Popcorn Market Size, Share & Trends Analysis Report By Type (Ready-to-Eat Popcorn, Microwave Popcorn), By Distribution Channel (B2B, B2C), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-008-4

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Popcorn Market Size & Trends

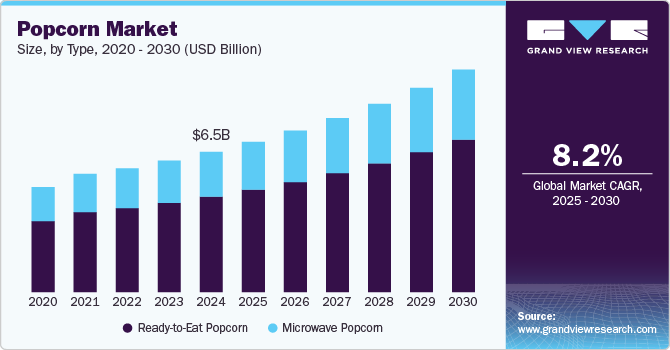

The global popcorn market size was estimated at USD 6.53 billion in 2024 and is projected to grow at a CAGR of 8.2% from 2025 to 2030. The market growth is reliant upon the global consumer trend toward well-being. In addition, the industry is being driven by changing consumer behavior patterns for food and beverage globally. The global popcorn supply chain and distribution channel were disrupted by the coronavirus outbreak, which resulted in the closure and restrictions of convenience stores, as well as super/hypermarkets.

Personal health and sustainable development, once relegated to the category of "niche" interests, are now at the forefront of buyers' minds, especially when it is related to food purchases. Demand for healthy, convenient, and sustainably-produced foods is on the rise, and plant-based proteins are more popular than ever. People are making personal purchasing decisions based on sustainability and are aiming to make more health-conscious shopping decisions due to the pandemic, which has caused a significant shift in consumer expectations. In addition, the demand for popcorn with different flavors is also driving the market growth.

The global demand for ready-to-eat snacks is increasing, significantly affecting the food and beverage market. Ready-to-eat (RTE) products dominate the industry. An expanding range of exciting new flavors, consistent product development, and innovation attract consumers and are attributed to the increased demand for gourmet flavored RTE popcorn. Sea salt flavor, for instance, is becoming increasingly popular, and PepsiCo, Inc. is capitalizing on this trend with its Smartfood Delight Sea Salt Popcorn. Companies in the RTE popcorn industry are taking steps to increase market share with their attractive product packaging, diverse product portfolio, and promotion of products on online platforms.

Flavor innovations have played a significant role in grabbing consumers' attention. Popcorn manufacturers have introduced a wide range of new and bold flavors, from sweet varieties like caramel and chocolate to savory options such as cheddar, truffle, and sriracha. These diverse offerings appeal to different consumer preferences, from those seeking indulgence to those looking for healthier alternatives. In addition, globally inspired flavors like Mexican chili lime or Japanese matcha cater to the increasing consumer interest in trying multicultural and exotic tastes, creating a broader appeal across markets.

Health-focused flavor innovations are also gaining traction, with brands offering lower-calorie or more natural flavorings, such as sea salt and olive oil, to meet the needs of health-conscious consumers. Meanwhile, limited-edition and seasonal flavors are helping brands create excitement and urgency among snackers. Seasonal offerings, like pumpkin spice in the fall or peppermint during the holidays, capture attention and drive purchases by appealing to the desire for novelty and timely treats. These new flavors, along with creative marketing and packaging strategies, keep consumers engaged and curious, driving continuous growth in the popcorn industry.

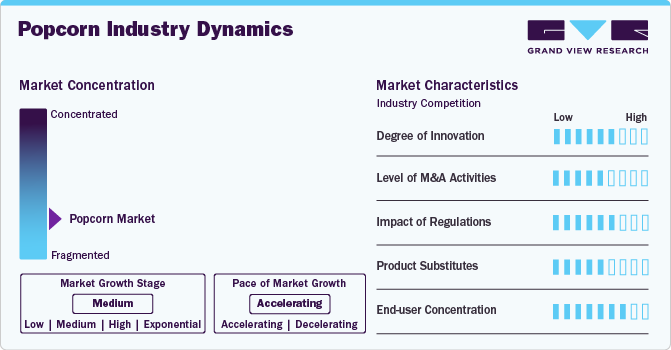

Market Concentration & Characteristics

Manufacturers in the market are actively engaged in various initiatives to meet evolving consumer demands and market trends.

The degree of innovation in the market is high, driven by several key trends. Brands are introducing bold new flavors, ranging from sweet to savory and globally inspired varieties, appealing to a wide range of consumer tastes. There is also significant premiumization, with gourmet and artisanal popcorn varieties featuring high-quality ingredients and creative packaging. Health-focused innovations, such as low-calorie, non-GMO, and organic options, are meeting the growing demand for better-for-you snacks. Seasonal and limited-edition flavors add further excitement, while sustainability efforts and customizable popcorn options are enhancing consumer engagement.

Type Insights

Ready-to-eat popcorn accounted for a revenue share of 68.0% in 2024. The rising consumption of RTE popcorn at home and in theatres, coupled with a rise in the spending capacity of consumers, is expected to drive the demand for RTE popcorn. The demand is also likely to be driven by the rising health consciousness among individuals. In addition, a growing range of new flavors, consistent product developments, and innovations attract consumers. In November 2021, AMC planned to open five popcorn stores in the first half of 2022, or counters and kiosks in shopping malls in the U.S., including kiosks in select retail locations in malls across the nation.

The market for microwave popcorn is expected to grow at a CAGR of 7.8% from 2025 to 2030. Microwave popcorn offers a quick and easy snack option that can be prepared in minutes, appealing to busy consumers looking for a hassle-free way to enjoy popcorn at home. Microwave popcorn often comes in pre-measured servings, making it easier for consumers to control portion sizes. In addition, there are healthier microwave options available, like low-calorie or air-popped varieties, catering to health-conscious snackers. The availability of a wide range of flavors, from classic butter to gourmet and healthier options, has made microwave popcorn more appealing to a broader audience.

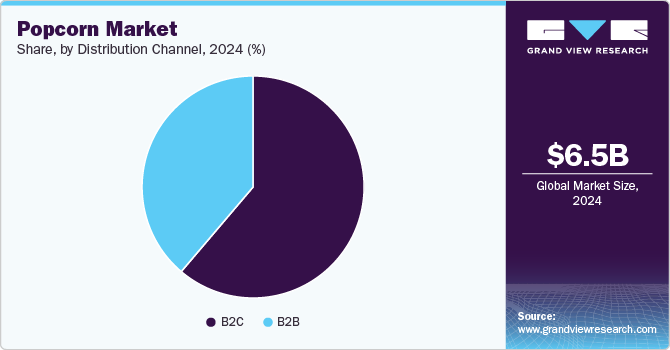

Distribution Channel Insights

Sales through B2C accounted for a revenue share of 61.2% in 2024 in the market. People's buying habits have been significantly altered by the internet distribution channel, as well as by a variety of options available at supermarkets/hypermarkets & convenience stores, which offer benefits, such as doorstep service, simple payment options, substantial savings, and availability of a wide choice of items on a single platform. Due to increased internet usage and customer preference for shopping apps, major market participants are rapidly building e-commerce websites in potential areas. Consumer inclination towards e-commerce is expected to drive segment growth. In addition, the prices of products in supermarkets/hypermarkets vary according to brand, and customers have the option of selecting from a variety of brands to fit their budget. Consumer demand for salty snacks, including popcorn, has increased in product portfolio expansions at supermarkets and hypermarkets.

Sales of popcorn through B2B channels are expected to grow at a CAGR of 7.6% from 2025 to 2030. Popcorn is becoming increasingly popular in the hospitality sector, including hotels, resorts, and event catering. Businesses in these sectors often offer popcorn as a complementary or added-value snack for guests, helping to enhance customer experiences. Popcorn is also being introduced as part of catering menus for corporate events, conferences, and parties due to its affordability and universal appeal. The growing number of businesses in the hospitality industry seeking unique snacks for their offerings has boosted B2B popcorn sales. In addition, popcorn remains a staple snack for movie theaters, driving consistent demand in the B2B space. As the cinema industry recovers and grows post-pandemic, theaters are stocking up on bulk popcorn to meet increasing foot traffic.

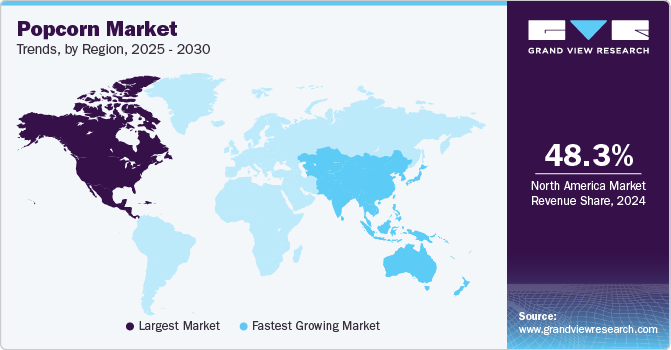

Regional Insights

The North America popcorn market accounted for a global revenue share of 48.3% in 2024. The rise of streaming platforms such as Netflix, Hulu, and Disney+ has transformed the way North Americans consume entertainment, with many opting for home-based movie nights and binge-watching sessions. Popcorn, long associated with cinema culture, has naturally become a go-to snack for these occasions. The convenience of microwave and ready-to-eat (RTE) popcorn, along with its affordability, makes it an easy choice for families and individuals seeking a traditional snack to enjoy while watching movies or TV shows at home.

U.S. Popcorn Market Trends

The popcorn market in the U.S. is expected to grow at a CAGR of 7.2% from 2025 to 2030. As American consumers increasingly prioritize healthier snack options, popcorn has gained popularity due to its low-calorie, high-fiber profile. Many people perceive popcorn as a better-for-you snack compared to chips, candy, or processed snack foods. Air-popped and lightly flavored popcorn varieties align with health trends, especially those focusing on clean-label ingredients, non-GMO, gluten-free, and whole-grain products. This has led to increased demand, especially among health-conscious individuals looking for satisfying yet guilt-free snack options.

Europe Popcorn Market Trends

Europe popcorn market is expected to grow at a CAGR of 8.1% from 2025 to 2030. European consumers are becoming more health-conscious and seeking snacks that align with their nutritional goals. Popcorn, particularly air-popped or lightly seasoned varieties, is perceived as a healthier alternative to traditional snacks like crisps or sugary treats. Its low-calorie, high-fiber content appeals to those looking for a guilt-free option that still provides satiety. Many European brands are also promoting popcorn as a gluten-free and whole-grain snack, making it attractive to individuals following specific diets or lifestyle choices.

Asia Pacific Popcorn Market Trends

Asia Pacific popcorn market is expected to grow at a CAGR of 10.0% from 2025 to 2030. Asian consumers are increasingly drawn to innovative and gourmet popcorn flavors, moving beyond classic butter or salted varieties. Unique offerings such as truffle, Mediterranean herbs, chili, and caramel have expanded the appeal of popcorn, catering to a wide range of taste preferences. The growing interest in indulgent, premium snacks has fueled the demand for artisanal and gourmet popcorn, particularly among younger consumers and food enthusiasts who seek out diverse flavor experiences.

Key Popcorn Company Insights

The global market for popcorn is characterized by numerous well-established and emerging players. Manufacturers in the market are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends. For instance, in August 2023, Joe & Seph's launched a new range of limited-edition air-popped popcorn flavors inspired by popular baked treats. This exciting collection includes Chocolate Fudge Cake, featuring chocolate caramel with cream cheese and vanilla; Millionaire’s Shortbread, coated in smooth caramel with shortbread and dark chocolate; Birthday Cake, covered in smooth caramel with raspberry and cream cheese frosting; and Peanut Butter Blondie, wrapped in white caramel sauce with crunchy peanut butter.

Key Popcorn Companies:

The following are the leading companies in the popcorn market. These companies collectively hold the largest market share and dictate industry trends.

- Campbell Soup Company

- PepsiCo Inc.

- Conagra Brands, Inc.

- Weaver Popcorn, Inc.

- Quinn Foods LLC

- The Hershey Company

- Eagle Family Foods Group LLC

- PROPER Snacks

- JOLLY TIME

- Intersnack Group GmbH & Co. KG.

Recent Developments

-

In June 2024, Netflix expanded beyond streaming by launching its line of popcorn called "Netflix Now Popping," The popcorn comes in two flavors: "Cult Classic Cheddar Kettle Corn" and "Swoonworthy Cinnamon Kettle Corn," priced at USD 4.50 per bag. This initiative is part of Netflix's broader strategy to enhance its brand presence, which includes plans for "Netflix Houses" and a pop-up restaurant in Los Angeles featuring dishes from its shows.

-

In October 2024, 4700BC launched a new gourmet popcorn range in collaboration with Netflix, featuring flavors inspired by popular Netflix shows. The collection includes “Caramel & Cheese,” “Spicy Jalapeno,” and “Truffle & Cheese.” This partnership aims to enhance the viewing experience for Netflix subscribers, offering unique snack options that complement their favorite shows.

Popcorn Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.99 billion |

|

Revenue forecast in 2030 |

USD 10.35 billion |

|

Growth rate (Revenue) |

CAGR of 8.2% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Argentina, & South Africa |

|

Key companies profiled |

Campbell Soup Company; PepsiCo Inc.; Conagra Brands, Inc.; Weaver Popcorn Inc.; Quinn Foods LLC; The Hershey Company; Eagle Family Foods Group LLC; PROPER Snacks; JOLLY TIME; Intersnack Group GmbH & Co. KG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Popcorn Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global popcorn market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ready-to-Eat Popcorn

-

Microwave Popcorn

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global popcorn market size was estimated at USD 6.53 billion in 2024 and is expected to reach USD 6.99 billion in 2025.

b. The global popcorn market is expected to grow at a compounded growth rate of 8.2% from 2025 to 2030 to reach USD 10.35 billion by 2030.

b. Microwave popcorn is expected to growth with a CAGR of 7.8% from 2025 to 2030. Microwave popcorn offers a quick and easy snack option that can be prepared in minutes, appealing to busy consumers looking for a hassle-free way to enjoy popcorn at home.

b. Some of the key players operating in the popcorn market include Campbell Soup Company, PepsiCo Inc., Conagra Brands, Inc., Weaver Popcorn Company, Inc., Quinn Foods, LLC, The Hershey Company, Eagle Family Foods Group LLC, Proper Snacks, JOLLY TIME, Intersnack Group.

b. The key factors that are driving the popcorn market include growing popcorn health and wellness trends among consumers globally, increasing millennial interest in salty snacks, and shifting consumer behavior patterns for food and beverage products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."