Polypropylene Nonwoven Fabric Market Size, Share & Trends Analysis Report By Product (Spunbonded, Staples), By Application (Hygiene, Industrial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-105-4

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

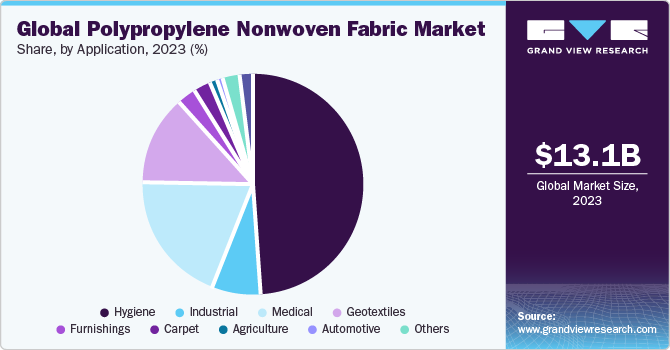

The global polypropylene nonwoven fabric market size was estimated at 28.83 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The product demand is expected to witness significant growth over the projected period on account of rising product demand in end-use industries including hygiene, medical, automotive, agriculture, and furnishing. High demand for polypropylene non-woven fabric in the hygiene industry for manufacturing sanitary products for babies, women, and adults is likely to drive industry growth.

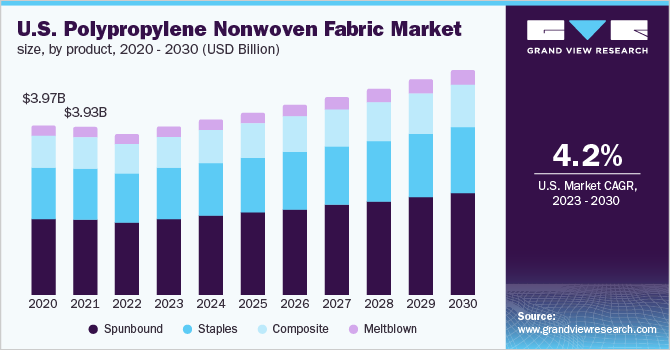

Spunbonded technology is the most widely used manufacturing process for polypropylene non-woven fabrics. Low cost and easy production process associated with this technology have been the key factor for a higher market share of these products. The demand for meltblown and composite products is expected to grow in geotextiles and industrial applications on account of their high moisture barrier and high strength properties. However, the high cost associated with meltblown polypropylene nonwoven fabrics is expected to hamper their market growth over the projected period.

The U.S. held the largest share in terms of revenue and accounted for 65% of the total market share in 2023. The U.S. emerged as one of the largest markets for polypropylene nonwoven fabric, in 2023, owing to huge demand from the healthcare industry on account of the COVID outbreak in the country. The country witnessed an increase in demand for disposable polypropylene nonwovens, which are primarily manufactured using spunbonded technology, owing to its wide usage in personal protective equipment.

The market is highly fragmented due to the presence of a large number of small players operating worldwide. It is characterized by high competition on prices that places a heavy demand on the development of innovative products and production efficiency thereby increasing competitive rivalry in the market. In addition, major manufacturers of polypropylene nonwoven fabric work together with their customers, raw material suppliers, and machinery manufacturers to research, develop, and implement new products to compete based on product differentiation and low-cost technology.

The largest polypropylene nonwoven producers are Berry Global, Freudenberg, Kimberly-Clark Corp., Ahlstrom-Munksjo Oyj, and Johns Manville Corp. Furthermore, prominent players in the market are focusing on enhancements in business by expanding their geographical reach and introducing application-specified products. Mergers, acquisitions, joint ventures, and agreements are considered by these players to expand their portfolio and business reach.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The polypropylene non-woven fabrics market is highly fragmented owing to the presence of numerous manufacturers. The companies in the market invest highly on R&D to improve product quality and reduce product weight. High production capacities, wide distribution network and goodwill in the market are the key factors that offer competitive advantage for the multinationals in this business. The companies in the market use mergers and acquisition and capacity expansion strategies in order to strengthen their position in the competitive market.

Polypropylene (PP) non-woven fabrics are manufactured by means of different technologies. The companies are emphasizing on development of innovative specialty products for various industrial applications. Additionally, polypropylene (PP) non-woven fabrics manufacturers are further investing towards development of new technologies of production, and usage of sustainable materials for making nonwovens.

Several regulations have been enforced for the production of and use of PP non-woven fabrics in different application industries. In addition, regulations are enforced about the use of raw material in the production of PP non-woven fabric.

The polypropylene nonwoven fabrics are majorly used in the market on account of its characteristics such as resistance to many chemical solvents, acids and bases among several others which offers premium quality nonwoven fabrics for application industries. However, the development of bio-based polypropylene on account of growing environmental concerns related to disposal is expected to hamper the market growth over the forecast period.

The buyers of PP nonwoven fabrics are the major producers of hygiene and medical products. The product property required by these players address specific requirements to meet government regulations and customer specific requirements for lower basis weights and softness indicates high bargaining power of buyers.

Product Insights

Spunbound led the market and accounted for a revenue of USD 13.07 billion in 2023 as it is the simplest and the most cost-efficient technology used for manufacturing polypropylene nonwoven fabrics. Excellent properties offered by spunbonded nonwoven fabrics coupled with high process efficiency associated with this technology are likely to drive the product demand in various applications. These applications include geotextiles, hygiene, medical, packaging, and shoe manufacturing among others. Spunbonded is the most widely used technology for manufacturing nonwoven fabrics.

The characteristics offered by these products vary from lightweight, flexible structures to highly stiff and heavy structures, thus offering wide application scope across end-use industries. The spunbonded nonwoven fabrics are characterized by random fibrous structures, high opacity, high tear strength, low drape ability, high liquid retention capacity, and excellent fray and crease resistance. The spunbonded nonwoven fabrics offer excellent tensile strength and filtration properties on account of their ability to resist chemical attack and provide a moisture barrier.

Staples polypropylene nonwoven fabrics are gaining importance in medical applications over other polypropylene nonwoven fabrics on account of their finer filtration and low-pressure drop properties. Increasing staple polypropylene nonwoven penetration in medical applications such as gloves, medical packaging, surgical gowns, masks, drapes, and covers is expected to augment the market growth. Surgical drapes, gowns, and masks are expected to be primary products driving demand for staples polypropylene nonwoven fabrics. Therefore, stapes polypropylene nonwoven fabric demand is expected to further increase around the world.

Composite had a revenue of USD 4.32 billion in 2023 as they exhibit high strength owing to the rise in the sanitary and hygiene industry. The polypropylene nonwoven composite fabric is used to manufacture baby diapers, sanitary napkins, and adult diapers. In addition, these fabrics are also used to manufacture medical and surgical products such as drapes, masks, caps, and gowns. Growing demand for these products as filtration material and oil absorbents is expected to further bolster its market growth in the future.

Application Insights

The hygiene application segment accounted for the largest share in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. Nonwoven fabric materials offer excellent smoothness, softness, comfort, stretchability, fluid-barring capacity, and absorption as compared to traditional textiles. Thus, are gaining high demand for manufacturing hygiene products.

These products help in retaining fences inside the fabric and retain and absorb urine thus isolating wetness from the skin. These products are odorless and offer excellent smoothness unlike traditional fabrics, thus are likely to gain high demand over the projected period. The increasing geriatric population, leading to the rising occurrence of chronic diseases such as diabetes is likely to drive demand for adult incontinence products, over the forecast period. Thus, positively influencing the demand for polypropylene nonwoven fabrics.

The industrial application segment accounted for the fastest-growing segment in 2023 with a CAGR of 9.4% over the forecast period. Polypropylene nonwoven fabrics are used for manufacturing coated fabrics, display felts, tapes, conveyor belts, cable insulation, air conditioner filters, semiconductor polishing pads, noise absorber felt, etc. in industrial applications. Thus, resulting in increased demand for polypropylene nonwoven fabric in industrial applications.

Medical emerged as the second largest application segment for the industry in 2023. Polypropylene nonwoven fabrics are used for manufacturing surgical caps, gowns, masks, drapes, bed linen, gloves, shrouds, underpads, heat packs, ostomy bag liners, incubator mattresses, etc. in the medical industry. The increasing number of surgical procedures is expected to act as a major driving factor for the demand for polypropylene nonwoven fabrics in the medical industry.

Regional Insights

Asia Pacific dominated the polypropylene nonwoven fabric market and is projected to grow at a CAGR of 8.4% in terms of revenue during the forecast period 2024-2030. This growth can be attributed to the growing demand for durable polypropylene nonwoven fabrics in industries such as construction, agriculture, and automobile over the forecast period. In addition, polypropylene nonwoven fabrics are majorly used in consumer products such as disposable diapers, adult incontinence products, and feminine care products, thus driving product demand.

The polypropylene nonwoven fabric market in China is expected to witness growth on account of presence of major hygiene product manufacturers such as Kimberley Clark, Diao and Berry Global. Furthermore, polypropylene nonwoven fabric market in India is expected to grow at a second fastest CAGR of 8.2% over the period of 2024-2030 owing to use of product for crop protection using products such as seed blanket, crop cover, root bags and turf protection products for improved agriculture.

The demand for polypropylene nonwoven fabrics in North America is likely to witness moderate growth over the projected period owing to the continuous demand from the hygiene, medical, and automotive industry. The industry growth in recent years is likely to grow at a slower pace over the forecast period owing to the market achieving maturity.

The nonwoven industry in Europe is witnessing growth in terms of production on account of the presence of several established nonwoven fabric manufacturers in the region. The nonwoven industry in well-established economies such as France is expected to witness steady growth, whereas countries including the U.K., Romania, Russia, Slovenia, and the Czech Republic are expected to gain traction in terms of production growth. This is expected to fuel the growth of the industry for polypropylene nonwoven fabric industry over the forecast period.

Central & South America was valued at USD 2.36 million in 2023 and is expected to grow at a CAGR of 7.9% over the forecast period. High consumer awareness regarding health, hygiene, and safety is expected to positively impact the polypropylene nonwoven fabrics industry over the forecast period. The economic recovery in the region is expected to support the modest growth in the polypropylene nonwoven fabrics industry. Furthermore, increasing healthcare expenditure in the region is expected to drive the hygiene and medical segment’s growth over the forecast period.

Key Companies & Market Share Insights

Key players in the market are entering into agreements with emerging and small-scale players to expand their distribution capacities and increase the geographical presence of their products. Furthermore, manufacturers are focusing on other efficient and effective distribution channels. As a result, companies are likely to establish partnerships with e-commerce portals to ensure that buyers have timely access to polypropylene nonwoven fabric products.

The innovation, development, and production of polypropylene nonwovens are influenced by the presence of major players, which contribute to a large share of the market. While many of the leading companies are based in developed regions such as North America and Europe, many companies based in emerging economies in Asia continue to invest and grow, increasing their share in the market.

-

In July 2023, Berry Global partnered with Deaconess Midtown Hospital and Nexus Circular for an initiative to recycle sterile, non-hazardous, plastic packaging as well as nonwoven fabric safely and effectively from the hospital’s surgical center. As a result, approximately 500 pounds of clean, used plastic, majorly consisting of the exterior packaging of surgical tools and unused nonwoven surgical gowns and cloths, will be diverted from landfills weekly.

-

In February 2023, Asahi Kasei announced an agreement with Mitsui Chemicals regarding the establishment of a new joint venture company through the integration of their nonwovens businesses. The new company would be named Mitsui Chemicals Asahi Life Materials Co. and would be based in Tokyo, Japan. The resulting company’s sites in Japan would include Mitsui’s Nogoya Works plant in Aichi and its Sunrex subsidiary in Mie. Outsourced production will be provided by Asahi Kasei’s Moriyama plant.

- In September 2022, Suominen launched its tri-layer nonwoven, ‘FIBRELLA Strata’, for various industries and applications, particularly in the baby market. The tri-layer structure of the product is stated to offer high levels of softness and an exceptional cleaning performance.

Key Polypropylene Nonwoven Fabric Companies:

- Kimberly-Clark Corporation

- Berry Global, Inc.

- Lydall, Inc.

- First Quality Nonwovens Inc.

- PFNonwovens a.s.

- Schouw & Co.

- Mitsui Chemicals Inc.

- FITESA

- Toray Industries Inc.

- Freudenberg Group

- Ahlstrom-Munksjo Oyj

- Johns Manville Corporation

- Suominen Corporation

- Asahi Kasai Corporation

Polypropylene Nonwoven Fabric Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 30.53 billion |

|

Revenue forecast in 2030 |

USD 45.29 billion |

|

Growth Rate |

CAGR of 6.8% from 2024 to 2030 |

|

Actual estimates/Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in Kilotons, revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Spain, Italy, Russia, China, Japan, India, South Korea, Oceania, Taiwan, Thailand, Malaysia, Brazil, Argentina, Saudi Arabia, Turkey, South Africa, Egypt, UAE |

|

Key companies profiled |

Kimberly-Clark Corporation, Berry Global, Inc., Lydall, Inc., First Quality Nonwovens Inc., PFNonwovens a.s., Schouw & Co., Mitsui Chemicals Inc., FITESA, Toray Industries Inc., Freudenberg Group, Ahlstrom-Munksjo Oyj, Johns Manville Corporation, Suominen Corporation, Asahi Kasai Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

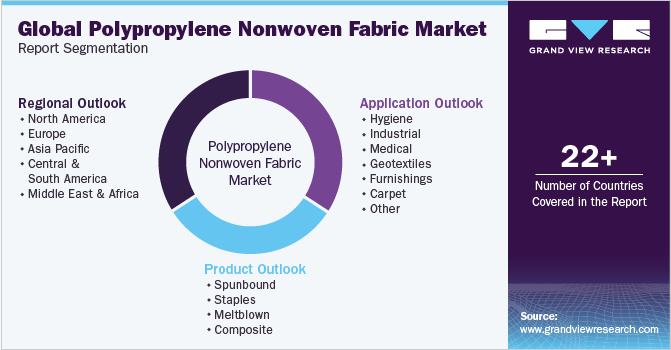

Global Polypropylene Nonwoven Fabric Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the polypropylene nonwoven fabric market on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Spunbound

-

Staples

-

Meltblown

-

Composite

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Hygiene

-

Industrial

-

Medical

-

Geotextiles

-

Furnishings

-

Carpet

-

Agriculture

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Oceania

-

Taiwan

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Turkey

-

South Africa

-

Egypt

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polypropylene nonwoven fabric market size was estimated at USD 27,445.2 million in 2022 and is expected to reach USD 28,830.2 million in 2023.

b. The global polypropylene nonwoven fabric market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 45,296.7 million by 2030.

b. Spunbound product dominated polypropylene nonwoven fabric market with a share of 48.0% in 2022 owing to its random fibrous structures, high opacity, high tear strength, low drape ability, high liquid retention capacity and excellent fray and crease resistance.

b. Some of the key players operating in the polypropylene nonwoven fabric market include Kimberly-Clark Corporation, Berry Global, Inc., Lydall, Inc., PFNonwovens a.s., Mitsui Chemicals Inc., FITESA, Toray Industries Inc.

b. The key factor which is driving polypropylene nonwoven fabric market is rising product demand in end-use industries including hygiene, medical, automotive, agriculture and furnishing.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Research Methodology

1.1. Research Scope & Assumption

1.1. Information Procurement

1.1.1. Purchased Database

1.1.1. GVR’s Internal Database

1.1.1. Secondary Sources & Third-Party Perspectives

1.1.1. Primary Research

1.1. Information Analysis

1.1.1. Data Analysis Models

1.1. Market Formulation & Data Visualization

1.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook, 2023 (USD Million)

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Polypropylene Nonwoven Fabric Market Variables, Trends & Scope

3.1. Parent Market Outlook

3.2. Value Chain Analysis

3.1.1. Raw Material Trends

3.3. Regulatory Framework

3.1.1. Analyst Perspective

3.4. Technology Overview

3.1.1. Spunbond Technology

3.1.1. Meltblown Technology

3.1.1. Air-laid Technology

3.1.1. Needlepunch Technology

3.1.1. Wet-laid Technology

3.1.1. Composite

3.5. Polypropylene Nonwoven Fabric Market - Market Dynamics

1.1.1. Market Driver Analysis

3.1.1.1. Rising Demand from Personal Hygiene Market

3.1.1.1. Rising Demand from Geotextiles

3.1.1. Market restraint analysis

1.1.1.1. Volatile Raw Material Prices

3.1.1. Market Opportunity Analysis

3.1.1. Market Challenge Analysis

3.6. Polypropylene Nonwoven Fabric Market- Price Trend Analysis

3.7. Supply Demand Landscape, by Region

3.1.1. North America

3.1.1. Europe

3.1.1. Asia Pacific

3.1.1. Central & South America

3.1.1. Middle East & Africa

3.8. Critical Success Factor in Global Market

3.1.1. Mergers & Acquisitions

3.1.1. Product Differentiation

3.1.1. Investment in Emerging Markets and Capacity Expansion

3.9. Polypropylene Nonwoven Fabric Market - Porter’s five forces analysis

3.1.1. Bargaining Power of Suppliers

3.1.2. Bargaining Power of Buyer

3.1.3. Threat of New Entrants

3.1.4. Threat of Substitution

3.1.5. Competitive Rivalry

3.10. Industry Analysis - PESTLE

3.10.1. Political Landscape

3.10.2. Economic Landscape

3.10.3. Social Landscape

3.10.4. Technological Landscape

3.10.5. Environmental Landscape

Chapter 4. Polypropylene Nonwoven Fabric Market: Product Estimates & Trend Analysis

4.1. Definition & Scope

4.2. Polypropylene Nonwoven Fabric Market: Product Movement Analysis, 2023 & 2030

4.3. Spunbounded

4.3.1. Spunbounded Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.4. Staples

4.4.1. Staples Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.5. Meltblown

4.5.1. Meltblown Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

4.6. Composite

4.6.1. Composite Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

Chapter 5. Polypropylene Nonwoven Fabric Market: Application Estimates & Trend Analysis

5.1. Definition & Scope

5.2. Polypropylene Nonwoven Fabric Market: Application Movement Analysis, 2023 & 2030

5.3. Hygiene

5.3.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Hygiene, 2018 - 2030 (Kilotons) (USD Million)

5.4. Industrial

5.4.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Industrial, 2018 - 2030 (Kilotons) (USD Million)

5.5. Medical

5.5.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Medical, 2018 - 2030 (Kilotons) (USD Million)

5.6. Geotextile

5.6.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Geotextile, 2018 - 2030 (Kilotons) (USD Million)

5.7. Furnishing

5.7.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Furnishing, 2018 - 2030 (Kilotons) (USD Million)

5.8. Carpet

5.8.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Carpet, 2018 - 2030 (Kilotons) (USD Million)

5.9. Agriculture

5.9.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Agriculture, 2018 - 2030 (Kilotons) (USD Million)

5.10. Automotive

5.10.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Automotive, 2018 - 2030 (Kilotons) (USD Million)

5.11. Others

5.11.1. Polypropylene Nonwoven Fabric Market Estimates and Forecasts in Other Applications, 2018 - 2030 (Kilotons) (USD Million)

Chapter 6. Polypropylene Nonwoven Fabric Market: Regional Estimates & Trend Analysis

6.1. Definition & Scope

6.2. Polypropylene Nonwoven Fabric Market: Regional Movement Analysis, 2023 & 2030

6.3. North America

6.3.1. North America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.2. North America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.3.3. North America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.3.4. U.S.

6.3.4.1. U.S. Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.2. U.S. Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.3.4.3. U.S. Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.3.5. Canada

6.3.5.1. Canada Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.2. Canada Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.3.5.3. Canada Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.3.6. Mexico

6.3.6.1. Mexico Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.2. Mexico Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.3.6.3. Mexico Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4. Europe

6.4.1. Europe Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.2. Europe Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.3. Europe Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.4. UK

6.4.4.1. UK Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.2. UK. Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.4.3. UK Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.5. Germany

6.4.5.1. Germany Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.2. Germany Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.5.3. Germany Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.6. France

6.4.6.1. France Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.2. France Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.6.3. France Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.7. Spain

6.4.7.1. Spain Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.2. Spain Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.7.3. Spain Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.8. Italy

6.4.8.1. Italy Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.2. Italy Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.8.3. Italy Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.4.9. Russia

6.4.9.1. Russia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.2. Russia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.4.9.3. Russia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.2. Asia Pacific Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.3. Asia Pacific Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.4. China

6.5.4.1. China Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.2. China Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.4.3. China Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.5. Japan

6.5.5.1. Japan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.2. Japan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.5.3. Japan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.6. India

6.5.6.1. India Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.2. India Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.6.3. India Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.7. South Korea

6.5.7.1. South Korea Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.2. South Korea Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.7.3. South Korea Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.8. Oceania

6.5.8.1. Oceania Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.2. Oceania Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.8.3. Oceania Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.9. Taiwan

6.5.9.1. Taiwan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.9.2. Taiwan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.9.3. Taiwan Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.10. Thailand

6.5.10.1. Thailand Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.10.2. Thailand Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.10.3. Thailand Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.5.11. Malaysia

6.5.11.1. Malaysia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.5.11.2. Malaysia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.5.11.3. Malaysia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.6. Central & South America

6.6.1. Central & South America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.2. Central & South America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.6.3. Central & South America Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.6.4. Brazil

6.6.4.1. Brazil Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.2. Brazil Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.6.4.3. Brazil Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.6.5. Argentina

6.6.5.1. Argentina Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.2. Argentina Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.6.5.3. Argentina Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.2. Middle East & Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.3. Middle East & Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.7.4. Saudi Arabia

6.7.4.1. Saudi Arabia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.2. Saudi Arabia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.4.3. Saudi Arabia Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.7.5. Turkey

6.7.5.1. Turkey Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.5.2. Turkey Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.5.3. Turkey Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

m 4.7.6. South Africa

6.7.6.1. South Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.6.2. South Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.6.3. South Africa Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.7.7. Egypt

6.7.7.1. Egypt Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.7.2. Egypt Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.7.3. Egypt Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

6.7.8. UAE

6.7.8.1. UAE Polypropylene Nonwoven Fabric Market Estimates and Forecasts, 2018 - 2030 (Kilotons) (USD Million)

6.7.8.2. UAE Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Product, 2018 - 2030 (Kilotons) (USD Million)

6.7.8.3. UAE Polypropylene Nonwoven Fabric Market Estimates and Forecasts, by Application, 2018 - 2030 (Kilotons) (USD Million)

Chapter 7. Competitive Landscape

7.1. Key Players, their Recent Developments, and their Impact on Industry

7.2. Vendor Landscape

7.3. Key Company/Competition Categorization

7.4. Public Companies

7.4.1. Company Market Position Analysis

7.4.2. Company Market Share, Ranking by Region

7.4.3. Competitive Dashboard Analysis

7.5. Private Companies

7.5.1. List of Key Emerging Companies and Their Geographical Presence

Chapter 8. Company Profiles

8.1. Kimberly-Clark Corporation

8.1.1. Company Overview

8.1.2. Financial Performance

8.1.3. Product Benchmarking

8.1.4. Strategic Framework

8.2. Berry Global, Inc.

8.2.1. Company Overview

8.2.2. Financial Performance

8.2.3. Product Benchmarking

8.2.4. Strategic Framework

8.3. Lydall, Inc.

8.3.1. Company Overview

8.3.2. Financial Performance

8.3.3. Product Benchmarking

8.3.4. Strategic Framework

8.4. First Quality Nonwovens Inc.

8.4.1. Company Overview

8.4.2. Product Benchmarking

8.5. PFNonwovens a.s.

8.5.1. Company Overview

8.5.2. Financial Performance

8.5.3. Product Benchmarking

8.5.4. Strategic Framework

8.6. Schouw & Co.

8.6.1. Company Overview

8.6.2. Financial Performance

8.6.3. Product Benchmarking

8.6.4. Strategic Framework

8.7. Mitsui Chemicals Inc.

8.7.1. Company Overview

8.7.2. Financial Performance

8.7.3. Product Benchmarking

8.8. FITESA

8.8.1. Company Overview

8.8.2. Product Benchmarking

8.8.3. Strategic Initiatives

8.9. Toray Industries Inc.

8.9.1. Company Overview

8.9.2. Financial Benchmarking

8.9.3. Product Benchmarking

8.9.4. Strategic Initiatives

8.10. Freudenberg Group

6.10.1. Company Overview

6.10.2. Financial Benchmarking

6.10.3. Product Benchmarking

6.10.4. Strategic Initiatives

8.11. Ahlstrom-Munksjo Oyj

8.11.1. Company Overview

8.11.2. Financial Benchmarking

8.11.3. Product Benchmarking

8.11.4. Strategic Initiatives

8.12. Johns Manville Corporation

8.12.1. Company Overview

8.12.2. Financial Benchmarking

8.12.3. Product Benchmarking

8.12.4. Strategic Initiatives

8.13. Souminen Corporation

8.13.1. Company Overview

8.13.2. Financial Benchmarking

8.13.3. Product Benchmarking

8.13.4. Strategic Initiatives

8.14. Asahi Kasai Corporation

8.14.1. Company Overview

8.14.2. Financial Benchmarking

8.14.3. Product Benchmarking

8.14.4. Strategic Initiatives

List of Tables

Table 1 Polypropylene (PP) spunbonded nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 2 Polypropylene (PP) staples nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 3 Polypropylene (PP) meltblown nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 4 Polypropylene (PP) composite nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 5 Polypropylene (PP) nonwoven fabric market estimates and forecasts for hygiene application, 2018 - 2030 (Kilotons) (USD Million)

Table 6 Polypropylene (PP) nonwoven fabric market estimates and forecasts for industrial application, 2018 - 2030 (Kilotons) (USD Million)

Table 7 Polypropylene (PP) nonwoven fabric market estimates and forecasts for medical application, 2018 - 2030 (Kilotons) (USD Million)

Table 8 Polypropylene (PP) nonwoven fabric market estimates and forecasts for geotextiles application, 2018 - 2030 (Kilotons) (USD Million)

Table 9 Polypropylene (PP) nonwoven fabric market estimates and forecasts for furnishing application, 2018 - 2030 (Kilotons) (USD Million)

Table 10 Polypropylene (PP) nonwoven fabric market estimates and forecasts for carpet application, 2018 - 2030 (Kilotons) (USD Million)

Table 11 Polypropylene (PP) nonwoven fabric market estimates and forecasts for agriculture application, 2018 - 2030 (Kilotons) (USD Million)

Table 12 Polypropylene (PP) nonwoven fabric market estimates and forecasts for automotive application, 2018 - 2030 (Kilotons) (USD Million)

Table 13 Polypropylene (PP) nonwoven fabric market estimates and forecasts in other application, 2018 - 2030 (Kilotons) (USD Million)

Table 14 North America polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 15 North America polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 16 North America polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 17 North America polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 18 North America polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 19 U.S. polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 20 U.S. polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 21 U.S. polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 22 U.S. polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 23 U.S. polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 24 Canada polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 25 Canada polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 26 Canada polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 27 Canada polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 28 Canada polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 29 Mexico polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 30 Mexico polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 31 Mexico polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 32 Mexico polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 33 Mexico polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 34 Europe polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 35 Europe polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 36 Europe polypropylene (PP) nonwoven fabric market revenue, by product2018 - 2030 (USD Million)

Table 37 Europe polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 38 Europe polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 39 UK polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 40 UK polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 41 UK polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 42 UK polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 43 UK polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 44 Germany polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 45 Germany polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 46 Germany polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 47 Germany polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 48 Germany polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 49 France polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 50 France polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 51 France polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 52 France polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 53 France polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 54 Spain polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 55 Spain polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 56 Spain polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 57 Spain polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 58 Spain polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 59 Italy polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 60 Italy polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 61 Italy polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 62 Italy polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 63 Italy polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 64 Russia polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 65 Russia polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 66 Russia polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 67 Russia polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 68 Russia polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 69 Asia Pacific polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 70 Asia Pacific polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 71 Asia Pacific polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 72 Asia Pacific polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 73 Asia Pacific polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 74 China polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 75 China polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 76 China polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 77 China polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 78 China polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 79 Japan polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 80 Japan polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 81 Japan polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 82 Japan polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 83 Japan polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 84 India polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 85 India polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 86 India polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 87 India polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 88 India polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 89 South Korea polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 90 South Korea polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 91 South Korea polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 92 South Korea polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 93 South Korea polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 94 Oceania polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 95 Oceania polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 96 Oceania polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 97 Oceania polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 98 Oceania polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 99 Taiwan polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 100 Taiwan polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 101 Taiwan polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 102 Taiwan polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 103 Taiwan polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 104 Thailand polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 105 Thailand polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 106 Thailand polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 107 Thailand polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 108 Thailand polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 109 Malaysia polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 110 Malaysia polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 111 Malaysia polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 112 Malaysia polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 113 Malaysia polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 114 Central & South America polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 115 Central & South America polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 116 Central & South America polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 117 Central & South America polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 118 Central & South America polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 119 Brazil polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 120 Brazil polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 121 Brazil polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 122 Brazil polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 123 Brazil polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 124 Argentina polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 125 Argentina polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 126 Argentina polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 127 Argentina polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 2028 (Kilotons)

Table 128 Argentina polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 129 Middle East & Africa polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 130 Middle East & Africa polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 131 Middle East & Africa polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 132 Middle East & Africa polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 133 Middle East & Africa polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 134 Saudi Arabia polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 135 Saudi Arabia polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 136 Saudi Arabia polypropylene (PP) nonwoven fabric market revenue, by product2018 - 2030 (USD Million)

Table 137 Saudi Arabia polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 138 Saudi Arabia polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 139 Turkey polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 140 Turkey polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 141 Turkey polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 142 Turkey polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 143 Turkey polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 144 South Africa polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 145 South Africa polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 146 South Africa polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 147 South Africa polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 148 South Africa polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 149 Egypt polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 150 Egypt polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 151 Egypt polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 152 Egypt polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 153 Egypt polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 154 UAE polypropylene (PP) nonwoven fabric market estimates and forecasts, 2018 - 2030 (Kilotons) (USD Million)

Table 155 UAE polypropylene (PP) nonwoven fabric market volume, by product, 2018 - 2030 (Kilotons)

Table 156 UAE polypropylene (PP) nonwoven fabric market revenue, by product, 2018 - 2030 (USD Million)

Table 157 UAE polypropylene (PP) nonwoven fabric market volume, by application, 2018 - 2030 (Kilotons)

Table 158 UAE polypropylene (PP) nonwoven fabric market revenue, by application, 2018 - 2030 (USD Million)

Table 159 Vendor landscape - Polypropylene nonwoven market

List of Figures

Fig. 1 Information Procurement

Fig. 2 Primary Research Pattern

Fig. 3 Primary Research Process

Fig. 4 Market research approaches - Bottom-Up Approach

Fig. 5 Market research approaches - Top-Down Approach

Fig. 6 Market research approaches - Combined Approach

Fig. 7 Penetration & growth prospect mapping

Fig. 8 Polypropylene (PP) nonwoven fabric market: Value chain analysis

Fig. 9 Technological landscape

Fig. 10 Polypropylene (PP) nonwoven fabric market dynamics

Fig. 11 Polypropylene (PP) nonwoven fabric market driver impact

Fig. 12 Global baby diapers market, 2021 (%)

Fig. 13 Global baby diapers market, 2017 - 2023 (USD Million)

Fig. 14 Global geotextiles market, 2023 (%)

Fig. 15 Global non-woven geotextiles market, 2018 - 2030 (USD Million)

Fig. 16 Polypropylene (PP) nonwoven fabric market driver impact

Fig. 17 Petroleum Prices (USD per Barrel) (Jan 2023 - Dec 2023)

Fig. 18 Polypropylene (PP) nonwoven fabrics market, price trend analysis, 2018 - 2030

Fig. 19 Polypropylene (PP) nonwoven fabric market: Product movement analysis, 2023 & 2030

Fig. 20 Polypropylene (PP) nonwoven fabric market: Application movement analysis, 2023 & 2030

Market Segmentation

- Polypropylene Nonwoven Fabric Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Spunbound

- Staples

- Meltblown

- Composite

- Polypropylene Nonwoven Fabric Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Polypropylene Nonwoven Fabric Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- North America Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- U.S.

- U.S. Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- U.S. Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- U.S. Polypropylene Nonwoven Fabric Market, by Product

- Canada

- Canada Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Canada Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Canada Polypropylene Nonwoven Fabric Market, by Product

- Mexico

- Mexico Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Mexico Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Mexico Polypropylene Nonwoven Fabric Market, by Product

- North America Polypropylene Nonwoven Fabric Market, by Product

- Europe

- Europe Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Europe Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- U.K.

- U.K. Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- U.K. Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- U.K. Polypropylene Nonwoven Fabric Market, by Product

- Germany

- Germany Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Germany Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Germany Polypropylene Nonwoven Fabric Market, by Product

- France

- France Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- France Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- France Polypropylene Nonwoven Fabric Market, by Product

- Spain

- Spain Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Spain Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Spain Polypropylene Nonwoven Fabric Market, by Product

- Italy

- Italy Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Italy Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Italy Polypropylene Nonwoven Fabric Market, by Product

- Russia

- Russia Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Russia Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Russia Polypropylene Nonwoven Fabric Market, by Product

- Europe Polypropylene Nonwoven Fabric Market, by Product

- Asia Pacific

- Asia Pacific Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Asia Pacific Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- China

- China Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- China Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- China Polypropylene Nonwoven Fabric Market, by Product

- Japan

- Japan Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Japan Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Japan Polypropylene Nonwoven Fabric Market, by Product

- India

- India Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- India Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- India Polypropylene Nonwoven Fabric Market, by Product

- South Korea

- South Korea Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- South Korea Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- South Korea Polypropylene Nonwoven Fabric Market, by Product

- Oceania

- Oceania Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Oceania Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Oceania Polypropylene Nonwoven Fabric Market, by Product

- Taiwan

- Taiwan Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Taiwan Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Taiwan Polypropylene Nonwoven Fabric Market, by Product

- Thailand

- Thailand Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Thailand Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Thailand Polypropylene Nonwoven Fabric Market, by Product

- Malaysia

- Malaysia Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Malaysia Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Malaysia Polypropylene Nonwoven Fabric Market, by Product

- Asia Pacific Polypropylene Nonwoven Fabric Market, by Product

- Central & South America

- Central & South America Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Central & South America Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Brazil

- Brazil Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Brazil Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Brazil Polypropylene Nonwoven Fabric Market, by Product

- Argentina

- Argentina Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Argentina Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Argentina Polypropylene Nonwoven Fabric Market, by Product

- Central & South America Polypropylene Nonwoven Fabric Market, by Product

- Middle East & Africa

- Middle East & Africa Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Middle East & Africa Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Saudi Arabia

- Saudi Arabia Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Saudi Arabia Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Saudi Arabia Polypropylene Nonwoven Fabric Market, by Product

- Turkey

- Turkey Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Turkey Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Turkey Polypropylene Nonwoven Fabric Market, by Product

- South Africa

- South Africa Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- South Africa Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- South Africa Polypropylene Nonwoven Fabric Market, by Product

- Egypt

- Egypt Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- Egypt Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- Egypt Polypropylene Nonwoven Fabric Market, by Product

- UAE

- UAE Polypropylene Nonwoven Fabric Market, by Product

- Spunbound

- Staples

- Meltblown

- Composite

- UAE Polypropylene Nonwoven Fabric Market, by Application

- Hygiene

- Industrial

- Medical

- Geotextiles

- Furnishings

- Carpet

- Agriculture

- Automotive

- Others

- UAE Polypropylene Nonwoven Fabric Market, by Product

- Middle East & Africa Polypropylene Nonwoven Fabric Market, by Product

- North America

Polypropylene Nonwoven Fabric Market Dynamics

Driver: Rising Demand from Personal Hygiene Market

PP non-woven fabrics are used in personal hygiene products such as sanitary napkins, baby diapers, wet and dry wipes, training pants, cosmetic applicators, lese tissues, adult incontinence products such as top sheets, stretch ears, back sheets, fastening systems, core wrap among several others. They offer superior absorption, elasticity, strength, softness, tear resistance opacity, and breathability. These factors have driven its adoption in the production of hygiene products.

The market growth is factored by the surge in demand for absorbent personal hygiene products to improve quality of life, skin health, discretion, reliability, and convenience. Increasing birth rates and rising awareness about the benefits of baby diapers are expected to accelerate the market growth.

Asia Pacific and Central & South America are among the emerging regions in terms of industrialization and consumerism. They exhibit promising growth prospects owing to rising consumer disposable income and increasing consumer awareness related to hygiene products. Whereas developed economies such as the U.S., Europe, and Japan where more than 95% of parents use diapers for babies are expected to exhibit a lower growth due to a comparatively low birth rate.

Driver: Rising Demand for Geotextiles

Geotextiles are a vital material in civil engineering projects and are commonly used in heavy construction, geotechnical engineering, environmental engineering, building and pavement construction, and hydrology industries. Geotextiles are widely used in filtration, drainage, separation, reinforcement, and protection in the construction of airfields, railways, motorways, drainage trenches, sports fields, dams, and dykes.

Geotextiles are manufactured using natural and synthetic polymers and are available in woven, non-woven, and other forms. Polypropylene, polyethylene, polyamide, polyester, and polyvinyl chloride are popularly used in the manufacturing process of geotextiles. are used in the manufacturing of geotextiles. These geotextiles are manufactured using different techniques of manufacturing, based on which it is categorized into woven, non-woven, and others.

Geotextiles have exceptional water flow rates and are primarily used for soil fine filtration for drainage applications, perforated pipe wrapping, erosion protection, and several others. Geotextiles offer several performance advantages such as better longevity and cost savings over traditional building materials such as layers of soil, rock aggregates, and concrete. In addition to this, geotextiles are easier to install and cost-effective as compared to traditional materials.

Restraint: Volatility in Raw Material Price

Polypropylene is the basic raw material required for manufacturing PP non-woven fabrics. Propylene is produced by cracking naphtha, which is used in the production of polypropylene using the polymerization process. Price fluctuations in petroleum, naphtha, and propylene directly affect the polypropylene cost. Polypropylene is a highly volatile commodity owing to imbalances in its supply and demand, which are reflected in fluctuations in its prices daily.

Polypropylene being one of the largest petrochemicals traded worldwide has a direct impact on the prices of its immediate products, including non-woven fabrics. The rising demand for polypropylene from emerging economies in the Asia Pacific primarily China has a major impact on fluctuation in prices. The production of polypropylene from unconventional low-cost feedstocks such as shale gas in North America and coal in China is driving new capacity investment in the market and has a significant impact on regional competitiveness and future global trade thereby increasing the price volatility.

What Does This Report Include?

This section will provide insights into the contents included in this polypropylene nonwoven fabric market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Polypropylene nonwoven fabric market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Polypropylene nonwoven fabric market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the polypropylene nonwoven fabric market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for polypropylene nonwoven fabric market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of polypropylene nonwoven fabric market data depending on the type of information we’re trying to uncover in our research.

-