continuity.

Regional Insights

The North American port equipment market is experiencing a shift towards automation and sustainability. Ports are increasingly adopting electric and hybrid equipment to meet environmental regulations and improve operational efficiency. Automation technologies, such as automated guided vehicles (AGVs) and remote-controlled cranes, are being implemented to handle growing cargo volumes and reduce labor costs.

U.S. Port Equipment Market Trends

The port equipment market in the U.S. is expected to grow at a CAGR of 3.2% from 2025 to 2030. In the U.S., port operators are investing in automation to address supply chain challenges and improve throughput. Technologies such as RFID, barcode readers, and automated cranes are being deployed to streamline cargo handling. Despite high implementation costs and labor concerns, automation is seen as essential for maintaining competitiveness and meeting future demand.

The port equipment market in Canada is expected to grow at a CAGR of 4.7% from 2025 to 2030. Canadian ports are focusing on sustainability and modernization to enhance their global competitiveness. Investments are being made in green technologies, including electric cranes and hybrid vehicles, to reduce carbon emissions. Digital solutions for cargo tracking and predictive maintenance are being adopted to improve efficiency.

Europe Port Equipment Market Trends

European ports are emphasizing sustainability and digital transformation. The adoption of electric and hybrid equipment is accelerating to meet stringent environmental regulations. Smart port technologies, including IoT integration and data analytics, are being implemented to optimize operations and reduce emissions. Public-private partnerships and EU-funded projects are supporting these advancements, aiming to position European ports as leaders in sustainable logistics.

Germany's port equipment market held 8.0% share in the European market. Germany's ports are investing in automation and digitalization to enhance efficiency and competitiveness. Automated cranes, AGVs, and digital twin technologies are being deployed to streamline operations. Sustainability is a key focus, with investments in electric and hybrid equipment to reduce carbon emissions. Germany's strong industrial base and technological expertise are driving innovation in port equipment.

The port equipment market in UK is driven by rising investments in automation and digital technologies which are improving efficiency and reducing costs. The adoption of electric and hybrid equipment is aligned with the UK's commitment to reducing carbon emissions. Moreover, Brexit has prompted ports to enhance infrastructure and streamline operations to maintain competitiveness in global trade.

Asia Pacific Port Equipment Market Trends

Asia Pacific region dominated the market and accounted for 38.2% of the global port equipment market. The region is at the forefront of port equipment innovation, driven by rapid urbanization and trade growth. Countries are investing heavily in automation, with ports implementing AGVs, automated cranes, and digital twin technologies to enhance operational efficiency. Sustainability is a key focus, with a shift towards electric and hybrid equipment to comply with environmental standards.

China port equipment market held a significant share in the Asia Pacific port equipment market. China continues to lead in port automation, with major ports adopting advanced technologies to handle increasing trade volumes. Investments in automated container terminals and smart port solutions are enhancing efficiency and reducing labor costs. The government's focus on green development is driving the adoption of electric and hybrid equipment.

The port equipment market in India is expected to grow at a CAGR of 5.7% from 2025 to 2030. India is undergoing significant port modernization, with a focus on infrastructure development and technological adoption. The Sagarmala project is facilitating the construction and upgrade of ports, aiming to improve connectivity and capacity. Automation and digitalization are being introduced to enhance efficiency, while sustainability initiatives are promoting the use of eco-friendly equipment.

Middle East & Africa Port Equipment Market Trends

Ports in the Middle East & Africa are investing in modernization to enhance capacity and efficiency. Automation technologies are being introduced to streamline operations and reduce labor costs. Sustainability is a focus, with investments in electric and hybrid equipment to meet environmental standards. Strategic location and infrastructure development are positioning the region as a key logistics hub connecting global trade routes.

Saudi Arabia is investing heavily in port infrastructure to diversify its economy and enhance trade capabilities. Automation and digital technologies are being adopted to improve efficiency and reduce costs. Sustainability initiatives are promoting the use of electric and hybrid equipment to align with environmental goals. The development of smart ports and logistics hubs is positioning Saudi Arabia as a central player in regional and global trade.

Latin America Port Equipment Market Trends

Latin American ports are investing in modernization to handle increasing trade volumes and improve efficiency. Automation technologies, such as automated cranes and AGVs, are being introduced to streamline operations. Sustainability initiatives are promoting the use of electric and hybrid equipment to reduce environmental impact. Government policies and international partnerships are supporting these advancements, aiming to enhance the region's position in global logistics.

Brazil's ports are focusing on infrastructure development and technological adoption to improve efficiency and competitiveness. Investments in automation and digitalization are enhancing cargo handling processes. Sustainability is a growing concern, with initiatives promoting the use of eco-friendly equipment. Public-private partnerships are facilitating modernization efforts, aiming to position Brazil as a key player in Latin American logistics.

Key Port Equipment Company Insights

Some of the key players operating in the market include Konecranes, Emerson Electric Co., and Liebherr Group among others.

-

Konecranes is a provider of lifting equipment and solutions, offering a wide range of port equipment for various applications. The company's focus on innovation and advanced technology has solidified its position in the market. Konecranes' port equipment is known for its high performance, reliability, and energy efficiency.

-

Liebherr Group is a prominent player in the port equipment market, known for its high-quality cranes and material handling equipment. The company's products are widely used in container handling, bulk handling, and ship handling applications for efficient and reliable cargo handling.

Anhui Heli Co. Ltd., Hyster-Yale Materials Handling Inc, and Sany Heavy Industry Co. Ltd. are some of the emerging market participants in the global port equipment market.

-

SANY Group specializes in providing high-performance port equipment for various industrial applications. The company's focus on quality and advanced technology has driven its market growth.

-

Hyster-Yale Materials Handling, Inc. is a major player in the port equipment market, offering a wide range of forklift trucks and material handling equipment for efficient and reliable cargo handling. The company's emphasis on innovation and customer-centric solutions has strengthened its position in the market.

Key Port Equipment Companies:

The following are the leading companies in the port equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Kalmar

- Liebherr Group

- Konecranes Abp

- Sany Heavy Industry Co. Ltd.

- Shanghai Zhenhua Heavy Industries

- Emerson Electric Co.

- Toyota Material Handling

- Cargotec Corporation

- Anhui Heli Co. Ltd.

- Gaussin Group

- CVS FERRARI

- LONKING HOLDINGS LIMITED

- AMERICAN CRANE AND EQUIPMENT

- ABB

- SIEMENS AG

Recent Developments

-

In March 2024, Konecranes launched a new series of advanced cranes featuring enhanced performance and energy efficiency for container handling and bulk handling applications.

-

In January 2024, Liebherr Group introduced a new range of automated port equipment with advanced features such as automated controls and improved operational efficiency to meet the demands of modern ports.

Port Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.96 billion

Revenue forecast in 2030

USD 19.00 billion

Growth rate

CAGR of 3.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Operation, equipment type, power, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Kalmar; Liebherr Group; Konecranes Abp; Sany Heavy Industry Co. Ltd.; Shanghai Zhenhua Heavy Industries; Emerson Electric Co.; Toyota Material Handling; Cargotec Corporation; Anhui Heli Co. Ltd.; Gaussin Group; CVS FERRARI; LONKING HOLDINGS LIMITED; AMERICAN CRANE EQUIPMENT; ABB; SIEMENS AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Port Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the port equipment market on the basis of operation, equipment type, power, and region:

-

Operation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional

-

Autonomous

-

- Power Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diesel

-

Electric

-

Hybrid

-

-

Equipment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Heavy Forklifts

-

Reach Stackers

-

Container Handlers

-

Terminal Tractors

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global port equipment market size was estimated at USD 15.71 billion in 2024 and is expected to reach USD 15.96 billion in 2025.

b. The global port equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.5% from 2025 to 2030 to reach USD 19.00 billion by 2030.

b. Asia Pacific dominated the port equipment market with a revenue share of 38.2% in 2024. The port equipment market in Asia Pacific is experiencing substantial growth due to increasing seaborne trade, growing economic development, and escalating demand for efficient cargo handling.

b. Some of the key players operating in the port equipment market include Kalmar, Liebherr Group, Konecranes Abp, Sany Heavy Industry Co. Ltd., Shanghai Zhenhua Heavy Industries, Emerson Electric Co., Toyota Material Handling, Cargotec Corporation, Anhui Heli Co. Ltd., Gaussin Group, CVS FERRARI, LONKING HOLDINGS LIMITED, AMERICAN CRANE EQUIPMENT, ABB, SIEMENS AG.

b. The demand for port equipment market is attributed to the increasing global trade activities, growing investments in port infrastructure development and modernization projects worldwide, and technological advancements in automation & electrification to enhance efficiency and reduce emissions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.