Polyester Fiber Market Size, Share & Trends Analysis Report By Type (Polyester Staple Fiber, Polyester Filament Yarn), By Source, By Grade, By Form, By Denier, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-259-4

- Number of Report Pages: 164

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Polyester Fiber Market Size & Trends

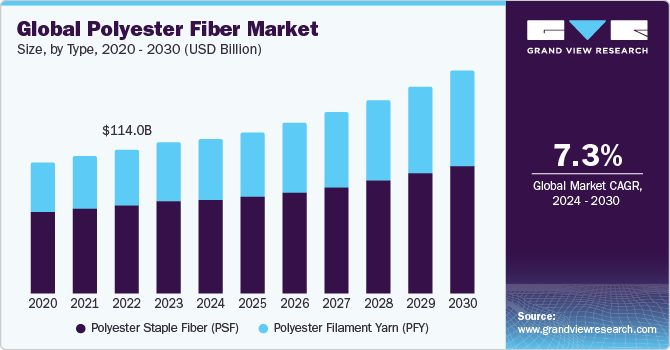

The global polyester fiber market size was estimated at USD 118.51 billion in 2023 and is expected to grow at a CAGR of 7.3% from 2024 to 2030. The market growth is being fueled by advancements in technology, expansion of research and development capabilities, and the growing utilization of polyester fiber in textile, apparel, and industrial applications. One of the main factors driving the product's growth is the increasing demand for cost-effective and durable materials in these industries. Polyester fibers offer several advantages over natural fibers, including high strength, wrinkle and abrasion resistance, and easy maintenance, making them an attractive choice for manufacturers and consumers alike.

Despite its widespread use, the market faces challenges, including fluctuating raw material prices, environmental concerns, and competition from alternative materials. The volatility of crude oil prices, which directly impacts the cost of petrochemical raw materials for polyester production, poses a significant risk to manufacturers' profit margins. In addition, the negative perception of synthetic fibers regarding their environmental impact, particularly about microplastic pollution and the lack of biodegradability has led to calls for more sustainable alternatives.

Market Concentration & Characteristics

The market is consolidated in nature with the presence of key industry players such as Reliance Industries, Indorama Ventures, and China Petroleum & Chemical Corporation (Sinopec), which dominate a significant market share. These companies often engage in aggressive marketing strategies, research and development initiatives, and mergers and acquisitions to strengthen their market position and expand their product offerings.

The market is influenced by factors such as production capacity, geographical reach, and product quality. Companies with larger production capacities and a diversified product portfolio have a competitive advantage when it comes to meeting the diverse needs of customers in different industries and regions. In addition, advances in manufacturing technologies, such as the development of environmentally friendly processes and the production of high-performance fibers, contribute to competitiveness by improving product quality and reducing production costs.

Type Insights

Based on type, the polyester staple fiber (PSF) segment held the market with the largest revenue share of 65.5% in 2023. These fibers are less uniform compared to filament fibers and offer advantages such as softness and bulkiness, making them ideal for applications requiring insulation or cushioning, bedding, and nonwovens for hygiene products.

The polyester filament yarn (PFY) fibers are preferred for their smooth texture and high strength, making them suitable for clothing, home textiles, and industrial fabrics. Their seamless construction eliminates the need for spinning and weaving processes, resulting in fabrics with increased durability and an elegant appearance.

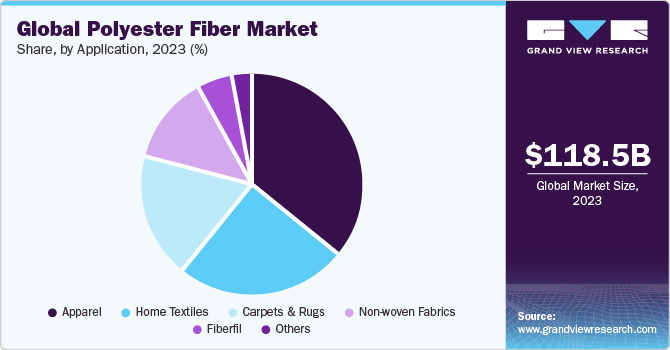

Application Insights

Based on application, the apparel segment led the market with the largest revenue share of 47.6% in 2023, because of their wrinkle resistance, colour fastness, and affordability, they are used in a variety of garments including shirts, dresses and sportswear.

Polyester fibers are used in curtains, bedding, and upholstery fabrics due to their durability, stain resistance and ease of care. In the industrial sector, polyester fibers are used in various technical textiles such as geotextiles, filter fabrics, and reinforcing materials due to their high strength, chemical resistance, and dimensional stability.

Source Insights

Based on source, the virgin segment held the market with the largest revenue share of 86.5% in 2023. Virgin polyester derived directly from petrochemical raw materials, maintains consistent quality and performance characteristics, making it a preferred choice for applications where purity and reliability are critical.

While recycled polyester fibers are gaining traction due to increasing environmental concerns and sustainability initiatives. These fibers are obtained from used PET bottles or industrial waste, reducing the carbon footprint and promoting the circular economy.

Grade Insights

Based on grade, the polyethylene terephthalate (PET) polyester segment led the market with the largest revenue share of 78.9% in 2023. These fibers are commonly used in textiles and offer a balance between cost-effectiveness and performance.

The PCDT polyesters segment has good elasticity and resilience, making them more suitable for applications that require these properties, such as high-performance applications such as curtains and furniture upholstery. In addition, PCDT polyester is more durable than PET polyester, further improving its suitability for specific applications in various industries.

Form Insights

Based on form, the solid segment held the market with the largest revenue share of 72.3% in 2023. Solid polyester fibers are known for their stability and strength and are an essential part of textile manufacturing processes. They ensure the production of durable, colorfast fabrics that meet strict quality standards.

In contrast, the hollow polyester fibers, although representing a smaller proportion, offers specific properties suitable for specific applications. With their tubular structure, hollow fibers provide lightweight construction and improved thermal insulation, making them ideal for products such as outerwear, sleeping bags, and technical textiles.

Denier Insights

Based on denier, the medium segment held the market with the largest revenue share of 42.5% in 2023. Medium denier polyester fibers offer a balance of fineness and strength, making them suitable for a variety of applications including clothing, home textiles and technical fabrics.

The coarse segment offers improved durability and loft with their thicker diameter, making them suitable for applications that require toughness and durability, such as: e.g. upholstery fabrics, carpets, and industrial filters.

Regional Insights

North America dominated the polyester fiber market with a revenue share of over 28% in 2023. In North America, the market is supported by a robust textile industry, advanced manufacturing infrastructure and increasing demand for sustainable products. Major players in the region, including the U.S. and Canada, are emphasizing innovation and environmentally friendly practices, driving growth in applications ranging from apparel and home furnishings to technical textiles.

U.S. Polyester Fiber Market Trends

The polyester fiber market in U.S. is expected to grow at the fastest CAGR of 6.2% from 2024 to 2030. With a focus on innovation and sustainability, the U.S. continues to make an important contribution to the global market, driving advances in product development and manufacturing processes of polyester fiber.

Europe Polyester Fiber Market Trends

The polyester fiber market in Europe is anticipated to grow at a moderate CAGR of 5.9% during the forecast period. The European market thrives on sustainability initiatives, with Germany, Italy and the United Kingdom leading the region's innovation in eco-friendly textiles and automotive applications.

The UK polyester fiber market is driven by diverse applications in the textile, automotive and construction sectors, supported by innovation and investment in sustainable materials.

The polyester fiber market in Germany was the leading manufacturer in Europe and captured around 32% of the revenue market share in 2023. The German market benefits from the strong automotive and textile industries, which drive steady growth and technological advances in sustainable polyester products.

The France polyester fiber market is witnessing growth driven by increasing demand for sustainable textiles and innovations in manufacturing processes, with a focus on environmentally friendly practices.

Asia Pacific Polyester Fiber Market Trends

The polyester fiber market in Asia Pacific region accounted for a revenue share of 43% in 2023. The Asia Pacific market particularly China and India is experiencing significant growth due to rapid industrialization, urbanization, and a growing middle class, resulting in increased consumption of polyester-based products.

The China polyester fiber market accounted for a revenue share of more than 53% in Asia Pacific, benefiting from its large production capacity, strong domestic demand, and leadership in global textile production, contributing significantly to the country’s growth.

The polyester fiber market in India is growing steadily, supported by a growing population, increasing disposable income, and a growing preference for polyester textiles across various industries including apparel, home textiles, and industrial applications.

Central & South America Polyester Fiber Market Trends

The polyester fiber market in Central & South America is anticipated to grow at the fastest CAGR during the forecast period. In Central and South America, the textile industry is one of the major consumers of polyester fibers. With the region's growing population and increasing disposable income, there is a rising demand for textiles, including clothing, home furnishings, and industrial fabrics. This trend has led to an expansion of polyester fiber production and consumption in the region.

The Brazil polyester fiber market is expected to grow at a steady CAGR of 6.5% from 2024 to 2030, owing to the growing production capacities and rising consumer demand, particularly in the apparel and home textile sectors, driven by improving economic conditions and increasing urbanization.

Middle East & Africa Polyester Fiber Market Trends

The polyester fiber market in the Middle East and Africa is witnessing steady growth driven by infrastructure development, increasing disposable income, and a shift towards polyester-based textiles in various sectors including apparel and home textiles, contributing to the region's economic development.

Key Polyester Fiber Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Polyester Fiber Companies:

The following are the leading companies in the polyester fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Reliance Industries Limited

- Sarla Performance Fibers Limited

- Märkische Faser GmbH

- Poly Fiber Industries

- Toray Industries Inc.

- Nirmal Fibers (P) Ltd

- Indorama Ventures Public Company Limited

- Stein Fibers LTD.

- Green Group S.A.

- Kayavlon

- Diyou Fiber (M) Sdn Bhd

- Swicofil AG

- Sinopec Yizheng Chemical Fiber Limited Liability Company

- Alpek S.A.B. de C.V.

Recent Developments

-

In March 2023, Reliance Industries finalized the acquisition of Sintex Industries, following approval from banks a year prior and a month after receiving approval from the National Company Law Tribunal (NCLT)

-

In January 2022, Fiber Industries LLC, a manufacturer of polyester staple fiber, unveiled intentions to allocate $30 million towards enhancing its operations in Darlington, S.C. This investment entails boosting capacity through upgrades and modernizing production lines, including the integration of cutting-edge control systems, alongside expanding warehouse facilities

Polyester Fiber Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 125.38 billion |

|

Revenue forecast in 2030 |

USD 191.57 billion |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, source, grade, form, denier, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia |

|

Key companies profiled |

Reliance Industries Limited; Sarla Performance Fibers Limited; Märkische Faser GmbH; Poly Fiber Industries; Toray Industries Inc.; Nirmal Fibers (P) Ltd; Indorama Ventures Public Company Limited; Stein Fibers LTD.; Green Group S.A.; Kayavlon; Diyou Fiber (M) Sdn Bhd; Swicofil AG; Sinopec Yizheng Chemical Fiber Limited Liability Company; Alpek S.A.B. de C.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polyester Fiber Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyester fiber market report based on source, grade, form, denier, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyester Staple Fiber (PSF)

-

Polyester Filament Yarn (PFY)

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Virgin

-

Recycled And Blended

-

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene Terephthalate (PET) Polyester

-

PCDT Polyester

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Hollow

-

-

Denier Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fine

-

Medium

-

Coarse

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Home textiles

-

Carpets And Rugs

-

Non-woven Fabrics

-

Fiberfil

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global polyester fiber market size was estimated at USD 118.51 billion in 2023 and is expected to reach USD 125.38 billion in 2024.

b. The global polyester fiber market is expected to grow at a compound annual growth rate of 7.3% from 2024 to 2030 and reach USD 191.57 billion by 2030.

b. Based on region, Asia Pacific was the largest market with a revenue share of over 42% in 2023, owing to the high demand from the clothing and apparel industry.

b. Some of the key players operating in the polyester fiber market include Reliance Industries Limited, Toray Industries Inc., Indorama Ventures Public Company Limited, Swicofil AG, and Alpek S.A.B. de C.V.

b. Key factors that are driving the polyester fiber market is the increasing due to its adaptability to various applications such as textile, apparel, home textiles, and industrial sectors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."