Polyphenylene Oxide Market Size & Trends

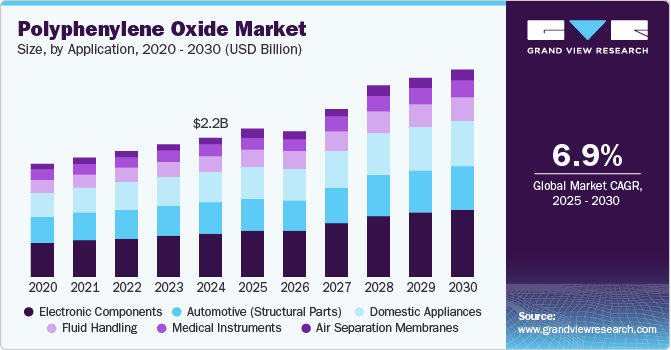

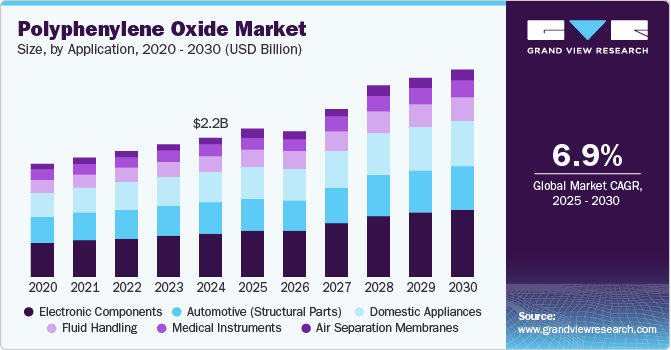

The global polyphenylene oxide market size was valued at USD 2.16 billion in 2024 and is expected to grow at a CAGR of 6.9% from 2025 to 2030. The increasing demand for high-performance materials in the automotive and electronics sectors significantly contributes to this growth. PPO's advantageous properties, such as excellent electrical insulation, low moisture absorption, and mechanical strength, make it a preferred choice for manufacturing components in these industries. In addition, technological advancements in polymer processing and innovative polyphenylene oxide (PPO) blends enhance its applicability across various sectors, thereby bolstering market demand.

The rising consumer awareness regarding advanced materials that improve product performance is expected to fuel demand for engineered polymers such as PPO. Furthermore, the expansion of the automotive market is expected to increase the demand for durable and lightweight components, which are essential for modern vehicles. The shift toward sustainability and eco-friendly products also influences manufacturers to adopt recyclable PPO materials, aligning with regulatory pressures and consumer preferences for environmentally responsible solutions.

The ongoing development of electronic components plays a crucial role in shaping the future of the PPO industry. With rising consumer spending on electronic devices, demand for high-quality materials that deliver superior performance continues to grow. Product design and functionality innovations create a need for advanced materials like PPO. This combination of technological advancements, increasing consumer expectations, and a heightened focus on sustainability collectively drives the polyphenylene oxide industry forward.

Application Insights

The electronic components segment dominated the market and accounted for the largest revenue share, 31.8%, in 2024. This can be attributed to the increasing reliance on advanced materials that enhance the performance and durability of electronic devices. PPO's exceptional electrical insulation properties and thermal stability make it an ideal material for various electronic applications, including connectors, circuit boards, and housings. As the demand for consumer electronics continues to rise, the polyphenylene oxide industry is well-positioned to benefit from this growth.

The domestic appliances segment is expected to grow at a significant CAGR over the forecast period, driven by the rising consumer preference for energy-efficient and high-performance appliances that require durable materials. Polyphenylene oxide's excellent mechanical strength and resistance to heat make it suitable for manufacturing components in household appliances, thereby increasing its adoption in this sector. The ongoing innovation in appliance design further supports the expanding applications of PPO, reinforcing its significance in the polyphenylene oxide industry.

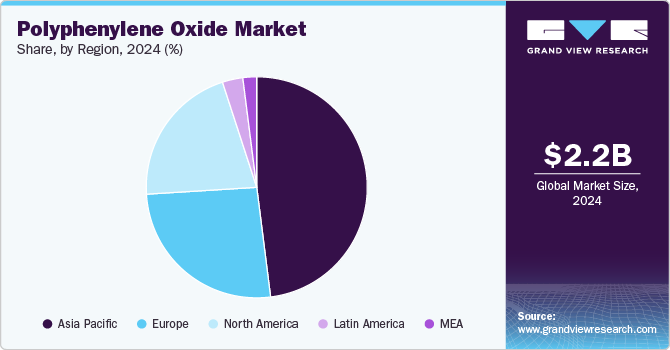

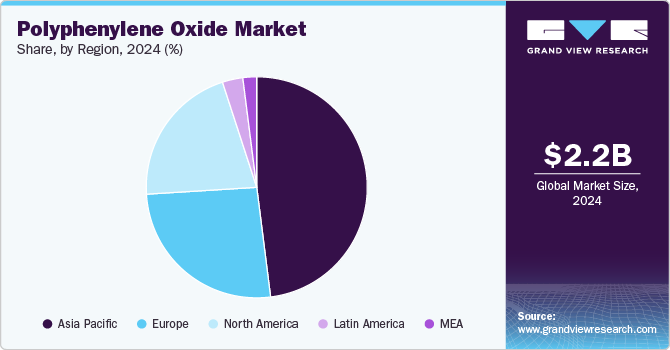

Regional Insights

The Asia Pacific polyphenylene oxide (PPO) market dominated the global market with a market share of 47.7%, driven by rapid industrialization across the region, which has led to increased production capacities and a surge in demand for advanced materials. The automotive and electronics sectors, in particular, are experiencing significant growth, necessitating high-quality materials like PPO that offer exceptional performance characteristics. As industries evolve, the reliance on engineered polymers such as PPO becomes critical to meet the demands of modern manufacturing.

The polyphenylene oxide (PPO) market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024. The country's extensive manufacturing infrastructure and focus on technological advancements play a crucial role in driving demand for polyphenylene oxide. With a burgeoning electronics sector and substantial investments in automotive production, China is a critical hub for PPO applications. The continued expansion of domestic industries ensures that the polyphenylene oxide industry remains vital to China's economic growth.

North America Polyphenylene Oxide Market Trends

The North America polyphenylene oxide (PPO) market is expected to grow at the highest CAGR over the forecast period. This growth is fueled by increasing consumer demand for advanced electronic products and automotive components that utilize high-performance materials. The region's strong emphasis on innovation and technological development further enhances the adoption of polyphenylene oxide in various applications. As manufacturers seek to improve product performance, the polyphenylene oxide industry is expected to thrive in North America.

U.S. Polyphenylene Oxide Market Trends

The U.S. polyphenylene oxide (PPO) market dominated the regional market in 2024, reflecting a strong demand for engineered polymers across multiple sectors. The country's advanced technological infrastructure and significant investments in research and development contribute to its leadership position within the global market. As industries increasingly prioritize quality and performance, the role of PPO becomes more pronounced, solidifying its importance within the polyphenylene oxide industry.

Europe Polyphenylene Oxide Market Trends

The Europe polyphenylene oxide (PPO) market is expected to witness significant growth over the forecast period. This growth can be attributed to rising awareness regarding advanced materials that enhance product functionality and efficiency. The European market's focus on sustainability and eco-friendly solutions drives demand for high-performance polymers such as PPO. As manufacturers adapt to evolving consumer preferences and regulatory requirements, the polyphenylene oxide industry is set to gain traction across various applications throughout Europe.

Key Polyphenylene Oxide Company Insights

Key companies in the global polyphenylene oxide (PPO) industry include SABIC produces a diverse range of specialty plastics and petrochemicals essential for industrial applications, while Asahi Kasei Corporation develops advanced materials that cater to various applications, emphasizing responsible sourcing. Mitsubishi Chemical Corporation is involved in ongoing research to improve the performance and efficiency of PPO products across multiple sectors, while Ensinger specializes in engineering plastics, providing reliable materials that support the growing demand for PPO in industries such as automotive and electronics.

-

Asahi Kasei Corporation is a Japanese chemical manufacturer focusing on various sectors, including chemicals, fibers, and healthcare. In the polyphenylene oxide (PPO) market, Asahi Kasei is recognized for developing advanced materials that leverage PPO's unique properties, such as high heat resistance and mechanical strength. The company's commitment to sustainability and innovation drives its efforts to enhance product performance and expand applications across industries like automotive and electronics.

-

Mitsubishi Chemical Corporation offers a wide range of products, including polymers and specialty chemicals. In the PPO industry, Mitsubishi Chemical focuses on improving the efficiency and performance of PPO materials, catering to sectors such as automotive and electrical components. The company emphasizes research and development to create innovative solutions that meet the growing demand for high-performance materials while aligning with sustainability goals.

Key Polyphenylene Oxide Companies:

The following are the leading companies in the polyphenylene oxide market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- Asahi Kasei Corporation

- Mitsubishi Chemical Group Corporation.

- Ensinger

- BASF

- Solvay

- LG Chem

- Toray Industries, Inc.

- Covestro AG

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In January 2024, Asahi Kasei and an affiliated company obtained the internationally recognized ISCC PLUS sustainability certification for various products, including thermoplastic elastomers, rubbers, and engineering plastics. This certification underscores the company's commitment to responsible sourcing and managing biomass and recycled materials throughout the supply chain.

Polyphenylene Oxide Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 2.27 billion

|

|

Revenue forecast in 2030

|

USD 3.17 billion

|

|

Growth Rate

|

CAGR of 6.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

December 2024

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application and region

|

|

Regional scope

|

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

|

|

Country scope

|

U.S., Canada, Mexico, China, India, Japan, South Korea, Taiwan, Germany, UK, France, Italy, Brazil, Saudi Arabia, and UAE

|

|

Key companies profiled

|

SABIC; Asahi Kasei Corporation; Mitsubishi Chemical Group Corporation.; Ensinger; BASF; Solvay; LG Chem; Toray Industries, Inc., Covestro AG, Sumitomo Chemical Co., Ltd.

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Polyphenylene Oxide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the polyphenylene oxide market report based on application, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

Latin America

-

Middle East and Africa