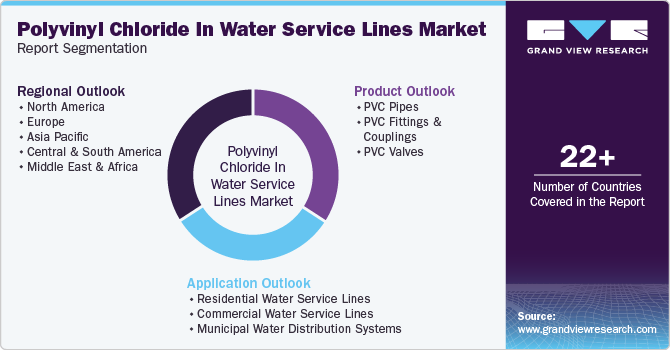

Polyvinyl Chloride In Water Service Lines Market Size, Share & Trends Analysis Report By Product (PVC Pipes, PVC Fittings & Couplings, PVC Valves), By Application (Residential, Commercial, Municipal), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-479-0

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

PVC In Water Service Lines Market Trends

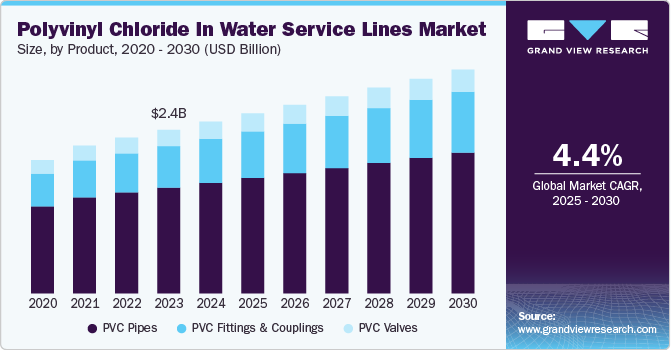

The global polyvinyl chloride in water service lines market size was valued at USD 2.51 billion in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The growth of the agriculture sector significantly influences the polyvinyl chloride (PVC) pipes market for water service lines, driven by the increasing need for efficient irrigation and water management solutions.

The growth of the PVC in water service lines market is fueled by increasing urbanization and the urgent need for modern water infrastructure. As global populations migrate to urban areas, the demand for efficient and reliable water distribution systems rises significantly.PVC pipes, known for their durability, corrosion resistance, and cost-effectiveness, have become the preferred choice for various applications in water supply and sanitation.

Drivers, Opportunities & Restraints

Infrastructure development and urbanization are pivotal factors driving the PVC pipes market for water service lines. As cities across the globe, particularly in the U.S., continue to expand, there is a pressing need for efficient and reliable water supply systems. PVC pipes are increasingly favored due to their durability, resistance to corrosion, and lightweight nature, which facilitates easier installation compared to traditional materials such as metal and concrete.

As urbanization accelerates and infrastructure investments increase, the PVC pipes market for water service lines is expected to create opportunities for robust growth, driven by the owing to the rising need for safe, reliable, and efficient water delivery systems that meet the demands of growing populations. This dynamic landscape positions PVC pipes as a critical component of future urban infrastructure development strategies in coming years.

However, environmental regulations and sustainability concerns pose significant restraints to the growth of the PVC pipes market for water service lines. As global awareness of plastic pollution and the need for eco-friendly solutions increases, there is mounting pressure on manufacturers to address the environmental impact of PVC pipes.Stricter regulations, such as the European Union's (EU) Single-Use Plastics Directive, aim to reduce plastic waste and promote sustainable alternatives, which could limit the use of PVC pipes in certain applications.

Product Insights

Based on product, the market has been segmented into PVC pipes, PVC Fittings & Couplings, and PVC Valves. The PVC pipes segment accounted for the largest revenue share of 64.36% in 2024. PVC pipes are essential for water service lines, due to their affordability, durability, and resistance to corrosion. Schedule 40 PVC pipes are designed for low-pressure applications and are typically used in residential and light commercial water systems. These pipes are lightweight, easy to handle, and provide excellent flow capacity for transporting water. They are commonly employed in underground water distribution and drainage systems, offering a cost-effective solution for non-pressurized applications.

PVC Fittings & Couplings segment is expected to grow at the fastest CAGR over the forecast period. PVC fittings and couplings are vital components in water service lines, allowing for the seamless connection and direction of pipes within a water distribution system. These fittings, such as elbows, tees, and reducers, ensure smooth transitions between pipes of different sizes or directions without compromising the system’s integrity.

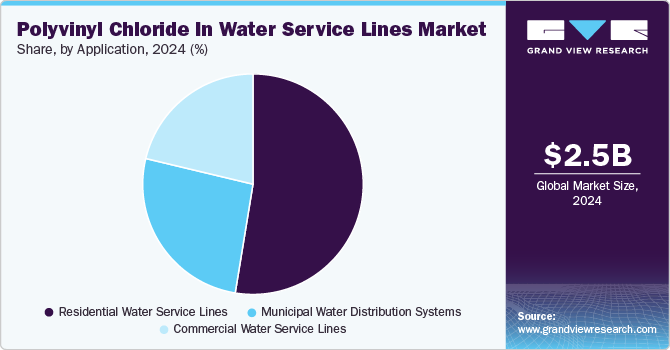

Application Insights

Based on application, the market has been segmented into Residential Water Service Lines, Commercial Water Service Lines, and Municipal Water Distribution Systems. The residential segment accounted for the largest revenue share of 52.58% in 2024,driven by the material’s cost-effectiveness, durability, and ease of installation. Increasing urbanization, particularly in emerging economies, and the need for reliable infrastructure to meet the demands of growing populations have also fueled the adoption of PVC pipes in residential water service lines.

Moreover, commercial water service lines in the PVC water service lines market play a vital role in ensuring efficient water distribution across large buildings and industrial facilities. These lines typically require pipes of greater dimensions compared to residential applications due to higher water usage and pressure demands.

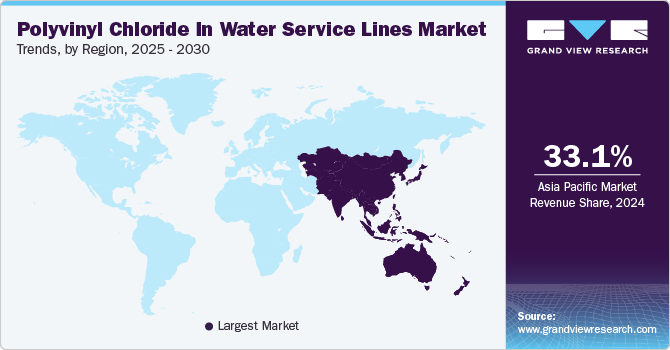

Regional Insights

North America polyvinyl chloride in water service lines market is experiencing steady growth, driven by increasing infrastructure development and the need for efficient, cost-effective materials in water distribution systems.These infrastructure upgrades, particularly in water and sewage systems, drive demand for PVC pipes as municipalities prioritize replacing aging pipelines to improve water quality and reduce leakage.

U.S. Polyvinyl Chloride In Water Service Lines Market Trends

The polyvinyl chloride (PVC) in the water service lines market in the U.S. is a significant market as its construction sector remains one of the largest in the region. The market is driven by the increasing need to upgrade aging water infrastructure and the demand for durable, cost-effective piping solutions. PVC pipes have become a favored choice in the U.S. due to their corrosion resistance, ease of installation, and long lifespan, which make them ideal for water service applications.

Asia Pacific Polyvinyl Chloride In Water Service Lines Market Trends

The polyvinyl chloride (PVC) in water service lines market in Asia Pacific accounted for the largest revenue share of 33.15% in 2024. PVC pipes are widely used in water distribution networks across Asia Pacific, due to their durability and corrosion-resistant properties. Governments in countries like China, India, and those in Southeast Asia are heavily investing in water management infrastructure, particularly as urban populations continue to grow.

Europe Polyvinyl Chloride In Water Service Lines Market Trends

The polyvinyl chloride (PVC) in water service lines market in Europe is witnessing steady growth, driven by the region's ongoing water and wastewater infrastructure investments. Countries across Europe are focusing on modernizing their water distribution systems to improve efficiency and meet rising environmental standards.

China polyvinyl chloride (PVC) in water service lines market is expanding rapidly due to the country's continuous investments in infrastructure and the rising demand for clean and reliable water supply systems.With the Chinese government prioritizing the improvement of water infrastructure in both urban and rural areas, the demand for PVC in water service lines is expected to register sustained growth.

Key Polyvinyl Chloride In Water Service Lines Company Insights

The PVC in water service lines market is highly competitive, with several key players dominating the landscape. Major companies include Arkema S.A., Formosa Plastics Corporation, INEOS AG, KEM ONE, and LG Chem, Ltd. The Polyvinyl Chloride (PVC) in Water Service Lines Market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyvinyl Chloride In Water Service Lines Companies:

The following are the leading companies in the PVC in water service lines market. These companies collectively hold the largest market share and dictate industry trends.

- Arkema S.A.

- Formosa Plastics Corporation

- INEOS AG

- KEM ONE

- LG Chem, Ltd.

- Mitsubishi Chemical Group Corporation

- Occidental Petroleum Corporation

- Shin-Etsu Chemical Co., Ltd.

- Sinochem Holdings Corporation Ltd

- Solvay

- Westlake Corporation

- Xinjiang Zhongtai Chemical Co., Ltd.

Recent Developments

- In August 2024, Johnson Controls announced an agreement to sell its commercial PVC pipe and fittings business, which caters to light commercial and residential sprinkler systems, to Belgium-based Aliaxis SA. This sale involves the manufacturing assets in Huntsville, Alabama. The sale is also part of Johnson Controls' ongoing strategy to streamline its operations and focus on engineered solutions.

- In May 2024, Westlake Pipe & Fittings, a division of Westlake Corporation, unveiled plans to construct a new PVCO pipe manufacturing plant at its existing facility in Wichita Falls, Texas. This expansion underscores Westlake's dedication to fostering growth, driving innovation, and generating employment opportunities in the local community.

Polyvinyl Chloride In Water Service Lines Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.63 billion |

|

Revenue forecast in 2030 |

USD 3.27 billion |

|

Growth rate |

CAGR of 4.4% from 2025 to 2030 |

|

Base year |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume & revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Arkema S.A.; Formosa Plastics Corporation; INEOS AG; KEM ONE ; LG Chem, Ltd.; Mitsubishi Chemical Group Corporation; Occidental Petroleum Corporation; Shin-Etsu Chemical Co., Ltd.; Sinochem Holdings Corporation Ltd; Solvay; Westlake Corporation; Xinjiang Zhongtai Chemical Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polyvinyl Chloride In Water Service Lines Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyvinyl chloride in water service lines market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PVC Pipes

-

Schedule 40

-

Schedule 80

-

C900 Pipes (Pressure-rated Pipes)

-

-

PVC Fittings & Couplings

-

PVC Valves

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential Water Service Lines

-

Commercial Water Service Lines

-

Municipal Water Distribution Systems

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyvinyl chloride in water service lines market size was estimated at USD 2.51 billion in 2024 and is expected to reach USD 2.63 billion in 2025.

b. The global polyvinyl chloride in water service lines market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 3.27 billion by 2030.

b. The PVC pipes segment accounted for the largest revenue share of 64.36% in 2024. PVC pipes are essential for water service lines, due to their affordability, durability, and resistance to corrosion. Schedule 40 PVC pipes are designed for low-pressure applications and are typically used in residential and light commercial water systems.

b. Some key players operating in the PVC in water service lines market include Arkema S.A.; Formosa Plastics Corporation; INEOS AG; KEM ONE ; LG Chem, Ltd.; Mitsubishi Chemical Group Corporation; Occidental Petroleum Corporation, and others.

b. The growth of the agriculture sector significantly influences the PVC pipes market for water service lines, driven by the increasing need for efficient irrigation and water management solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."