Polypropylene Catalyst Market Size, Share & Trends Analysis Report By Product (Ziegler-natta Catalyst, Metallocene Catalyst), By Manufacturing Process (Bulk Phase), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-394-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Polypropylene Catalyst Market Size & Trends

“2030 Polypropylene Catalyst Market value to reach USD 3.62 billion”

The global polypropylene catalyst market size was valued at USD 2.06 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. The market is driven by increasing consumption of polypropylene in sectors like packaging, automotive, construction, and consumer goods. The surge in demand for lightweight and durable packaging materials, as well as the increasing production of vehicles, is boosting the requirement for polypropylene and, consequently, polypropylene catalysts.

Polypropylene (PP) catalysts are specialized compounds used to initiate and control the polymerization process of propylene monomers into PP polymers. These catalysts play a crucial role in determining the properties and characteristics of the final PP product. The activity and productivity of a catalyst determine the efficiency of the polymerization process. Highly active catalysts require lower catalyst loadings, reducing production costs and minimizing waste.

Drivers, Restraints & Opportunities

The increasing polypropylene production, particularly in the Asia-Pacific (APAC) region, is a major driver for the polypropylene catalyst industry. The growing demand for PP in various applications, such as packaging, automotive, and consumer goods, has led to the establishment of new PP production plants, especially in countries like China and India.

A significant restraint for the polypropylene catalyst industry is the strict regulations associated with the usage of phthalate-based PP in consumer products. Phthalates are commonly used as plasticizers in PP, but concerns over their potential health and environmental impacts have led to regulatory restrictions in various regions, limiting their use in certain applications, such as toys and food packaging.

A major opportunity for the polypropylene catalyst industry lies in the growing focus on metallocene catalyst-based PP production. Metallocene catalysts offer improved control over polymer properties, enabling the production of specialized PP grades with tailored characteristics for specific applications. This trend is driven by the increasing demand for high-performance PP products in sectors like automotive, medical, and advanced packaging.

Product Insights

“Metallocene Catalyst emerged as the fastest growing product with a CAGR of 8.9%”

Ziegler-Natta catalyst coatings dominated the market and accounted for a revenue share of approximately 82.4% in 2023. They consist of transition metal compounds, typically titanium halides, and organoaluminum compounds as co-catalysts. These products are known for producing isotactic PP with high crystallinity and stiffness, which is desirable for many applications. Ziegler-Natta contain multiple active sites, resulting in the production of PP with a broad molecular weight distribution and chemical composition distribution. This broad distribution can be advantageous for certain applications, such as improving processability and impact resistance.

Metallocene catalysts are more advanced and specialized catalysts based on organometallic compounds, typically containing metals like zirconium or hafnium. They offer better control over the polymer microstructure, enabling the production of isotactic, syndiotactic, or atactic PP with tailored properties. Compared to Ziegler-Natta catalysts, metallocene catalysts produce PP with a narrower molecular weight distribution and more uniform chemical composition. This uniformity can lead to improved mechanical properties, clarity, and processability in certain applications.

Other types of polypropylene processes include homogeneous catalysts and non-metallocene catalysts. Non-metallocene catalysts use a variety of complexes involving metals like scandium, lanthanides, or actinides, along with multidentate oxygen- and nitrogen-based ligands they offer an alternative to traditional metallocene products and can produce polypropylene with unique properties. Homogeneous catalysts are soluble and based on complexes of hafnium, titanium, or zirconium, often featuring nitrogen-based and multidentate oxygen-based ligands. They provide better control over the polymerization process compared to heterogeneous catalysts.

Manufacturing Process Insights

“Bulk Phase emerged as the fastest growing manufacturing process with a CAGR of 9.0%”

Gas phase dominated the market and accounted for a revenue share of approximately 68.6% in 2023. In this process, the polymerization reaction occurs in the gaseous phase, typically in a fluidized bed reactor. The catalyst is introduced into a fluidized bed reactor along with gaseous PP monomer and optional co-monomers. The polymerization reaction takes place on the surface of the catalyst particles, forming solid PP particles. The resulting polypropylene particles are continuously removed from the reactor and sent for downstream processing. The ability to produce PP with a narrow molecular weight distribution and uniform particle size gives this process an advantage over others.

The bulk phase process, also known as the bulk slurry process, is one of the primary manufacturing processes for PP catalysts. In this process, the polymerization reaction occurs in a liquid medium, typically a hydrocarbon solvent or the monomer itself (propylene). The process has the ability to produce PP with a broad molecular weight distribution, which can improve processability and impact resistance.

Other manufacturing processes include slurry process and solution process. In the slurry process, the polymerization reaction occurs in an inert liquid medium, such as hexane or isobutane. The catalyst and monomer are introduced into the slurry reactor, and the resulting PP particles are suspended in the liquid medium. On the other hand, Solution process involves dissolving the catalyst and monomer in an inert solvent, typically at higher temperatures and pressures. The polymerization reaction occurs in the solution phase, and the resulting PP is recovered by precipitation or solvent removal.

Application Insights

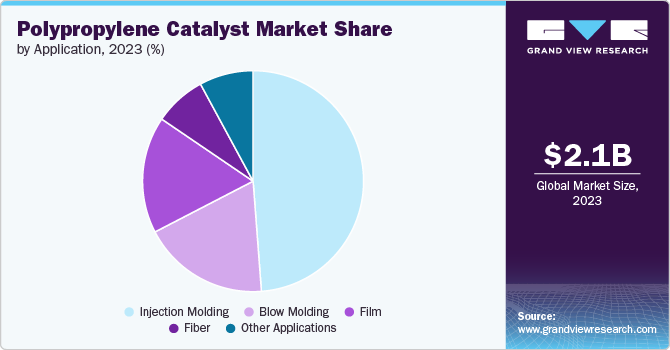

“Blow molding emerged as the fastest growing application with a CAGR of 9.1%”

Injection molding dominated the market and accounted for a revenue share of 48.9% in 2023. PP is a cost-effective and versatile thermoplastic that is well-suited for injection molding processes. Injection molded polypropylene products are commonly used in automotive components, household goods, and packaging applications. The injection molding process involves melting PP pellets and injecting the molten material into a mold cavity under high pressure. The use of these catalysts is crucial in the production of polypropylene resins with desired properties, such as strength, stiffness, and impact resistance.

Blow molding is another important application segment for polypropylene catalysts. In this process, a hollow PP product is formed by inflating a molten plastic tube inside a mold cavity. Polypropylene catalysts play a crucial role in producing polypropylene resins suitable for blow molding applications, such as bottles, containers, and automotive parts. The properties of PP resins, including melt flow index, impact strength, and thermal stability, are influenced by the type of products used in their production.

The production of polypropylene films is a significant application segment for PP catalysts. PP films are widely used in packaging, consumer goods, and industrial applications due to their excellent moisture barrier properties, strength, and transparency. PP films can be manufactured through either cast film or blown film extrusion processes. The choice of catalyst system and polymerization conditions significantly impacts the properties of the resulting polypropylene resin, such as molecular weight distribution, crystallinity, and melt flow index, which in turn affect the film's performance characteristics.

Regional Insights

North America polypropylene catalyst market, comprising the United States and Canada, is an important market for polypropylene catalysts. The region's well-established automotive industry, along with the packaging and consumer goods sectors, drives the demand for polypropylene and, consequently, PP catalyst products.

Asia Pacific Polypropylene Catalyst Market Trends

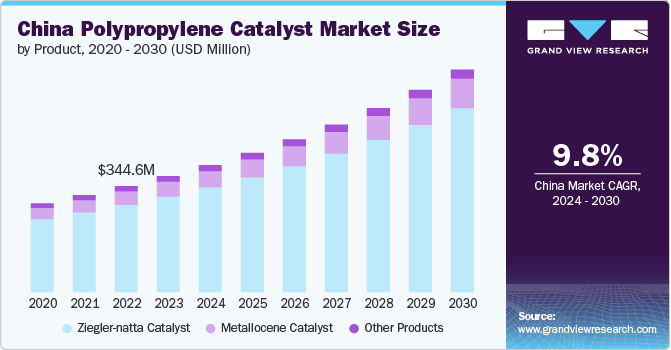

“Asia Pacific emerged as the fastest growing market with a CAGR of 8.9% from 2024-2030”

The polypropylene catalyst market in Asia Pacific dominated the global market and accounted for a 41.3% share in 2023. It is driven by the region's robust manufacturing sector and growing demand for various polypropylene-based products. Several countries in the region, such as China, India, and Japan, have well-established automotive, packaging, and consumer goods industries that rely heavily on polypropylene.

China polypropylene catalyst market is the world's largest producer and consumer of polypropylene, China's demand for polypropylene catalysts is driven by its vast manufacturing sector and growing consumer market. The Chinese government's initiatives to promote domestic catalyst production and reduce reliance on imports have led to significant investments in research and development by both domestic and international catalyst manufacturers. Chinese companies have made strides in developing advanced catalyst systems tailored to the specific requirements of the local market.

Europe Polypropylene Catalyst Market Trends

The polypropylene catalyst market in Europe is a mature market for PP catalysts, with a well-established manufacturing base and stringent regulations governing the production and use of plastics. The region's automotive, packaging, and consumer goods industries are major consumers of polypropylene, driving the demand for advanced catalyst system. Countries such as Germany, France, Italy, and the United Kingdom have a strong presence in the automotive and manufacturing sectors, contributing significantly to the demand for PP catalysts.

Key Polypropylene Catalyst Company Insights

The market is highly competitive, with several key players vying for market share. Manufacturers are actively pursuing various strategies and initiatives to gain a competitive edge and capitalize on emerging trends. A significant trend is the increasing demand for metallocene catalysts due to their ability to produce high-performance polypropylene with tailored properties. With growing environmental concerns and stricter regulations, there is a shift towards sustainable catalysts and eco-friendly practices in the polypropylene industry. Manufacturers are exploring the development of catalysts that are more environmentally friendly and have a lower carbon footprint.

-

SABIC's polypropylene catalysts are used in the manufacturing of a wide range of polypropylene products, including automotive components, packaging materials, and consumer goods. Their catalyst portfolio includes both traditional Ziegler-Natta and advanced metallocene catalysts, offering solutions for various applications and processing techniques.

-

Mitsui Chemical Corporation is a leading Japanese chemical company with a strong presence in the polypropylene catalyst market. Mitsui Chemical has developed advanced catalyst technologies, including the Hypol II process, which utilizes a miniature loop reactor for catalyst prepolymerization. This process allows for precise control over the catalyst's properties, enabling the production of polypropylene resins with tailored characteristics.

-

Dow is a leading global manufacturer of polypropylene catalysts and a pioneer in the development of advanced catalyst technologies. Dow's polypropylene catalysts are widely used in the production of various polypropylene grades for applications such as injection molding, blow molding, film, and fiber.

Key Polypropylene Catalyst Companies:

The following are the leading companies in the polypropylene catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Lyondell Basell Industries Holdings BV

- SABIC

- Univation Technologies LLC

- Japan polypropylene corporation

- Mitsubishi chemical corporation

- Clariant

- Mitsui Chemicals Inc/li>

- China petrochemical corporation

- Reliance industries limited

- R.Grace and Co conn

Recent Developments

-

In October 2023, Dow and Evonik Industries AG announced the startup of a hydrogen peroxide to Propylene Glycol pilot project situated in Evonik’s production facility in Germany. The project uses HYPROSYN method to conduct the direct synthesis of Propylene Glycol from PP and Hydrogen Peroxide.

-

In July 2023, Advanced Refining Technologies LLC launched ENDEAVOR, a novel hydro processing catalyst product for the production of renewable diesel and sustainable aviation fuel from 100% renewable sources. The major sources used for the purpose would include animal fats, refined oils, vegetable oils and greases.

Polypropylene Catalyst Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.23 billion |

|

Revenue forecast in 2030 |

USD 3.62 billion |

|

Growth Rate |

CAGR of 8.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons; revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, manufacturing process, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa |

|

Key companies profiled |

Dow, Lyondell Basell Industries Holdings BV, SABIC, Univation Technologies LLC, Japan polypropylene corporation, Mitsubishi chemical corporation, Clariant, Mitsui Chemicals Inc, China petrochemical corporation, Reliance industries limited, R.Grace and Co conn |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polypropylene Catalyst Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polypropylene catalyst market report based on product, manufacturing process, application and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ziegler-natta Catalyst

-

Metallocene Catalyst

-

Other Catalysts

-

-

Manufacturing Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bulk Phase

-

Gas Phase

-

Other Manufacturing Processes

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Film

-

Fiber

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the polypropylene catalyst market include Dow, Lyondell Basell Industries Holdings BV, SABIC, Univation Technologies LLC, Japan polypropylene corporation, Mitsubishi chemical corporation, Clariant, Mitsui Chemicals Inc, China petrochemical corporation, Reliance industries limited and R.Grace and Co conn.

b. Key factors that are driving the market growth include increasing consumption of polypropylene in sectors like packaging, automotive, construction, and consumer goods is fueling the demand for these products, which are essential for the production of polypropylene.

b. The global polypropylene catalyst market size was estimated at USD 2.06 billion in 2023 and is expected to reach USD 2.23 billion in 2024.

b. The global polypropylene catalyst market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 3.62 billion by 2030.

b. Asia Pacific dominated the polypropylene catalyst market with a share of 41.5% in 2023. This is attributable to the region's robust manufacturing sector and growing demand for various polypropylene-based products by industries such as automotive, packaging, and consumer goods.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."