- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyimide Film Market Size & Share, Industry Report, 2033GVR Report cover

![Polyimide Film Market Size, Share & Trends Report]()

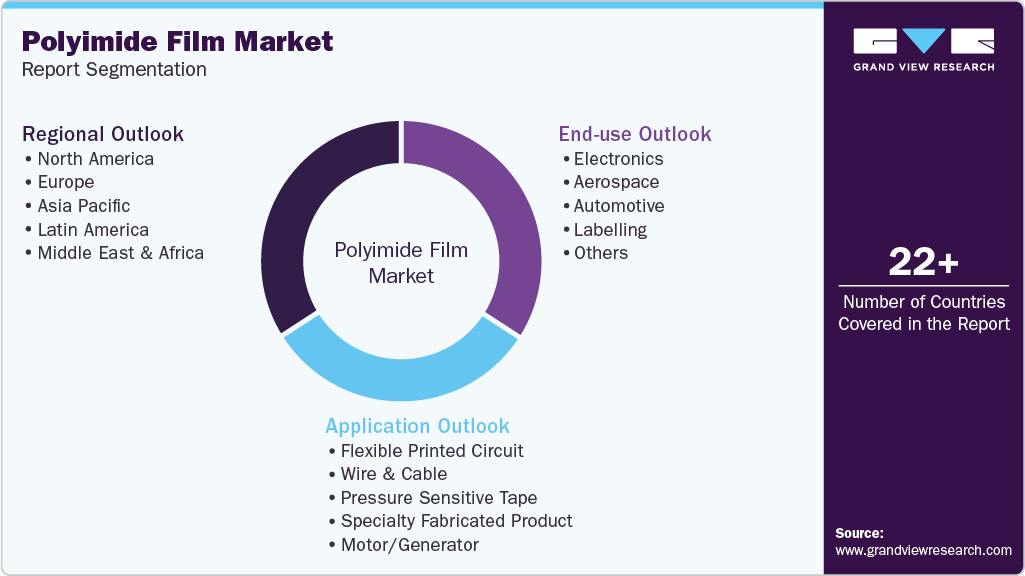

Polyimide Film Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Flexible Printed Circuit, Wire & Cable, Pressure Sensitive Tape, Specialty Fabricated Product, Motor/Generator), By End-use (Electronics, Aerospace, Automotive, Labelling), By Region And Segment Forecasts

- Report ID: GVR-1-68038-522-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyimide Film Market Summary

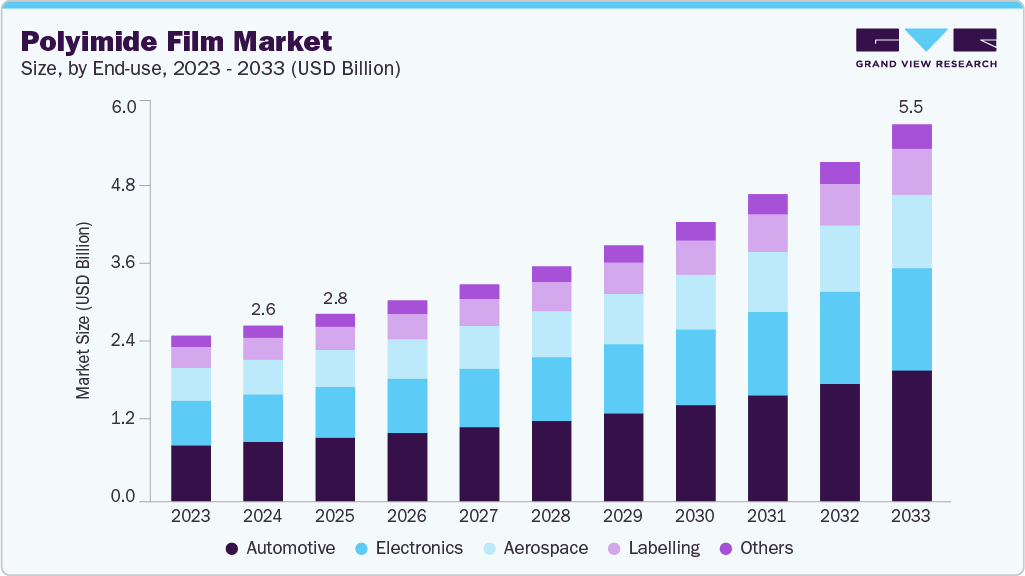

The global polyimide film market size was estimated at USD 2.59 billion in 2024 and is projected to reach USD 5.55 billion by 2033, growing at a CAGR of 9.1% from 2025 to 2033. Due to the increasing demand for consumer electronics, including modern computers, LEDs, mobile phones, and other products, the polyimide film industry is expected to drive growth over the forecast period.

Key Market Trends & Insights

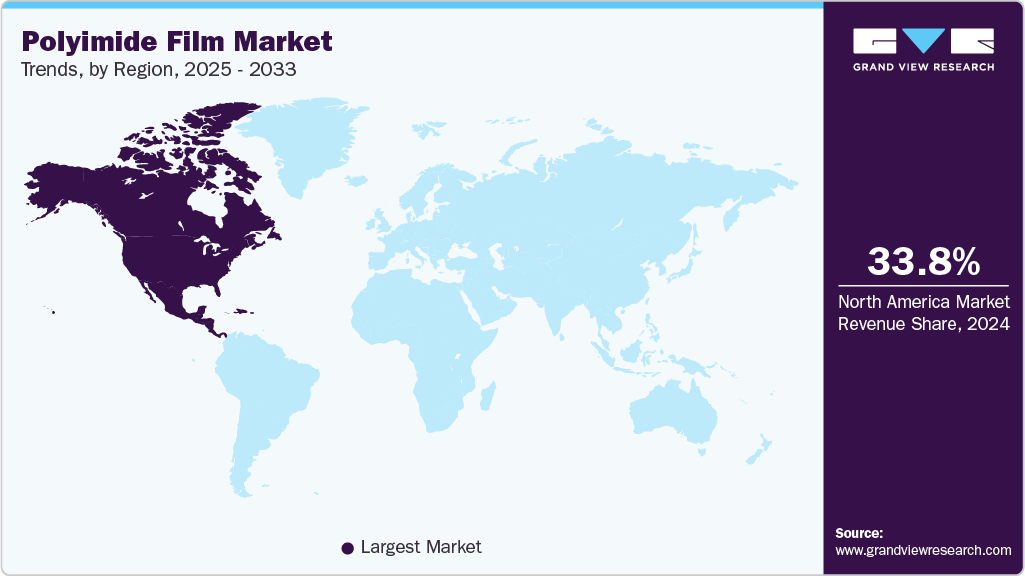

- North America dominated the global polyimide film market with the largest revenue share of 33.85% in 2024.

- The polyimide film industry in the U.S. accounted for the largest market revenue share in North America in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 9.4% from 2025 to 2033.

- By application, the flexible printed circuit segment is expected to grow at the fastest CAGR of 9.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 2.59 Billion

- 2033 Projected Market Size: USD 5.55 Billion

- CAGR (2025-2033): 9.1%

- North America: Largest market in 2024

Polyimide Film are increasingly migrating from rigid substrates to thin, flexible layers as device form factors shrink. Demand for flexible printed circuits, foldable displays and high-density interconnects is driving engineers to prefer polyimide for its dielectric stability and thermal endurance. Colorless and ultra-thin formulations are getting notable traction because they enable transparent, bendable substrates in consumer devices. This structural shift is turning polyimide from a niche high-temperature film into a mainstream flexible-substrate material.

Drivers, Opportunities & Restraints

Electrified transport and next-generation avionics are creating steady, volume-driven demand for high-performance insulating films. EV battery systems, power electronics and motor drives require thin insulation that tolerates high temperature, voltage and mechanical stress; polyimide meets those needs while enabling lighter systems. At the same time, aerospace and defense programs continue to specify polyimide for high-temperature circuit and harness applications, anchoring sustained industrial uptake.

Manufacturers can expand margins by developing specialty grades tuned for battery separators, high-voltage insulation, and low-hygroscopy display substrates. Commercializing colorless and low-outgassing formulations opens direct access to foldable OLED and micro-LED supply chains. There is also upside in vertically integrated offerings, which combine coated, metallized, and patterned Polyimide Film to create turnkey flexible-circuit laminates that command premium pricing and foster stronger customer relationships.

Production of high-performance polyimide involves multi-stage chemistries, solvent handling, and tight quality controls, which raise capital and operating costs. Feedstock price swings and constrained specialty polymer capacity create margin pressure and intermittent supply risk for downstream OEMs. Environmental and emissions regulations further increase compliance costs, slowing the achievement of price parity with lower-cost alternatives in certain volume segments.

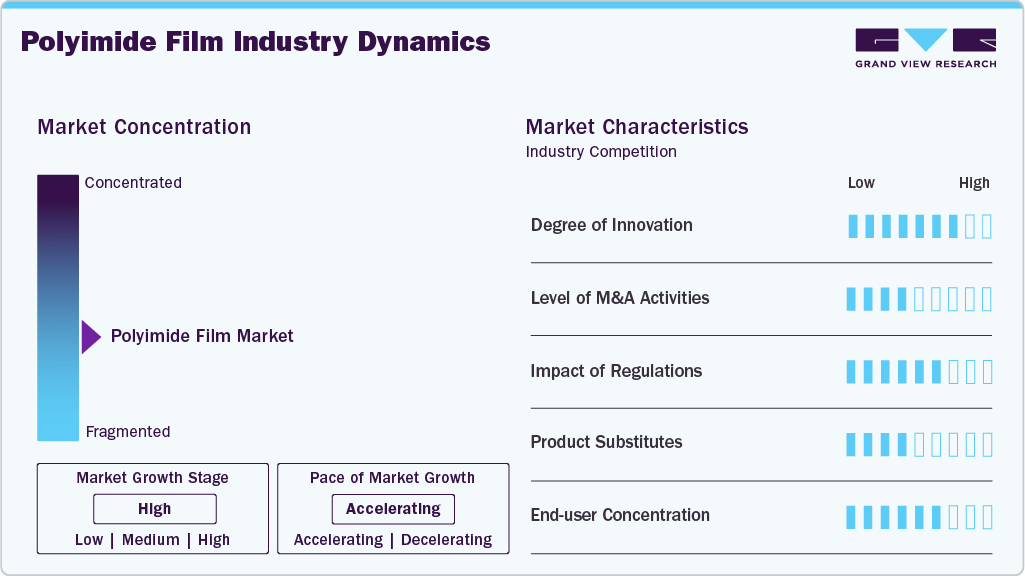

Market Concentration & Characteristics

The polyimide film industry is experiencing high growth, with an accelerating pace. The market exhibits slight fragmentation, with key players dominating the industry landscape. Major companies, including DuPont, Kolon Industries, Inc., Compagnie de Saint-Gobain, Taimide Tech, Inc., and KANEKA CORPORATION, among others, play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Polyimide Film continue to evolve from a commodity heat-resistant substrate into a platform material for advanced electronics. Recent R&D efforts focus on developing colorless and low-dielectric formulations that combine optical clarity with a low dielectric constant, enabling the fabrication of foldable displays and high-frequency RF modules. Materials science advances also target a lower coefficient of thermal expansion and controlled outgassing to meet demanding semiconductor and aerospace specifications. These improvements are shortening qualification cycles and widening design adoption in next-generation flexible and high-speed systems.

In many cost-sensitive or volume applications, standard polyester (PET), polycarbonate, and polypropylene serve as practical alternatives to polyimide. These thermoplastics offer lower raw material and processing costs and broad manufacturing availability, making them attractive for non-critical insulation and masking tasks. For high-temperature or vacuum applications, PTFE and specialty glass-reinforced laminates are considered, while proprietary polyimide tape variants directly compete with legacy Kapton products. The choice of substitute is therefore a balance of thermal, electrical, and economic requirements.

End-use Insights

The automotive segment led the market with the largest revenue share of 33.91% in 2024 and is forecasted to grow at the fastest 9.4% CAGR from 2025 to 2033.The growing automotive production, along with the increasing percentage of electrification in the vehicles, is driving the demand for polyimide film. Common automotive applications of polyimide film include EGR valve bushings, thrust washers, seat sensor applications, and traction control systems. The harsh temperature condition present in the powertrain applications requires materials that can withstand high thermal, mechanical, and electrical loads.

The electronics segment is anticipated to grow at a substantial CAGR of 9.2% through the forecast period. The rollout of 5G and more advanced semiconductor packaging is boosting demand for low-loss, dimensionally stable substrates and interposers. At high frequencies, material dielectric properties and coefficient of thermal expansion become critical; therefore, polyimide variants tuned for low dielectric loss and low CTE are experiencing strong uptake. This positions polyimide as a strategic material for next-generation RF modules and high-density package substrates.

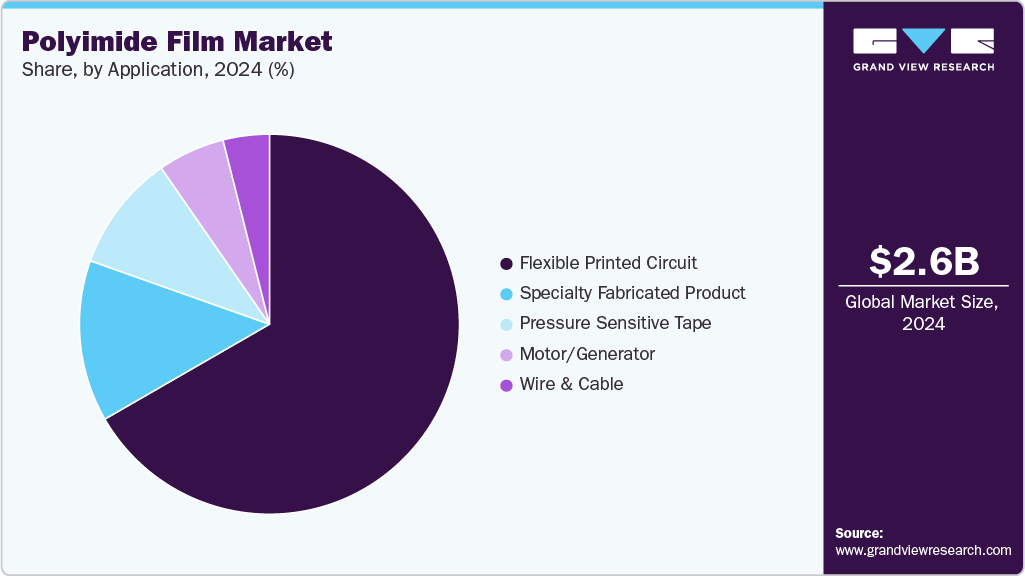

Application Insights

The flexible printed circuit segment led the market with the largest revenue share of 66.67% in 2024 and is forecasted to grow at the fastest CAGR of 9.3% from 2025 to 2033. Growth in the electronics sector, along with growing electrification trends in the automotive sector, is augmenting the FPC demand, which is attracting polyimide makers to expand their product portfolio for the application segment. Flexible printed circuits are used as connectors in numerous applications where production constraints, space limitations, and flexibility requirements restrict the serviceability of rigid circuit boards. These factors are likely to propel the demand for FPC in the polyimide film industry.

The specialty fabricated product segment is expected to expand at a substantial CAGR of 9.1% through the forecast period. Aerospace and high-reliability medical fabricators are specifying polyimide for parts that must survive extreme heat and harsh chemical exposure. The material’s high glass transition temperature and chemical resistance make it suitable for custom laminates, insulating blankets, and precision-formed components used in avionics and satellite systems. This creates a steady, specification-driven revenue stream for converters who can meet the requirements for traceability and certification.

Regional Insights

North America dominated the polyimide film market with the largest revenue share of 33.85% in 2024 and is expected to grow at the fastest CAGR of 9.4% over the forecast period, owing to the development of the electronics, automotive, and aerospace industries. The presence of top manufacturers in the automotive industry, such as Ford, Chrysler, Cadillac, Tesla, and others. In this region, proper infrastructure coupled with high disposable income is expected to drive this market.

Rising deployment of EVs and electrified powertrains in North America is increasing demand for thin, high-temperature insulation in battery packs, inverters, and motor housings. The electronics content per vehicle is growing, so polyimide film, which enables compact and thermally robust insulation, is finding more design wins. Suppliers serving automotive tier-1s and battery manufacturers, therefore, see steady volume growth.

U.S. Polyimide Film Market Trends

The polyimide film market in the U.S. accounted for the largest market revenue share in North America in 2024. Federal incentives and CHIPS Act investments are accelerating the development of new FABS and advanced packaging capacity across the United States. That expansion boosts local demand for specialty dielectric films used in wafer-level packaging, interposers, and high-frequency substrates. Materials suppliers that align with domestic fabs and packaging houses can capture the upstream value created by onshoring.

Europe Polyimide Film Market Trends

The polyimide film market in Europe is experiencing rapid growth. European CO₂ targets and tightening vehicle standards are keeping OEMs focused on electrification and weight reduction, which supports demand for high-performance insulation films. At the same time, the rollout of 5G and upgrades to telecom infrastructure increase the need for low-loss, dimensionally stable substrates. Firms that supply low-outgassing, qualified polyimide grades benefit from both automotive and telecom investments.

Asia Pacific Polyimide Film Market Trends

The polyimide film market in the Asia Pacific remains the production epicenter for flexible displays, consumer electronics, and chip making capacity. Large investment pipelines in China, South Korea, Japan, and Taiwan keep demand for colorless and ultra-thin polyimide film high. Regional fabs and display fabs create sustained, high-volume opportunities for material producers and converters.

Key Polyimide Film Company Insights

The polyimide film industry is highly competitive, with several key players dominating the landscape. Major companies include DuPont, Kolon Industries, Inc., Compagnie de Saint-Gobain, Taimide Tech. Inc., and KANEKA CORPORATION. The polyimide film industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyimide Film Companies:

The following are the leading companies in the polyimide film market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- Compagnie de Saint-Gobain

- Kolon Industries, Inc.

- KANEKA CORPORATION

- Taimide Tech. Inc.

- FLEXcon Company, Inc.

- Arakawa Chemical Industries Ltd.

- Anabond

- Goodfellow

- I.S.T Corporation

Recent Developments

-

In July 2025, Toray announced a new photosensitive polyimide solution that enables high-aspect-ratio fine patterning. The material targets advanced packaging and precision cavity formation for next-gen semiconductors.

-

In October 2024, Ube Industries began trial operations on expanded UPILEX polyimide film capacity to support larger display and COF demand. The capacity increase was timed to serve rising OLED and COF requirements across the Asia Pacific.

Polyimide Film Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.76 billion

Revenue forecast in 2033

USD 5.55 billion

Growth rate

CAGR of 9.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segment covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

DuPont; Compagnie de Saint-Gobain; Kolon Industries, Inc.; KANEKA CORPORATION; Taimide Tech. Inc.; FLEXcon Company, Inc.; Arakawa Chemical Industries Ltd.; Anabond; Goodfellow; I.S.T Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyimide Film Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, providing an analysis of the latest industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global polyimide film market report based on the application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flexible Printed Circuit

-

Wire & Cable

-

Pressure Sensitive Tape

-

Specialty Fabricated Product

-

Motor/Generator

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electronics

-

Aerospace

-

Automotive

-

Labelling

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.