- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyamide Market Size, Share, Growth, Industry Report 2033GVR Report cover

![Polyamide Market Size, Share & Trends Report]()

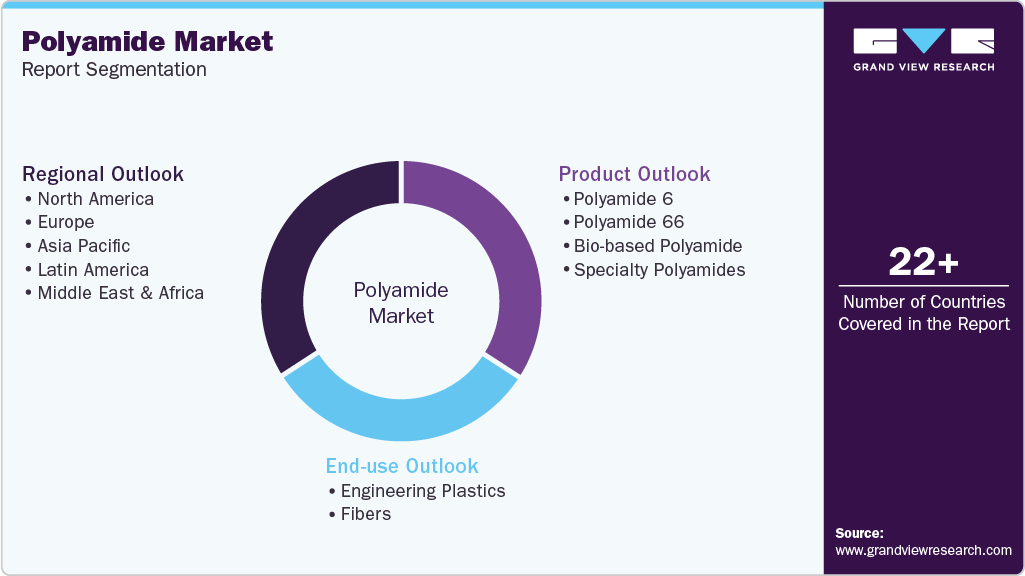

Polyamide Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Polyamide 6, Polyamide 66, Bio-based Polyamide, Specialty Polyamides), By End-use (Engineering Plastics, Fibers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-353-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyamide Market Summary

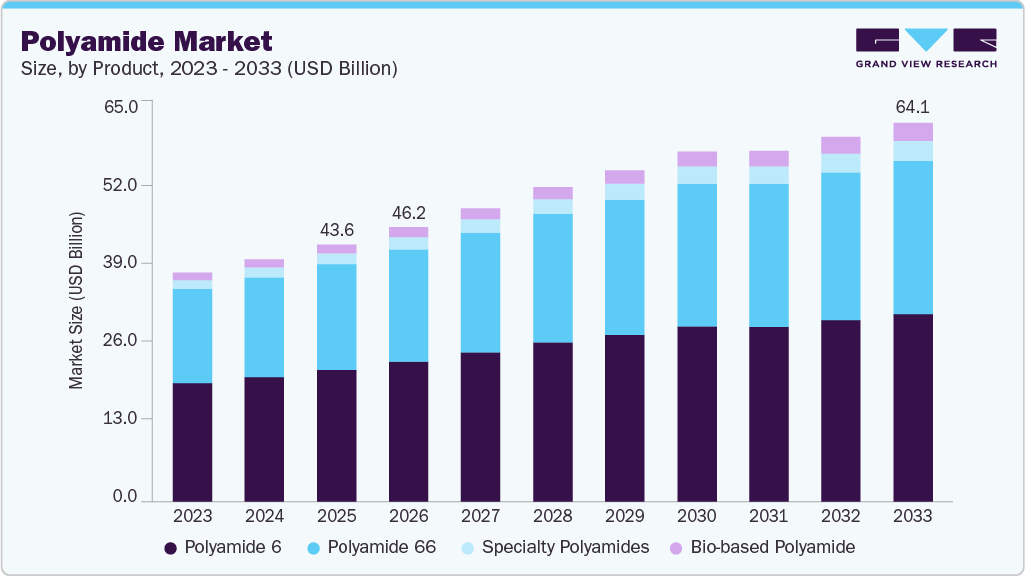

The global polyamide market size was estimated at USD 43.57 billion in 2025 and is projected to reach USD 64.11 billion by 2033, growing at a CAGR of 4.7% from 2026 to 2033. A growing focus on improving energy efficiency in industrial machinery is driving the use of polyamides, as they offer strong wear resistance and longer component life.

Key Market Trends & Insights

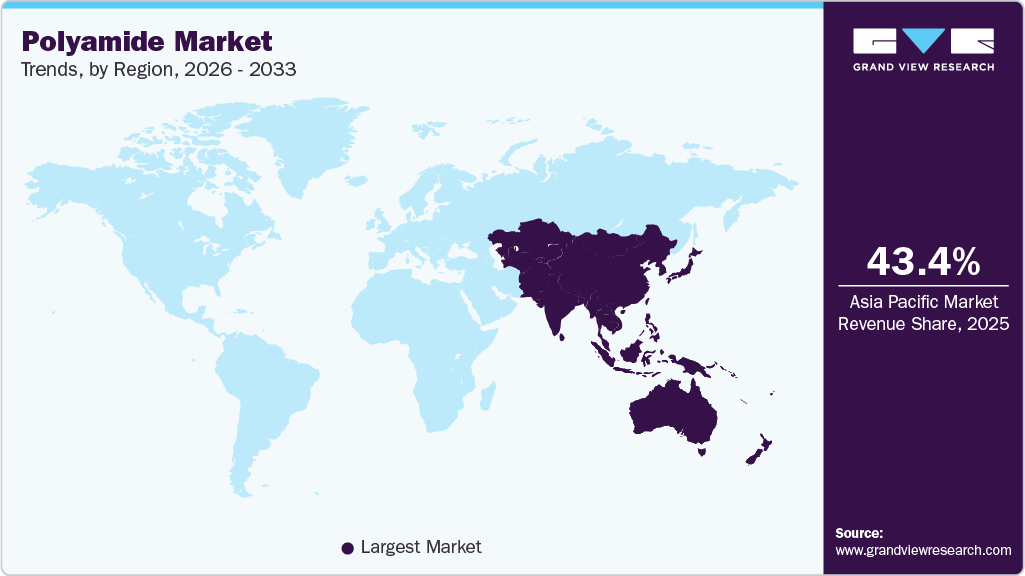

- Asia Pacific dominated the global polyamide market with the largest revenue share of 43.35% in 2025.

- The polyamide industry in China is expected to grow at a substantial CAGR of 5.7% from 2026 to 2033.

- By product, the bio-based polyamide segment is expected to grow at a considerable CAGR of 8.8% from 2026 to 2033 in terms of revenue.

- By end use, the fibers segment is expected to grow at a considerable CAGR of 5.0% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 43.57 Billion

- 2033 Projected Market Size: USD 64.11 Billion

- CAGR (2026-2033): 4.7%

- Asia Pacific: Largest Market in 2025

Rising production of consumer appliances is also driving demand, as manufacturers prefer durable and lightweight polyamide resins for structural and functional parts. The polyamide market is shifting from commodity uses to engineering applications that demand temperature resistance and mechanical strength. Growth in the polyamide imide market reflects the increasing demand for high-temperature insulators and coatings in the automotive electrification and industrial equipment sectors. The demand for the high-performance polyamide is also driven by the electronics and aerospace industries, where weight savings and performance are critical. At the same time, the broader polyamide resin market is diversifying into composite and additive manufacturing grades to capture new end uses.

Drivers, Opportunities & Restraints

Electrification, lightweighting, and miniaturization in transportation and consumer electronics are the primary drivers of polyamide demand. Automakers specify advanced polyamide resins to reduce vehicle mass and to meet thermal and chemical resistance requirements around batteries and powertrains. Telecom and server equipment require materials from the polyamide imide market for high temperature stability and dielectric performance. Investment in molding and extrusion capacity is increasing to supply engineered polyamide and high-performance polyamide formulations at scale.

There is a clear opportunity to develop recycled and biobased polyamide resin grades and to expand into value-added niches. Suppliers offering certified circular content or tailored formulations for battery housings, 5G infrastructure, and medical devices can capture premium margins. The high-performance polyamide market also offers licensing and co-development paths with OEMs to secure long-term supply. Adoption of polyamide imide in specialty coatings and additive manufacturing creates adjacent revenue streams and technical differentiation.

Cost volatility for base feedstocks increases the cost of polyamide resins relative to cheaper polymers, constraining margin expansion. High-performance polyamide grades and polyamide imide are expensive to produce and require lengthy qualification cycles for automotive and aerospace buyers. Moisture sensitivity and recycling complexity for engineering polyamides create processing and end-of-life challenges. These technical and economic barriers slow adoption in price-sensitive segments despite clear performance advantages.

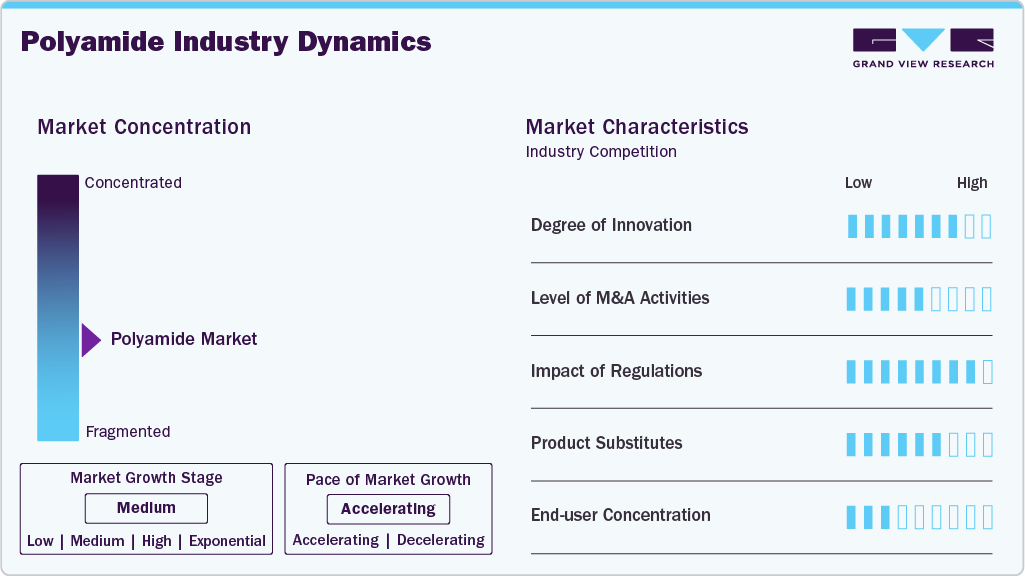

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The polyamide industry exhibits fragmentation, with key players dominating the market landscape. Major companies such as BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC.; Advansix; Celanese Corporation; Huntsman International LLC; and Mitsui Chemicals play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

Innovation in polyamides for electronic protection devices centers on tailored chemistries and compound engineering that meet stricter safety and miniaturization demands. Suppliers are developing flame-retardant and low-smoke PA grades, as well as polyamide imide coatings, for high-temperature circuit protection. Nano-fillers and compatibilizers are improving mechanical strength without raising part weight. These moves enable smaller, safer housings for EV chargers, telecom, and industrial breakers while shortening OEM qualification cycles.

Buyers evaluate alternatives that strike a balance between cost, moisture behavior, and thermal performance. PBT and PC/PBT blends offer lower moisture uptake and good electrical properties for connectors. PPS and PEEK offer superior chemical and hydrolysis resistance for hot, harsh environments, albeit at a higher cost. Polycarbonate and ABS remain popular choices where impact resistance and lower cost are priorities. Material choice depends on part function, qualification timelines, and total cost of ownership.

Product Insights

The polyamide 6 segment dominated the polyamide market, accounting for the largest revenue share of 51.20% in 2025, and is forecasted to grow at a 4.3% CAGR from 2026 to 2033. Demand for engineered Nylon 6 is rising as manufacturers replace metal parts with lighter thermoplastics to cut vehicle weight and improve fuel efficiency. Growth in automotive electrification and consumer electronics is driving demand for tougher, glass-filled PA6 grades that can withstand heat and mechanical stress. Capacity additions in Asia and localized supply chains are supporting faster delivery to OEMs and tier suppliers, strengthening the polyamide PA 6 market.

The bio-based polyamide segment is anticipated to grow at a substantial CAGR of 8.8% through the forecast period. Sustainability commitments from brand owners and stricter scope 3 targets are accelerating the adoption of bio-based polyamides in industrial and consumer applications. Improvements in renewable feedstock sourcing and lower carbon footprints for products such as bio-based PA11 are persuading automotive and sports goods makers to switch to certified grades. This regulatory and procurement pressure is creating market pull for bio-polyamide and for suppliers with traceable supply chains.

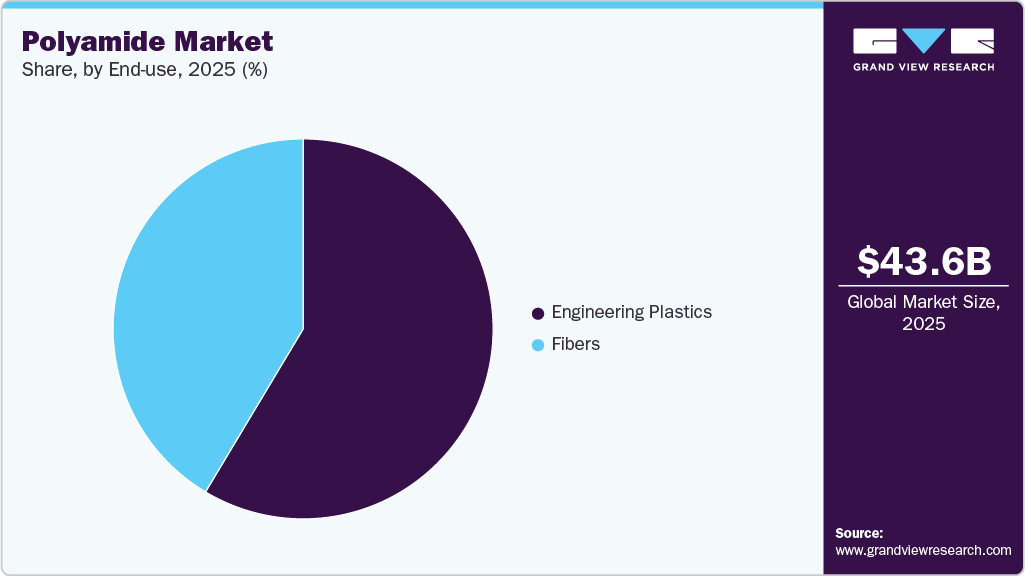

End-use Insights

Engineering plastics dominated the market across the end-use segmentation in terms of revenue, accounting for a market share of 58.59% in 2025, and is forecasted to grow at a 4.5% CAGR from 2026 to 2033. Growth in advanced electrical and industrial equipment is strengthening the polyamide 12 market within the engineering plastics sector. PA12 is chosen when chemical resistance, low moisture uptake, and dimensional stability are important considerations. Telecom infrastructure, pneumatic tubing, and oilfield components are shifting from metal to PA12 to lower weight and assembly costs. OEM qualification cycles are long, yet once approved, PA12 secures recurring order streams and higher average selling prices.

The fibers segment is expected to expand at a substantial CAGR of 5.0% through the forecast period. Electrification trends create new demand for polyamide in e-mobility market applications, including wiring, connectors, and cooling ducts. EV platforms require materials that can withstand higher temperatures and harsh chemistries while maintaining weight savings. Polyamide fibers gain share as braided hoses and thermal management textiles, which improve vehicle efficiency and battery life. Close collaboration between fiber manufacturers and OEMs is accelerating the adoption of modular design across powertrain and thermal subsystems.

Regional Insights

The Asia Pacific polyamide market held the largest revenue share of 43.35% in 2025, and is expected to grow at the fastest CAGR of 5.2% over the forecast period. Growth across the Asia Pacific reflects the rapid industrial electrification and expansion of high-value manufacturing in electronics and EV supply chains. The polyamide imide resin market is benefiting from increased demand for high-temperature insulating varnishes and molding resins used in motors and power electronics. Regional capacity additions and technology transfers are strengthening local availability and lowering qualification barriers for OEMs.

China’s polyamide market growth is underpinned by large-scale vehicle electrification, textile output, and packaging demand. Local producers scale PA6 and specialty grades to supply domestic OEMs and export markets. Investments in bio-based feedstocks and higher value compounding aim to capture premium segments. Strong upstream chemical integration keeps raw material costs and supply more competitive than many other regions.

North America Polyamide Market Trends

Demand for engineered polyamides in North America is driven by the rapid electrification of transport and a resilient aerospace repair cycle. OEMs and tier suppliers specify glass-filled and high-temperature grades to meet weight, thermal, and durability targets. Supply chain regionalization is lifting local compounding and finishing capacity. Investment in domestic capacity shortens lead times and strengthens supplier-customer collaboration for qualification.

U.S. Polyamide Market Trends

In the U.S., the reshoring of electronics and automotive components is expected to boost demand for high-performance polyamide grades. Federal incentives for clean vehicle production and the energy transition increase volume requirements for battery housings and high-voltage connectors. Buyers prioritize suppliers with qualified personnel, local technical support, and a traceable resin supply. This raises near-term demand for specialty polyamide resin and engineered compounds.

Europe Polyamide Market Trends

Stricter emissions targets and circularity regulations are the core growth drivers for the polyamide industry in Europe. Automakers and aerospace firms specify lightweight, recyclable, and bio-based resins to meet fleet CO2 reduction targets and extended producer responsibility requirements. Demand for certified low-carbon feedstocks is rising among brand owners. These forces push converters and compounders to invest in closed-loop processes and validated recycled content.

Key Polyamide Company Insights

The polyamide industry is highly competitive, with several key players dominating the landscape. Major companies include BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC; Advansix; Celanese Corporation; Huntsman International LLC; and Mitsui Chemicals. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Polyamide Companies:

The following are the leading companies in the polyamide market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Evonik AG

- Arkema

- Solvay

- Domo Chemicals

- DSM-Firmenich

- Lanxess

- DuPont

- TORAY INDUSTRIES, INC.

- Ascend Performance Materials

- Koch IP Holdings, LLC.

- Advansix

- Celanese Corporation

- Huntsman International LLC

- Mitsui Chemicals

Recent Developments

-

In October 2025, BASF launched two new sustainable nylon 6 grades, Ultramid LowPCF and Ultramid BMB, in North America, with reduced cradle-to-gate carbon footprint of ~30% and ~50% respectively, expanding the polyamide resin market with lower-carbon solutions.

-

In April 2025, TE Connectivity and BASF announced a collaboration to produce automotive connectors using Ultramid Ccycled polyamide, a circular polyamide solution derived from post-consumer waste, marking a step forward in sustainable materials for the polyamide market.

Polyamide Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 46.42 billion

Revenue forecast in 2033

USD 64.11 billion

Growth rate

CAGR of 4.7% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Global Transparent Plastic Market Report Segmentation

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC.; Advansix; Celanese Corporation; Huntsman International LLC; Mitsui Chemicals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyamide Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyamide market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyamide 6

-

Polyamide 66

-

Bio-based Polyamide

-

Specialty Polyamides

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Engineering Plastics

-

Automotive

-

Electrical & Electronics

-

Consumer Goods & Appliances

-

Packaging

-

Others

-

-

Fibers

-

Textile

-

Carpet

-

Others

-

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global polyamide market size was estimated at USD 43.57 billion in 2025 and is expected to reach USD 46.42 billion in 2026.

b. The global polyamide market is expected to grow at a compound annual growth rate of 4.7% from 2026 to 2033 to reach USD 64.11 billion by 2033.

b. Asia-Pacific dominated the Polyamide market with a share of over 43.35% in 2025. This is attributable to the region's robust manufacturing sector, particularly in countries such as China, Japan, South Korea, and India. Additionally, the expansion of the automotive sector is benefiting the market in the region.

b. Some key players operating in the polyamide market include BASF; Evonik AG; Arkema; Solvay; Domo Chemicals; DSM-Firmenich; Lanxess; DuPont; TORAY INDUSTRIES, INC.; Ascend Performance Materials; Koch IP Holdings, LLC.; Advansix; Celanese Corporation; Huntsman International LLC; Mitsui Chemicals

b. Key factors that are driving the polyamide market growth include increasing demand in the automobile industry and electrical & electronics sectors across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.