Polypropylene Market Size, Share & Trends Analysis Report By Polymer Type (Homopolymer, Copolymer), By Process, By Application, By End-Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-493-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global polypropylene market size was estimated to be USD 123.46 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. The growth of the market is expected to be driven by the increasing consumption of polypropylene (PP) in end-use industries such as automotive, packaging, and building & construction. The growing utilization of PP in the automotive sector to manufacture lightweight vehicles for increased fuel efficiency is anticipated to be a major factor driving the market over the forecast period. However, the supply of PP has been hugely affected owing to the outbreak of COVID-19 in 2020.

In recent years, the demand for polypropylene has increased from the building & construction industry, which has witnessed favorable growth in the U.S. on account of infrastructural developments. Polypropylene is finding increased utilization in the construction industry for residential housing and industrial applications.

The overall U.S. construction industry is expected to observe favorable growth owing to new import tariffs, changing trade deals, huge infrastructural projects, and immigration reforms. Moreover, other application areas of polypropylene are expected to continue to drive the market over the forecast period.

Polymer Type Insights

By type, homopolymer was the largest segment of the polypropylene market in 2022, which accounted for a market share of over 80%. The polypropylene produced by using a single type of monomer is known as a homopolymer. Homopolymer is widely used by various end-users such as medical, automotive, electrical, building & construction, packaging, and others.

Copolymers are produced by using more than one type of monomer. These are further classified into random copolymers and block copolymers. Ethylene random copolymer is formed by the polymerization of propene. It is flexible and optically clear, which makes it suitable for applications that require high transparency.

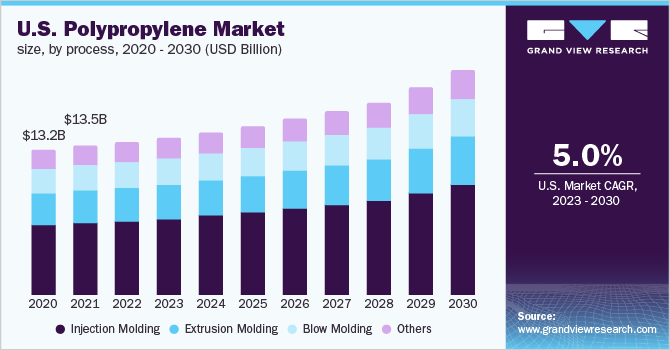

Process Insights

By process, injection molding was the largest segment of the polypropylene industry in 2022, which accounted for a market share of more than 48%, followed by blow molding as the second-largest segment. The injection molding process comprises the injection of molten polypropylene into a mold and then freezing it at a low temperature.

These properties are expected to propel the demand for polypropylene Polymer types made using the injection molding process. Furthermore, injection molding is significantly being adopted by multiple end-use industries such as automotive, medical equipment, housewares, consumer goods, storage container packaging, musical instruments, and furniture.

The blow molding process is used for manufacturing plastic containers. It involves the injection of molten plastics into a resonating container design and then air is blown into the mold for expanding the plastic into the shape of the resonating container design.

Properties such as enhanced chemical resistance, stability at high temperatures, excellent moisture barrier, and clarity at low temperatures are fueling the adoption of the blow molding process in the polypropylene industry.

End-use Insights

Automotive was estimated to be the largest segment of the polypropylene industry by end-use in 2022, accounting for a market share of above 28%. It was followed by electrical & electronics as the second largest segment in terms of market share.

Polypropylene is also witnessing augmented demand from the automotive application segment. The automotive industry uses polypropylene for manufacturing under the hood, exterior & interior components, and electrical fittings.

The growing electrical & electronics industry in Asia due to the emergence of small-scale electrical component manufacturers and a versatile manufacturing landscape (support from the government, availability of raw materials, and cheap labor) are expected to drive the demand for polypropylene in the electronics industry.

Polypropylene is a highly durable thermoplastic polymer and can withstand extreme weather conditions. Key applications of polypropylene in the building & construction industry include sidings, moisture barrier membranes, films & sheets, carpet textiles, plastic parts, and industrial adhesives & tapes.

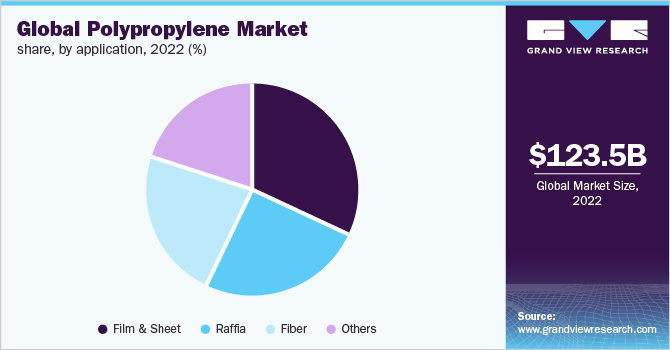

Application Insights

Among applications, film and sheet was the prominent segment in the polypropylene industry in 2022, which accounted for a market share of over 36%, followed by fiber as the second-largest segment. Polypropylene fiber is a high-yield fiber, which is made from 85% of polypropylene and used in various applications including carpet yarns and most economical carpets intended for light domestic use.

Properties such as resistance to chemicals, abrasion, mildew, rot, stain, perspiration, and weather conditions along with quick-drying, thermal bonding, anti-static behavior, and comfort & lightness are propelling the demand for polypropylene fiber in the textile industry.

Polypropylene films are commonly used for packaging cigarettes, snacks, candies, and food wraps. These films in shrink wraps, diapers, tape liners, and sterile wraps are commonly used in medical applications. Polypropylene is often coated with polyvinylidene chloride (PVDC) to improve its gas barrier properties, hence making it odor-free.

Properties such as chemical resistance, inertness, and low odor make polypropylene suitable for food packaging under the U.S. Food & Drug Administration (FDA) regulations. Properties such as chemical resistance, inertness, and low odor also make polypropylene suitable for food packaging under the U.S. Food & Drug Administration (FDA) regulations.

Regional Insights

The growing demand for polypropylene among various end-use industries such as packaging, building & construction, automotive, medical, and others is fueling the market growth in North America. North America is the world's largest consumer of packaging products.

Europe polypropylene industry is likely to witness modest growth in the next couple of years owing to various factors such as stalled industrial output caused by the COVID-19 pandemic, rising unemployment, and debt crisis. However, a positive outlook across Eastern Europe, in terms of consumerism and manufacturing, is expected to drive the polypropylene industry.

Asia Pacific is expected to be one of the fastest-growing markets globally over the forecast period. This is attributed to the ascending demand for polypropylene from key industries including automotive, electrical & electronics, building & construction, medical, and packaging in emerging economies such as China and India.

An increase in construction activities, particularly in Brazil and Chile, is expected to propel the demand for polypropylene in Central & South America. Rising consumer disposable income along with rapid infrastructure development in the region is expected to drive the construction industry’s growth, in turn, steering the demand for polypropylene.

Key Companies & Market Share Insights

Strategic partnerships, capacity expansions, and new Polymer Type developments are popular strategies adopted by a majority of the players operating in the global polyisobutylene industry. Recently, researchers at the University of Tokyo have developed a material called isotactic polar polypropylene (iPPP), which in comparison to traditional polypropylene has high isotacticity. Some prominent players in the global polypropylene market include:

-

SABIC

-

Exxon Mobil Corporation

-

Borealis AG

-

BASF SE

-

INEOS Group

-

Reliance Industries Limited

-

LG Chem

-

LyondellBasell Industries Holdings B.V.

-

DuPont

-

Braskem

Polypropylene Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 126.95 billion |

|

Revenue forecast in 2030 |

USD 177.73 billion |

|

Growth rate |

CAGR of 4.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Polymer type, process, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil; Argentina; GCC Countries; South Africa |

|

Key companies profiled |

SABIC; Exxon Mobil Corporation; Borealis AG; BASF SE; INEOS Group; Reliance Industries Limited; LG Chem; LyondellBasell Industries Holdings B.V.; DuPont; Braskem |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polypropylene Market Segmentation

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polypropylene market report based on polymer type, process, application, end-use, and region:

-

Polymer Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Homopolymer

-

Copolymer

-

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Extrusion Molding

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fiber

-

Film & Sheet

-

Raffia

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Packaging

-

Medical

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polypropylene market size was estimated at USD 123.46 billion in 2022 and is expected to reach USD 126.95 billion in 2023 owing to the increasing use of polypropylene for lightweight vehicles across the automotive industry.

b. The global polypropylene market is expected to grow at a compound annual growth rate of 4.7% from 2023 to 2030 to reach USD 177.73 billion by 2030.

b. Asia pacific dominated the polypropylene market with a share of 36.28% in 2022. This is attributable to growing demand for polypropylene from automotive and packaging sector, especially in the countries such as India, China and Japan.

b. Some key players operating in the polypropylene market include SABIC; Exxon Mobil Corporation; Borealis AG; BASF SE; INEOS Group; Reliance Industries Limited; LG Chem; LyondellBasell Industries Holdings B.V.; DuPont; and Borealis.

b. Key factors that are driving the market growth include rising application of polypropylenes in fiber, raffia, and film & sheet coupled with the rising trend towards the application of polypropylene in the automotive sector to manufacture lightweight vehicles for increased fuel efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."