- Home

- »

- Plastics, Polymers & Resins

- »

-

Popcorn Containers Market Size And Share Report, 2030GVR Report cover

![Popcorn Containers Market Size, Share & Trends Report]()

Popcorn Containers Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper), By Product (Buckets, Tubs, Cups), By Application (Residential, Cinemas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-466-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Popcorn Containers Market Size & Trends

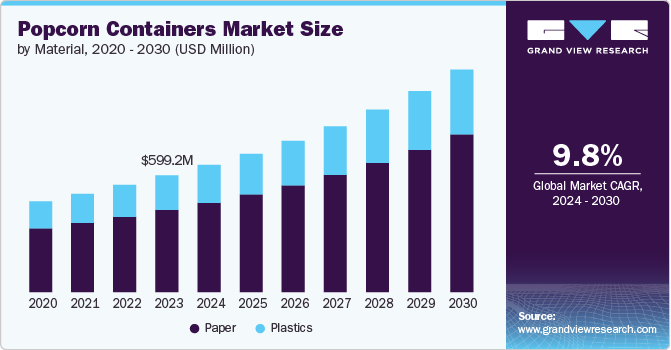

The global popcorn containers market size was estimated at USD 599.2 million in 2023 and is expected to grow at a CAGR of 9.8% from 2024 to 2030. The market is driven primarily by the growing popularity of cinema, home entertainment, and sporting events, which boost demand for convenient and durable packaging solutions. With the resurgence of movie theaters post-pandemic and the rise in at-home streaming services, the demand for popcorn as a favorite snack has grown, driving the need for packaging to preserve freshness and enhance the snacking experience.

In addition, an increasing preference for eco-friendly and sustainable packaging positively influences market growth. Consumers are becoming more environmentally conscious, prompting a shift away from traditional plastic and non-recyclable materials. Manufacturers respond by using biodegradable, compostable, or recyclable materials such as paperboard and bioplastics.

Moreover, the convenience of ready-to-eat popcorn sold in retail settings is also contributing to the growth of the popcorn container market. Retailers and snack companies package popcorn in various formats, from single-serve bags to larger family-sized containers, offering consumers flexibility in how they enjoy their snacks. This trend is prevalent in regions such as North America and Europe, where convenience is a significant factor in purchasing decisions.

Furthermore, the rise of online food delivery and snack subscription services has created new opportunities for popcorn packaging. As more consumers order snacks online, companies focus on packaging that can withstand shipping and handling without compromising the quality of the product. For example, specialized popcorn containers with moisture-resistant coatings ensure that popcorn remains crisp during transit, further driving innovation in the packaging segment. This intersection of convenience, sustainability, and growing demand across multiple platforms supports the overall growth of the popcorn container market.

Material Insights

Based on material, the market has been segmented into plastics and paper. Paper dominated the overall market with a revenue market share of over 70.0% in 2023 and is expected to witness robust growth with a CAGR of 9.9% over the forecast period. Paper-based popcorn containers are eco-friendly, biodegradable, and often made from recyclable materials, making them an attractive option for environmentally conscious consumers. They are typically used in movie theaters and event venues.

Furthermore, plastic popcorn containers are durable, lightweight, and moisture-resistant. They provide a longer shelf life for popcorn and are often reusable. However, growing environmental concerns over single-use plastics and increasing regulations on plastic packaging have limited the growth of this segment.

Product Insights

Based on product, the market has been segmented into buckets (4 liters & above), tubs (2-4 liters), and cups (2 liters). Cups dominated the overall market with a revenue market share of over 71.0% in 2023. Popcorn cups, typically with a capacity of up to 2 liters, are the smallest container type used for popcorn, often seen in quick-service restaurants, kiosks, or snack stands. Their compact size makes them a common choice for younger audiences or those looking for a quick snack.

Furthermore, tubs are expected to witness robust growth with a CAGR of 10.2% over the forecast period. Popcorn tubs, typically ranging from 2 to 4 liters, are popular in theaters and entertainment venues for individual or small-group consumption. These tubs balance portability and capacity, making them ideal for personal use or sharing between two people.

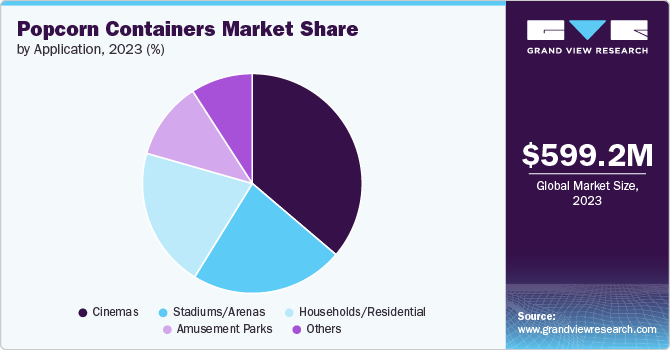

Application Insights

Based on the application, the market is segmented into residential, cinemas, stadiums, amusement parks, and others. Cinemas dominated the market and accounted for the largest revenue share of over 36.0% in 2023. Cinemas represent one of the largest segments for popcorn containers, typically using branded, large-volume containers. These are often designed for portability and branding, enhancing the movie theater experience.

The residential application segment is expected to grow at the fastest CAGR of 10.2% during the forecast period. The residential market segment caters to individual consumers who purchase popcorn for home consumption, such as during movie nights or social gatherings.The rise in at-home entertainment platforms like streaming services has increased the demand for residential popcorn containers.

Moreover, popcorn containers in stadiums cater to spectators of sports events or concerts. These containers are often larger to accommodate the prolonged nature of such events, providing an easy-to-carry solution for fans moving between seats and concession stands. The rising popularity of live sports and entertainment events and higher stadium attendance are expected to drive the demand for popcorn containers.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 33.8% in 2023. The rapidly growing cinema industry across many Asian countries, particularly in China and India, is driving market growth. As these nations continue to expand their urban middle classes, demand for entertainment options like movie theaters has surged. For instance, China has been aggressively building new cinemas, with the number of screens more than doubling between 2015 and 2020. This expansion directly translates to an increased need for popcorn containers, as popcorn remains a popular cinema snack across the region.

India Popcorn Containers Market Trends

The popcorn containers market in India is primarily driven by the rapidly growing movie theater and multiplex industry. With rising disposable incomes and a strong film culture, more Indians frequent cinemas, leading to increased popcorn consumption. Major chains like PVR Cinemas and INOX have been expanding aggressively, opening new locations across tier 1 and 2 cities. This expansion directly correlates with higher demand for popcorn packaging.

North America Popcorn Containers Market

The popcorn containers market in North America is growing due to the rise of home entertainment and streaming services. As more people recreate the cinema experience at home, there's an increased demand for cinema-style popcorn containers for personal use. Companies have capitalized on this trend by offering microwave popcorn bags and boxes resembling theater-style containers. In addition, the growing popularity of gourmet popcorn shops in urban areas has further fueled the demand for specialized and aesthetically pleasing popcorn containers.

The U.S. popcorn containers market is growing due to the high consumption of popcorn, strong demand from the entertainment industry, and evolving consumer preferences. The U.S. has long been a major consumer of popcorn, with the snack deeply ingrained in American culture. This cultural significance and a robust film and entertainment industry have created a strong demand for popcorn containers. Movie theaters, a primary driver of popcorn consumption, are abundant in the country. According to the National Association of Theatre Owners, there were over 40,000 indoor movie screens in the U.S. as of 2020. This extensive network of theaters requires a steady supply of popcorn containers, driving market growth in the region.

Europe Popcorn Containers Market Trends

The popcorn containers market in Europeheld a revenue share of over 23.0% in 2023. The positive outlook of the market in Europe is due to several key factors, including changing consumer preferences, the increasing popularity of home entertainment, and a strong cinema culture. Popcorn has emerged as a preferred option as more consumers opt for healthier snacks due to its low-calorie profile. This shift is particularly strong in countries such as Germany, France, and the UK, where health-conscious consumers actively seek alternatives to traditional high-calorie snacks. The growing demand for popcorn has, in turn, increased the need for convenient and sustainable packaging solutions, driving the market for popcorn containers in Europe.

The UK popcorn containers market is growing significantly due to the growth of retail channels, including supermarkets and online platforms. Popcorn has become a popular snack in cinemas and for events, festivals, and sports venues. Retailers offer various packaging sizes and designs, catering to different customer preferences. These product offerings and distribution channel diversification have expanded the popcorn container market, particularly in the UK.

Key Popcorn Containers Company Insights

The competitive environment is characterized by a mix of large packaging companies and specialized manufacturers. Key players influence the market with extensive distribution networks and advanced packaging solutions. These companies leverage their scale, innovation capabilities, and eco-friendly packaging trends to gain market share. Meanwhile, smaller players focus on niche segments, such as customizable or eco-friendly options, to carve out their presence. Market share distribution is influenced by sustainability, product design, and the increasing demand for ready-to-eat popcorn, particularly in cinemas and retail sectors.

Key Popcorn Containers Companies:

The following are the leading companies in the popcorn containers market. These companies collectively hold the largest market share and dictate industry trends.

- Berry Global Inc.

- Graphic Packaging International, LLC

- Divan Packaging LLC

- Kai Lai Packaging

- Hutzler Manufacturaing Co, Inc.

- Wuhan Yoon Import & Export Co., Ltd.

- Paper Cup Company

- ISHWARA

- Susitra Agencies

- Venturepak

- Hotpack Packaging Industries LLC

- Bentley Advanced Materials

- Shantou Linghai Plastic Packing Co., Ltd.

- Zhejiang Pando EP Technology Co., Ltd

- Cartoprint

- BHAGVATI PLASTIC

- Packaging Concepts Inc.

- Day Young

Recent Developments

-

In June 2024, Saica and Mondelez launched a new recyclable packaging solution, contributing to virgin plastic reduction goals. The new paper-based packaging is recyclable in the paper waste stream and suitable for heat-sealable packing. Depending on the desired final appearance, it can be produced coated or uncoated. The product has been developed to meet the Confederation of European Paper (CEPI) sustainability standards.

-

In April 2024, Parkside launched Recoflex, a range of recyclable paper-based flexible packaging materials offering durability, barrier performance, and heat sealability. The new range of papers is available as a single-ply or laminate in several specifications. It will be joined by two configurations of Recoflex Translucent, a translucent barrier paper suitable for various food applications.

Popcorn Containers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 651.6 million

Revenue forecast in 2030

USD 1.14 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Berry Global Inc.; Graphic Packaging International, LLC; Divan Packaging LLC; Kai Lai Packaging; Hutzler Manufacturaing Co, Inc.; Wuhan Yoon Import & Export Co., Ltd.; Paper Cup Company; ISHWARA; Susitra Agencies; Venturepak; Hotpack Packaging Industries LLC; Bentley Advanced Materials; Shantou Linghai Plastic Packing Co., Ltd.; Zhejiang Pando EP Technology Co., Ltd; Cartoprint; BHAGVATI PLASTIC; Packaging Concepts Inc.; Day Young

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Popcorn Containers Market Report Segmentation

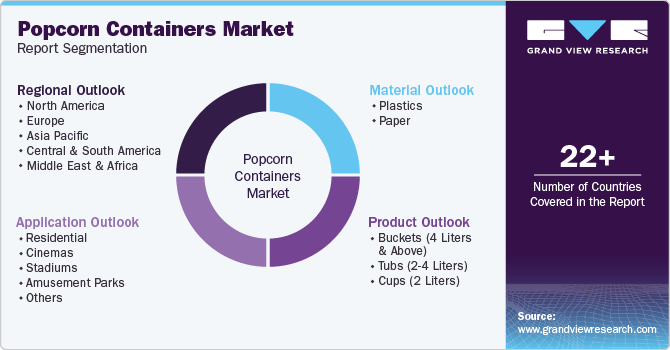

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global popcorn containers market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Buckets (4 Liters & Above)

-

Tubs (2-4 Liters)

-

Cups (2 Liters)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Cinemas

-

Stadiums

-

Amusement Parks

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global popcorn containers market was estimated at USD 599.2 million in 2023 and is expected to reach USD 651.61 million in 2024.

b. The global popcorn containers market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030, reaching around USD 1.14 billion by 2030.

b. Paper dominated the overall market. Paper-based popcorn containers are eco-friendly, biodegradable, and often made from recyclable materials, making them an attractive option for environmentally conscious consumers. They are typically used in movie theaters and event venues.

b. Some key players in the popcorn containers market include Berry Global Inc.; Graphic Packaging International, LLC; Divan Packaging LLC; Kai Lai Packaging; Hutzler Manufacturaing Co, Inc.; Wuhan Yoon Import & Export Co., Ltd.; Paper Cup Company; ISHWARA; Susitra Agencies; Venturepak; Hotpack Packaging Industries LLC; Bentley Advanced Materials; Shantou Linghai Plastic Packing Co., Ltd.; Zhejiang Pando EP Technology Co., Ltd; Cartoprint; BHAGVATI PLASTIC; Packaging Concepts Inc.; and Day Young.

b. The popcorn containers market is driven primarily by the growing popularity of cinema, home entertainment, and sporting events, which boost demand for convenient and durable packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.