- Home

- »

- Food Additives & Nutricosmetics

- »

-

Polyol Sweeteners Market Size, Share, Industry Report, 2033GVR Report cover

![Polyol Sweeteners Market Size, Share & Trends Report]()

Polyol Sweeteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sorbitol, Xylitol, Mannitol), By Form (Powder, Liquid), By Function (Excipients, Humectants), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-068-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyol Sweeteners Market Summary

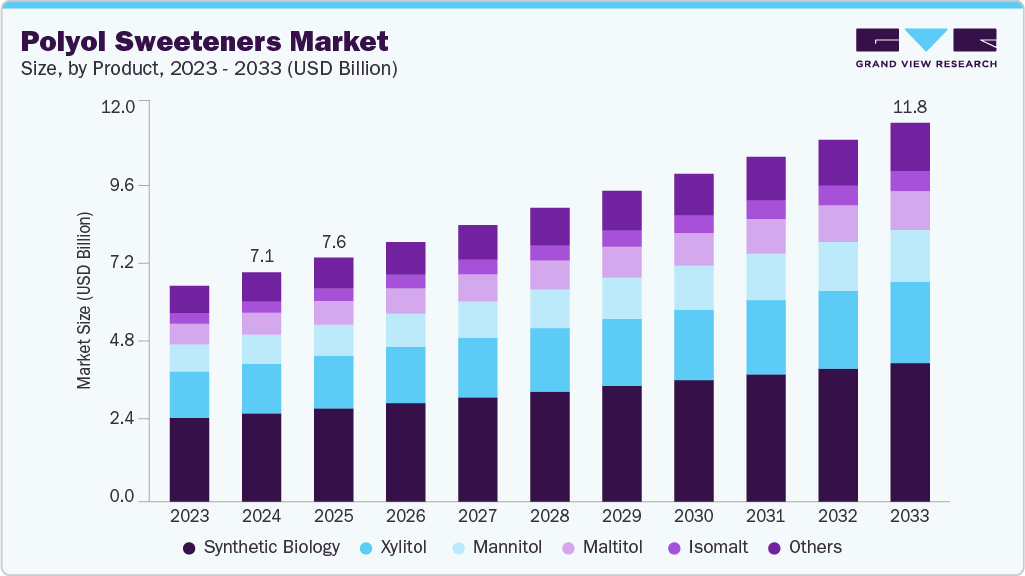

The global polyol sweeteners market size was estimated at USD 7,121.4 million in 2024 and is projected to reach USD 11,768.2 million by 2033, growing at a CAGR of 5.7% from 2025 to 2033. The market is expected to grow due to increasing demand for sugar substitutes in food and beverage industry, coupled with increasing health-consciousness, among other factors, inclining towards low-calorie sweeteners.

Key Market Trends & Insights

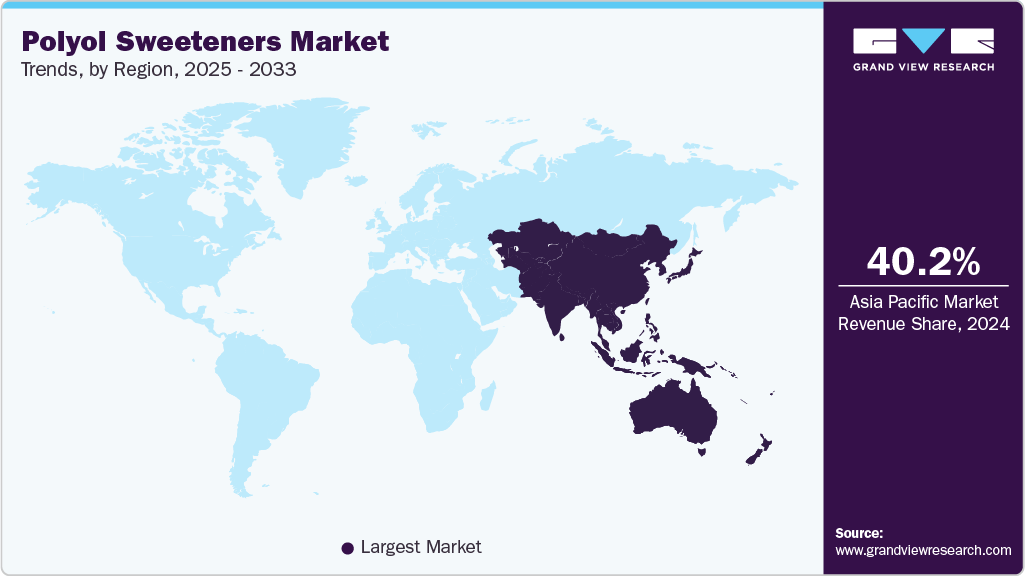

- Asia Pacific dominated the polyol sweeteners market with the largest revenue share of 40.2% in 2024.

- The market in China is expected to grow at a significant CAGR of 6.2% from 2025 to 2033.

- By product, the mannitol segment is expected to grow at the highest CAGR of 7.4% from 2025 to 2033 in terms of revenue.

- By form, the powder segment held the largest revenue share of 78.3% in 2024 in terms of value.

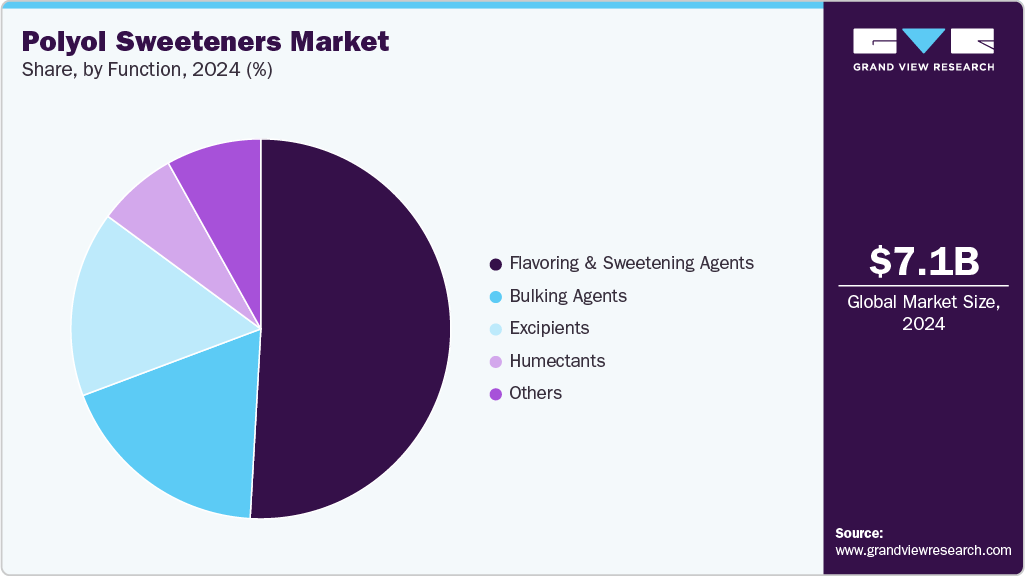

- By function, the flavoring segment held the largest revenue share of 50.9% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 7,121.4 Million

- 2033 Projected Market Size: USD 11,768.2 Million

- CAGR (2025-2033): 5.7%

- Asia Pacific: Largest market in 2024

Also termed sugar alcohol, the product is being utilized as a favorable “natural” ingredient in several applications, such as food, pharmaceutical, cosmetics, and other technical & chemical industries. The U.S. market is projected to grow due to consumer demand for healthier, low-calorie food products. In addition, the product is used as a bulking agent, binder, humectant, and chemical reactant in the tobacco, textile, and paper industries.

The market is expected to be driven by increasing demand for sugar substitutes in the food and beverage industry, coupled with growing consumer awareness regarding overall health and wellness. Polyol sweeteners are saccharide derivatives obtained from fermentation or hydro-generation of carbohydrates from biowastes, such as birch bark, corn cob, and pulp & paper waste.

Increasing awareness regarding personal health and safety is anticipated to stimulate the growth of the personal care market over the forecast period. Improved standards of living, high disposable income, and an increasing proportion of the working population are expected to propel the growth of the personal care market in the coming years. In addition, growing consciousness about personal appearance among individuals is propelling the demand for personal care products.

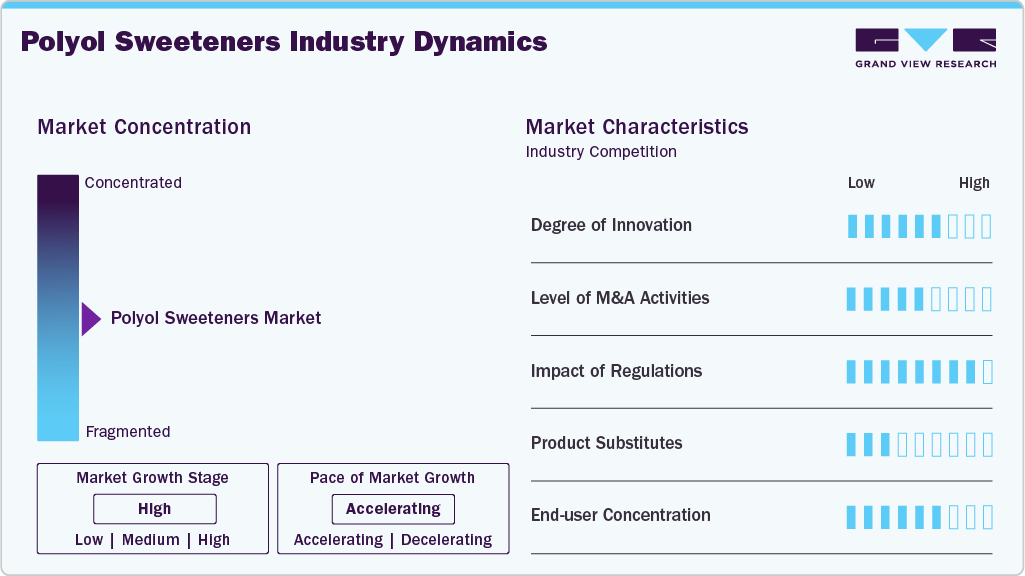

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Cargill, Inc., Sweeteners Plus, LLC, Gulshan Polyols Ltd., and Roquette Frères, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global polyol sweeteners industry are adopting a combination of capacity expansion, product innovation, strategic partnerships, and sustainability initiatives to strengthen their market position. Companies such as DuPont, DFI Corp, and Tereos are investing in advanced refining technologies to enhance product purity and performance for high-end applications like cosmetics and phase change materials. Several players are expanding their production and distribution networks in these regions to cater to rising demand in the Asia Pacific and the Middle East.

Product Insights

The sorbitol segment dominated with a revenue market share of 38.5% in 2024. The demand for sorbitol in bakery & confectionery applications is projected to witness steady growth due to its ability to preserve freshness, prevent deterioration, and keep the water content at a fixed level in products, such as cakes, bread, creams, and jellies. Sorbitol is utilized as a cryoprotectant additive to produce surimi, an uncooked and highly refined fish paste. The product is also used to harmonize the flavors in beverages, such as fruit juices and carbonated drinks. Rising consumption of sorbitol-based sweeteners in manufacturing, distinguished food & beverage, and dietary supplement products is projected to drive the product demand.

Mannitol is expected to grow fastest with a CAGR of 7.4% during the forecast period. The demand for mannitol-based sweeteners in pharmaceutical applications is projected to witness steady growth on account of its ability to lessen the intracranial pressure in the cranium and to treat patients suffering from oliguric renal failure. In the latter situation, the product is administered intravenously and filtered in the kidneys.

Form Insights

The powder segment dominated the market, with a revenue share of 78.3% in 2024. Polyol sweeteners in the form of icing powder are used in manufacturing various food products, such as candies, chewing gums, and bakery goods. The product, in the form of solid crystals, is widely used as a drug component in the pharmaceutical industry.

Powdered or crystallized sugar alcohols are likely to witness steady growth over the forecast period because they are easier to handle, transport, and store, and have a longer shelf life, thereby exhibiting decreased chances of spoilage. Most functions of powdered polyol sweeteners are similar to those of their liquid counterparts, and they are widely used as bulking and coating agents in the manufacturing of nutraceutical and functional foods.

Liquid is expected to grow at a CAGR of 4.8% during the forecast period. Liquid or syrup-based polyol sweeteners have high water solubility, which is excellent for manufacturing pharmaceutical and nutraceutical formulations. The growing demand for naturally derived sugar substitutes due to rising consumer awareness regarding low-calorie intake is anticipated to propel the demand for liquid sugar alcohols.

Applications Insights

The food and beverage segment dominated the market with a revenue share of 46.0% in 2024. The rising demand for mannitol, isomalt, and sorbitol as bulk sweeteners to produce frozen desserts, dairy products, fruit spreads, and baked goods is likely to fuel the segment's growth over the next few years.

Polyol sweeteners are approved by the United States Food and Drug Administration (FDA) for use in food products as food additives or as Generally Recognized as Safe (GRAS) chemicals or substances. Products, such as erythritol, isomalt, sorbitol, lactitol, polyglycitols, and maltitol, are considered GRAS, while mannitol holds interim food additive status, and xylitol is acceptable for use in special dietary foods.

Polyols are used as active pharmaceutical ingredients or excipients in the pharmaceutical industry for modern formulations such as consumer-friendly lozenges or chewable tablets. They are widely used due to their sweet taste and tooth-friendliness. Conventional polyols are used in conventional tablets, and non-hygroscopic polyols are used in water-sensitive active pharmaceutical ingredients (API).

Function Insights

The flavoring & sweetening agents segment dominated the market with a revenue share of 50.9% in 2024. The sweetness of distinguished polyols differs from each other and is often influenced by other ingredients in the products in which they are used. Moreover, mouthfeel and flavor underpinning attributes are important for polyol sweeteners. Polyols are frequently combined with low-calorie or intense sweeteners, such as aspartame, saccharin, acesulfame potassium, neotame, sucralose, and stevia sweeteners, to produce sugar-free confectionery products. Polyols' ability to contribute mild sweetness as well as the bulk and texture of conventional sugar is likely to spur product demand in the food and beverage industry over the next few years.

The product is also used as a bulking agent to replace the sugar in food & beverage products. Polyols such as sorbitol, xylitol, maltitol, mannitol, isomalt, and erythritol provide sweetness and add texture in bakery and confectionery goods. Consumption of polyols as humectants in the cosmetic industry will likely further augment market growth.

Regional Insights

North America is experiencing steady growth, driven by increasing demand for low-calorie and sugar-free alternatives in food and beverage applications. Rising health concerns such as obesity, diabetes, and metabolic disorders are encouraging consumers to adopt healthier diets, fueling the use of sugar substitutes like erythritol, xylitol, and sorbitol. The growing popularity of ketogenic, diabetic-friendly, and low-carb food products is also supporting market expansion. Furthermore, regulatory support for sugar reduction initiatives in the U.S. and Canada is encouraging food manufacturers to reformulate products using polyol-based sweeteners. The bakery, confectionery, and beverage segments are among the key end users.

US Polyol Sweeteners Market Trends

The polyol sweeteners market in the U.S. is witnessing strong growth, primarily driven by rising consumer demand for healthier, low-calorie alternatives to traditional sugar. Growing awareness about lifestyle-related health issues such as obesity and Type 2 diabetes has prompted food manufacturers to adopt sugar alcohols like erythritol, sorbitol, and maltitol in product formulations. The U.S. Food and Drug Administration’s (FDA) support for sugar-reduction initiatives and favorable labeling laws has further accelerated their use in sugar-free and reduced-sugar products.

Europe Polyol Sweeteners Market Trends

The polyol sweeteners market in Europe is expanding steadily due to increasing consumer preference for reduced-sugar and low-calorie food products. Regulatory backing from the European Food Safety Authority (EFSA) and sugar taxes in several countries have driven reformulation efforts across the food and beverage industry. Polyols such as xylitol, erythritol, and sorbitol are widely used in bakery, confectionery, and oral care products. The growing diabetic population and focus on healthier lifestyles further support market demand.

Germany polyol sweeteners marketis particularly robust, driven by rising awareness of sugar-related health issues and strong demand for functional and clean-label foods. German manufacturers are actively reformulating products to reduce added sugars without compromising taste. Sorbitol and xylitol are commonly used in chewing gums, mints, and pharmaceutical applications. Moreover, Germany’s position as a key food processing hub in Europe contributes to its growing consumption of polyol sweeteners.

Asia Pacific Polyol Sweeteners Market Trends

The polyol sweeteners market in the Asia Pacific dominated with a revenue market share of 40.2% in 2024. The market is witnessing rapid growth, driven by urbanization, changing dietary habits, and increasing health consciousness among consumers. The demand for sugar-free and low-calorie alternatives is rising, particularly in countries with high diabetic populations like India and Japan. Local food and beverage manufacturers increasingly incorporate polyols such as maltitol and erythritol into processed foods. Regulatory support and rising disposable incomes further contribute to market expansion.

China polyol sweeteners market dominates the regional market due to its large consumer base and significant manufacturing capacity. The growing demand for functional foods, along with an expanding diabetic and obese population, is driving the adoption of polyol sweeteners in domestic products. China is also a major exporter of polyols, especially sorbitol and erythritol, due to cost-effective production and scale. The market is further supported by government initiatives promoting healthier food alternatives.

Latin America Polyol Sweeteners Market Trends

The polyol sweeteners market in Latin America is growing steadily, fueled by rising awareness of lifestyle-related diseases such as obesity and diabetes. Countries like Brazil and Mexico are seeing increasing demand for sugar substitutes in beverages, confectionery, and bakery products. Regional manufacturers are adopting polyols like sorbitol and xylitol to cater to health-conscious consumers.

Middle East & Africa Polyol Sweeteners Market Trends

The polyol sweeteners market in the Middle East & Africa is at a nascent stage but showing promising growth potential. The rising prevalence of diabetes, especially in Gulf countries, is encouraging the use of low-calorie sweeteners. Due to limited local production, imports dominate the market. Increased investment in food processing and growing demand for healthier food options are expected to support future market expansion.

Key Polyol Sweeteners Companies:

The following are the leading companies in the polyol sweeteners market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Inc.

- Sweeteners Plus, LLC

- B Food Science Co., Ltd.

- Gulshan Polyols Ltd.

- Ingredion Inc.

- Roquette Frères

- PT. Ecogreen Oleochemicals

- Mitsubishi Corporation Life Sciences Ltd.

- Tereos

- SPI Pharma

- Jungbunzlauer Suisse AG

- DFI Corp.

- Sukhjit Starch & Chemicals Ltd.

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Sunar Misir

- ADM

- International Flavors & Fragrances

Key Polyol Sweeteners Company Insights

Key players in the market include Novozymes, BASF SE, DuPont, DSM, and Associated British Foods Plc.

- Novozymes was established as a result of a demerger from a pharmaceutical company named Novo Nordisk, and today it is a prominent player in bioinnovation. It deals with polyol sweeteners and microorganisms. The company discovers enzymes in nature and improves them for further use in several end-use industries. Its enzymes are broadly utilized in dishwashing & laundry detergents and the food & beverage sector, especially in beer production, animal feed, and the production of biofuels.

Recent Developments

- In April 2020, Ingredion EMEA launched its first polyol sweetener, ERYSTA Erythritol, to enable manufacturers to reduce or replace sugar in various applications such as ice cream, desserts, confectionery, baked goods, beverages, and fruit preparations

Polyol Sweeteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,573.8 million

Revenue forecast in 2033

USD 11,768.2 million

Growth rate

CAGR of 5.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, function, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Cargill, Inc.; Sweeteners Plus, LLC; B Food Science Co., Ltd.; Gulshan Polyols Ltd.; Ingredion Inc.; Roquette Frères; PT. Ecogreen Oleochemicals; Mitsubishi Corp. Life Sciences Ltd.; Tereos; SPI Pharma; Jungbunzlauer Suisse AG; DFI Corp.; Sukhjit Starch & Chemicals Ltd.; Zhejiang Huakang Pharmaceutical Co., Ltd.; Sunar Misir; ADM; International Flavors & Fragrances

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyol Sweeteners Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyol sweeteners market report based on form, product, function, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Sorbitol

-

Xylitol

-

Mannitol

-

Maltitol

-

Isomalt

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Powder

-

Liquid

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flavoring & Sweetening Agents

-

Bulking Agents

-

Excipients

-

Humectants

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Pharmaceutical

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global polyol sweeteners market size was estimated at USD 7.12 billion in 2024 and is expected to reach USD 7.57 billion in 2025.

b. The global polyol sweeteners market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2033 to reach USD 11.76 billion by 2033.

b. Sorbitol dominated the polyol sweeteners market with a volume share of 41.8% in 2019. Growing demand for sorbitol-based polyol sweeteners in dietary supplements and dairy processing industries as a low-calorie functional ingredient and as an excellent substitute to conventional sugar is likely to spur the product demand in the global market.

b. Some of the key players operating in the polyol sweeteners market include Cargill, Incorporated; Sweeteners Plus, LLC; B Food Science Co., Ltd.; Gulshan Polyols Ltd.; Ingredion Incorporated; Roquette Frères; PT. Ecogreen Oleochemicals; Mitsubishi Corporation Life Sciences Limited; Tereos; SPI Pharma; HYET Sweet; Jungbunzlauer Suisse AG; DFI Corporation; Sukhjit Starch & Chemicals Ltd.; Zhejiang Huakang Pharmaceutical Co., Ltd.; Shandong Futaste Co.; Dancheng Caixin Sugar Industry Co. Ltd.; Shijiazhuang Huaxu Pharmaceutical Co.,Ltd.; DuPont; zuChem; Zibo Shunda Biotech Co., Ltd.; Hylen Co.,Ltd.; BENEO; Foodchem International Corporation.

b. The key factors that are driving the polyol sweeteners market include growing demand for the product as a functional ingredient in various application segments such as bakery & confectionery, oral care, and pharmaceuticals, among others. Additionally, shifting consumer inclination towards the consumption of low-calorie products, together with a growing number of health issues such as the increased risk of diabetes, obesity, and heart diseases across the globe is anticipated to spur the industry growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.