- Home

- »

- Renewable Chemicals

- »

-

Polyester Staple Fiber Market Size, Industry Report, 2033GVR Report cover

![Polyester Staple Fiber Market Size, Share & Trends Report]()

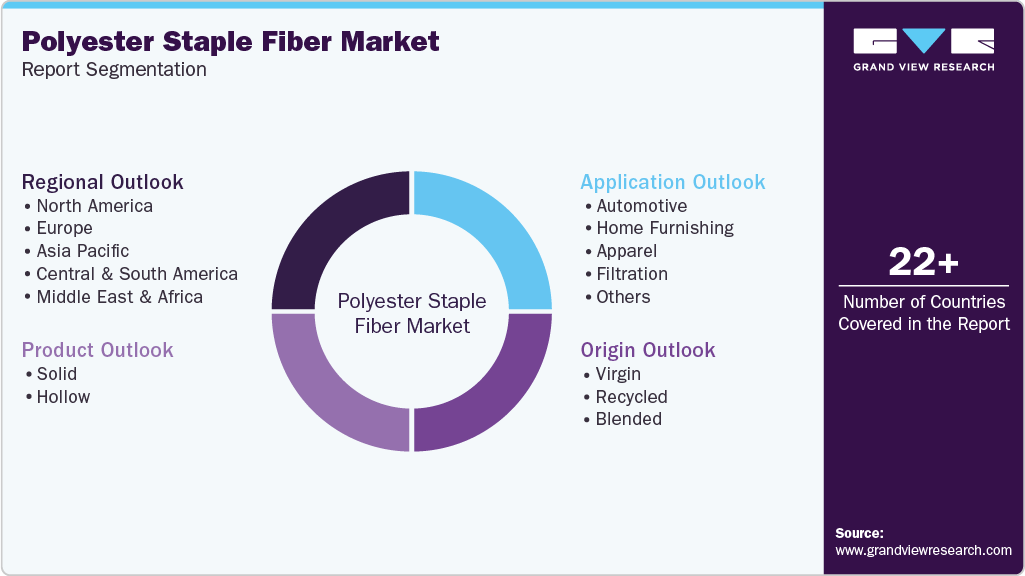

Polyester Staple Fiber Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Solid, Hollow), By Origin, By Application (Automotive, Home Furnishing, Apparel, Filtration), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-632-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyester Staple Fiber Market Summary

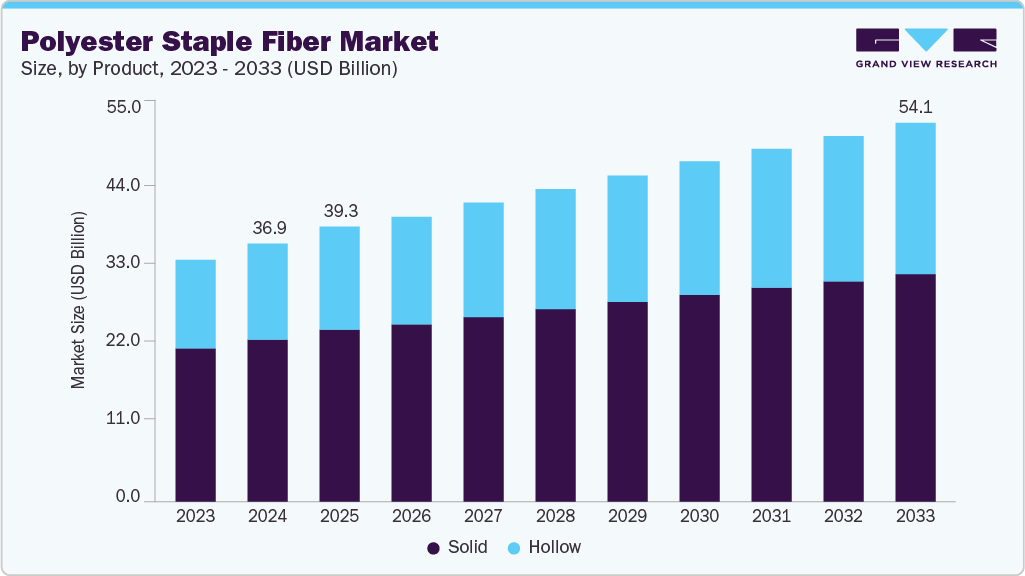

The global polyester staple fiber market size was estimated at USD 36.90 billion in 2024 and is projected to reach USD 54.15 billion by 2033, growing at a CAGR of 4.3% from 2025 to 2033. The market is primarily driven by increasing demand from the textile industry, the expanding home furnishing sector, and the rising adoption of synthetic fibers.

Key Market Trends & Insights

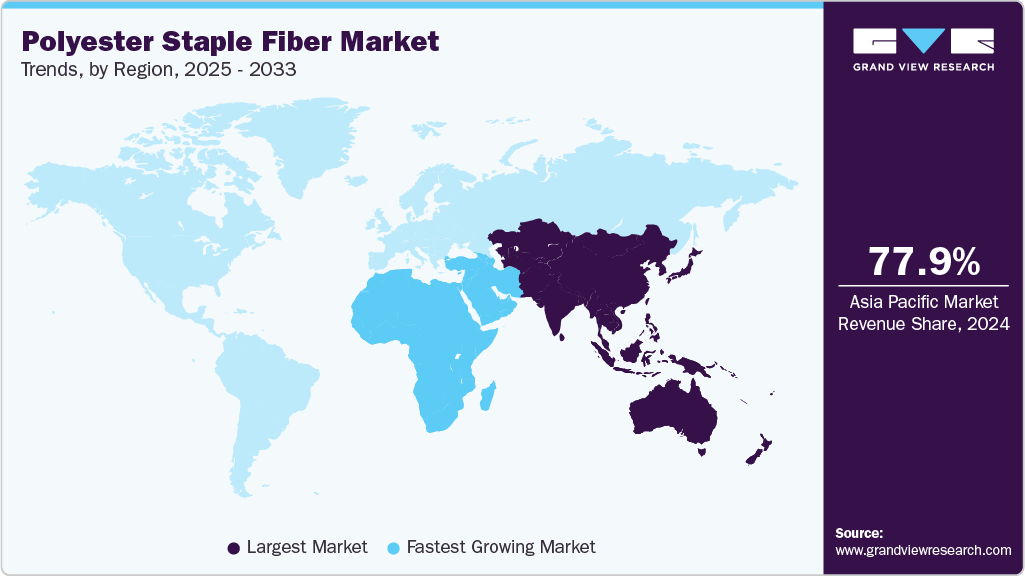

- Asia Pacific polyester staple fiber market dominated the global industry and accounted for a revenue share of 77.9% in 2024.

- China polyester staple fiber market dominated in Asia Pacific in 2024.

- Based on products, the solid segment dominated the global polyester staple fiber market, accounting for a revenue share of 62.8% in 2024.

- Based on origin, the virgin origin segment held the largest revenue share of the global market in 2024.

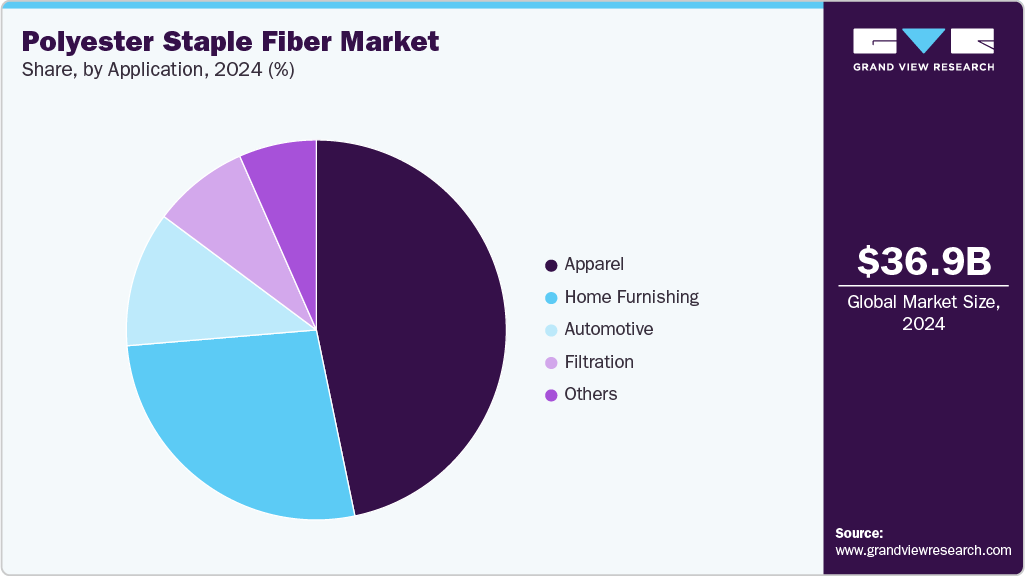

- Based on application, the apparel segment dominated the polyester staple fiber market in 2024 with a revenue share of 46.7%.

Market Size & Forecast

- 2024 Market Size: USD 36.90 Billion

- 2033 Projected Market Size: USD 54.15 Billion

- CAGR (2025-2033): 4.3%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

PSF is an artificial fiber made from purified terephthalic acid and mono-ethylene glycol. The growing automotive industry is another significant factor that has increased demand for polyester staple fibers in car seats and interior components. In addition, with advancements in production and processes and an ever-increasing focus on eco-friendly and sustainable products, the market is expected to experience lucrative growth. The flexibility, high toughness, heat resistance, and affordable price of Polyester staple fiber have resulted in extensive use in the textile industry around the globe. The growing adoption of synthetic fibers over natural fibers is also fueling market growth, as consumers often prefer synthetic fibers owing to their quick drying and ease of use properties.

Another key growth driver for this market is the increasing home furnishing sector, as PSFs are widely utilized in developing and designing various home textile products. The growing demand for indoor and outdoor furniture and other home décor accessories, such as carpets, has increased demand for polyester staple fibers. Furthermore, home decor and interior design trends have driven the demand for high-quality, premium textile products such as PSF.

The increasing automotive industry is also driving the market as these fiber materials are used in car seats, floor mats, and automotive carpets, owing to the features such as durability, stain resistance, and ability to create high-end finishes and textures. In addition, the growing trend of environment-friendliness and sustainability further fuels market growth. Companies are focusing on this sustainable trend by introducing environment-friendly and recycled polyester staple fiber (PSF). For instance, in July 2024, Indorama Ventures Public Company Limited joined a pioneering initiative to develop the world's first supply chain ingeniously formed for sustainable polyester fiber. This strategic partnership aims to enhance the sustainability of polyester production by integrating environmentally friendly practices.

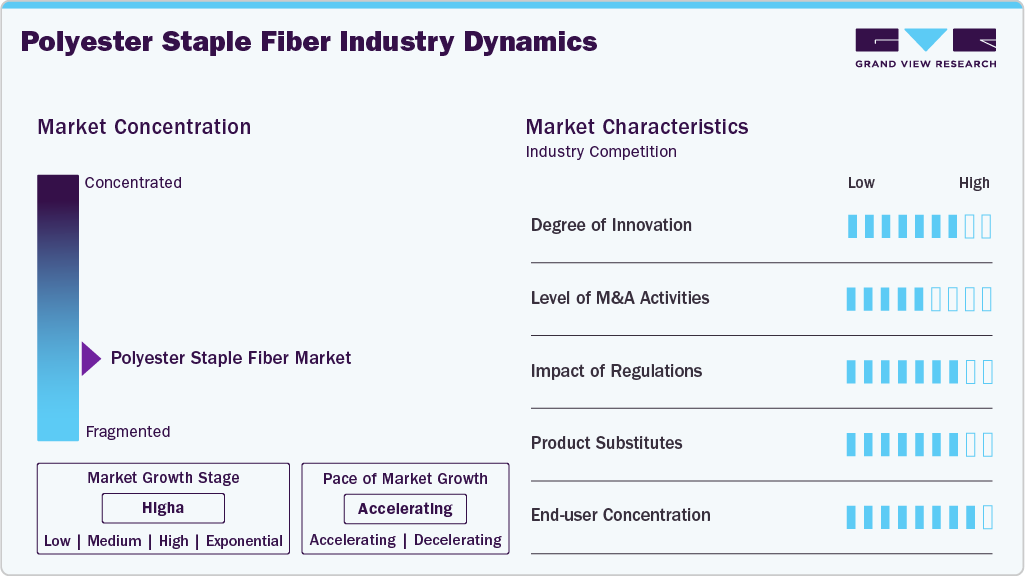

Market Concentration & Characteristics

The polyester staple fiber market is highly fragmented, with a mix of global players and regional manufacturers competing on pricing, quality, and sustainability. This fragmentation fosters innovation but intensifies competition, especially in emerging economies. Furthermore, stringent environmental regulations, especially in Europe and North America, are influencing the shift toward recycled PSF and greener production processes. Compliance with these norms is pushing manufacturers to invest in eco-friendly technologies.

Polyester staple fiber market faces competition from natural fibers such as cotton and wool, as well as from other synthetic fibers such as nylon and polypropylene. However, its cost-effectiveness and durability continue to make it a preferred choice in many applications. Moreover, the market sees significant end user concentration from key sectors such as textiles, automotive, and home furnishings. Large-scale textile and automotive manufacturers hold considerable purchasing power, influencing supply chain dynamics and pricing.

Product Insights

Based on products, the solid segment dominated the global polyester staple fiber market, accounting for a revenue share of 62.8% in 2024. Solid fibers offer greater strength, durability, and resistance to abrasion, making them ideal for a wide range of applications, including apparel, home furnishing, and industrial products. Solid fibers are generally easier to process and dye, leading to lower production costs and greater efficiency for manufacturers. Ease of availability, ease of use, and growing adoption in multiple industries are expected to develop growth for this segment in the coming years.

Hollow segment is anticipated to experience the fastest CAGR during the forecast period. Hollow polyester fiber has a wide range of applications in numerous industries, such as automotive, construction, and filtration materials. Its properties, such as improved thermal insulation, lightweight properties, and moisture management, have driven the growing adoption of hollow PSFs. Furthermore, the rising awareness of energy efficiency and thermal insulation in buildings drives the demand for hollow fibers in construction materials. Growing demand for these applications and technological advancements is expected to propel the segment's growth.

Origin Insights

The virgin origin segment held the largest revenue share of the global market in 2024. Increasing demand for high-quality textiles, particularly in apparel and home furnishing, has driven the segment's dominance. Virgin fibers are synthetic fibers created from raw materials derived from non-renewable sources and are the most common form of polyethylene terephthalate. Virgin fibers offer excellent strength and durability, making them ideal for high-end textile applications such as clothing, upholstery, and the automotive sector.

The recycled segment is anticipated to experience the fastest CAGR during the forecast period. Increasing regulations on plastic waste have also contributed to the growth of this segment. Recycled polyester fibers are produced from plastic waste, such as plastic bottles and containers. Recycled PSF is an excellent alternative to reduce plastic waste and minimize environmental threats. In addition, several governments and organizations are implementing initiatives to promote recycling and a circular economy, further boosting the demand for recycled polyester staple fibers. Technological advancements have also improved the quality and performance of recycled PSF.

Application Insights

The apparel segment dominated the polyester staple fiber market in 2024 with a revenue share of 46.7%. Increasing urbanization, clothing consumption, and changing fashion trends drive segment growth. Polyester staple fibers offer superior performance, wrinkle resistance, and moisture-wicking properties, making them ideal for activewear, sportswear, and outdoor clothing. Growing consumer awareness and sustainability are other significant factors driving the growth of this segment as consumers increasingly seek clothes made from sustainable products such as recycled PSF. Furthermore, advancements in technology, such as 3D knitting and digital printing, further enable the creation of complex designs using PSF.

The home furnishings segment is expected to experience a significant CAGR over the forecast period. Expanding economies of various nations, rising living standards leading to changed lifestyles, and urbanization are driving the growth of this segment. PSF are increasingly used in upholstery, curtains, and carpets due to their durability, stain resistance, and ease of maintenance. The growing trend of home décor and interior design, driven by increasing consumer spending, further fuels demand for polyester-based home furnishings. Moreover, the rising middle-class population and urbanization are expected to increase household spending on home improvement products in the next few years. In addition, polyester's cost-effectiveness compared to natural fibers makes it an attractive choice for manufacturers and consumers looking for affordable and high-quality home furnishings.

Regional Insights

North America held a significant revenue share in the polyester staple fiber market in 2024. The increasing demand from the healthcare industry and the expanding automotive sector have driven the growth of this regional market. The expanding textile industry in the region, particularly in the U.S. and Mexico, has been fueled by increasing domestic consumption and exports. Furthermore, the trends of early adoption of innovation and technological advancements, including developing recycled polyester and specialty fibers, have generated greater growth for the regional industry.

U.S. Polyester Staple Fiber Market Trends

The U.S. polyester staple fiber market held the largest revenue share of the regional industry in 2024. The growth of this market is primarily driven by increasing consumer awareness, robust technological advancements coupled with rising domestic textile manufacturing, and a growing automotive industry. There is an increasing shift toward using recycled polyester fibers, including recycled PSF, to produce eco-friendly apparel as governments and brands become more environmentally conscious to reduce their carbon footprint, significantly driving the region's growth. For instance, Patagonia, one of the prominent brands in the textile industry, has committed itself to using recycled materials to reduce carbon emissions in the industry.

Asia Pacific Polyester Staple Fiber Market Trends

Asia Pacific polyester staple fiber market dominated the global industry and accounted for a revenue share of 77.9% in 2024. One of the key growth drivers for this industry is the rapid expansion of the textile industry in countries such as China, India, and Bangladesh, where polyester staple fibers are widely used in industries such as apparel, home furnishings, and industrial textiles. For instance, the garments and textile industry in the Asia Pacific accounts for more than 55% of textile exports. The presence of lower labor costs and the enhancement of the availability of resources for multiple businesses have propelled the demand for PSFs in the Asia Pacific region. Moreover, the automotive industry in the Asia Pacific region is contributing to the growth of the PSF market. Polyester staple fiber is widely used in automotive interiors for seat covers, carpets, and padding due to its durability and cost-effectiveness.

China polyester staple fiber market dominated in Asia Pacific in 2024. A well-established textile industry and booming automotive manufacturing sector have contributed to the region's dominance. China is the world's largest textile and apparel producer, retailer, and exporter. The textile industry in China heavily relies on polyester staple fiber owing to its cost-effectiveness, versatility, and ability to meet mass production demand, including both domestic and global demand.

Europe Polyester Staple Fiber Market Trends

The European polyester staple fiber market is growing steadily due to strong demand in home textiles, automotive applications, and technical textiles. Increasing focus on sustainability has accelerated the shift toward recycled polyester staple fiber, supported by EU environmental directives. In addition, the region’s advanced manufacturing infrastructure and consumer preference for eco-conscious products are driving innovation and investment in fiber production.

Germany polyester staple fiber market holds a significant position in the Europe, driven by its robust automotive and textile industries. The country's emphasis on high-quality manufacturing and innovation has led to increased use of polyester staple fiber in automotive interiors, technical textiles, and home furnishings.

Central & South America Polyester Staple Fiber Market Trends

The Central & South America market is experiencing growth due to rapid urbanization and industrialization, which are increasing the demand for textiles in apparel, home furnishings, and automotive sectors. The region's expanding middle class and rising consumer spending are further propelling the market. In addition, the push towards sustainable materials is encouraging the adoption of recycled polyester fibers.

Middle East & Africa Polyester Staple Fiber Market Trends

Middle East & Africa polyester staple fiber market is anticipated to experience the fastest CAGR during the forecast period. The growing adoption of PSF in the automotive sector, the increasing development of infrastructure and construction projects across the region, and the expansion of the textile and apparel industry are the primary growth factors fueling the region's growth. The rising industrialization in the area further promotes the development of PSF in manufacturing various products, including textiles and nonwovens. For instance, the increasing focus on economic diversification in the Gulf Cooperation Council countries aims to reduce dependency on oil revenues and promote industrialization in the region, leading to growth in this regional market.

Key Polyester Staple Fiber Company Insights

Some key companies involved in the polyester staple fiber market include Tongkun Holding Group, Alpek S.A.B. de C.V., Xin Feng Ming Group, Bombay Dyeing and others. Companies are expanding their business to achieve a competitive edge in the marketplace. Major companies are implementing mergers and acquisitions and establishing alliances with other leading companies to achieve this goal.

-

Tongkun Holding Group, a Chinese group of companies, engaged in multiple businesses, including petroleum & chemical, polyester fiber, textile, fine chemicals, new materials & new energy, real estate, and others. One of its numerous businesses also includes manufacturing and selling polyester and polyester filament yarn. The company’s polyester filament product portfolio contains categories such as Partially Oriented Yarn (POY), Full Drawn Yarn (FDY), Drawn Textured Yarn (DTY), Intermingled Textured Yarn (ITY), combined filaments, and mid-tenacity filaments.

-

Alpek S.A.B. de C.V., one of the prominent companies in the petrochemical, polyester, and plastic industry, produces numerous products across several key sectors, including polyester chains, plastics, chemical products, and energy production. The company operates through several brands and subsidiaries, such as Alpek Polyester, INDELPRO, Stropek, and NEG.

Key Polyester Staple Fiber Companies:

The following are the leading companies in the polyester staple fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Alpek S.A.B. de C.V.

- Bombay Dyeing

- China Petrochemical Corporation

- Indorama Ventures Public Company Limited.

- Reliance Industries Limited.

- TORAY INDUSTRIES, INC.

- Tongkun Holding Group

- Zhejiang Hengyi Group Co., Ltd.

- Shenghonggroup.cn (Shenghong)

- Xin Feng Ming Group

Recent Developments

-

In April 2024, Toray Group collaborated with Hyundai Motor Group to advance mobility through material innovation. This partnership aims to develop and incorporate innovative materials into Hyundai’s vehicle lineup and emphasize sustainability in its material development efforts.

-

In August 2024, UNIFI, one of the prominent innovators in synthetic and recycled yarn, launched REPREVE, an extensive portfolio featuring performance polyester. This also included black and white staple fiber and black filament yarn, which was equipped with inherent tracer technology.

Polyester Staple Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 39.36 billion

Revenue forecast in 2033

USD 54.15 billion

Growth rate

CAGR of 4.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Report updated

June 2025

Quantitative units

Revenue in USD million, volume in kilotons and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, origin, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; South Korea; India

Key companies profiled

Alpek S.A.B. de C.V.; Bombay Dyeing; China Petrochemical Corporation; Indorama Ventures Public Company Limited.; Reliance Industries Limited.; TORAY INDUSTRIES, INC.; Tongkun Holding Group; Zhejiang Hengyi Group Co., Ltd.; Shenghonggroup.cn (Shenghong); Xin Feng Ming Group

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyester Staple Fiber Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyester staple fiber market report based on product, origin, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Solid

-

Hollow

-

-

Origin Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Virgin

-

Recycled

-

Blended

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Home Furnishing

-

Apparel

-

Filtration

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global polyester staple fiber market size was estimated at USD 36.90 billion in 2024 and is expected to reach USD 39.36 billion in 2025.

b. The global polyester staple fiber market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033 to reach USD 54.15 billion by 2033.

b. The solid segment led the market and accounted for the largest revenue share, 62.8%, in 2024, driven by their ability to offer greater strength, durability, and resistance to abrasion, making them ideal for a wide range of applications, including apparel, home furnishing, and industrial products.

b. Key players in the polyester staple fiber market included Alpek S.A.B. de C.V.; Bombay Dyeing; China Petrochemical Corporation; Indorama Ventures Public Company Limited.; Reliance Industries Limited.; and TORAY INDUSTRIES, INC.

b. Key factors driving the polyester staple fiber market include increasing demand from the textile industry, the expanding home furnishing sector, and the rising adoption of synthetic fibers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.