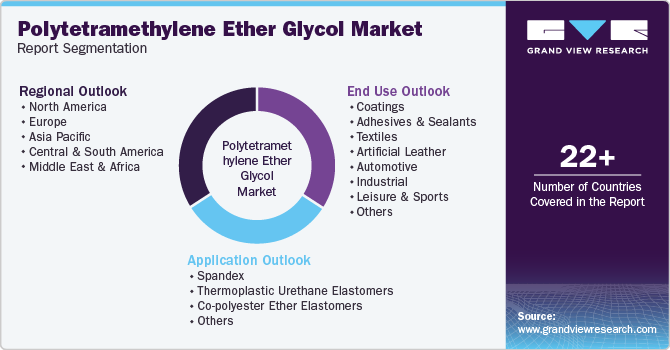

Polytetramethylene Ether Glycol Market Size, Share & Trends Analysis Report By Application (Spandex, Thermoplastic Urethane Elastomers), By End-use ( Coatings, Adhesives & Sealants, Textiles), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-458-2

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

PTMEG Market Size & Trends

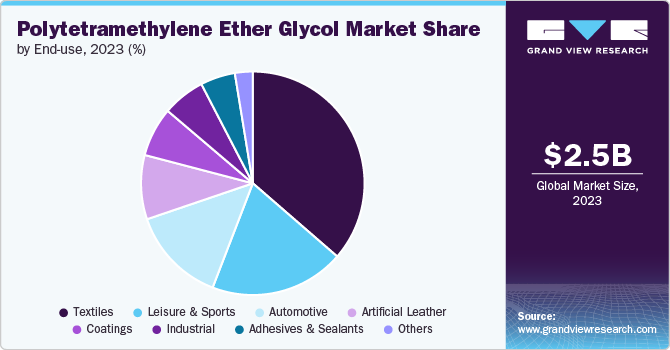

The global polytetramethylene ether glycol market size was valued at USD 2.56 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030.The industry growth is mainly attributed to the rising demand from the automotive, construction, and electronics industries. Furthermore, the wide-ranging application of these products in medical equipment, home furnishings, apparel, and automotive fabrics is expected to positively influence the overall market revenue in the upcoming forecast period.

Polytetramethylene ether glycol (PTMEG) is a high-quality raw material extensively utilized in the production of various thermoplastic urethane elastomers, including polyurethanes, polyesters, and polyamide elastomers. PTMEG is extensively used in creating spandex, thermoplastic urethanes, among other products. The increased use of spandex fibers in the manufacturing of various consumer products, such as baby diapers, hosiery, sportswear, and bandages, has significantly contributed to industry growth.

Drivers, Opportunities & Restraints

Manufacturers use PTMEG to produce wheels, belts, tubing, tires, abrasion-resistant surfaces, and other products. PTMEG exhibits several properties, including hydrolysis resistance, resilience, and low-temperature properties. Polyurethane elastomers are essential materials used in various applications such as tires, mowers, all-terrain vehicles, gaskets, valves, and wiper blades. The advancements in automotive manufacturing capabilities and the increasing demand for electric vehicles are driving the global automotive industry.

The growing automotive industry is one of the major drivers of the global polytetramethylene ether glycol market share. However, the use of PTMEG can cause skin corrosion or irritation, as well as serious eye damage or irritation, which is hindering its uptake. Manufacturers are making efforts and conducting R&D initiatives to lower the toxicity levels and introduce non-hazardous, stable PTMEG polyol products, which is expected to help them overcome this restraint in the coming years.

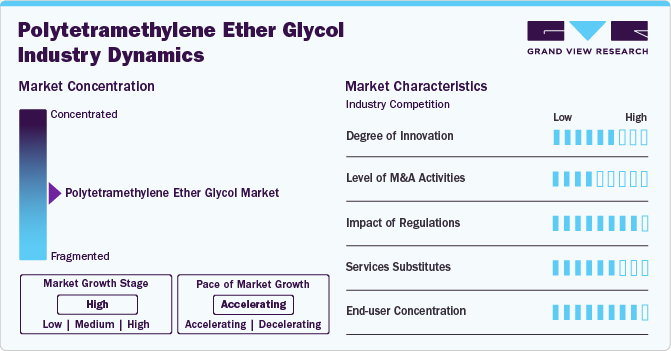

Market Concentration & Characteristics

The polytetramethylene ether glycol market is moderately fragmented with robust competition among the tier-1 and domestic players.

The PTMEG market exhibits a competitive landscape with several prominent players. These companies primarily vie for market share based on factors such as product quality, innovation, and pricing. Key industry participants encompass BASF SE, Mitsubishi Chemical Corporation, DuPont, and Invista. Notably, BASF and Mitsubishi Chemical are prominent leaders, leveraging their broad portfolio of high-quality PTMEG products and extensive global distribution networks.

These entities prioritize investments in research and development to enhance the efficiency and applicability of PTMEG, alongside expanding their production capacities. Furthermore, they are actively pursuing sustainability initiatives aimed at mitigating the environmental impact of PTMEG production processes, with a keen focus on resonating with environmentally conscious consumers and adhering to regulatory standards.

Application Insights

“Thermoplastic Urethane Elastomers segment is expected to witness growth at 6.9% CAGR”

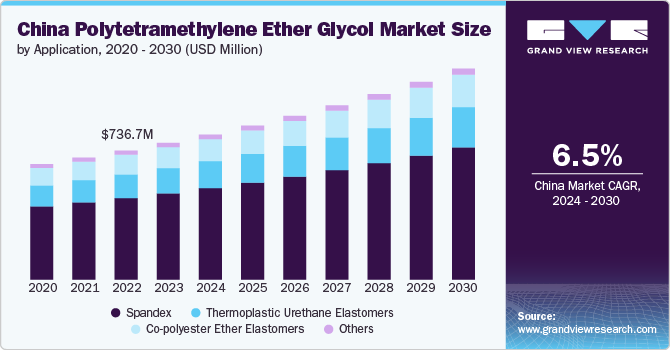

The spandex segment of the market was valued at USD 1,619.1 million in 2023 and is projected to reach USD 2,431.7 million by 2030. The use of PTMEG in spandex production enhances the comfort and durability of various garments. It has significantly improved the performance and versatility of apparel, particularly in activewear, swimwear, and undergarments. Additionally, PTMEG's adaptability allows for the development of spandex blends with other fibers, creating fabrics that cater to diverse needs and preferences.

Thermoplastic Urethane Elastomers (TPU) are one of the major applications of PTMEG in advanced materials. PTMEG greatly enhances TPU's elasticity, mechanical strength, and abrasion resistance, making it ideal for various demanding applications, from athletic footwear to electronic device cases. This signifies the vital role of PTMEG in bolstering TPU's versatility and durability, showcasing the synergy between polymer science and practical material applications.

End Use Insights

“Artificial leather segment is expected to witness highest growth at 6.6% CAGR”

The textiles segment accounted for the largest revenue share of 36.4% of the market in 2023. Polytetramethylene ether glycol (PTMEG) is crucial in creating elastic fibers for high-quality stretch fabrics in the textile industry. The increasing demand for superior stretch fabric drives the need for PTMEG, which is widely used in sportswear, activewear, and undergarments to provide exceptional stretch and recovery properties. Its versatility also allows for blending with other materials to create composite fabrics that are durable, elastic, and comfortable.

PTMEG plays a crucial role in the production of artificial leather, particularly in polyurethane (PU) elastomers. This application of PTMEG enhances the elasticity, tear strength, and durability of artificial leather. The resulting material offers the aesthetic appeal of genuine leather while providing additional benefits such as breathability, easy maintenance, and versatile design options. This sustainable alternative to traditional leather finds applications in fashion, automotive upholstery, furniture, and accessories, meeting the demand for ethical and eco-friendly materials without compromising on performance and aesthetics.

Regional Insights

“North America. is expected to witness a market growth of CAGR 6.9%”

The resurgence of the textile and apparel manufacturing sector in North America, especially in the US and Mexico, has driven up demand for spandex fibers, directly influencing PTMEG consumption.As the region's textile industry continues to grow, fueled by a shift towards more local and regional manufacturing to shorten supply chains and reduce reliance on overseas production, the demand for PTMEG has correspondingly risen.

U.S. Polytetramethylene Ether Glycol Market Trends

In the U.S., PTMEG plays a crucial role in manufacturing specialized spandex fibers used in athletic wear. Moreover, the high popularity of skateboarding and roller coaster activities among teenagers is likely to spur the demand for PTMEG in manufacturing durable wheels.

Asia Pacific Polytetramethylene Ether Glycol Market Trends

Asia Pacific accounted for the largest revenue share of 65.4% in 2023. The regional growth is driven by surging demand for polytetramethylene ether glycol due to its extensive use in polyurethane (PU) production for automotive, textile, and footwear industries. China and India are major contributors to this demand. Significant research and development efforts are focused on enhancing the efficiency and sustainability of PTMEG production processes in the region, particularly in reducing energy consumption and emissions during production.

China is a significant market for textiles, automotive, paints, and coatings, with companies investing to reduce dependence on imports. The country also has a strong demand for athletic apparel and footwear, despite rising labor costs, thereby boosting the product demand in the region.

Europe Polytetramethylene Ether Glycol Market Trends

The European market is seeing an uptick in demand for technical and performance textiles, which are used in a wide range of applications from sportswear to medical textiles. This is further driving the consumption of spandex, as consumers and industries alike seek out materials that offer flexibility, comfort, and durability. This, in turn, spurred the product demand in the region.

Polytetramethylene Ether Glycol Company Insights

Some of the key players operating in the market include BASF SE, Chang Chun Group, Henan Energy Chemical Group Hebi among others.

-

BASF SE operates through six diverse business segments: industrial solutions, materials, surface technologies, chemicals, nutrition and care, and agricultural solutions. The company's wide-ranging products find applications in agriculture, construction, pharmaceuticals, energy and power, home care and nutrition, automotive and transportation, rubber and plastics, leather and textiles, and personal care and hygiene industries.

-

The Chang Chun Group, headquartered in Taiwan, is a prominent entity in the chemical and materials industry. Its serves as the hub for a far-reaching global operation, with a notable presence in numerous countries across Asia, Europe, and the Americas. Renowned for its steadfast commitment to innovation, sustainability, and uncompromising quality, the Chang Chun Group has diversified its product portfolio to encompass a broad spectrum of offerings, including petrochemicals, plastics, synthetic fibers, and specialty chemicals..

Key Polytetramethylene Ether Glycol Companies:

The following are the leading companies in the polytetramethylene ether glycol market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Chang Chun Group

- Henan Energy Chemical Group Hebi

- Hyosung Corporation

- INVISTA

- Korea PTG

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Sinopec Great Wall Energy & Chemical Co. Ltd

- Shanxi Sanwei Group Co. Ltd

Recent Developments

-

In June 2024, China's 1,4-Butanediol capacity expanded which contributed to the growth of downstream spandex production in recent years. Consequently, there has been an increase in the capacity of polytetramethylene ether glycol. Presently, the supply of polytetramethylene ether glycol surpasses demand, resulting in heightened competition among companies.

-

In September 2023, BASF announced the planned expansion of its current range of BDO derivatives to include bio-based variants of polytetramethylene ether glycol (PolyTHF) and tetrahydrofuran (THF). Anticipated availability of the initial commercial quantities is expected in Q1 2025..

Polytetramethylene Ether Glycol Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.71 billion |

|

Revenue forecast in 2030 |

USD 3.88 billion |

|

Growth rate |

CAGR of 6.2% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa. |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Thailand, Brazil, Argentina, South Africa |

|

Key companies profiled |

BASF SE, Chang Chun Group, Henan Energy Chemical Group Hebi, Hyosung Corporation, INVISTA, Korea PTG, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Corporation, Sinopec Great Wall Energy & Chemical Co. Ltd, and Shanxi Sanwei Group Co. Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polytetramethylene Ether Glycol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polytetramethylene ether glycol market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Spandex

-

Thermoplastic Urethane Elastomers

-

Co-polyester Ether Elastomers

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coatings

-

Adhesives & Sealants

-

Textiles

-

Artificial Leather

-

Automotive

-

Industrial

-

Leisure & Sports

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."