Polybutadiene Market Size & Trends

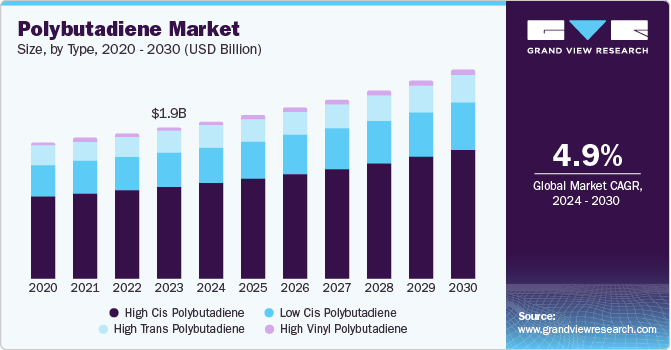

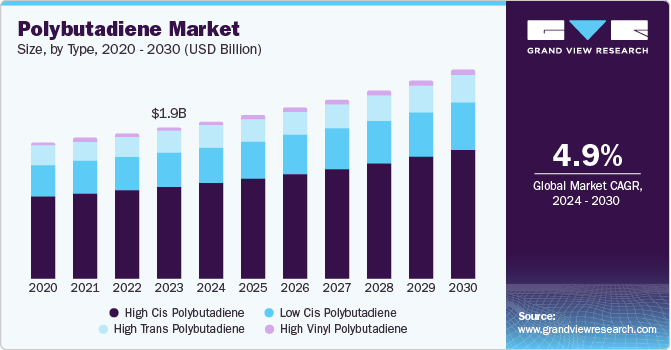

The global polybutadiene market size was valued at USD 1.88 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The market is driven by the automotive industry's expansion, with increased vehicle production and a focus on tire performance driving demand. Infrastructure development, encompassing road construction and tire replacement, further stimulates growth.

Increased global vehicle production, especially in emerging economies, drives the demand for tires and consequently, polybutadiene. Increased utilization of polybutadiene in tire compounds is a result of the emphasis on enhancing tire performance, including fuel efficiency, grip, and durability. Advancements in tire technology research and development are resulting in the development of new polybutadiene based compounds with enhanced characteristics. With the increasing global vehicle production, specifically in emerging markets, there is anticipated growth in the demand for polybutadiene.

The aerospace sector uses polybutadiene in different applications, such as tires, coatings, adhesives, and sealants in aircraft manufacturing. The increasing need for new airplanes around the world plays a major role in the market's growth. The adhesives and sealants industry is increasingly using polybutadiene based products due to their exceptional bonding properties. Rising disposable income in many countries results in increased spending on automobile and related products, which further boosts the demand for polybutadiene.

Type Insights

High cis polybutadiene type dominated the market with 60.7% of revenue share in 2023. High cis polybutadiene exhibits excellent elasticity, resilience, and wear resistance, making it an ideal choice for producing tires that require enhanced durability and performance under various driving conditions. The increasing focus on high-performance tires, coupled with the growing automotive industry, is further propelling the market for high cis polybutadiene.

Low cis polybutadiene is anticipated to witness a significant CAGR of 4.7% over the forecast period. Low cis polybutadiene is often used in the production of synthetic rubber products due to its lower production costs compared to high cis variants. This makes it an attractive option for manufacturers looking to optimize their production processes while maintaining acceptable quality standards.

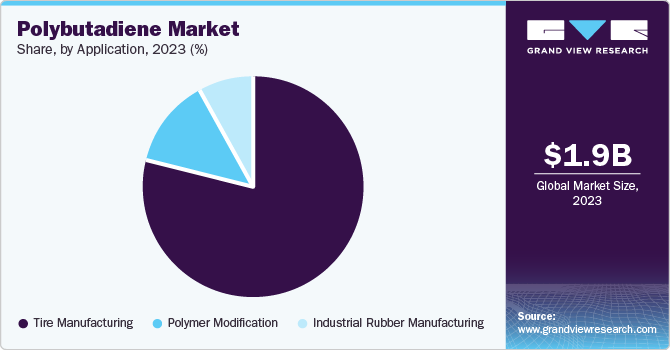

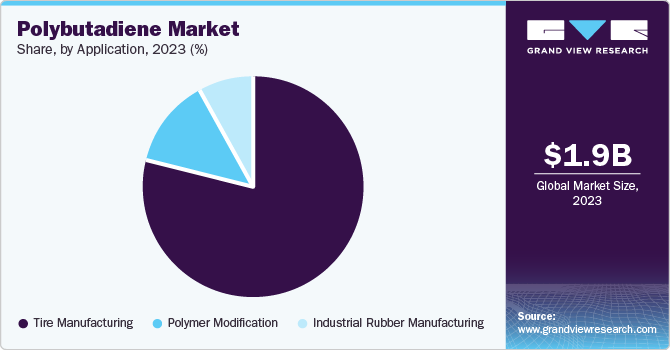

Application Insights

Tire manufacturing accounted for the largest market revenue share of 78.9% in 2023 due to its superior properties that enhance the performance and durability of tires. Polybutadiene rubber is known for its excellent abrasion resistance, low rolling resistance, and high resilience, making it an ideal material for both passenger and commercial vehicle tires. As automotive manufacturers strive to improve fuel efficiency and reduce emissions, the use of polybutadiene helps achieve these goals by contributing to lighter tire designs that maintain structural integrity under various driving conditions.

Polymer modification is projected to grow at a CAGR of 4.7% over the forecast period. The demand for polybutadiene in this sector is increasing due to its capability to improve the properties of other polymers, such as enhancing impact resistance and flexibility. The growing use of modified polymers in various industries, including automotive, construction, and consumer goods, is contributing to the expansion of this segment.

Regional Insights

The North America polybutadiene market is anticipated to grow at a CAGR of 4.9% during the forecast period. It is attributable to the robust automotive and tire industries. The region's well-established manufacturing infrastructure, coupled with increasing vehicle production and a focus on fuel-efficient tires, has fuelled demand for polybutadiene.

U.S. Polybutadiene Market Trends

The U.S. polybutadiene market held a dominant position in North America polybutadiene market in 2023. The country's large automotive production base, coupled with a growing emphasis on tire performance and durability, is driving demand. Furthermore, increasing infrastructure development and construction activities are creating additional demand for polybutadiene based products.

Europe Polybutadiene Market Trends

The Europe polybutadiene market was identified as a lucrative region in 2023 driven by a robust automotive and tire industries. The increasing focus on renewable energy and sustainable materials is creating new opportunities for polybutadiene based products in sectors such as wind energy and construction.

The UK polybutadiene market held a substantial market share in 2023. The country's well-established automotive industry and the presence of major tire manufacturers contribute to the demand for polybutadiene.

Asia Pacific Polybutadiene Market Trends

Asia Pacific dominated the market with 38.8% of revenue share in 2023. The region's burgeoning automotive industry, rapid urbanization, and rising disposable incomes are driving demand for tires and other rubber products. Moreover, the increasing focus on infrastructure development and industrialization is creating new opportunities for polybutadiene applications.

Key Polybutadiene Company Insights

Some key companies in polybutadiene market include BASF, SABIC, RTP Company, Chang Chun Group, Polyplastics Co., Ltd. and others. The manufacturers are expanding their production capacities to meet the growing demand for polybutadiene from the application industries.

-

LANXESS focuses on the manufacturing, development, and marketing of additives, chemical intermediates, specialty chemicals, & consumer protection products.

Key Polybutadiene Companies:

The following are the leading companies in the polybutadiene market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- SABIC

- RTP Company

- Chang Chun Group

- Wuxi Xingsheng New Material Technology Co., Ltd.

- Xiamen Keyuan Plastic Co., Ltd

- Polyplastics Co., Ltd.

- LANXESS

- Kingfa Science & Technology (India) Limited

- Evonik Industries

Recent Developments

-

In February 2023, Arlanxeo inaugurated its 65 ktpa Polybutadiene Rubber (PBR) production line in Brazil and celebrated its milestone in South American expansion.

-

In June 2022, Evonik’s introduced sustainable liquid polybutadiene products with the launch of the POLYVEST eCO range. By offering this sustainable option, Evonik is demonstrating its commitment to meeting the growing market demand for eco-friendly solutions in the coatings and adhesives industry.

Polybutadiene Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.96 billion

|

|

Revenue forecast in 2030

|

USD 2.60 billion

|

|

Growth Rate

|

CAGR of 4.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilo Tons, Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, Application, and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, China, Japan, India, South Korea, Indonesia, Australia, Argentina, Brazil, Saudi Arabia, UAE, South Africa

|

|

Key companies profiled

|

BASF, SABIC, RTP Company, Chang Chun Group, Wuxi Xingsheng New Material Technology Co., Ltd., Xiamen Keyuan Plastic Co., Ltd, Polyplastics Co., Ltd., LANXESS, Kingfa Science & Technology (India) Limited, Evonik Industries

|

|

Customization scope

|

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

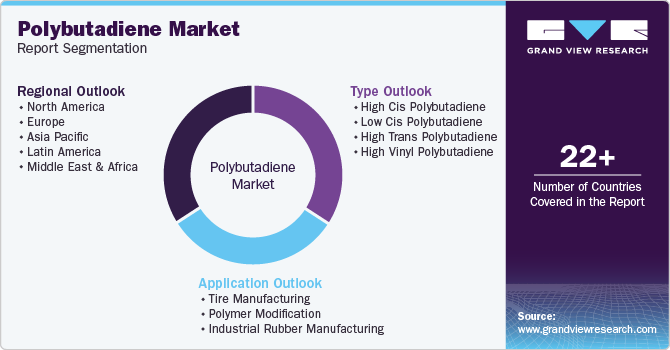

Global Polybutadiene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polybutadiene market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

High cis polybutadiene

-

Low cis polybutadiene

-

High trans polybutadiene

-

High vinyl polybutadiene

-

Application Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)