- Home

- »

- Consumer F&B

- »

-

Pork Meat Market Size And Share, Industry Report, 2030GVR Report cover

![Pork Meat Market Size, Share & Trends Report]()

Pork Meat Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Chilled Pork Meat, Frozen Pork Meat), By Distribution Channel (Specialty Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-498-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pork Meat Market Summary

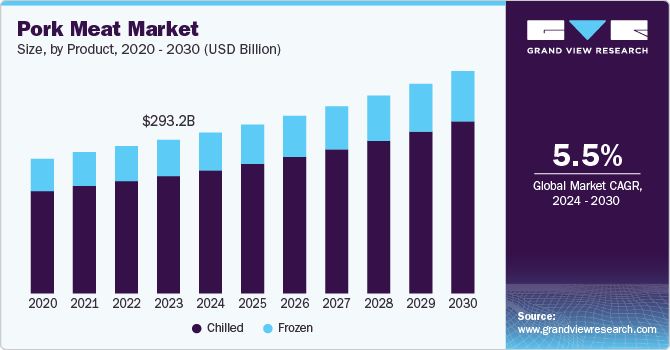

The global pork meat market size was estimated at USD 293.18 billion in 2023 and is projected to reach USD 424.44 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. One of the primary market drivers is the rising global demand for protein-rich foods. Pork, known for its balanced nutritional profile, is a significant protein source, particularly in regions where it is a dietary staple.

Key Market Trends & Insights

- Asia Pacific dominated the global pork market with a share of 45.0% in 2023.

- The U.S. pork meat market is expected to grow at a CAGR of 6.5% from 2024 to 2030.

- By product, fresh pork segment is expected to grow at a CAGR of 4.9% from 2024 to 2030.

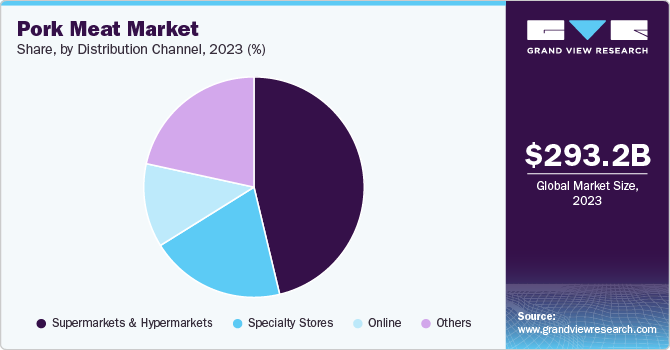

- By distribution, the supermarkets & hypermarkets segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 293.18 Billion

- 2030 Projected Market Size: USD 424.44 Billion

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

As populations grow and dietary habits evolve, more consumers are seeking affordable and accessible sources of protein, leading to increased pork consumption globally. This trend is particularly evident in developing regions where economic growth has enabled greater meat consumption.

The expansion of the retail sector has also played a crucial role in the pork meat industry’s growth. The convenience of packaged pork products has made them more appealing to consumers who prefer ready-to-eat meals or easy-to-cook options. The rise of supermarkets and hypermarkets has facilitated the availability of shrink-wrapped pork products, which are convenient and help maintain freshness. This shift towards packaged food aligns with broader consumer trends favoring convenience, thereby driving sales in the pork meat sector.

Another important factor influencing the market is the growing consumer awareness regarding health and nutrition. As consumers become more conscious of their dietary choices, demand for organic and lean meats has increased. This trend is partly driven by concerns over processed foods and their health implications. As a result, pork producers increasingly focus on organic offerings to cater to health-conscious consumers, thus expanding their market reach.

The food processing industry has experienced significant growth, positively impacting the demand for pork meat. Processed food products have become more diverse and appealing with food technology and logistics innovations. The increasing popularity of fast food and ready-to-eat meals has created new opportunities for pork suppliers as they adapt their offerings to meet changing consumer preferences. This evolution within the food industry supports sustained demand for pork meat as an ingredient in various processed foods.

The ongoing supply chain disruptions are one of the most pressing challenges for the market. Fluctuations in the global export market have led to instability in pricing and availability of pork products. These disruptions can result in low and unpredictable prices, complicating financial planning for producers and retailers. Despite strong consumer demand for pork, these supply chain issues hinder the ability to meet that demand consistently, which can lead to lost sales opportunities and reduced market confidence.

The rise of alternative protein sources presents another challenge for the market. Consumers increasingly explore plant-based proteins and other meat alternatives as they become more health-conscious and environmentally aware. The perception that these alternatives may be healthier or more sustainable can divert potential customers from traditional meat products like pork. This shift in consumer behavior requires the pork industry to adapt its marketing strategies to emphasize pork's nutritional benefits and versatility.

Product Insights

Fresh pork is expected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing consumer preference for fresh, high-quality meat products is a significant market driver. Many consumers associate fresh pork with superior taste and nutritional value to frozen alternatives. This trend is powerful in regions where culinary traditions emphasize using fresh ingredients. As health-conscious consumers seek fresh options, the demand for chilled pork continues to rise, supporting market growth.

Cultural factors significantly influence the demand for fresh pork. In many cultures, pork is a staple protein source, and deep-rooted culinary traditions emphasize its use in various dishes. As global culinary influences spread, there is a growing interest in diverse pork-based recipes that highlight its versatility. This cultural appreciation for fresh pork contributes to sustained demand as consumers seek authentic culinary experiences incorporating high-quality ingredients.

Frozen pork meats were the other significant product in the market. One of the primary drivers of the frozen pork market is the rising demand for convenience foods. As lifestyles become busier, consumers increasingly seek quick and easy meal solutions. Frozen pork products, which require minimal preparation time, cater to this need. The convenience factor particularly appeals to working professionals and families who may not have the time to cook from scratch. This trend towards convenience is expected to continue fueling market growth.

Frozen pork offers a significant advantage in terms of shelf life compared to fresh meat. Storing pork for extended periods without spoilage reduces food waste and allows consumers to stock up on essential items. This aspect is crucial in regions where access to fresh meat may be limited or where consumers prefer to buy in bulk. The longer shelf life of frozen products makes them a practical choice for many households, contributing to their increasing popularity. Economic conditions play a crucial role in market growth. Frozen pork is often more affordable than fresh alternatives, making it an attractive option for budget-conscious consumers. As disposable incomes rise in developing countries, more consumers can afford to purchase frozen meat products, further driving demand. The affordability of frozen pork compared to other protein sources positions it as a staple in many diets, especially in regions with significant middle-class populations.

Distribution Channel Insights

Supermarkets & hypermarkets have the highest revenue share in the distribution of pork meats and accounted for a market revenue of USD 135.71 billion in 2023. One of the primary drivers for pork meat sales in supermarkets and hypermarkets is the convenience they offer. These retail formats provide a one-stop shopping experience where consumers can find various pork products alongside other grocery items. This accessibility encourages consumers to purchase pork as part of their regular shopping routine, making it easier to include in their diets. Well-organized meat sections in these stores also enhance the shopping experience, allowing customers to select from fresh, frozen, and processed pork options. Supermarkets and hypermarkets often feature diverse pork products, including fresh cuts, processed meats, and specialty items. This variety caters to different consumer tastes and dietary preferences, driving sales. Retailers are also increasingly introducing innovative products, such as marinated or pre-seasoned pork cuts, which appeal to busy consumers seeking quick meal solutions. For instance, the introduction of dry-aged pork products has been noted as a way to attract consumers looking for premium quality. Such innovations help maintain consumer interest and encourage repeat purchases.

Specialty stores were an essential part of the distribution channel for pork meat. Specialty stores often emphasize the quality and freshness of their products, which is a significant draw for consumers seeking premium meat options. These stores typically source pork from local farms or trusted suppliers, ensuring the meat is fresh and high-quality. This focus on quality appeals to health-conscious consumers who prioritize fresh ingredients in their diets, driving sales through specialty retail channels. Specialty stores frequently provide unique and diverse pork products that may not be available in larger supermarkets or hypermarkets. This includes specialty cuts, organic options, and artisanal products such as cured meats and sausages. The availability of such niche products attracts consumers looking for specific tastes or dietary preferences, enhancing the appeal of shopping at specialty stores.

Online sales of pork meats are expected to grow at a CAGR of 8.9% from 2024 to 2030. One of the primary drivers for online sales of pork meat is the convenience it offers consumers. With busy lifestyles, many individuals prefer to shop for groceries from home, avoiding visiting physical stores. Online platforms allow consumers to browse various pork products, compare prices, and make purchases with just a few clicks. This ease of access significantly enhances the appeal of buying pork online, particularly for those with limited time or mobility.

Health and safety concerns have become increasingly important for consumers, especially in light of recent global health events. Online retailers often emphasize their commitment to hygiene and safety standards in food handling and packaging. Many consumers feel more secure purchasing meat products online from retailers that provide clear information about sourcing, handling practices, and product quality. This focus on health can enhance consumer trust and encourage them to choose online shopping for pork meat. Promotions and discounts are effective strategies used by online retailers to boost sales of pork meat products. Many e-commerce platforms offer special deals, loyalty programs, or bulk purchase discounts, incentivizing consumers to buy more. These financial incentives can encourage shoppers to try new products or stock up on favorites, driving overall sales online.

Regional Insights

The North America pork meat market was USD 51.81 billion in 2023 and is expected to grow at a CAGR of 6.2% over the forecast period. Advancements in pork production techniques have significantly improved efficiency and quality. Innovations such as better breeding practices, enhanced feed formulations, and advanced processing technologies have increased productivity and reduced costs. These improvements ensure a steady pork supply and improve the meat's overall quality, making it more appealing to consumers. There is a growing awareness among consumers regarding health and nutrition, which has positively impacted the pork market. Pork is recognized for its high protein content and essential vitamins and minerals, making it an attractive option for health-conscious individuals. As consumers seek balanced diets with lean protein sources, pork has remained a favorable choice within the broader meat market.

U.S. Pork Meat Market Trends

The pork meat market in the U.S. is expected to grow at a CAGR of 6.5% from 2024 to 2030. The increasing awareness of the health benefits associated with animal protein consumption is a significant driver of pork meat sales in the U.S. Consumers are gravitating towards high-protein diets, including ketogenic and paleo diets, which emphasize the inclusion of meats like pork. This shift in dietary preferences has led to a consistent demand for pork products as consumers seek nutritious and satisfying meal options. There is a growing trend towards convenience in food consumption, with many consumers opting for ready-to-cook and processed pork products. The popularity of pre-marinated pork cuts, sausages, and other value-added products has increased significantly. These products cater to busy lifestyles, allowing consumers to prepare meals quickly without sacrificing quality or flavor. The convenience factor particularly appeals to working families and individuals seeking efficient meal solutions.

Asia Pacific Pork Meat Market Trends

The pork meat market in Asia Pacific accounted for approximately 45% of the global market in 2023. Across Asia, consumers have a growing awareness of health and nutrition. Pork is recognized for its high protein content and essential vitamins, making it an attractive option for health-conscious individuals. This trend is particularly evident among fitness enthusiasts who incorporate lean cuts of pork into their diets to support muscle building and overall health1. As consumers become more educated about nutritional benefits, the demand for quality pork products rises. The food service industry is crucial in driving pork consumption across Asia. With an increase in dining out and the popularity of fast-casual restaurants, there is a higher demand for pork dishes. This trend is particularly strong in countries like China and Japan, where restaurants frequently feature pork-based dishes. The tourism sector also contributes to this demand as international visitors seek local culinary experiences that often include traditional pork dishes.

China pork meat market dominated the market in 2023, as they are the largest consumer of pork in the world, with per capita consumption reaching approximately 25 kg in 2023. The country's deep-rooted culinary traditions heavily feature pork, making it a staple protein source. In addition, rising disposable incomes and urbanization have increased the demand for animal protein, including pork. The growing middle class in China is willing to spend more on quality meat products, further driving consumption. The trend towards convenience and processed pork products is also notable, as busy lifestyles lead consumers to seek ready-to-cook options.

Key Pork Meat Company Insights

Several key players operate on both national and international levels. These companies leverage vertical integration, innovation, sustainability initiatives, and strategic acquisitions to navigate a competitive environment while meeting evolving consumer demands for quality pork products.

Key Pork Meat Companies:

The following are the leading companies in the pork meat market. These companies collectively hold the largest market share and dictate industry trends.

- Smithfield Foods, Inc.

- Tyson Foods, Inc.

- JBS S.A.

- WH Group Limited

- Hormel Foods Corporation

- Cargill, Incorporated

- Marfrig Global Foods S.A.

- Clemens Food Group

- BRF S.A. (Sadia)

- Sysco Corporation

- Johnsonville LLC

- Minerva Foods S.A.

- NH Foods Ltd.

Pork Meat Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 306.98 billion

Revenue forecast in 2030

USD 424.44 billion

Growth rate (revenue)

CAGR of 5.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Smithfield Foods, Inc.; Tyson Foods, Inc.; JBS S.A.; WH Group Limited; Hormel Foods Corporation; Cargill, Incorporated; Marfrig Global Foods S.A.; Clemens Food Group; BRF S.A. (Sadia); Sysco Corporation; Johnsonville LLC; Minerva Foods S.A.; NH Foods Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pork Meat Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pork meat market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chilled Pork Meat

-

Frozen Pork Meat

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. One of the primary drivers of the pork meat market's growth is the rising global demand for protein-rich foods. Pork, known for its balanced nutritional profile, is a significant protein source, particularly in regions where it is a dietary staple. As populations grow and dietary habits evolve, more consumers are seeking affordable and accessible sources of protein, leading to increased pork consumption globally. This trend is particularly evident in developing regions where economic growth has enabled greater meat consumption.

b. The global pork meat market was valued at USD 293.18 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030.

b. The global pork meat market was valued at USD 293.18 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030.

b. Fresh pork is expected to grow at a CAGR of 4.9% from 2024 to 2030. The increasing consumer preference for fresh, high-quality meat products is a significant driver of the fresh pork market. Many consumers associate fresh pork with superior taste and nutritional value to frozen alternatives. This trend is powerful in regions where culinary traditions emphasize using fresh ingredients. As health-conscious consumers seek out fresh options, the demand for chilled pork continues to rise, supporting market growth.

b. Some key players operating in the pork meat market include Smithfield Foods, Inc.; Tyson Foods, Inc.; JBS S.A.; WH Group Limited; Hormel Foods Corporation; Cargill, Incorporated; Marfrig Global Foods S.A.; Clemens Food Group; BRF S.A. (Sadia); Sysco Corporation; Johnsonville LLC; Minerva Foods S.A.; NH Foods Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.