Ponzu Sauce Market Size, Share & Trends Analysis Report By Flavor (Traditional, Yuzu Ponzu), By Nature (Conventional, Organic), By End-ue (Foodservice, Industry), By Packaging (PET Bottle, Glass Bottle), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-416-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Ponzu Sauce Market Size & Trends

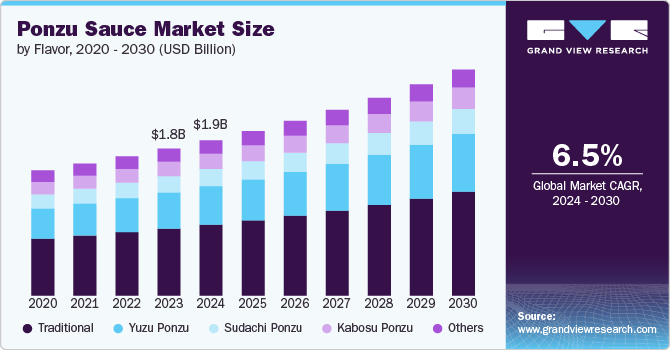

The global ponzu sauce market size was estimated at USD 1.83 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.One of the primary drivers behind the growth of the market is the rising popularity of Asian cuisine. Over the past decade, there has been a significant surge in the global interest in Asian food, driven by its diverse flavors and unique culinary techniques. Asian restaurants have proliferated globally, with many consumers seeking to replicate restaurant-quality dishes at home. Ponzu sauce, being a staple in Japanese cuisine, has gained traction as an essential ingredient in this culinary trend. This growing consumer interest has driven the demand for ponzu sauce as a key ingredient in various dishes, from sushi and sashimi to grilled meats and salads. Manufacturers have responded to this trend by increasing their production capacities and expanding distribution networks to cater to the growing market.

Ponzu sauce is valued for its versatility, which has expanded its use beyond traditional Japanese dishes. Originally used as a dipping sauce for sushi and sashimi, ponzu sauce is now featured in a wide range of culinary applications. It is increasingly used as a marinade for meats and vegetables, a salad dressing, and even a flavor enhancer in soups and stews. This broadening of applications has contributed significantly to the growth of the ponzu sauce market. Food manufacturers and chefs are experimenting with ponzu sauce in innovative ways, incorporating it into fusion cuisines and new recipe formats.

Innovation within the market has also played a crucial role in its growth. Manufacturers are continually introducing new formulations and flavors to cater to diverse consumer preferences. Product diversification includes variations such as spicy ponzu sauce, ponzu sauce with added herbs or vegetables, and even ponzu sauce with alternative citrus fruits. Manufacturers are expanding their product lines to include ponzu sauces with different flavor profiles, such as yuzu ponzu or ponzu with added chili. This innovation not only meets the demands of adventurous consumers but also positions ponzu sauce as a versatile ingredient suitable for a wide range of recipes.

Consumers increasingly seek authentic culinary experiences, which has driven interest in traditional ingredients like ponzu sauce. Authenticity in food is valued for its ability to deliver genuine flavors and cultural experiences. Ponzu sauce, with its traditional Japanese origins, fits well within this consumer preference for authentic and culturally significant foods. Moreover, the rise of e-commerce has had a profound impact on the market. Online retail platforms have made it easier for consumers to access a wide variety of ponzu sauces, including niche and artisanal brands that may not be available in local grocery stores. The convenience of online shopping, coupled with the ability to compare prices and read reviews, has contributed to the increased sales of ponzu sauce through digital channels.

Flavor Insights

Traditional ponzu sauce accounted for a revenue share of 45.6% in 2023. Traditional ponzu sauce has been a staple in Japanese cuisine for decades. Its widespread use in various Japanese dishes, such as sushi and sashimi, has established it as a familiar and favored product among consumers. This long-standing popularity means that traditional ponzu sauce enjoys a high level of consumer trust and preference. Traditional ponzu sauce is versatile and can be used in a variety of dishes beyond its original applications. It is commonly used as a marinade, dipping sauce, and flavor enhancer, which broadens its appeal. This versatility helps maintain its dominant position in the market.

Yuzu ponzu sauce is expected to grow at a significant CAGR from 2024 to 2030. Yuzu ponzu offers a unique flavor profile that combines the tangy, aromatic notes of yuzu with the umami richness of soy sauce. This distinctive flavor appeals to consumers seeking new and exotic tastes, driving the rapid growth of yuzu ponzu. Yuzu citrus has gained significant popularity in recent years due to its use in a variety of culinary applications, from beverages to desserts. This trend has translated into a growing interest in yuzu ponzu, which capitalizes on the fruit’s increasing visibility.

Nature Insights

Conventional ponzu sauce accounted for a revenue share of 86.4% in 2023. Conventional ponzu sauce typically costs less to produce and purchase than organic versions. The ingredients used in conventional ponzu are often more readily available and less expensive, contributing to its larger market share. The supply chains for conventional ponzu sauce are well-established, allowing for efficient production and distribution. Organic ponzu, on the other hand, may face challenges in sourcing certified organic ingredients and maintaining production standards. In addition, many consumers are more accustomed to traditional, non-organic products, which are widely available and familiar.

Organic ponzu sauce is expected to grow at a significant CAGR from 2024 to 2030. Consumers are increasingly seeking organic products as part of a broader health and wellness trend. Organic ponzu sauce aligns with this demand, offering a product made from organic ingredients with fewer additives and preservatives. Moreover, organic products often cater to a premium market segment willing to pay more for perceived health benefits and quality. As consumer awareness and demand for organic products grow, so does the market for organic ponzu sauce.

End-use Insights

The foodservice segment accounted for a revenue share of 44.2% in 2023. Foodservice establishments, including restaurants, hotels, and catering services, use large quantities of ponzu sauce in their daily operations. This high volume of usage contributes to its significant market share.Foodservice providers use ponzu sauce in a variety of dishes and preparation methods, from appetizers to main courses. This broad application helps to maintain a strong market presence for ponzu sauce in the foodservice sector. Chefs and culinary professionals prefer ponzu sauce for its quality and flavor profile. Its use in creating authentic Japanese dishes and its versatility in menu development contribute to its dominance in the foodservice sector.

Retail segment is expected to grow at a significant CAGR from 2024 to 2030. With rising interest in home cooking and gourmet ingredients, consumers are increasingly purchasing ponzu sauce for use in their kitchens. The growth in home cooking trends has driven demand in retail settings. As consumers become more knowledgeable about different culinary ingredients, they are more likely to seek out and experiment with ponzu sauce. Moreover, retailers are expanding their offerings of international and specialty products, including ponzu sauce. Increased availability in supermarkets, grocery stores, and online platforms supports the growth of retail sales.

Packaging Insights

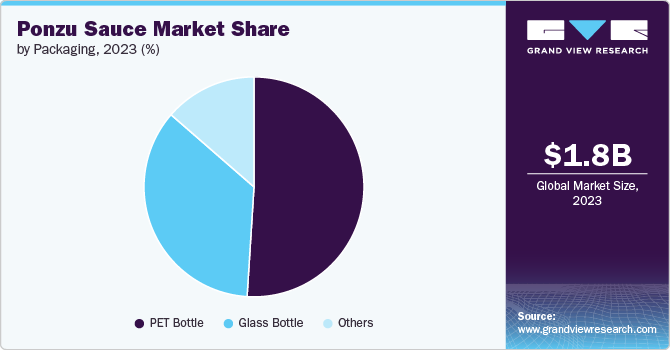

PET bottles accounted for a revenue share of 51.0% in 2023. PET bottles are generally more cost-effective to produce and transport than glass bottles. This cost advantage makes PET bottles a popular choice for packaging ponzu sauce. PET bottles are lightweight and less likely to break compared to glass bottles. Their durability and convenience make them a preferred packaging option for both manufacturers and consumers. In addition, PET bottles are commonly used in the food and beverage industry, including for sauces and condiments. This widespread adoption contributes to their large market share.

Glass packaging is expected to grow at a CAGR of 6.5% from 2024 to 2030. Glass packaging is often perceived as more premium and upscale compared to plastic alternatives. This perception drives consumer preference for glass bottles, especially for higher-end or artisanal ponzu sauces. Glass is a recyclable and environmentally friendly material, aligning with the growing consumer preference for sustainable packaging options. This shift towards sustainability supports the growth of glass bottle packaging. Additionally, glass bottles offer superior preservation of flavor and quality. This attribute is particularly important for high-quality ponzu sauces, which benefit from the inert nature of glass that does not interact with the product.

Regional Insights

The market in North America is expected to grow at a CAGR of 6.6% from 2024 to 2030. The rising popularity of Asian cuisine in North America has led to increased demand for Asian condiments, including ponzu sauce. The trend towards culinary exploration and international flavors drives growth in the region. North American consumers are increasingly interested in diverse and exotic flavors, driving demand for products like ponzu sauce. This interest supports the region’s rapid growth in the market.

U.S. Ponzu Sauce Market Trends

The U.S. market is expected to grow at a CAGR of 6.8% from 2024 to 2030. Japanese cuisine has seen a surge in popularity across the U.S., with sushi, ramen, and other Japanese dishes becoming mainstream. The proliferation of Japanese restaurants, both high-end and casual, has introduced a wide audience to ponzu sauce. Additionally, the growth of fusion cuisine, which blends elements of different culinary traditions, has also incorporated ponzu as a versatile ingredient.

Europe Ponzu Sauce Market Trends

The market in Europe is expected to grow at a CAGR of 6.1% from 2024 to 2030. The adoption of Japanese cuisine in Europe has significantly increased over the past decade. Europeans have embraced Japanese food culture, which includes not only sushi and sashimi but also a variety of other dishes that utilize ponzu sauce. Ponzu, with its unique blend of citrus and umami flavors, complements a wide range of European culinary traditions, leading to its widespread acceptance and use. There has been a notable rise in the number of Japanese restaurants across Europe. Cities like London, Paris, Berlin, and Madrid have seen a proliferation of Japanese eateries, including fine dining establishments and casual sushi bars. This increase in Japanese restaurants has boosted the visibility and popularity of ponzu sauce, making it a staple in both professional kitchens and home cooking.

Asia Pacific Ponzu Sauce Market Trends

The Asia Pacific market accounted for a revenue share of 39.9% in 2023. Ponzu sauce is a traditional condiment in Japanese cuisine and is widely used across Asia. Its cultural significance and high consumption rates in countries like Japan, South Korea, and China contribute to its dominant market share in the region. Asia’s large and diverse population drives high demand for a variety of food products, including ponzu sauce. The region's significant consumer base supports substantial market growth. Moreover, numerous ponzu sauce manufacturers are based in Asia, contributing to the region’s large market share. The proximity to production facilities and raw materials supports regional dominance.

Key Ponzu Sauce Company Insights

Manufacturers in the market are employing various strategies to capitalize on the growing demand and ensure sustained market growth. These steps include product innovation, quality assurance, sustainable practices, strategic partnerships, effective marketing, and expanding distribution channels.

Key Ponzu Sauce Companies:

The following are the leading companies in the ponzu sauce market. These companies collectively hold the largest market share and dictate industry trends.

- Kikkoman Corporation

- Mizkan Holdings Co., Ltd.

- YAMASA CORPORATION

- Morita Co., Ltd.

- Gold Mine Natural Foods

- Lee Kum Kee

- Shoda Sauces Europe Company Limited

- Marukan Vinegar (U.S.A) Inc.

- Otafuku Foods

- Yamasan Ltd.

Recent Developments

-

In January 2024, Nojo London announced the launch of various sauces & dressings for foodservice in 5 liters bottle packaging. The product line includes Yuzu Ponzu, Tahini, Teriyaki, Orange Poke, Miso, and Sesame.

-

In February 2020, Mizkan, announced the launch of its line of Japanese sauces and rice vinegars to the United States. The product line includes ponzu sauce, mirin, and rice vinegar. The Mizkan America offerings include three varieties of Non-GMO Project verified rice vinegars: natural, seasoned, and organic natural. The sauces feature ponzu citrus seasoned soy sauce, sesame dipping sauce, and dumpling sauce.

Ponzu Sauce Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.93 billion |

|

Revenue forecast in 2030 |

USD 2.81 billion |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Flavor, nature, end-use, packaging, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain;, China; Japan; India; South Korea; Australia; South Africa |

|

Key companies profiled |

Kikkoman Corporation; Mizkan Holdings Co., Ltd.; YAMASA CORPORATION; Morita Co., Ltd.; Gold Mine Natural Foods; Lee Kum Kee; Shoda Sauces Europe Company Limited; Marukan Vinegar (U.S.A) Inc.; Otafuku Foods; Yamasan Ltd. |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Ponzu Sauce Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ponzu sauce market report based on flavor, nature, end- use, packaging, and region :

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Yuzu Ponzu

-

Sudachi Ponzu

-

Kabosu Ponzu

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Industry

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Others

-

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

PET Bottle

-

Glass Bottle

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ponzu sauce market size was estimated at USD 1.83 billion in 2023 and is expected to reach USD 1.93 billion in 2024.

b. The global ponzu sauce market is expected to grow at a compounded growth rate of 6.5% from 2024 to 2030 to reach USD 2.81 billion by 2030.

b. The traditional ponzu sauce accounted for a revenue share of 45.57% in 2023. Traditional ponzu sauce has been a staple in Japanese cuisine for decades. Its widespread use in various Japanese dishes, such as sushi and sashimi, has established it as a familiar and favored product among consumers.

b. Some key players operating in the ponzu sauce market include Kikkoman Corporation; Mizkan Holdings Co., Ltd.; YAMASA CORPORATION; Morita Co., Ltd.; Gold Mine Natural Foods; Lee Kum Kee; Shoda Sauces Europe Company Limited; Marukan Vinegar (U.S.A) Inc.; Otafuku Foods; Yamasan Ltd.

b. One of the primary drivers behind the growth of the ponzu sauce market is the rising popularity of Asian cuisine.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."