Polymer Filler Market Size, Share & Trends Analysis Report By Product (Organic, Inorganic), By End-use (Automotive, Building & Construction, Electrical & Electronics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-851-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Polymer Filler Market Size & Trends

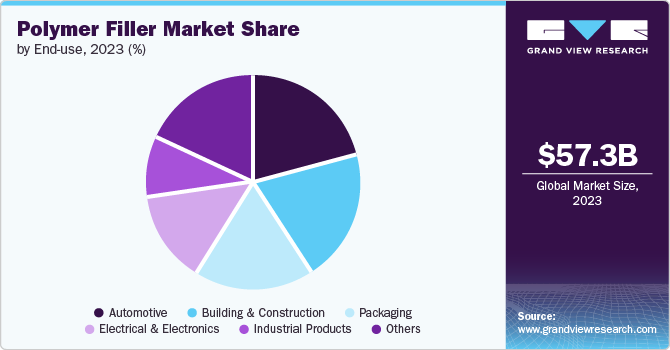

The global polymer filler market size was valued at USD 57.33 billion in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. Increasing demand for high strength and lightweight materials in automotive and industrial applications is likely to propel the low-density polymer filler market. Polymer fillers, due to their improved impact strength, are expected to replace costly plastic resins across various industrial products in the coming years.

The easy availability of natural fibers such as wood and cellulose at a reduced price is propelling the demand for polymer filler. Moreover, the growing demand for eco-friendly and sustainable materials is leading to advancements in recycled and bio-based polymer fillers. By substituting expensive resins with polymer fillers, the overall cost of the final product is reduced thereby encouraging the manufacturers to provide enhanced and efficient products.

High-quality characteristics and the capacity to substitute costly plastic resins make polymer filler a common material for different apps. Polymer fillers provide possibilities for the growth of sectors, such as new products that enhance molding characteristics. Increased demand for high strength and lightweight materials in automotive and industrial applications as well as environmentally friendly applications is projected to boost polymers filler's growth.

Product Insights

The inorganic segment accounted for the largest market share of 77.9% in 2023. The segment is further divided into oxides, hydro-oxides, salts, silicates, and metals. The use of inorganic fillers such as gypsum, talc, calcium carbonate, silica, and others enhances the material’s mechanical characteristics such as elasticity, strength, impact resistance, and others. It helps in reducing plastic costs by as much as 50%. This enables plastic to be more cost-effective and appropriate for a wider variety of uses. The improved thermal resistance of plastics makes them better suited for high temperature applications.

The organic segment is expected to register the fastest CAGR of 5.6% during the forecast period. The segment is further divided into natural, carbon, and other organics. The rising demand for ultraviolet resistance is one of the key drivers contributing to the polymer filler market growth. The common types of organic fillers include wood powder, chicken feathers, cellulose, natural fibers, synthetic polymers, and others. The emerging automotive sector is demanding for organic fillers, utilized in door panels, dashboards, and interior decorative parts.

End-use Insights

The automotive segment accounted for the largest market share in 2023. Global regulations for fuel economy and emissions have forced automotive industries to decrease the weight of vehicles. This is leading to the rise in demand for polymer filler. Stringent regulations pertaining to vehicular emission is further expected to trigger product demand.

The packaging segment is projected to grow at the fastest CAGR over the forecast period. Packaging materials made using polymer fillers are easy to seal and allows content to remain fresh for a longer period during transportation. Less weight in packaging allows for increased product capacity per container, resulting in lower logistics costs and environmental impact. The specific fillers enhance the barrier characteristics of packaging materials, safeguarding them from oxygen, moisture, and various impurities.

Regional Insights

The North America polymer filler market anticipated to witness significant growth. The region is a central location for the production of vehicles, placing a significant focus on advancement and new technology. This results in a greater utilization of materials such as polymer fillers, leading to its higher demand in the market. The developing infrastructure projects are producing the requirement for polymer fillers to improve the characteristics of concrete, insulation, and other construction materials.

U.S. Polymer Filler Market Trends

The polymer filler market in U.S. held a substantial market share in 2023. The rise in e-commerce has boosted the need for packaging supplies. The fillers aid in decreasing the weight of the packaging. Moreover, the manufacturers in the country are utilizing high-performance and lightweight automotive parts, leading to growth in the polymer fillers market.

Asia Pacific Polymer Filler Market Trends

The polymer filler market in Asia Pacific held a considerable share of 49.2% in 2023. The increasing demand for the automotive sector is fueling the growth of polymer filler market. The automotive sector is prioritizing the manufacture of lighter vehicles to enhance fuel efficiency.

The China polymer filler market dominated the APAC market with a share of 37.3% in 2023 due to the continuous development in the construction industry in China. It is one of the leading automobile manufacturers. It is anticipated that the rising number of cars manufactured in China will drive up the sales of polymer fillers in the coming years.

Europe Polymer Filler Market Trends

The polymer filler market in Europe identified as a lucrative region in 2023. The increasing customer demand for specialized fillers demands for advanced materials to meet their specific requirements. The rising demand for polymer fillers such as carbon nanotubes, glass microspheres, and hollow ceramic spheres to increase the strength-to-weight ratio of polymers is resulting in market growth.

Key Polymer Filler Company Insights

Some key companies in the polymer filler market include 3M, Dow, Lanxess, Momentive Performance Materials, and others. Market players are expected to encounter tougher competition from alternative materials like scrap or waste materials. Scrap or waste materials are utilized as fillers in the production of concrete.

-

Dow produces specialty chemicals, rubber, agro-science, and plastic materials. Dow Chemical operates globally in the packaging, infrastructure, agricultural, and consumer care sectors.

Key Polymer Filler Companies:

The following are the leading companies in the polymer filler market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Dow

- Lanxess

- Momentive Performance Materials

- Rogers Corporation

- Saint-Gobain Performance Plastics

- Trelleborg AB

- Solvay

- Shin-Etsu Chemical Co. Ltd.

- PolyMod Technologies, Inc.

- Holland Shielding Systems

Polymer Filler Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 60.20 billion |

|

Revenue forecast in 2030 |

USD 80.75 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Turkey, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia, UAE |

|

Key companies profiled |

3M; Dow ; Lanxess; Momentive Performance Materials; Rogers Corporation; Saint-Gobain Performance Plastics; Trelleborg AB; Solvay; Shin-Etsu Chemical Co. Ltd.; PolyMod Technologies, Inc.; Holland Shielding Systems |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polymer Filler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymer filler market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Natural

-

Carbon

-

Others

-

-

Inorganic

-

Oxides

-

Hydro-oxides

-

Salts

-

Silicates

-

Metals

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Electrical & Electronics

-

Industrial Products

-

Packaging

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."