- Home

- »

- Plastics, Polymers & Resins

- »

-

Polycarbonate Diols Market Size, Share, Growth Report 2030GVR Report cover

![Polycarbonate Diols Market Size, Share & Trends Report]()

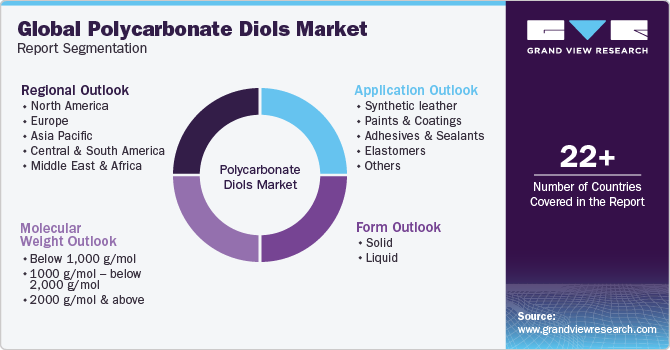

Polycarbonate Diols Market (2024 - 2030) Size, Share & Trends Analysis Report By Molecular Weight (below 1,000 g/mol, 1000 g/mol - below 2,000 g/mol, and 2000 g/mol and above), By Form (Solid, Liquid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-256-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polycarbonate Diols Market Size & Trends

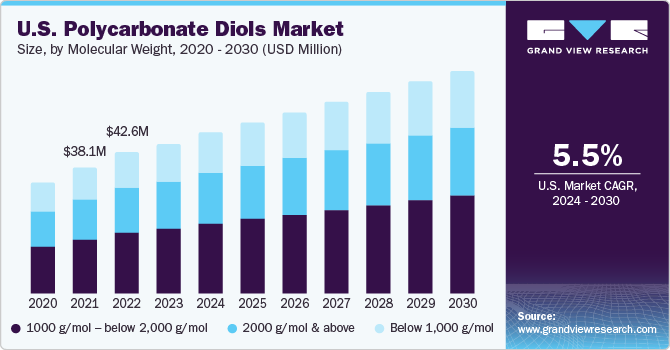

The global polycarbonate diols market size was estimated at USD 262.48 million in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. The growing demand for polycarbonate diols is being driven by the construction and automotive industries, particularly in developing countries. In 2023, the U.S. was the largest market for polycarbonate diols in North America. Increasing product consumption in the country’s automotive industry, due to their wide usage in applications including adhesives, coatings, and interior components, is expected to drive market growth. In addition, the product demand is anticipated to rise as a result of continuous infrastructure building and rehabilitation projects, notably in sectors including transportation, residential, and commercial construction.

Polycarbonate diols are used in sealants and coatings for construction applications. Moreover, ongoing advancements in material science and engineering technologies are resulting in the development of advanced polycarbonate diol materials with improved performance characteristics. For instance, in July 2021, Tohoku University, Osaka City University (OCU), and Nippon Steel Corp. collaborated to develop a catalytic approach that is effective in synthesizing polycarbonate diols.

The new technique is the high-yield “green” reaction system as it does not rely on hazardous chemical inputs like phosgene and carbon monoxide. One of the major challenges faced by the market includes the high costs of product materials compared to conventional polyols, which are subject to fluctuate according to demand and supply. This can make it difficult for companies to plan for the long term and can also make it challenging to ensure that the price of polycarbonate diols provides a sufficient financial incentive for production.

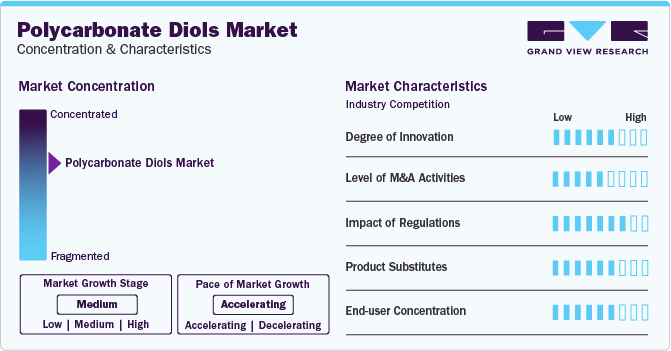

Market Concentration & Characteristics

The market is moderately consolidated, with key participants involved in R&D and technological innovations. Notable companies include Covestro AG, Tosoh Corporation, Mitsubishi Chemical Corporation, UBE Corporation, and Asahi Kasei Corporation, among others. Several players are engaged in framework development to improve their market share.

For instance, in December 2023, the Mitsubishi Chemical Group announced the selection of their plant-derived polycarbonate diol, named BENEBiOL, for the interior finish coating at the Lawson Obihiro Nishi 21-Jo Minami 4-chome Store in Obihiro City, Hokkaido, Japan

For instance, in August 2022, UBE Corporation announced the third expansion of its Polycarbonate Diol (PCD) production facilities at UBE Fine Chemicals (Asia) Co., Ltd., one of its local subsidiaries in Thailand. The expansion was announced in response to growing demand in the Asian region. The production capacity of the facility is expected to grow from 8,000 metric tons per year to 12,000 metric tons per year, as it began operations in August 2023

Regulations in the plastic industry have a significant impact, driving industry players to invest in advanced technologies and quality assurance measures. Compliance with regulatory frameworks ensures patient safety, fosters innovation, and establishes trust among customers.

Polycarbonate diol technologies can be more expensive to develop, manufacture, and implement than conventional plastic technologies, especially for smaller manufacturers with limited resources. This can create potential growth for conventional substitutes for the market, mainly in underdeveloped economies.

Companies are pursuing regional expansion strategies through market entry into new geographic areas, forming partnerships with local distributors, and customizing products to align with rising needs for polycarbonate diol materials in each region.

Molecular Weight Insights

In terms of revenue, the 1000 g/mol - below 2,000 g/mol segment accounted for the largest revenue share in 2023. Polycarbonate diols with molecular weights ranging from 1,000 g/mol to below 2,000 g/mol cater to specific applications owing to their several characteristics, such as high flexibility, durability, and adhesion.

The demand for polycarbonate diols is being driven by the demand for lightweight materials that can improve fuel efficiency and reduce emissions. They are used in several automotive interior and exterior components, such as headlamp lenses and bezels. Moreover, the rising trends of miniaturization and lightweighting, along with the laws promoting the use of sustainable and recyclable materials, are expected to boost product demand.

Form Insights

In terms of form type, the solid form type segment led the market in 2023 and accounted for a substantial revenue share owing to the huge volume of sales and production of solid polycarbonate diols globally. High resistance to hydrolysis, oxidation, stain, and wear in polyurethane diol-based products are some of the factors driving the market demand. The increasing need for high-performance adhesives and coatings in industrial, automotive, and building applications is expected to boost the production of solid polycarbonate diols.

The adoption of high-performance polymers, such as solid polycarbonate diols, along with the increasing healthcare expenditure, is being driven by the emphasis on material safety and compatibility in medical applications. Solid polycarbonate diols are utilized in the production of various medical devices, equipment, and healthcare products owing to their biocompatibility and sterilizability.

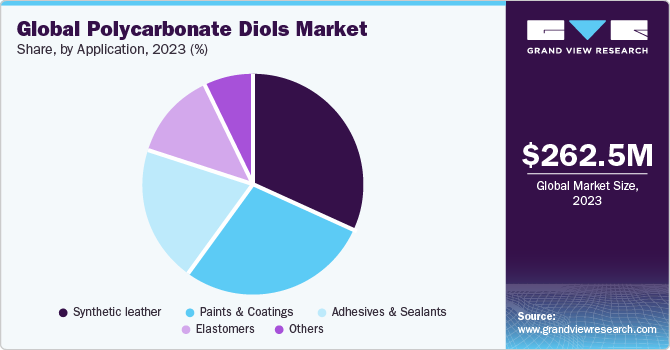

Application Insights

In terms of revenue, the synthetic leather segment led the market in 2023 and accounted for a revenue share of over 31.50%. Polycarbonate diol systems are widely used in passenger car interior applications including synthetic leathers. The market's growth is being driven by the large volume of sales and production of passenger cars, particularly in Asia Pacific and Europe.

In addition, increasing adoption and innovation to meet regulatory requirements, customer preferences, and competitive pressures are expected to boost product demand and usage in passenger cars. For instance, in January 2023, Roechling Group, a prominent producer of lightweight solutions, launched a new polycarbonate diols system for electric vehicles (EVs). The system is intended to improve the thermal management of EVs and increase battery life.

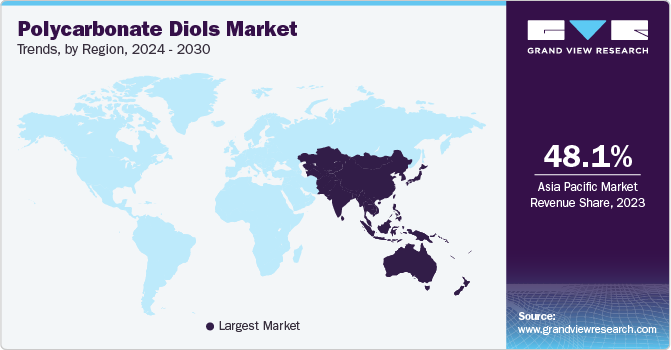

Regional Insights

The North America polycarbonate diols market accounted for a considerable revenue share of 17.18% in 2023 owing to the presence of advanced manufacturing facilities, along with the rising construction and automotive industry in the region. Polycarbonate diols-based sealants are widely used in building & construction applications, as they offer weathering and chemical resistance.

U.S. Polycarbonate Diols Market Trends

The polycarbonate diols market in the U.S. is expected to grow significantly in the coming years due to incentives and support programs to promote the use of ecologically friendly materials, such as polycarbonate diols. The usage of these products promotes a circular economy as they are recyclable, help in emission reduction, and have a lower environmental impact.

Asia Pacific Polycarbonate Diols Market Trends

The Asia Pacific polycarbonate diols market led the global industry in 2023 and accounted for the largest revenue share of over 48.10%. This growth is attributed to the rapid economic expansion, along with the growing industries, such as automotive, construction, and consumer goods. The growing demand for innovations that improve vehicle performance, comfort, and efficiency is pushing the development of polycarbonate diols systems, thus driving the market in the region.The presence of major automotive OEMs, including Toyota, Honda, Daihatsu, Nissan, Suzuki, Mazda, Mitsubishi, Subaru, and Isuzu, is expected to drive the automotive industry and the polycarbonate diols market.

The polycarbonate diols market in China held a significant share in the Asia Pacific regional market. The market growth is anticipated to register a CAGR of 5.8% from 2024 to 2030. The growing middle-class population will continue to drive the growth of the Chinese car market, with markets for new purchases and replacement vehicles developing fast.

The Japan polycarbonate diols market is expected to grow significantly in the coming years. The emergence of smartphones offering popular elements of feature phones has also notably encouraged consumers to switch to smartphones, which, in turn, has boosted product consumption in lightweight components and casings.

Europe Polycarbonate Diols Market Trends

The polycarbonate diols market in Europe is expected to witness significant growth over the forecast period. Well-developed infrastructure along with the presence of renowned automakers including Fiat, BMW, and Volkswagen is propelling the development of the automotive sector in this region, which, in turn, is expected to boost the demand for polycarbonate diols in automotive applications.

The Germany polycarbonate diols market held a significant share in 2023 and is anticipated to register a CAGR of 5.5% from 2024 to 2030. The growth of the industrial and automotive sectors is expected to fuel product demand in the country. It is the largest consumer of non-alcoholic beverages in Europe, which is expected to fuel product demand in packaging applications. Polycarbonate diols offer crystallinity and soft-block chain packing of the products.

The polycarbonate diols market in Spain is expected to grow significantly over the coming years. In emerging economies, such as Spain, the government makes sincere efforts to develop infrastructure, such as building hospitals, education hubs, commercial centers, and residential complexes. These factors coupled with the increasing population are expected to drive product demand in the region.

Central & South America Polycarbonate Diols Market Trends

The Central & South America polycarbonate diols market is expected to witness significant growth over the forecast period due to the increasing demand for vehicles and the region’s strategic location for export. Moreover, the recovering residential building & construction sector in Central & South America is driving the demand for related materials and components, including polycarbonate diols.

The polycarbonate diols market in Brazil held a significant share in 2023 and is anticipated to register a CAGR of 5.0% over the forecast period due to the revival of the economy and growing interest of investors in the manufacturing industries.

Middle East & Africa Polycarbonate Diols Market Trends

The Middle East & Africa polycarbonate diols market is expected to witness significant growth over the forecast period owing to the growth in consumer goods, which will drive product consumption in packaging applications.

Key Polycarbonate Diols Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In August 2023, UBE Corporation paved the way for a new generation of highly durable polycarbonate-based polyurethane elastomers. UBE's polycarbonate diols and polycarbonate-based urethane prepolymers technology provide long-term performance even when exposed to harsh environments.

Key Polycarbonate Diols Companies:

The following are the leading companies in the polycarbonate diols market. These companies collectively hold the largest market share and dictate industry trends.

- Covestro AG

- Tosoh Corporation

- Mitsubishi Chemical Corporation

- UBE Corporation

- Asahi Kasei Corporation

- Daicel Corporation

- Chemwill Asia Co. Ltd.

- Perstorp Group

- GRR Fine Chem Pvt. Ltd.

- DuPont

Polycarbonate Diols Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 283.62 million

Revenue forecast in 2030

USD 388.85 million

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Molecular weight, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Covestro AG; Tosoh Corp.; Mitsubishi Chemical Corp.; UBE Corp.; Asahi Kasei Corp.; Daicel Corp.; Chemwill Asia Co. Ltd.; Perstorp Group; GRR Fine Chem Pvt. Ltd.; DuPont

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polycarbonate Diols Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polycarbonate diols market report based on molecular weight, form, application, and region:

-

Molecular Weight Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Below 1,000 g/mol

-

1000 g/mol - below 2,000 g/mol

-

2000 g/mol and above

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Solid

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Synthetic leather

-

Paints & Coatings

-

Adhesives & Sealants

-

Elastomers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polycarbonate diols market size was estimated at USD 262.48 million in 2023 and is expected to reach USD 283.62 million in 2024.

b. The global polycarbonate diols market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 and reach USD 388.85 million by 2030.

b. Asia Pacific dominated the polycarbonate diols market with a share of over 48% in 2023. This growth is attributed to the rapid economic expansion, along with the growing industries such as automotive, construction, and consumer goods.

b. Some of the key players operating in polycarbonate diols include Covestro AG, Tosoh Corporation, Mitsubishi Chemical Corporation, UBE Corporation, Asahi Kasei Corporation, Daicel Corporation, and Chemwill Asia Co. Ltd.

b. Key factors driving the polycarbonate diols market growth include the growing demand for the product in construction and automotive industries, particularly in developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.