- Home

- »

- Plastics, Polymers & Resins

- »

-

Polypropylene Absorbent Hygiene Market Size Report, 2030GVR Report cover

![Polypropylene Absorbent Hygiene Market Size, Share & Trends Report]()

Polypropylene Absorbent Hygiene Market (2024 - 2030) Size, Share & Trends Analysis By Product (Spundbond, Meltdown), By Application (Baby Diapers, Female Hygiene Products), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-337-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

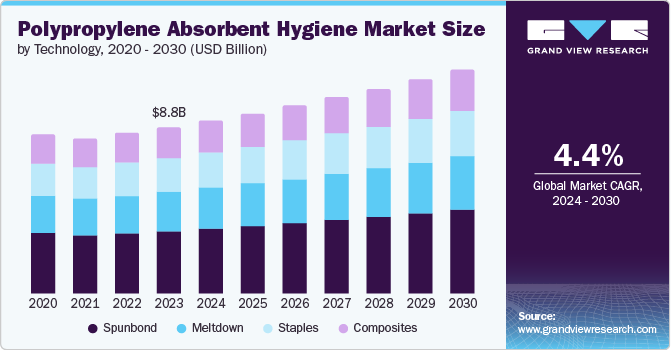

The global polypropylene absorbent hygiene market size was valued at USD 8.78 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The market was primarily driven by population growth and increased awareness of personal hygiene leading to the demand for polypropylene-based absorbent hygiene products such as diapers, adult incontinence pads, and feminine hygiene products. The global market has witnessed consumers worldwide rapidly shift toward disposable hygiene products due to convenience and lifestyle changes.

Furthermore, the market witnessed considerable growth as consumers recognized the importance of maintaining personal well-being through reliable and comfortable hygiene after the pandemic. Polypropylene (PP) absorbent items, known for their effectiveness and affordability, are expected to continue their demand, with people prioritizing health and safety. This demand has led companies to diversify suppliers, implement digital solutions, and optimize logistics networks, ensuring consistent availability of raw materials and finished products.

In addition, growing environmental concerns have made manufacturers recognize the importance of recycling products, including absorbent hygiene products. PP-based hygiene products can be effectively reused, reducing waste and minimizing environmental impact. Moreover, PP’s lightweight properties lower greenhouse gas emissions during production.

Several industry players, such as Unilever Plc and Essity AB, have increasingly invested in research and development activities to enhance the sustainability of absorbent hygiene products. Innovations in materials, including Super Absorbent Polymers (SAPs), design, and manufacturing processes, have led to improved absorbency, comfort, and overall quality. They are increasingly expanding their product portfolios to cater to consumer needs, including gender-specific designs and eco-friendly variants. This ensures that consumers find products that align with their preferences and values.

Technology Insights

In terms of technology, spunbond dominated the market in 2023 owing to its cheaper production of PP fibers compared to other nonwoven fabrics. PP spunbond nonwovens are extensively used in baby and adult diapers, feminine hygiene products, and adult incontinence products as they offer comfort, absorbency, and skin-friendliness with cost-effectiveness. In addition, spunbond products provide huge convenience and disposability with their lightweight, soft texture and excellent fluid management properties, further driving their adoption.

Meltblown technology has emerged as the fastest-growing segment during the forecast period. This can be credited to its ability to filter particles and impurities, which is crucial for hygiene applications, including face masks, surgical gowns, and air filters. Moreover, the rising infant populations have contributed to the sustained demand for meltblown PP absorbent products as they wick away moisture and maintain optimal dryness as lightweight, single-use solutions.

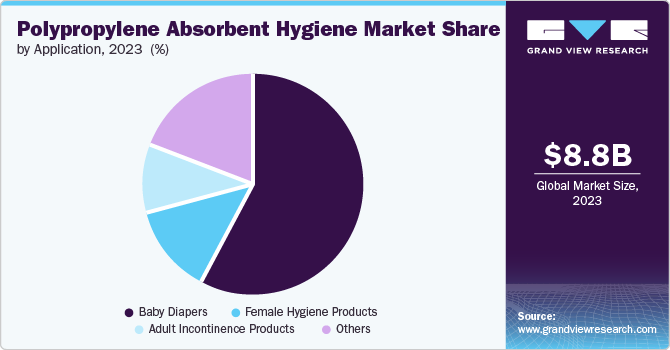

Application Insights

Baby diapers registered a substantial market share of 58.0% in 2023, owing to the increasing awareness about infant hygiene. The market is projected to grow with the rising awareness of the impact of high-quality hygiene products on the infant’s overall health. Consumers are rapidly inclining towards diapers that offer comfort and effective moisture absorption. Moreover, the increased concern about skin sensitivity drives the demand for diapers made from skin-friendly materials. PP, commonly used in diaper cores, provides excellent absorbency without causing skin irritation or rashes.

Female hygiene products have emerged as the fastest-growing segment at a CAGR of 3.86% over the forecast period. The growing concern about potential health risks has propelled significant demand for safer, non-toxic PP absorbent hygiene products. PP based hygiene products avoid harmful chemicals used in bleaching processes, prioritize skin comfort, and have a positive impact on reproductive health and development.

Regional Insights

The North America polypropylene absorbent hygiene market accounted for 20.7% of the share. The market was driven by the increase in disposable income among consumers. As consumers prioritize convenience, comfort, and health, the adoption of baby diapers, feminine care items, and adult incontinence pads made from polypropylene continues to be strong. Additionally, the aging population in North America has led to a surge in demand for reliable and comfortable adult incontinence products.

U.S. Polypropylene Absorbent Hygiene Market Trends

The U.S. polypropylene absorbent hygiene market was propelled by the rising geriatric population which led to an increased demand for adult incontinence products. Urinary incontinence, a common issue among the elderly population, has significantly driven the need for high-quality absorbent products. Additionally, the replacement of synthetic raw materials with bio-based polypropylene diapers helps prevent skin rashes among babies while keeping them dry.

Asia Pacific Polypropylene Absorbent Hygiene Market Trends

The polypropylene absorbent hygiene market in Asia Pacific held the dominant share with 46.4% in 2023. This was primarily driven by the rapid growth of birth rates in countries including China and India, where the need for reliable and effective baby diapers grew significantly. These polypropylene-based products provide comfort and absorbency for infants. In addition, urban lifestyles increase the demand for convenient, disposable hygiene items. Baby diapers, feminine care products, and adult incontinence pads have become essential for urban dwellers seeking comfort and convenience.

China has emerged as the largest volume market for hygiene absorbent products in 2023. China’s robust economic growth and increasing disposable income among consumers played a pivotal role in the rapid penetration and growth of these products. In addition, government policies and incentives supporting the manufacturing sector to focus on bio-chemicals and materials aligning with sustainability goals have further augmented significant growth.

Europe Polypropylene Absorbent Hygiene Market Trends

The polypropylene absorbent hygiene market in Europe held 24.9% of the market share in 2023 owing to the extensive demand for female hygiene products. The market has witnessed high demand for adult incontinence products, designed for seniors and individuals with bladder control issues to maintain comfort. In addition, as European countries emphasize sustainability and environmental consciousness, policies promoting the energy transition and supporting bio-chemical materials have augmented growth in the manufacturing sector.

Key Polypropylene Absorbent Hygiene Company Insights

Some of the prominent players in the market are Asahi Kasei Corporation, Beco by Kwick Living (I) Limited, and C&S Paper Co., Ltd. These companies are increasingly investing in R&D activities and strategic collaborations to maintain their lucrative footprint in the market. However, established market players encounter strong competition from local or unorganized sectors that offer cost-effective products meeting international standards.

- Kimberly Clark is a global leader in personal care and hygiene products. Their brands, such as Huggies and Kotex, dominate the baby diaper and feminine hygiene segments. Their innovations and marketing strategies shape industry dynamics.

Key Polypropylene Absorbent Hygiene Companies:

The following are the leading companies in the polypropylene absorbent hygiene market. These companies collectively hold the largest market share and dictate industry trends.

- Asahi Kasei Corporation

- Beco by Kwick Living (I) Limited

- C&S Paper Co., Ltd.

- CNC International Co., Ltd.

- DuPont de Nemours, Inc.

- Essity AB

- Fibertex Nonwovens A/S

- Georgia-Pacific Consumer Products LP

- Global Nonwovens

- Godrej & Boyce Manufacturing Company Limited

- Gulsan Holding A.S.

- Hengan International Group Co., Ltd.

- Kimberly-Clark Corporation

- METSÄ GROUP

- Mitsui Chemicals, Inc.

Recent Developments

-

In 2024, Kimberly Clark Corporation announced the launch of the Skin Essentials equipped with the innovative SkinProtect liner technology to safeguard baby’s skin against the primary causes of rashes.

Polypropylene Absorbent Hygiene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.13 billion

Revenue forecast in 2030

USD 11.82 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

Asahi Kasei Corporation; Beco by Kwick Living (I) Limited; C&S Paper Co., Ltd.; CNC International Co., Ltd.; DuPont de Nemours, Inc.; Essity AB; Fibertex Nonwovens A/S; Georgia-Pacific Consumer Products LP; Global Nonwovens; Godrej & Boyce Manufacturing Company Limited; Gulsan Holding A.S.; Hengan International Group Co., Ltd.; Kimberly-Clark Corporation; METSÄ GROUP; Mitsui Chemicals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polypropylene Absorbent Hygiene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polypropylene absorbent hygiene market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Spunbond

-

Meltdown

-

Composites

-

Staples

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

Baby Diapers

-

Female Hygiene Products

-

Adult Incontinence

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030) (Volume in Kilotons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.