Polyethylene Market Size, Share & Trends Analysis Report By Product (LDPE, HDPE), By Application (Bottles & Containers, Films & Sheets), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Polyethylene Market Size & Trends

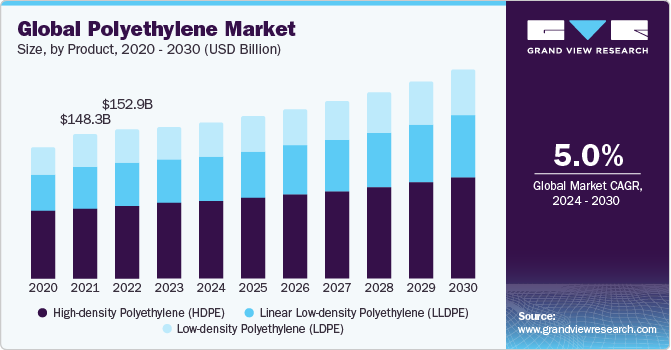

The global polyethylene market size was estimated at USD 155.18 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. The ongoing technological advancements in several end-use industries and the growing demand for lightweight and cost-effective products are expected to boost market growth over the forecast period. The growth of various end-use industries, such as packaging, construction, and automotive, fuels the demand for virgin polyethylene (PE). As these industries expand globally, the need for high-quality and consistent PE for manufacturing essential products like packaging materials, pipes, and automotive components rises, contributing to market growth.

In addition, population growth and rapid urbanization contribute significantly to the demand for virgin PE. The rising global population, particularly in developing regions, leads to increased consumption of products that utilize PE. Moreover, urbanization drives the need for infrastructure development, including construction projects that rely on PE for various applications. This demographic and societal shift results in a higher demand for virgin PE as a fundamental material in the construction and development processes.

One of the major challenges faced by the market includes fluctuations in raw material prices. The global crude oil prices have witnessed severe fluctuations in the past few years. Social disruption in key crude oil-producing regions, such as Venezuela, Libya, Iran, Nigeria, and Iraq has hampered crude oil supply, generating inelasticity in the supply-demand balance. These factors are short-lived in the market causing immediate fall and rise in prices, thus impacting market growth.

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include BASF SE, Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Formosa Plastics, INEOS Group, and LG Chem, among others. Several players are engaged in framework development to improve their market share.

Regulatory measures and policies aimed at reducing plastic pollution and promoting a circular economy contribute to the restraint on PE adoption. Governments and environmental agencies worldwide are implementing measures to limit single-use plastics, encourage recycling, and incentivize the use of alternative materials.

Growing demand for alternative materials, such as bioplastics and bio-based polymers, is constraining the market growth. These substitutes offer the potential for reduced environmental impact and are often marketed as eco-friendly alternatives. This can create potential growth for sustainable substitutes.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for PE materials in several industries including packaging, construction, and automotive.

Product Insights

In terms of revenue, the high-density polyethylene (HDPE) segment accounted for the largest revenue share of over 49% in 2023. The HDPE segment benefits from the increasing demand for durable and corrosion-resistant materials in construction and infrastructure projects. HDPE's suitability for pipes, geo-membranes, and other construction applications drives its demand.HDPE pipes are widely used for water distribution, irrigation, and drainage systems due to their durability, corrosion resistance, and flexibility. The demand for efficient and long-lasting solutions in water infrastructure and agriculture enhances the growth prospects of the HDPE segment.

Moreover, with rapid urbanization and continuous infrastructure development, the HDPE demand is expected to rise. The HDPE’s role in supporting critical sectors, such as construction, highlights its significance in driving the overall growth and stability of the market. The linear Low-density Polyethylene (LLDPE) segment is expected to grow at the fastest CAGR of 5.5% from 2024 to 2030. The role of LLDPE in the production of electrical conduits and cable insulation contributes to its demand in the electrical and telecommunication sectors. LLDPE's insulating properties, durability, and environmental resistance are essential for protecting insulating cables from sunlight, fire, adverse weather conditions, and chemical degradation.

End-use Insights

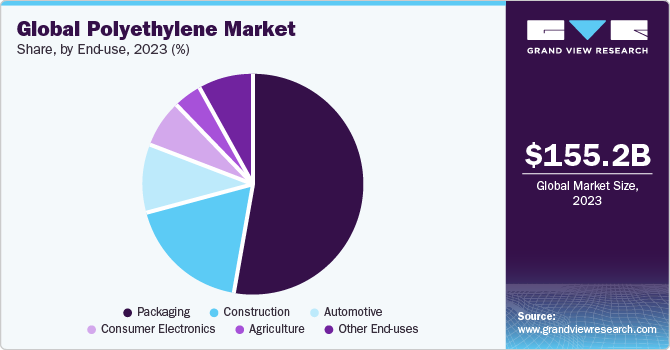

In terms of revenue, the packaging industry led the end-use segment in 2023 with a share of over 52.0%. The extensive use of PE in the production of plastic bags, pouches, and flexible packaging films is driving the segment growth. From food & beverages to pharmaceuticals and consumer goods, PE packaging plays a crucial role in preserving product freshness, extending shelf life, and enhancing the overall visual appeal of products on retail shelves.

The construction industry is anticipated to grow at the fastest CAGR of 5.5% from 2024 to 2030 owing to the growing emphasis on sustainable and energy-efficient construction practices, positioning PE as a key driver in improving the performance of building structures. In addition, the demand for geomembranes and geotextiles, both made from PE, drives product adoption in the construction segment.

Application Insights

In terms of application, the bottles & containers segment led the market in 2023 and accounted for a substantial revenue share of 39.8%. The growth of the bottles & containers segment is driven by the consistent demand for efficient and cost-effective packaging solutions across various sectors, reflecting the adaptability of PE in meeting the diverse packaging needs of these sectors.

The films & sheets segment is projected to grow at the fastest CAGR of 6.0% from 2024 to 2030. The popular trend of smart packaging is driving the segment's growth. Polyethylene films are integrated with features, such as RFID tags and QR codes. These technologies enable real-time tracking, authentication, and communication of information about the packaged products. The films & sheets segment enhances the supply chain visibility and engages consumers with interactive packaging by facilitating the integration of smart packaging solutions.

Regional Insights

The North America polyethylene market accounted for a significant revenue share of 19.2% in 2023. The shale gas boom in North America has transformed the regional PE market. The abundant and easy availability of cost-effective feedstocks derived from shale gas, particularly ethane, has given PE producers, based in North America, a significant competitive advantage.

U.S. Polyethylene Market Trends

The U.S. polyethylene Market is expected to grow over the forecast period. The U.S. energy landscape, specifically the abundant availability of shale gas, is a critical driver for the PE market growth in the country. Shale gas serves as a primary feedstock for ethylene production, which is a key building block for PE. The accessibility and the cost competitiveness of shale gas contribute to the expansion of ethylene production capacities in the U.S., thereby supporting market growth.

Asia Pacific Polyethylene Market Trends

The Asia Pacific polyethylene market dominated the global industry in 2023 with a share of over 50.3%. Asia Pacific is a diverse market for PE owing to the growing automotive and construction industries in the region that are key consumers of this material. The growing manufacturing industry in Asia Pacific is anticipated to drive the requirement for PE.

The Polyethylene Market in China held a significant share in the Asia Pacific region. The market is anticipated to register a CAGR of 5.3% over the forecast period. Government initiatives for infrastructure development projects are driving market growth in China. The ambitious infrastructure development plans of the country, including the Belt and Road Initiative, stimulate the demand for PE in construction and related activities.

The Australia Polyethylene Market is expected to grow at a significant CAGR in the coming years. Infrastructure development and urbanization are propelling market growth. The prevailing trend of outdoor and recreational activities contributes to the demand for PE-based products for manufacturing outdoor furniture, sports equipment, and leisure items. The resistance of PE to weathering and its ability to withstand outdoor conditions drive its usage in outdoor furniture, sports equipment, and leisure items.

Europe Polyethylene Market Trends

The Polyethylene Market in Europe is expected to witness significant growth over the forecast period. The focus of regional governments on advancing their healthcare sector contributes to market growth in Europe. The product usage in the development of medical packaging, tubes, etc. aligns with the focus of governments on healthcare innovations and quality medical services in the region.

The Germany Polyethylene Market held a significant share in Europe. The market is anticipated to register a CAGR of 4.8% over the forecast period. The manufacturing industry of Germany significantly influences the demand for polyethylene in the country. The use of this material in the automotive industry, as well as in industrial production, also contributes to the demand for polyethylene in the country.

The Polyethylene Market in Italy is expected to grow significantly in the coming years. The cultural emphasis of Italy on design and fashion influences the product demand in the regional textiles and apparel industry. The versatility of PE allows its use in creative design applications, thereby contributing to the development of stylish clothing.

Central & South America Polyethylene Market Trends

The Central & South America Polyethylene Market is expected to witness significant growth over the forecast period. The rise of e-commerce and changing consumer preferences in Central & South America are contributing to the product demand in packaging applications.

The Polyethylene Market in Brazil is anticipated to register a CAGR of 4.8% over the forecast period. The versatility and cost-effectiveness of PE make it a preferred choice for packaging applications, meeting the requirements of diverse industries and driving sustained growth in the market.

Middle East & Africa Polyethylene Market Trends

The Middle East & Africa Polyethylene Market is expected to witness significant growth over the forecast period. Abundant access to petrochemical feedstock, particularly ethane and propane, positions the Middle East as a major hub for PE production. The region benefits from its proximity to vast hydrocarbon reserves, enabling cost-effective production and export of PE.

The Polyethylene Market in UAE is anticipated to register a CAGR of 4.9% over the forecast period. The increased product demand in the logistics and transportation sectors is driving the market growth in the UAE.

Key Polyethylene Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In November 2023, Dow announced an investment in the Fort Saskatchewan Path2Zero project in Alberta, Canada, with an investment of USD 6.5 billion, as part of the company's goal to achieve carbon neutrality by 2050. The project involves the construction of a new ethylene plant and expanding polyethylene capacity by 2 million metric tons annually. The construction is scheduled to commence in 2024, and the increased capacity is set to be implemented in stages, with the initial phase anticipated to begin in 2027

-

In October 2023, Borealis AG and TotalEnergies SE announced plans to construct a USD 1.4 billion Borstar PE unit within their Baystar joint venture. This PE unit, boasting a capacity of 625,000 metric tons annually, marks a significant increase, doubling the current production capabilities at the Baystar site including two existing PE production units

-

In August 2023, Dow partnered with Mengniu, a dairy company, to launch a PE yogurt pouch, specifically designed for recyclability. This joint effort signifies a significant step for both companies in reinforcing their dedication to promoting a circular economy in China. The partnership with Mengniu enables both brands to take the lead in pioneering recyclable all-PE dairy packaging in the Chinese market.

Key Polyethylene Companies:

The following are the leading companies in the polyethylene market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Borealis AG

- Braskem

- Dow

- Exxon Mobil Corporation

- Formosa Plastics

- INEOS Group

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- MOL Group

- SABIC

- China Petrochemical Corporation (Sinopec)

View a comprehensive list of companies in the Polyethylene Market

Polyethylene Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 159.89 billion |

|

Revenue forecast in 2030 |

USD 213.77 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia, Brazil; Argentina; Saudi Arabia ; UAE ; South Africa |

|

Key companies profiled |

BASF SE; Borealis AG, Braskem; Dow; Exxon Mobil Corp.; Formosa Plastics; INEOS Group; LG Chem; LyondellBasell Industries Holdings B.V.; Mitsubishi Chemical Corp.; MOL Group; SABIC; China Petrochemical Corp. (Sinopec) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polyethylene Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyethylene market report based on product, application, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Low-density Polyethylene (LDPE)

-

High-density Polyethylene (HDPE)

-

Linear Low-density Polyethylene (LLDPE)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bottles & Containers

-

Films & Sheets

-

Bags & Sacks

-

Pipes & Fittings

-

Other applications

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Construction

-

Automotive

-

Agriculture

-

Consumer Electronics

-

Other End-uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The polyethylene market size was estimated at USD 155.18 billion in 2023 and is expected to reach USD 159.89 billion in 2024.

b. The polyethylene market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 and reach USD 213.77 billion by 2030.

b. Asia Pacific dominated the polyethylene market with a share of 50.3% in 2023. The expanding manufacturing industry in Asia Pacific is anticipated to drive the requirement for polyethylene.

b. Some of the key players operating in polyethylene include BASF SE, Borealis AG, Braskem, Dow, Exxon Mobil Corporation, Formosa Plastics, INEOS Group, LG Chem, and LyondellBasell Industries Holdings B.V.

b. Key factors driving the polyethylene market growth include the ongoing technological advancements in several end-use industries and the growing demand for lightweight and cost-effective products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."