- Home

- »

- Plastics, Polymers & Resins

- »

-

Polymer Membranes For Energy Storage Market Report, 2030GVR Report cover

![Polymer Membranes For Energy Storage Market Size, Share & Trends Report]()

Polymer Membranes For Energy Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Proton Exchange Membranes, Anion Exchange Membranes), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-544-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

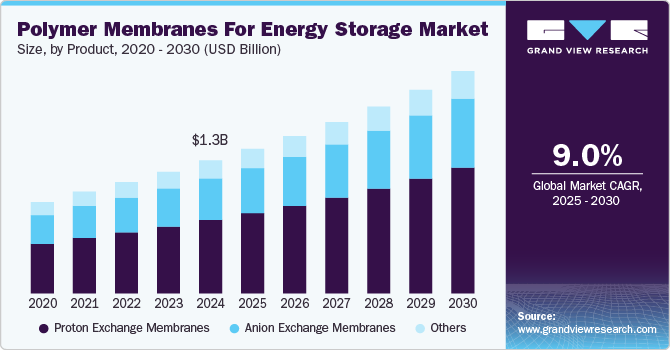

The global polymer membranes for energy storage market size was estimated at USD 1.35 billion in 2024 and is expected to expand at a CAGR of 9.0% from 2025 to 2030. The growing adoption of renewable energy and electric vehicles (EVs) drives demand for polymer membranes in energy storage, supported by advancements in membrane technologies and government funding for clean energy initiatives. In addition, the need for efficient and durable membranes in applications such as redox flow and lithium-ion batteries is boosting market growth.

The rapid expansion of renewable energy sources such as solar and wind has driven the need for reliable and efficient energy storage systems to mitigate supply fluctuations. Polymer membranes play a critical role in energy storage technologies, particularly redox flow batteries (RFBs) and lithium-ion batteries, facilitating ion transport and improving system efficiency.

For example, increasingly used for grid-scale energy storage, vanadium redox flow batteries (VRFBs) rely on ion exchange membranes to separate electrolytes and minimize crossover. As governments worldwide aim to meet carbon neutrality goals and integrate more renewable energy sources, the demand for polymer membranes in energy storage is expected to rise significantly.

Ongoing innovations in polymer membrane technologies enhance energy storage systems' efficiency, durability, and cost-effectiveness. Researchers are developing next-generation membranes with higher ionic conductivity, reduced resistance, and improved chemical stability to withstand harsh operating conditions.

For example, perfluorosulfonic acid (PFSA) membranes, such as Nafion, dominate the market due to their high proton conductivity and stability, but emerging alternatives such as sulfonated polyether (ether ketone) (SPEEK) and polybenzimidazole (PBI) are gaining attention due to their lower costs and improved performance at higher temperatures. These advancements are driving the adoption of polymer membranes across various energy storage applications, ensuring longer operational life and greater efficiency.

The global push toward electric mobility has significantly contributed to the rising demand for lithium-ion batteries, where polymer membranes act as separators to prevent short circuits and enhance battery safety. As EV manufacturers focus on increasing energy density and reducing charging time, advanced polymer membranes with superior ion selectivity and thermal stability are becoming essential.

Companies such as Toray Industries are investing heavily in developing high-performance polymer membranes that can improve EV batteries' overall performance and safety. With EV sales projected to grow exponentially, the demand for advanced polymer membranes is expected to follow a similar trajectory.

Government initiatives aimed at accelerating the transition to clean energy and electric mobility are strongly supporting the polymer membranes market. Countries such as the U.S., China, and Germany offer subsidies and incentives to encourage the development of next-generation energy storage technologies, including those utilizing polymer membranes.

In addition, funding for research and development (R&D) in energy storage materials fosters innovation in membrane technologies. For example, the U.S. Department of Energy’s (DOE) support for solid-state battery development has spurred advances in polymer electrolyte membranes, promising to improve future battery technologies' safety and longevity. These policy-driven initiatives are expected to fuel market growth by ensuring continuous innovation and commercializing polymer membranes for energy storage.

Product Insights

The proton exchange membranes (PEM) segment recorded the largest market revenue share of over 55.0% in 2024 and is projected to grow at the fastest CAGR of 9.4% during the forecast period. PEMs are widely used in fuel cells and energy storage systems, allowing protons to pass through while blocking gases such as hydrogen and oxygen. These membranes are typically made from perfluorosulfonic acid (PFSA) polymers, such as Nafion, which offer high ionic conductivity and chemical stability. PEMs are essential in applications requiring rapid energy delivery and high power density, including automotive, stationary power, and portable electronic devices.

Anion exchange membranes (AEM) facilitate the transfer of hydroxide ions (OH⁻) across the membrane and are commonly used in alkaline fuel cells, redox flow batteries, and water electrolysis systems. They offer a cost-effective alternative to PEMs, as they can operate with non-precious metal catalysts, making them attractive for low-cost energy storage applications. The push toward green hydrogen through electrolysis fuels the demand for AEMs due to their compatibility with alkaline electrolyzers.

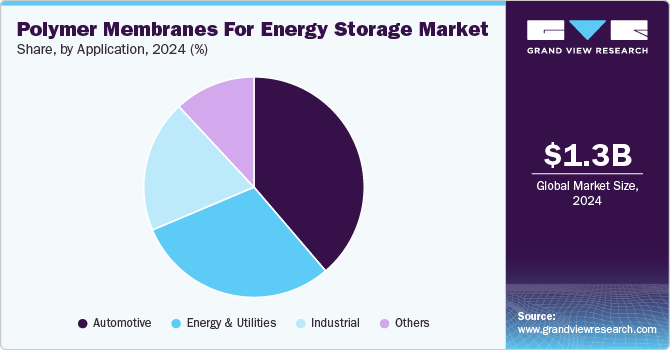

Application Insights

The automotive segment recorded the largest market share of over 38.0% in 2024 and is projected to grow at the fastest CAGR of 9.6% during the forecast period. Polymer membranes are widely used in automotive applications, particularly in electric vehicles (EVs) and hybrid electric vehicles (HEVs), where they are integral to the performance of fuel cells and lithium-ion batteries. The growing adoption of electric vehicles due to stringent government regulations on emissions and increasing consumer preference for eco-friendly transportation is driving the demand for polymer membranes.

Polymer membranes are extensively used in energy and utility applications, including grid-scale energy storage, renewable energy systems, and fuel cells for power generation. These membranes facilitate efficient energy storage in flow batteries and hydrogen fuel cells, ensuring stable energy supply and enhanced performance of energy storage systems, especially in peak demand scenarios. The global shift towards renewable energy and the need to stabilize intermittent power sources, such as solar and wind, drive the demand for polymer membranes in energy and utility applications.

Polymer membranes are used in various energy-intensive industrial applications that require effective energy storage and management. They play a crucial role in electrochemical processes, industrial battery systems, and backup power solutions to ensure continuous operation and prevent downtime. Industries such as chemical processing, manufacturing, and power generation rely on these membranes to improve operational efficiency.

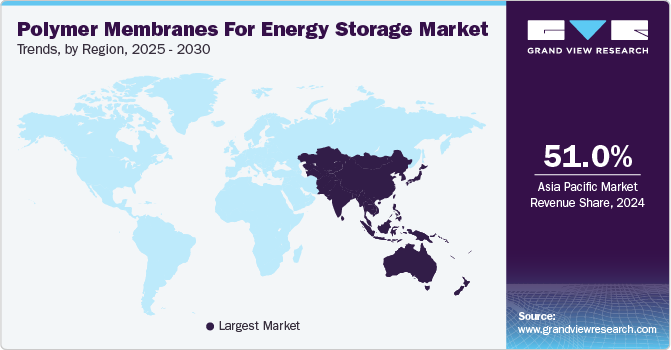

Region Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 51.0% in 2024. This positive outlook is due to the region’s growing emphasis on renewable energy sources and energy storage systems (ESS). Countries such as China, India, Japan, and South Korea actively invest in solar and wind energy projects, which require efficient and durable energy storage solutions. Moreover, Asia Pacific's booming electric vehicle (EV) industry is another significant driver. According to the International Energy Agency (IEA), China, the largest EV market globally, accounted for nearly 60% of global EV sales in 2023, followed by strong growth in Japan and South Korea.

China Polymer Membranes For Energy Storage Market Trends

The polymer membranes for energy storage market in China is experiencing robust growth, largely driven by strong government policies and investments to promote renewable energy and energy storage technologies. China has been actively expanding its energy storage capabilities through initiatives such as the 14th Five-Year Plan (2021-2025) and the Dual Carbon Goals of peaking carbon emissions by 2030 and achieving carbon neutrality by 2060. Hence, government-backed programs, including subsidies, tax benefits, and funding for research and development, have accelerated the growth of polymer membrane technologies in the country.

North America Polymer Membranes For Energy Storage Market Trends

The polymer membranes for energy storage market in North America is anticipated to grow at the fastest CAGR of 9.6% over the forecast period. The region’s market growth is primarily due to its strong investments in renewable energy infrastructure and the growing need for efficient energy storage solutions. The U.S. Department of Energy (DOE) has invested heavily in advancing energy storage technologies, allocating billions of dollars through initiatives such as the Energy Storage Grand Challenge to improve battery efficiency, lifespan, and cost-effectiveness. This has driven research and development (R&D) efforts focused on polymer membrane innovations that improve ionic conductivity and durability in battery applications.

The U.S. polymer membranes for energy storage market growth is majorly driven by the surge in electric vehicle (EV) adoption, which is driven by federal incentives, state-level policies, and ambitious goals to phase out internal combustion engine vehicles. EVs heavily rely on advanced lithium-ion batteries that utilize polymer membranes to enhance performance, durability, and safety. According to the U.S. Department of Energy (DOE), battery production capacity in the U.S. is expected to reach over 1,000 GWh annually by 2030, further fueling the demand for high-performance polymer membranes.

Europe Polymer Membranes For Energy Storage Market Trends

The polymer membranes for energy storage market in Europe is growing primarily due to its aggressive policies and investments in renewable energy and energy storage technologies. The European Union (EU) has set ambitious goals to achieve net-zero emissions by 2050 under the European Green Deal, which promotes the adoption of renewable energy sources such as solar and wind. Efficient energy storage technologies, including batteries and fuel cells, are essential to ensure a stable energy supply from these intermittent sources. Countries such as Germany and France are heavily investing in advanced energy storage systems, further boosting demand for polymer membranes.

Germany polymer membranes for energy storage market is primarily driven by its aggressive renewable energy policies and commitments toward reducing carbon emissions. Through its Energiewende (energy transition) strategy, Germany has set ambitious targets to transition from fossil fuels to renewable energy sources. With a goal to achieve 80% renewable electricity by 2030 and carbon neutrality by 2045, the country is investing heavily in energy storage technologies to stabilize the grid and support the integration of renewable energy.

Key Polymer Membranes For Energy Storage Company Insights

The market's competitive environment is characterized by the presence of established players and emerging innovators focusing on advanced membrane technologies. Major players dominate the market with a strong focus on research and development to enhance the efficiency and durability of polymer membranes used in applications such as lithium-ion batteries, flow batteries, and fuel cells.

Startups and niche companies are introducing next-generation membranes with improved ionic conductivity and thermal stability to meet the growing demand for high-performance energy storage systems. Strategic collaborations, mergers, and acquisitions are common as companies aim to strengthen their portfolios and expand their global footprint. The increasing emphasis on renewable energy integration and the transition to electric mobility drive heightened competition and innovation in this rapidly evolving market.

Key Polymer Membranes For Energy Storage Companies:

The following are the leading companies in the polymer membranes for energy storage market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik AG

- The Chemours Company

- Compact Membrane Systems, Inc.

- TORAY INDUSTRIES, INC.

- Ionomr Innovations Inc.

- Conventus Polymers LLC

- PolyCera

- UBE Corporation

- DuPont

- Celgard

Recent Developments-

In March 2024, Toray Industries developed an innovative ion-conductive polymer membrane that addresses critical challenges in lithium-metal batteries, potentially revolutionizing electric vehicle (EV) range and battery performance. This breakthrough technology achieves 10 times higher ion conductivity than previous solutions while preventing dendrite formation, a major cause of battery degradation and safety risks.

-

In April 2022, Compact Membrane Systems (CMS) and Braskem launched the Optiperm demonstration plant at Braskem's Marcus Hook facility. This project represents a significant milestone in developing CMS’s proprietary Optiperm technology, which focuses on olefin-paraffin separation. The technology is designed to improve efficiency, reduce waste, lower carbon emissions, and enhance sustainability in petrochemical processes.

Polymer Membranes For Energy Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.47 billion

Revenue forecast in 2030

USD 2.25 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Evonik AG; The Chemours Company; Compact Membrane Systems, Inc.; TORAY INDUSTRIES, INC.; Ionomr Innovations Inc.; Conventus Polymers LLC; PolyCera; UBE Corporation; DuPont; Celgard

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymer Membranes For Energy Storage Market Report Segmentation

This report forecasts volume & revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymer membranes for energy storage market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Proton Exchange Membranes (PEM)

-

Anion Exchange Membranes (AEM)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Energy & Utilities

-

Industrial

-

Others

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polymer membranes for energy storage market was estimated at around USD 1.35 billion in the year 2024 and is expected to reach around USD 1.47 billion in 2025.

b. The global polymer membranes for energy storage market is expected to grow at a compound annual growth rate of 9.0% from 2025 to 2030 to reach around USD 2.25 billion by 2030.

b. Automotive emerged as a dominating application with a value share of around 38.0% in the year 2024 owing to the rising adoption of electric vehicles (EVs), increasing demand for efficient energy storage systems, and advancements in battery technologies that require high-performance membranes for improved energy efficiency and safety.

b. The key players in the polymer membranes for energy storage market include Evonik AG, The Chemours Company, Compact Membrane Systems, Inc., TORAY INDUSTRIES, INC., Ionomr Innovations Inc., Conventus Polymers LLC, PolyCera, UBE Corporation, DuPont, and Celgard.

b. The polymer membranes for energy storage market is driven by the rising adoption of electric vehicles (EVs) and growing demand for efficient and durable energy storage solutions. Additionally, advancements in membrane technologies and increasing investments in renewable energy systems further boost market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.