- Home

- »

- Consumer F&B

- »

-

Popping Boba Market Size And Share, Industry Report, 2030GVR Report cover

![Popping Boba Market Size, Share & Trends Report]()

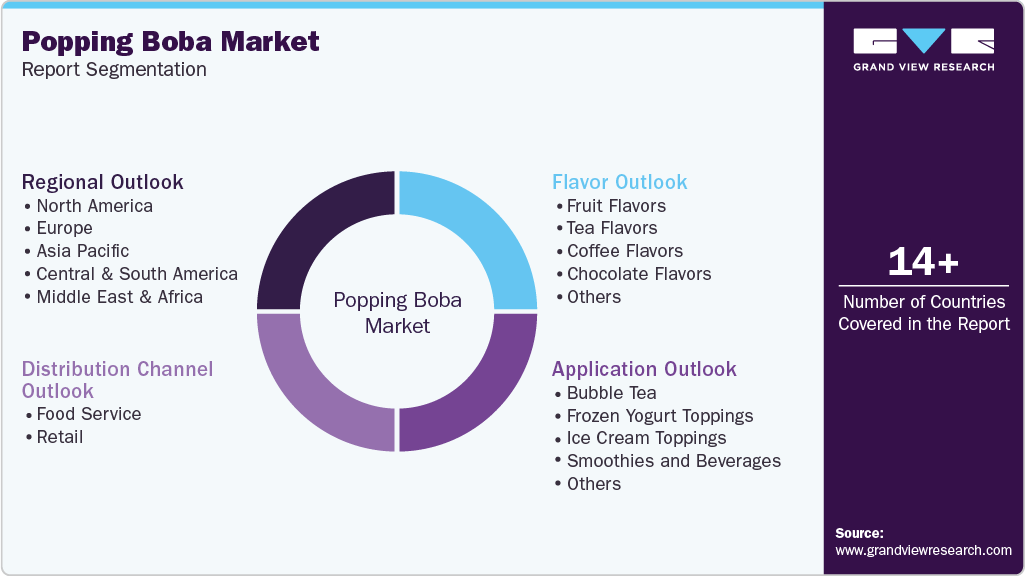

Popping Boba Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Fruit Flavors, Tea Flavors), By Application (Bubble Tea, Frozen Yogurt Toppings), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-394-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Popping Boba Market Summary

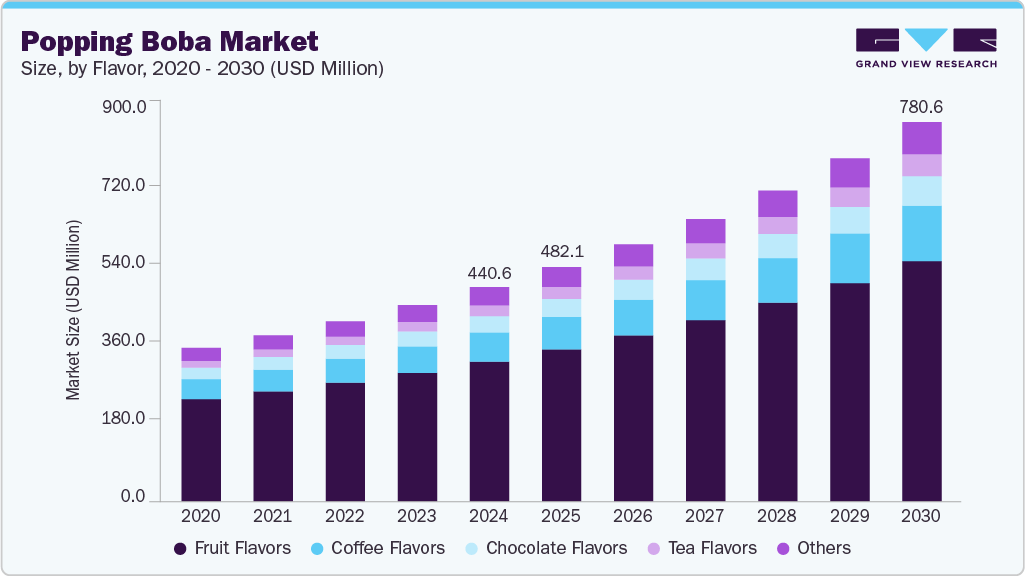

The global popping boba market size was estimated at USD 440.6 million in 2024 and is projected to reach USD 780.6 million by 2030, growing at a CAGR of 10.1% from 2025 to 2030. Popping boba, also known as tapioca pearls, are translucent spheres filled with fruit juice or other flavors that burst upon consumption, adding a textural and sensory element to drinks.

Key Market Trends & Insights

- The Asia Pacific popping boba market held the largest revenue share of 41.2% in 2024.

- The popping boba industry in China accounted for the largest market revenue share of 24.7% in the Asia Pacific in 2024.

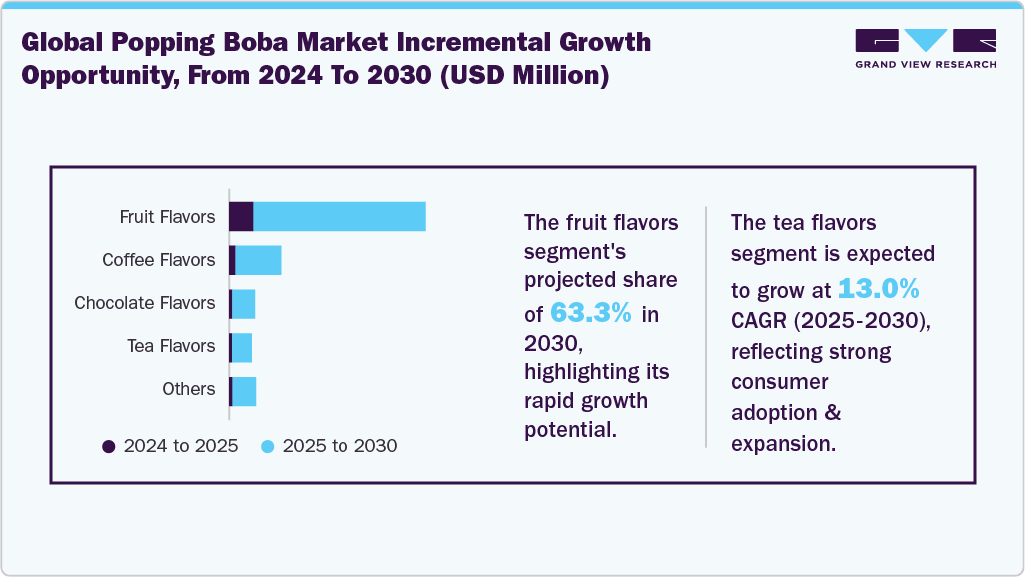

- By flavor, the fruit flavors segment led the market with the largest revenue share of 65.2% in 2024.

- The tea flavors segment is expected to grow at the fastest CAGR of 13.0% from 2025 to 2030.

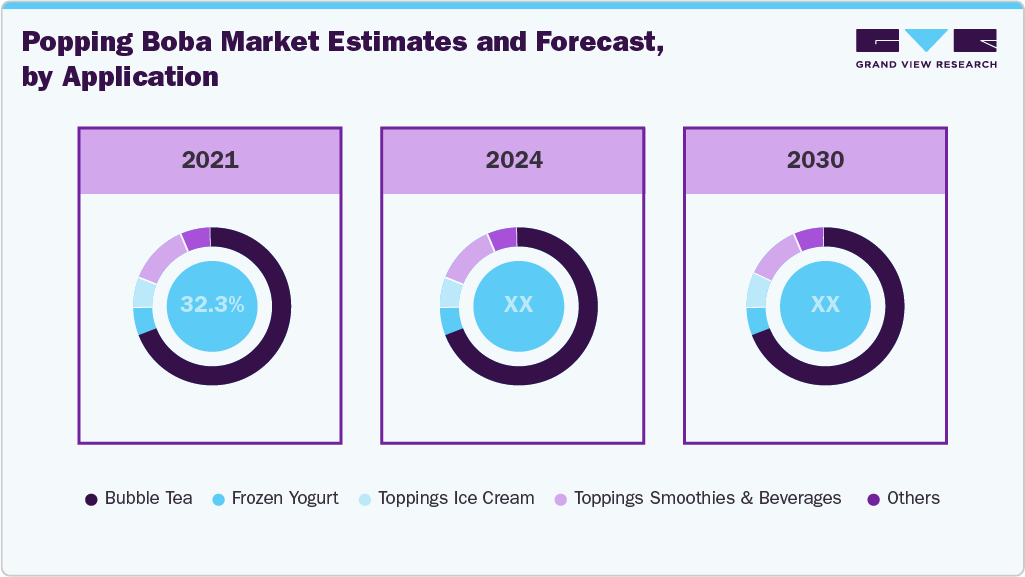

- By application, the bubble tea segment led the market with the largest revenue share of 70.1% in 2024.

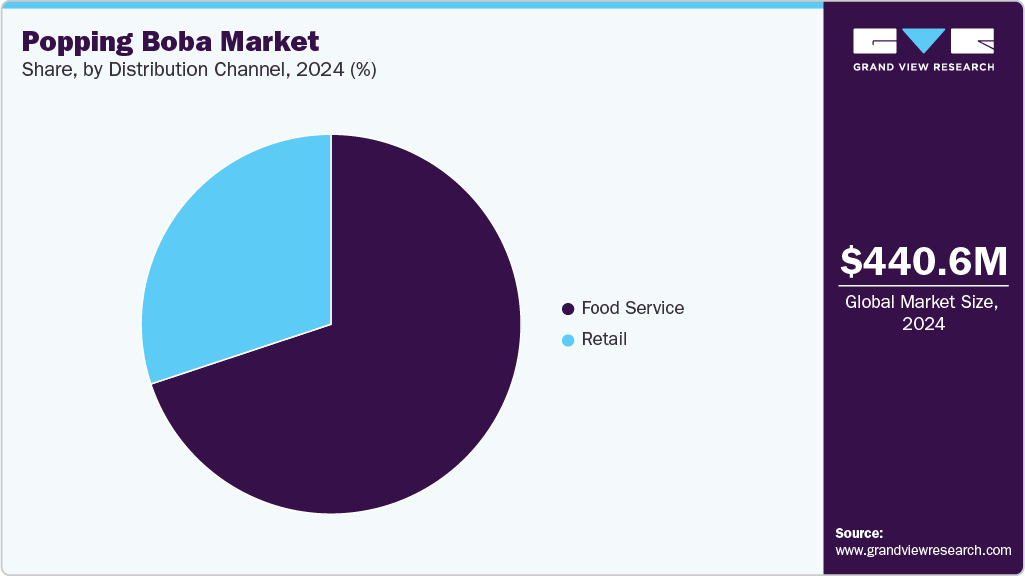

- By distribution channel, the food service segment led the market with the largest revenue share of 69.9% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 440.6 Million

- 2030 Projected Market Size: USD 780.6 Million

- CAGR (2025-2030): 10.1%

- Asia Pacific: Largest market in 2024

- Central & South America: Fastest growing market

Its popularity has gained momentum in the food and beverage industry, particularly among younger consumers seeking experiential eating and drinking options. The popularity of popping boba is enhanced by the influence of social media platforms, where visually appealing food and drink items are extensively shared and popularized, thereby fueling interest in and consumption of products, including popping boba. Popping boba, a gluten-free, low-calorie, and vegan option, appeals to health-conscious consumers. Moreover, the demand for exotic flavors and textures has fueled the growth of popping boba varieties, including fruit-flavored, tea-infused, and alcoholic options. Restaurants, cafes, and dessert shops incorporate popping boba into their menus to meet the growing demand for innovative and flavorful offerings. In addition, supermarkets and convenience stores are experiencing a surge in sales as consumers seek convenient and affordable ways to enjoy popping boba at home.The expanding popularity of bubble tea across developed and emerging regions has significantly boosted the use of popping boba as a key ingredient in beverages and desserts. Flavor diversification, product innovation, and wider retail and e-commerce availability have further supported market expansion. Increasing disposable incomes, urban lifestyles, and the trend toward visually appealing, social media–friendly foods also fuel demand for popping boba worldwide.

The rising popularity of Asian-inspired cuisine and beverages, particularly in Western markets, has significantly contributed to the market growth. Social media trends also play a crucial role, with aesthetically pleasing drinks featuring popping boba becoming viral sensations. The vibrant colors and playful nature of these beverages make them ideal for photo-sharing platforms, further driving consumer interest and demand. Brands have responded to the demand for innovative, healthy, and ethically sourced ingredients by introducing various flavors, including tropical fruits, exotic blends, and savory varieties.

Technological advancements also enhance the popping boba experience. Automated boba machines that precisely control the size and consistency of the popping boba streamline the production and ensure consistent quality. Furthermore, online platforms facilitate the purchase and delivery of popping boba, making it accessible to a wider audience. The future of popping boba is bright, with ongoing innovation and growing demand for unique and customizable beverage experiences poised to propel the market to new heights.

Consumer Insights

Globally, consumers are increasingly gravitating toward interactive and customizable beverages, with popping boba enhancing the sensory and visual appeal of drinks and desserts. Its burst-in-mouth texture and vibrant colors make it popular in bubble tea, smoothies, yogurt drinks, and other specialty beverages. Social media influence and the rising café culture have contributed to global awareness and trial, while retail availability has enabled at-home consumption, further promoting its adoption across diverse markets.

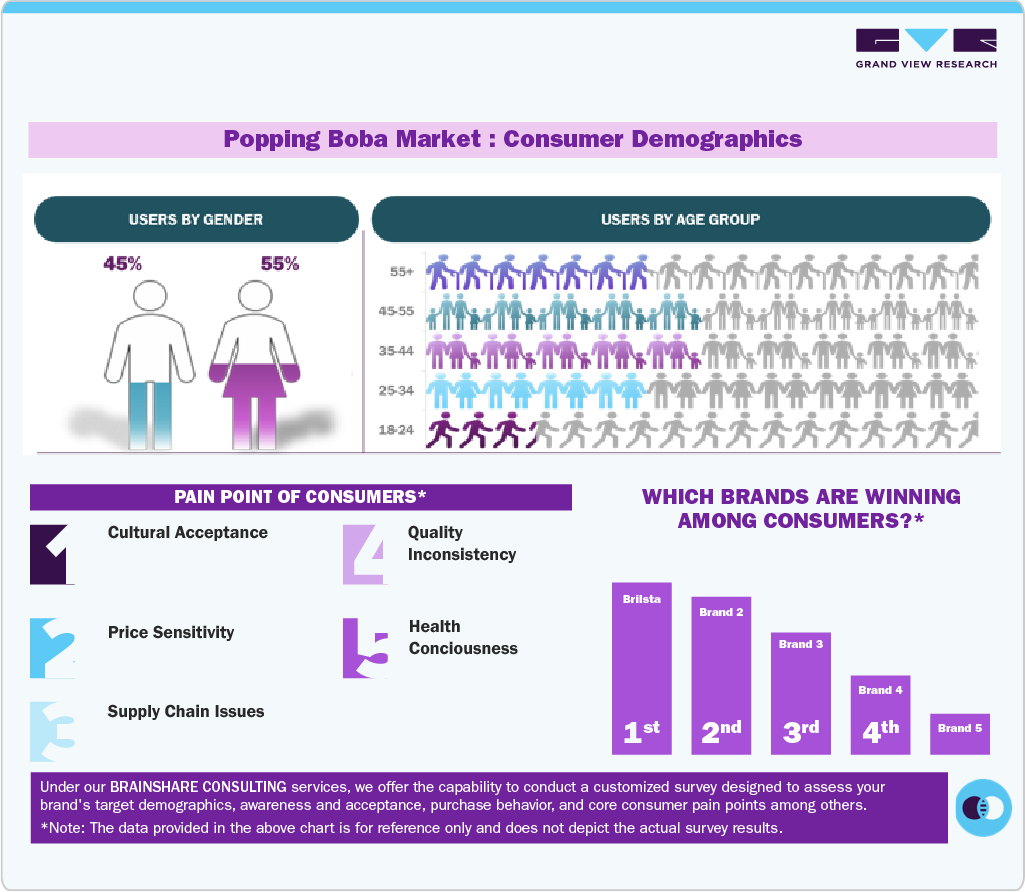

Popping boba primarily appeals to young consumers, including teenagers and adults in their twenties and thirties, who seek novel, interactive, and visually engaging beverage experiences. Female consumers dominate the market, showing higher consumption rates than males and actively experimenting with different flavors and textures. Urban centers are also witnessing rising adoption, supported by bubble tea cafés, juice bars, and specialty retail outlets, while suburban areas are catching up through packaged products and online availability. The influence of social media, experiential marketing, and the desire for customizable drinks have made female consumers particularly responsive to trends, fostering ongoing growth in both foodservice and retail channels worldwide.

Flavor Insights

The fruit flavors segment led the market with the largest revenue share of 65.2% in 2024. The growth of this segment is driven by increasing consumer preference for natural, refreshing, and health-oriented flavor options in beverages and desserts. Fruit-flavored popping boba has emerged as a prominent category, capturing the attention of health-conscious consumers and younger demographics seeking novelty in the foods and beverages. In this segment, the popularity of flavors such as mango, strawberry, green apple, and passionfruit has surged, primarily owing to their naturally refreshing taste profiles and versatility across various culinary applications. These flavors appeal to consumers' palates and align with current health trends, emphasizing the use of real fruit ingredients and natural flavors. By incorporating these elements, manufacturers have effectively marketed their products as delightful yet guilt-free indulgences, leading to sustained demand within the market.

The tea flavors segment is projected to grow at the fastest CAGR of 13.0% over the forecast period. The segment has gained substantial traction, driven by the rising popularity of tea-based beverages such as bubble tea, milk tea, and fruit tea blends. Consumers increasingly seek refreshing, flavorful, and customizable drinks, making tea-flavored popping boba a preferred choice in cafes and specialty beverage outlets. This segment benefits from the versatility of tea bases such as green, black, oolong, and herbal, which can be paired with various toppings, enhancing taste experiences and visual appeal. In addition, health-conscious trends promoting natural antioxidants in tea are further expected to boost consumer interest and contribute to the steady growth of this segment over the coming years.

The coffee flavors segment is anticipated to witness at a significant CAGR during the forecast period, driven by evolving consumer preferences and trends toward unique and indulgent experiences. As more consumers seek novel culinary experiences, the demand for coffee-flavored popping boba has surged, becoming a popular addition to beverages such as bubble tea, smoothies, and desserts. This trend can be attributed to the growing affinity for coffee culture among younger demographics, particularly millennials and Gen Z, who are not only regular coffee drinkers but also adventurous eaters. These consumers are drawn to innovative flavor combinations that add excitement and a fun sensory experience to their drinks, thereby fostering a burgeoning market for coffee-flavored popping boba that caters to both their caffeine cravings and their desire for creativity.

Application Insights

The bubble tea segment led the market with the largest revenue share of 70.1% in 2024. This growth is driven by the rising popularity of customizable beverages and innovative textures among younger consumers. The demand for bubble tea has surged among consumers owing to its unique texture and wide range of flavors. Moreover, the increasing interest in innovative beverage experiences has encouraged businesses to experiment with diverse flavor combinations and toppings, thereby driving the adoption of popping boba in bubble tea formulations. This trend is also reflected in the growing number of brands emphasizing natural ingredients and alternatives, such as low-sugar or fruit-based boba, further contributing to market expansion. As consumer preferences shift toward more unique and refreshing beverage options, incorporating popping boba into smoothies and fruit teas reinforces its versatility and broad appeal.

The smoothies and beverages segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by rising consumer demand for innovative and customizable drink experiences. The versatility of popping boba plays a key role in expanding its use in smoothies and beverages. As consumers increasingly seek unique flavors and textures, popping boba made from natural ingredients, including fruit purees and organic sugars, has gained attention. Juice bars and smoothie shops experiment with novel combinations, incorporating superfoods such as acai or spirulina alongside popping boba to enhance flavor and nutritional appeal. This innovation aligns with current market trends, emphasizing cleaner-label products while still offering the indulgent, fun experience that popping boba provides.

Distribution Channel Insights

The food service segment led the market with the largest revenue share of 69.9% in 2024. This growth can be attributed to the increasing consumer demand for innovative and experimental dining options. As dining experiences become more adventurous and personalized, restaurants, cafés, and other food service establishments incorporate popping boba into their offerings, appealing to younger demographics and those seeking unique culinary experiences. This trend reflects a broader movement toward experiential dining, where novelty and sensory appeal are key in attracting customers. The vibrant colors and playful texture of popping boba enhance the visual appeal of beverages and desserts and provide a satisfying flavor, making them an ideal addition to diverse food service menus.

The retail segment is projected to grow at the fastest CAGR over the forecast period, driven by rising consumer preference for convenient and at-home beverage options. This segment benefits from the increasing accessibility of product through online shopping channels and the convenience of having a wide range of popping boba brands and flavors delivered directly to consumers' doorsteps. The online environment also allows for personalized recommendations, detailed product information, and consumer reviews, further influencing purchase decisions. Collaborations with Asian grocery brands and beverage manufacturers have become commonplace, allowing these retail giants to offer special promotions and exclusive products that cater to the tastes of local and multicultural communities.

Regional Insights

The North America popping boba market is expected to grow at a substantial CAGR over the forecast period, driven by a surge in the popularity of bubble tea and innovative dessert options. The North American market showcases a vibrant landscape characterized by innovation and regional preferences. As diverse culinary influences merge in the food and beverage sector, flavor experimentation has become a key trend, with brands introducing exotic fruit bursts and seasonal flavors that cater to local tastes. Moreover, regional variations in consumption patterns also influence market dynamics, with urban areas exhibiting higher demand due to greater exposure to food trends and a higher proportion of younger consumers.

Europe Popping Boba Market Trends

The popping boba market in Europe is expected to grow at a significant CAGR of 10.5% over the forecast period, with increasing consumer demand for unique, customizable, and visually appealing beverage experiences. Countries such as the UK, Germany, and France witness a rapid proliferation of bubble tea shops, with many establishments incorporating popping boba into their offerings. In Northern Europe, particularly in Scandinavian countries, there's a growing trend toward health consciousness and natural ingredients, leading to the emergence of popping boba products made from organic and sustainably sourced materials. The ability to maintain enjoyable flavors while promoting health has attracted health-conscious consumers and spurred innovation within the market, leading to a welter of product variations that cater to specific dietary needs, such as vegan or gluten-free options.

Asia Pacific Popping Boba Market Trends

Asia Pacific dominated the popping boba market with the largest revenue share of 41.2% in 2024, driven by the increasing popularity of bubble tea, particularly in countries such as Taiwan, China, and Japan, where bubble tea originated and quickly became a cultural phenomenon. The dynamics of the Asia Pacific market are also influenced by the burgeoning café culture, particularly in urban areas. Coffee shops and tea houses increasingly incorporate popping boba into their menus to differentiate themselves from competitors, leveraging the trend to attract a younger clientele. In May 2025, the Canadian coffee chain Tim Hortons launched its new Summer Poppers popping-boba beverages across India, marking a regional refreshment innovation using culturally inspired flavors, including Mosambi Litchi, Spicy Jamun, and Aam Panna.

The popping boba market in China accounted for the largest market revenue share of 24.7% in 2024, driven by the growing demand for innovative and customizable beverages among younger consumers. Rising popularity of bubble tea, smoothies, and specialty drinks has encouraged cafés and beverage brands to incorporate popping boba, offering novel flavors and textures. In addition, the expansion of online retail and food delivery platforms is making popping boba more accessible, while social media trends and influencer promotions fuel consumer interest. As a result, the market is witnessing rapid adoption of this product, focusing on flavor variety, creative combinations, and visually appealing product options.

The Taiwan popping boba market is witnessing an increasing demand for seasonal flavors and premium ingredients, which has encouraged many retailers to innovate and differentiate their products. For instance, incorporating fruit-based popping boba with unique fillings like mango, passion fruit, or even alcoholic variants has become increasingly common. The expansion of retail channels also plays a vital role in shaping the Taiwanese market. Traditional bubble tea shops and modern cafes are the primary venues for the sale of popping boba, but there has been a noticeable rise in e-commerce platforms that deliver these products directly to consumers.

Central & South America Popping Boba Market Trends

The popping boba market in Central & South America is expected to grow at the fastest CAGR of 12.1% over the forecast period, fueled by rising consumer interest in trendy and customizable beverages. Countries across the region are witnessing increased adoption of bubble tea, smoothies, and fruit-based drinks that incorporate popping boba for enhanced texture. Market expansion is supported by growing urbanization, café culture, and social media influence, highlighting visually appealing and innovative drink experiences. As a result, popping boba is gaining traction as a popular ingredient in foodservice and retail segments throughout the region.

The Brazil popping boba market is anticipated to grow at a notable CAGR during the forecast period, driven by strong consumer demand for innovative and visually appealing beverages. Bubble tea, smoothies, and fruit-based drinks featuring popping boba are gaining popularity among younger consumers who seek novel textures and flavors. The market is further supported by the expansion of café chains, increased retail availability, and social media trends that showcase unique and indulgent drink experiences. Collaborations with local fruit suppliers and flavor innovations are helping brands cater to Brazilian tastes, boosting adoption across urban and suburban areas.

Key Popping Boba Company Insights

The global popping boba industry is characterized by intense competition. Key players in the market are actively introducing new products and offering diverse flavors and combinations that enhance the sensory experience and cater to the evolving preferences of consumers. Moreover, strategic partnerships and collaborations are also driving growth in the market, as companies partner with restaurants, cafes, and food delivery platforms to expand their reach and increase product visibility. Recent product launches highlighting unique and exotic flavors and innovative packaging solutions that appeal to visually oriented consumers are further driving interest in popping boba, making it a versatile addition to a range of culinary applications. Besides, the trend of geographic expansion continues to shape the market as key players look to penetrate new regions and capture untapped customer bases.

-

The Italian Beverage Company is a UK company that produces, sells, and distributes products internationally to the food service industry. Its simple range offerings include syrups, popping boba, smoothies, purees, and more.

Key Popping Boba Companies:

The following are the leading companies in the popping boba market. These companies collectively hold the largest market share and dictate industry trends.

- Tachiz Enterprise Co., Ltd.

- PT. Formosa Ingredient Factory Tbk.

- Nam Viet Foods & Beverage JSC

- Italian Beverage Company

- BRILSTA

- Sunnysyrup Food Co, Ltd.

- Possmei International Co., Ltd.

- Golden Choice Sdn. Bhd.

- BossenStore.com

- Boba Box Limited

- Twrl Milk Tea

Recent Developments

-

In July 2025, India-based beverage chain Third Wave Coffee rolled out nine new variants under its Bobbles bubble tea range across national outlets. The launch featured popping and chewy boba to broaden its drink portfolio and appeal to younger, experience-seeking consumers.

-

In January 2025, Unifying Spirits launched Boba POPS, the only patented alcoholic popping boba in the world. The launch marked a novel fusion of flavored spirits and bubble-style textures, aiming to diversify the alcoholic beverage category and consumers seeking experiential drink formats.

-

In May 2024, Starbucks announced its plans to introduce its new Summer-Berry Starbucks Refreshers beverages for the summer, marking the beginning of a series of texture-focused innovations aimed at enhancing customer experiences.

-

In April 2024, Twrl Milk Tea launched its first single-serve, plant-based, dye-free Popping Boba in Honey, Lychee, and Strawberry flavors. These vegan, gluten-free, and gelatin-free toppings come in convenient single-serve packets, marking a significant milestone for the brand.

Popping Boba Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 482.1 million

Revenue forecast in 2030

USD 780.6 million

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Flavor, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; Brazil; Saudi Arabia

Key company profiled

Tachiz Enterprise Co., Ltd.; PT. Formosa Ingredient Factory Tbk.; Nam Viet Foods & Beverage JSC; Italian Beverage Company; BRILSTA; Sunnysyrup Food Co., Ltd.; Possmei International Co., Ltd.; Golden Choice Sdn. Bhd.; BossenStore.com; Boba Box Limited.; Twrl Milk Tea

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Popping Boba Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the global popping boba market report based on the flavor, application, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2021 - 2030)

-

Fruit Flavors

-

Tea Flavors

-

Coffee Flavors

-

Chocolate Flavors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2030)

-

Bubble Tea

-

Frozen Yogurt Toppings

-

Ice Cream Toppings

-

Smoothies and Beverages

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2030)

-

Food Service

-

Retail

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global popping boba market was estimated at USD 440.6 million in 2024 and is expected to reach USD 482.1 million in 2025.

b. The global popping boba market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 780.6 billion by 2030.

b. Asia Pacific dominated the popping boba market with a share of 41.23% in 2024, driven by the increasing popularity of bubble tea, particularly in countries like Taiwan, China, and Japan, where bubble tea originated and quickly became a cultural phenomenon. The dynamics of the Asia Pacific market are also influenced by the burgeoning café culture, particularly in urban areas.

b. Some of the key market players in the popping boba market are Tachiz Group, PT. Formosa Ingredient Factory Tbk., Nam Viet F&B, Italian Beverage Company, Brilsta, Sunnysyrup Food Co, Ltd., Possmei, Golden Choice Marketing Sdn Bhd, Bossen, and Boba Box Limited.

b. The popping boba market has experienced significant growth in recent years, driven by the changing consumer preferences and a burgeoning interest in unique culinary experiences. Moreover, the rise of e-commerce platforms has expanded the reach of popping boba manufacturers, making these products more accessible to consumers globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.