Polydextrose Market Size, Share & Trends Analysis Report By Product, By Application (Beverages, Cultured Dairy, Nutritional Food, Ready-to-Eat Meals, Bakery & Confectionery), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-704-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Polydextrose Market Size & Trends

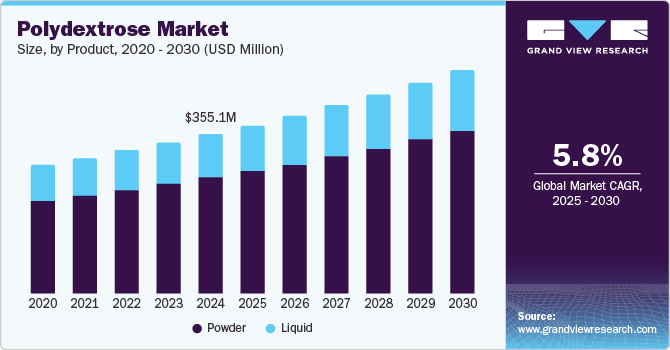

The global polydextrose market size was valued at USD 355.1 million in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The rapidly growing health awareness among the global population and rising consumption of nutritional and functional foods are expected to remain major market drivers in the near future. Additionally, an increasing preference for low-calorie and sugar-free products, along with the popularity of clean-label and natural ingredients, has highlighted polydextrose as a viable alternative in food and beverage manufacturing. Regulatory authorities across different regions have marked the product as a safe food additive, which has resulted in a strong market growth potential.

Polydextrose is a synthetic polymer obtained from glucose that is widely known for its role in weight management, improved satiety, fat reduction, and prebiotics. It has been characterized as a soluble fiber by regulatory agencies, including the U.S. Food & Drug Administration (FDA) and Health Canada. The increasing prevalence of digestive disorders such as irritable bowel syndrome (IBS), constipation, and bloating is driving substantial demand for fiber-rich products globally, with polydextrose being considered an effective and mild fiber solution. The extensive use of sports and nutritional supplements among athletes presents another opportunity for market expansion, as polydextrose offers unique functional properties such as being a soluble fiber, providing low-calorie bulk, and offering prebiotic benefits. In October 2024, scientists in Kazakhstan, through the Science and Higher Education Ministry, announced the production of advanced homemade nutritional supplements for athletes and elderly people. These products contain plant polyphenols, gelling agents, prebiotics, polydextrose, and dietary fibers, helping combat oxidative stress and boosting activity.

The various health-focused trends that are emerging in the food & beverage industry have helped drive the appeal of polydextrose among ingredient manufacturers and food & beverage companies. The product is being increasingly utilized in the baking industry, as it enhances moisture retention and texture without compromising taste, leading to its use in various types of baked goods. Further advancements in research in the food industry are expected to lead to the discovery of new features and applications of polydextrose. Emerging research studies suggest its potential applications in the development of functional foods and personalized nutrition.

Researchers are further exploring innovative usage techniques such as encapsulation technologies and controlled-release systems, which are expected to positively shape the expansion of the polydextrose industry during the forecast period. In March 2023, BioSyent, through its subsidiary BioSyent Pharma, announced the launch of the FeraMAX Pd Maintenance 45 supplement in Canada. This made it the company’s third product that incorporates Polydextrose-Iron Complex (PDIC), which is a patented iron supplement delivery system that is administered through oral mode. It has been designed to address iron deficiency in women, maintain optimum iron levels, and efficiently address gaps in iron health therapy for this demographic.

Product Insights

The powder segment accounted for a leading revenue share of 72.8% in the global market in 2024 on account of the growing use of this form in bakery & confectionery items and functional foods. Powdered polydextrose provides a wide range of nutritional advantages, including low-calorie formulation, fiber enrichment, improved texture, and prebiotic benefits. The powdered form contains a higher concentration of polydextrose than the liquid form. This makes it more useful in applications requiring a significant amount of dietary fiber in a formulation without significantly increasing the liquid content. Powdered polydextrose also has a longer shelf life due to the absence of moisture and is less susceptible to microbial contamination and degradation.

Meanwhile, the liquid segment is expected to grow at a substantial CAGR during the forecast period. The rising popularity of products such as nutritional drinks, probiotic beverages, sports drinks, energy drinks, and smoothies has driven segment demand. These products are available in a viscous, syrup-like liquid form and generally contain a lower percentage of polydextrose (around 40-60%), as they are diluted with water or other liquid carriers to facilitate usage in liquid-based products. Liquid polydextrose is instantly soluble in water and other liquid ingredients, making it more convenient for formulations that involve liquid foods and beverages. These products further enhance the viscosity of liquid-based formulations, which can help thicken sauces, beverages, and dairy drinks.

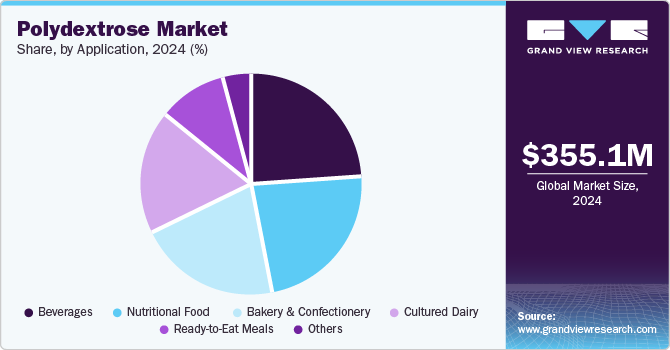

Application Insights

The beverages segment accounted for a leading revenue share in the global market in 2024. Increasing consumption of nutritional and functional beverages globally has provided a major growth avenue to companies involved in manufacturing polydextrose. The product is utilized in different types of beverages, including probiotic drinks, diet sodas, soft drinks, flavored water, sports drinks, and energy drinks. Polydextrose is a versatile, synthetic carbohydrate that is often used in beverage products as a dietary fiber, texturizer, and low-calorie sweetener. It is produced by polymerizing glucose and adding citric acid and is typically used to improve the nutritional profile and functional properties of beverages without adding significant calories.

The cultured dairy segment is anticipated to grow at the fastest CAGR from 2025 to 2030. Polydextrose is extensively used in cultured dairy products such as yogurt, kefir, and other probiotic dairy items for a range of functional and nutritional purposes. It can act as a dietary fiber, texturizer, and low-calorie bulking agent, making it a vital ingredient for improving the texture, nutritional profile, and consumer appeal of such products. Moreover, it can be incorporated to balance sweetness in flavored yogurts and other dairy items when combined with other sweeteners. Polydextrose can contribute to a more desirable flavor profile in low-calorie or sugar-free formulations by moderating the aftertaste of high-intensity sweeteners such as stevia and sucralose. In ready-to-drink dairy-based nutritional shakes, polydextrose helps add fiber and texture, enhancing the product's functionality for weight management and digestive health.

Regional Insights

North America polydextrose market accounted for a leading revenue share of 34.7% in the global industry in 2024. Regional consumers are increasingly becoming health-conscious, seeking products in the food industry that offer functional benefits such as digestive health, weight management, and blood sugar control. This has driven strong demand for ingredients such as polydextrose, which is marketed as a low-calorie fiber source. The continued evolution of regulatory frameworks in the U.S. and Canada is expected to propel the inclusion of polydextrose in a variety of foods and supplements. For instance, polyols and polydextrose have been permitted to be used as additives in food items sold in Canada by the Food and Drug Regulations and related Marketing Authorizations (MAs). These ingredients are extensively tested by Health Canada scientists to determine their safety and efficacy.

U.S. Polydextrose Market Trends

The U.S. accounted for a dominant revenue share in the North American market in 2024. Increasing awareness regarding the benefits of fiber inclusion in diet has resulted in the expanding use of polydextrose as a vital ingredient in fiber-enriched products being sold in the country. Moreover, the rising prevalence of type 2 diabetes in the U.S. has led to heightened demand for ingredients that support glycemic control. According to the Centers for Disease Control and Prevention (CDC), diabetes impacts over 38 million people in the country, with about 90-95% of this population living with type 2 diabetes. Polydextrose has a low glycemic index, which makes it suitable for products aimed at people managing this condition or those who constantly monitor their blood sugar levels.

Europe Polydextrose Market Trends

The European polydextrose industry accounted for a significant revenue share in 2024 due to increasing demand for healthy food products among regional consumers and constant research and product innovations across institutes. The low-calorie and high-fiber content benefits of polydextrose have driven their usage in functional food items, beverages, and baked goods. Additionally, rising concerns regarding gut health and awareness regarding prebiotics and probiotics have helped market players promote the extensive use of their products, particularly across economies in Western Europe. The European Food Safety Authority (EFSA) carried out a re-evaluation of polydextrose as a food additive, publishing its results in January 2021. The organization stated that there is no requirement for any acceptable daily intake (ADI) value for this product, and it does not present any safety concerns in terms of usage levels and use cases. Such developments are expected to strengthen the demand for polydextrose in the coming years.

Asia Pacific Polydextrose Market Trends

The Asia Pacific region is anticipated to expand at the fastest CAGR from 2025 to 2030. The rapidly growing population in regional economies such as China, Japan, and India, coupled with the increasing incidence of various lifestyle diseases, has highlighted the need for functional ingredients such as polydextrose in food items. For instance, the diabetic population has steadily grown in India, with a study published in The Lancet journal in July 2023 concluding that an estimated 101 million people in the country were living with diabetes. Additionally, a health ministry survey found that 136 million citizens were potentially living with pre-diabetic conditions. These factors have influenced the demand for products that can control blood sugar levels, including polydextrose.

China polydextrose market accounted for a substantial revenue share in the Asia Pacific market in 2024 and is expected to maintain its position during the forecast period. The country has witnessed rapid urbanization and lifestyle changes in the past decade, which has increased the risk of disorders such as diabetes and various digestive conditions. As a result, consumers are aiming to improve their digestive health, reduce sugar intake, manage weight, and consume more functional food items. The ability of polydextrose to act as a low-calorie, fiber-rich substitute for sugar, combined with its prebiotic effects and regulatory safety, makes it a highly attractive option for food and beverage manufacturers in the country. Moreover, China is home to a number of notable food ingredient manufacturers, such as Shandong Minqiang Biotechnology, Baolingbao Biology, and Henan Tailijie Biotech, which has further helped propagate market demand among health-conscious consumers.

Key Polydextrose Company Insights

Some major companies involved in the global polydextrose industry include Baolingbao Biology, Tate & Lyle, and Cargill, among others.

-

Baolingbao Biology Co., Ltd. specializes in manufacturing products that support the food, health, and pharmaceutical sectors. It develops prebiotics such as galactooligosaccharides and isomaltooligosaccharide; and dietary fibers including polydextrose and resistant dextrin. Other notable offerings include sugar alcohols and sources such as erythritol, alodonose, and maltose; modified starch; corn starch; and different types of starch sugar.

-

Tate & Lyle offers products such as fibers, gelling agents, stabilizers, thickeners, texturants, sweeteners, and specialty flours and proteins. The STA-LITE Polydextrose is developed under the fiber segment and has extensive application in products with reduced sugar and calories. It reduces calories by rebalancing the viscosity, bulk, and mouthfeel in reduced-sugar or fat products and promotes healthy blood glucose and satiety.

Key Polydextrose Companies:

The following are the leading companies in the polydextrose market. These companies collectively hold the largest market share and dictate industry trends.

- Tate & Lyle

- International Flavors & Fragrances Inc.

- Medallion Labs (General Mills Inc.)

- Baolingbao Biology Co., Ltd.

- Henan Tailijie Biotech Co., Ltd.

- CJ CheilJedang Corp.

- Shandong Minqiang Biotechnology Co., Ltd.

- SAMYANG CORPORATION

- Cargill, Incorporated

- VW-Ingredients

Recent Developments

-

In September 2024, Samyang Corporation announced that it completed the construction of the largest allulose facility in South Korea’s Ulsan region. The specialty plant comprises two buildings, one for allulose production and the other for prebiotics. The facility has a production capacity of 25,000 tons per year. It is expected to enable the company to expand its footprint in Japan, North America, and Southeast Asia by launching differentiated solutions.

Polydextrose Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 375.0 million |

|

Revenue forecast in 2030 |

USD 498.0 million |

|

Growth Rate |

CAGR of 5.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa |

|

Key companies profiled |

Tate & Lyle; International Flavors & Fragrances Inc.; Medallion Labs (General Mills Inc.); Baolingbao Biology Co., Ltd.; Henan Tailijie Biotech Co., Ltd.; CJ CheilJedang Corp.; Shandong Minqiang Biotechnology Co., Ltd.; SAMYANG CORPORATION; Cargill, Incorporated; VW-Ingredients |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Polydextrose Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polydextrose market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Cultured Dairy

-

Ready-to-Eat Meals

-

Bakery & Confectionery

-

Nutritional Food

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."