Polymer Binders Market Size, Share & Trends Analysis Report By Type (Acrylic, Vinyl Acetate, Latex, Polyurethane, Polyester), By Form, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-359-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Polymer Binders Market Size & Trends

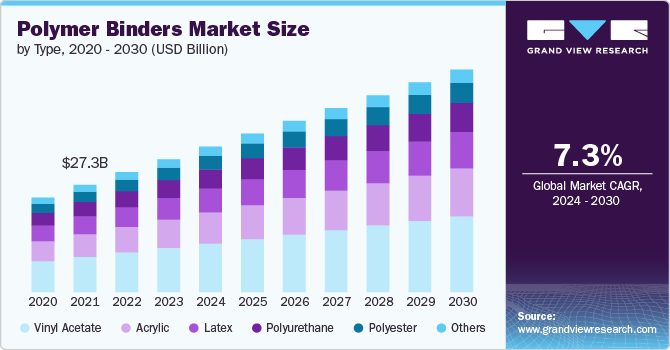

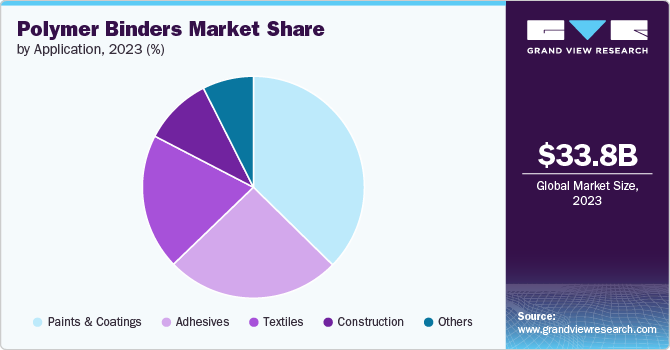

The global polymer binders market size was estimated at USD 33.84 billion in 2023 and expected to grow at a CAGR of 7.3% from 2024 to 2030. The polymer binders market is expected to experience significant growth in the coming years. The market is driven by growing demand in the construction, automotive and packaging industries, the development of water-based binders and environmental regulations promoting green products. In addition, increasing urbanization, infrastructure development, and innovation in polymer technology are expected to fuel the market growth.

Continuous research and development in polymers has resulted in improved binders with improved properties such as higher strength, better adhesion and increased durability. These innovations are expanding the applications of polymer binders and is expected to create new market opportunities for the key players.

Drivers, Opportunities & Restraints

Strict environmental regulations aimed at reducing volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) have stimulated the development and adoption of environmentally friendly polymer binders. Advances in polymer technology have led to the creation of binders that require less energy during production and application. Lower cure temperatures and faster drying times contribute to overall energy savings. Manufacturers are increasingly paying attention to the production of binders that comply with these standards, which is leading to a transition to environmentally friendly products.

The trend toward using lightweight materials to improve fuel efficiency and reduce emissions in several industries including automotive and aerospace is creating opportunities for polymer binders used in composite materials and lightweight components. Moreover, the introduction of advanced manufacturing technologies such as 3D printing and smart manufacturing can drive demand for innovative polymer binders that provide increased productivity and compatibility with these technologies.

However, the volatility in the raw material prices such as petroleum-based products and specialty chemicals might restrain the market growth of polymer binders. Price fluctuations impact the production costs and profit margins, making it difficult for companies to maintain stable pricing strategies.

Type Insights & Trends

Based on type, polymer binders market has been segmented into acrylic, vinyl acetate, latex, polyurethane, polyester, and others. Vinyl Acetate dominated polymer binders market with a share of over 33.23% in 2023.

Vinyl acetate polymer binders are widely utilized several construction applications including coatings, sealants, and adhesive. Strong adherence, flexibility, and water resistance are key characteristics that make them ideal for enhancing the performance and longevity of building materials.

Acrylic polymer binder is expected to grow at significant CAGR of 7.5%. The growing need for protective coatings in industrial applications, such as machinery and equipment is expected to fuel the demand for acrylic polymer binders. Moreover, the growing awareness and demand for sustainable and eco-friendly products is driving the use of acrylic polymer binders, which are thought to be less hazardous to the environment than solvent-based alternatives.

Form Insights & Trends

Based on type, polymer binders market is segmented into powder, liquid, and high solids. Powder segment accounted for highest revenue share of 58.14% in 2023. Powder-based polymer binders are vital in dry mix mortars, as offer improve workability, adhesion, and durability. The rising construction sector, particularly in emerging nations, drives up demand for these materials.

Liquid form is expected grow at highest CARG of 7.2% in coming years. Liquid-based binders protect against corrosion, chemicals, and wear, making them widely used in machinery, equipment, and infrastructure. Liquid polymer binders are essential in architectural paints and coatings, as they enhance adhesion, durability, and weather resistance. The need for high-performance coatings in residential and commercial structures is driving market growth.

Application Insights & Trends

Based on application, polymer binders market is segmented into paints & coatings, adhesives, textiles, construction, and others. Paints & coatings dominated polymer binders market in 2023 and accounted for a share of over 37.34%. The polymer binder market is critical in paint and coating applications, providing a range of benefits to meet the needs of diverse industries. Polymer binders increase the durability, adhesion, and mechanical qualities of paints and coatings. They helps in generating a cohesive coating that increases resistance to abrasion, chemicals, corrosion, and UV radiation, extending the lifespan of coated surfaces.

Adhesives segment is expected to grow at a significant CAGR of 7.4%. Polymer binders are an essential components in adhesive formulations, providing the necessary properties of adhesion, cohesion, flexibility and durability. The automotive industry requires high-performance adhesives for a variety of applications, including bonding various materials, sealing and component assembly. The shift towards lightweight and fuel-efficient vehicles is likely to create need for advanced polymer binders.

Regional Insights & Trends

North America polymer binders market is expected to grow at a significant rate of 7.4% over the forecast period. Growing demand for high-performance and environmentally friendly binders across several industries including construction across the region has augmented demand for polymer binders in the region.

U.S. Polymer Binders Market Trends

The U.S. dominated the polymer binders market in Asia Pacific and accounted for a share of over 7.6% in 2023. U.S. polymer binders market is expected to grow significantly over the forecast period backed by the rising demand from end-use industries such as automotive, packaging, construction, and healthcare.

Europe Polymer Binders Market Trends

The European polymer binders market has seen significant growth. The European market is seeing a growing focus on sustainability and the development of sustainable products. Strict environmental regulations and policies of the European Union aimed at reducing VOC (volatile organic compound) emissions and promoting sustainable development are expected to drive the demand for environmentally friendly bio-based polymer binders.

Asia Pacific Polymer Binders Market Trends

Asia Pacific dominated the polymer binders market in 2023 with revenue market share of 39.66%, and is expected to grow significantly in the coming years. The Asia Pacific region is a major automotive manufacturing hub, with significant production volumes in countries such as China, Japan, South Korea, and India. Growing demand for lightweight and high-performance materials in the automotive sector is projected to drive the need for advanced polymer binders in adhesives and coatings.

Key Polymer Binders Company Insights

The polymer binders market is a highly competitive industry with several key players operating globally, who have strong distribution networks and good knowledge about suppliers and regulations. The polymer binders market is a highly competitive sector with numerous major firms operating globally, each with strong distribution networks and a broad understanding of suppliers and regulations. Major players, in particular, compete on the basis of application development capability and new technologies used for product formulation. Major companies in particular, enter based on innovative technologies and application development competency engaged in product composition.

Key Polymer Binders Companies:

The following are the leading companies in the polymer binders market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Wacker Chemie AG

- OMNOVA Solutions Inc.

- Celanese Corporation

- Arkema

- Dairen Chemical Corporation

- Toagosei Co. Ltd.

- Guangdong Yinyang Environment-Friendly New Materials Co., Ltd.

- Weifang Tainuo Chemical Co., Ltd.

- Mayfair Biotech Pvt. Ltd.

- VINAVIL S.p.A.

- The Lubrizol Corporation

Recent Developments

-

In December 2024, Trinseo launched LIGOS BH 7340 SCE Binder, a biodegradable bio-hybrid binder for coated paper board products. LIGOS BH 7340 SCE binder can replace a significant portion of synthetic binder in coatings. The product offers several comparable to traditional paper or paperboard coatings with synthetic binders. This includes excellent coater run ability, cohesive coating strength, and glue ability.

-

In December 2023, the School of Energy and Chemical Engineeringcreated a unique binder technique that promises to transform battery performance.The company plans to significantly increase the performance of silicon cathode-based secondary batteries by producing high-electrical conductivity polymer binders using widely available.

-

In February 2023, WACKER AG introduces a polymer resin binder with improved solubility for use in printing inks, high-solids, and UV-curing systems.WACKER's VINNOL product line already includes a wide range of polymer resins that fulfill this same function in a variety of applications.

Polymer Binders Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 37.10 billion |

|

Revenue forecast in 2030 |

USD 56.68 billion |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Form, type, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands, Denmark, China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

BASF SE; Wacker Chemie AG; OMNOVA Solutions Inc.; Celanese Corporation ; Arkema; Dairen Chemical Corporation; Toagosei Co. Ltd.; Guangdong Yinyang Environment-Friendly New Materials Co., Ltd.; Weifang Tainuo Chemical Co., Ltd.; Mayfair Biotech Pvt. Ltd.; VINAVIL S.p.A.; The Lubrizol Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polymer Binders Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented polymer binders market report on the basis of form, type, application, and region:

-

Type Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Vinyl Acetate

-

Latex

-

Polyurethane

-

Polyester

-

Others

-

-

Form Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

High Solids

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesives

-

Textiles

-

Construction

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

The Netherlands

-

Denmark

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polymer binders market size was estimated at USD 33.84 billion in 2023 and is expected to reach USD 37.10 billion in 2024.

b. The global polymer binders market is expected to grow at a compound annual rate of 7.3% from 2024 to 2030, reaching USD 56.68 billion by 2030.

b. Asia Pacific led the global polymer binders market, accounting for 39.7% of the global revenue in 2023.

b. Some of the major companies in the global polymer binders market include BASF SE, Wacker Chemie AG, OMNOVA Solutions Inc., Celanese Corporation, Arkema, Dairen Chemical Corporation, and Toagosei Co. Ltd, among others.

b. The market is driven by growing demand in the construction, automotive and packaging industries, the development of water-based binders and environmental regulations promoting green products. Additionally, increasing urbanization, infrastructure development, and innovation in polymer technology are expected to fuel the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."