- Home

- »

- Petrochemicals

- »

-

Polyacrylic Acid Market Size & Share, Industry Report, 2030GVR Report cover

![Polyacrylic Acid Market Size, Share & Trends Report]()

Polyacrylic Acid Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Water & Wastewater Treatment, Detergents & Cleaners, Paints, Coatings, & Inks), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-525-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyacrylic Acid Market Size & Trends

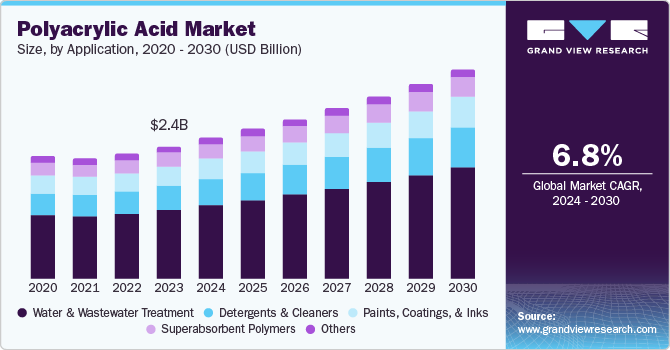

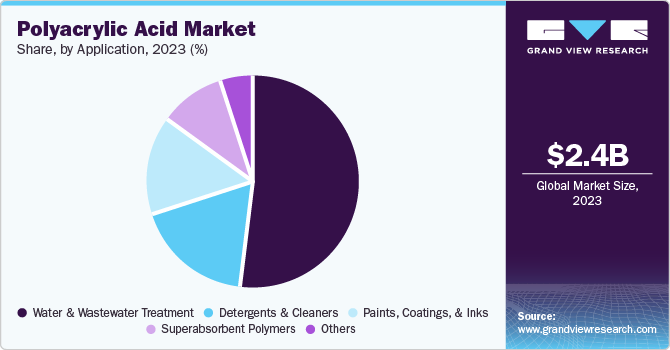

The global polyacrylic acid market size was valued at USD 2.37 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030 owing to the increasing use of polyacrylic acid in water treatment processes. As global awareness about water conservation and the need for clean water supplies is on the rise, polyacrylic acid’s role as a scale inhibitor, dispersant, and chelating agent has become increasingly crucial. Its ability to prevent mineral scaling in pipes and equipment, enhance particle separation, and bind with heavy metals makes it indispensable in both municipal and industrial water treatment plants.

In addition, with stricter environmental regulations being implemented worldwide, industries have considerably sought eco-friendly alternatives to traditional chemicals. Polyacrylic acid, known for its biodegradability and low toxicity, has been increasingly favored in applications where environmental impact is a concern. This shift towards sustainable practices is particularly evident in the water treatment sector, where polyacrylic acid’s properties align well with the goals of reducing environmental harm.

The personal care industry has been a major market driver. Polyacrylic acid’s thickening, stabilizing, and water-retention properties make it a valuable ingredient in a wide range of personal care products, including lotions, creams, shampoos, and hair styling products. This trend was further supported by the expanding personal care industry which increasingly sought innovative ingredients to meet consumer expectations.

Furthermore, strong utilization of household cleaning products and laundry & dishwashing detergents along with the presence of key end-user industry players in the country such as Unilever, Reckitt Benckiser, and Procter & Gamble Co., are a couple of growth-supporting factors of the industry. Companies such as The Lubrizol Corporation are engaged in providing cross-linked polyacrylic acid products for the home care sector. These polymers are used for the processing of household products such as surface and floor cleaners.

Application Insights

The water and waste treatment segment secured the dominant market share of 52.1% in 2023 credited to the increasing global emphasis on sustainable water management with effective solutions. Polyacrylic acid with its excellent dispersing and anti-scaling properties, plays a crucial role in water treatment processes by preventing the formation of scale and enhancing the efficiency of water purification systems. It is a key component in manufacturing inorganic and composite membranes that are used in aqua purification.

This performance chemical prevents and stabilizes the precipitation of calcium carbonate, calcium sulfate, and other mineral scaling in various equipment systems including cooling water circulation, seawater desalination, and boiler units. Furthermore, the industrial sector’s growth, particularly in emerging economies such as India and China, has further propelled the demand for polyacrylic acid in water and waste treatment. The acid’s ability to act as a flocculant enhances the removal of contaminants from industrial effluents.

Detergents and cleaners are expected to boost over the forecast period owing to the heightened demand for efficient and eco-friendly cleaning products. Consumers have become progressively more environmentally conscious, which has led to a preference for biodegradable and non-toxic ingredients in household and industrial cleaners. The anti-redeposition properties of polyacrylic acid are widely used in detergents to enhance cleaning efficiency and prevent dirt from resettling on fabrics and surfaces.

Its ability to act as a thickening agent and stabilizer enhances the viscosity and stability of liquid detergents, which makes them more effective in removing stains and dirt. Furthermore, manufacturers have continuously developed new and improved formulations that incorporate this acid such as the development of concentrated and multi-functional cleaning products that offer superior performance.

Regional Insights

The Asia Pacific polyacrylic acid market secured the largest market share of 39.6% in 2023 owing to the rapid industrialization and urbanization in the region. Countries such as China, India, and Philippines have witnessed significant growth in their industrial sectors, leading to increased demand for polyacrylic acid in various applications, including water treatment, personal care, and construction. The expanding industrial base generates substantial wastewater, necessitating efficient treatment solutions. In addition, the booming construction industry in the region propelled the market forward. Polyacrylic acid was significantly used in various construction materials, including coatings, paints, and adhesives, to enhance their performance and durability. The region’s focus on developing smart cities and modern infrastructure projects is expected to drive significant demand over the forecast period.

Europe Polyacrylic Acid Market Trends

The polyacrylic acid market in Europe accounted for a significant share of the global revenue share in 2023 attributed to the stringent environmental regulations across the region. Countries such as the UK and Germany are known for their rigorous environmental standards, particularly concerning water and wastewater treatment. The European Union’s directives on wastewater treatment and the protection of water bodies significantly boost the demand for polyacrylic acid in this application.

North America Polyacrylic Acid Market Trends

The North America polyacrylic acid market is expected to witness a significant CAGR over the forecast period owing to the increasing demand for water treatment solutions. With the growing concerns about water scarcity and pollution, the market witnessed a heightened need for effective water treatment chemicals including polyacrylic acid. This petrochemical prevents scale formation and enhances the efficiency of water purification systems. Additionally, the trend towards eco-friendly and biodegradable ingredients in personal care products is further expected to stimulate market demand.

The U.S. polyacrylic acid market is expected to be driven by the country’s well-established medical infrastructure over the forecast period. Polyacrylic acid is used in the production of superabsorbent polymers, which are essential in medical products such as wound dressings and hygiene products. The rising demand for these products, driven by an aging population and increasing healthcare awareness, has propelled the market. Additionally, ongoing research and development efforts by key players in the industry aim to develop new and improved polyacrylic acid-based products, enhancing their applications and performance.

Key Polyacrylic Acid Company Insights

The market is concentrated by key players that are fully integrated across the value chain. Key market participants include BASF SE, Dow, The Lubrizol Corporation, and others. These companies have majorly focused on manufacturing raw materials and product derivatives to penetrate into the distribution channels and end use sectors.

-

Lubrizol Corporation offers specialty chemicals for the transportation, industrial, and consumer markets. The company specializes in additives for engine oils, industrial lubricants, and fuel additives and produces ingredients for personal care products, pharmaceuticals, and medical devices.

-

Arkema is a multinational manufacturer of specialty materials, known for its expertise in adhesives, advanced materials, and coatings. The company has grown to become a key player in addressing global challenges such as new energies, resource depletion, and urbanization.

Key Polyacrylic Acid Companies:

The following are the leading companies in the polyacrylic acid market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- The Lubrizol Corporation

- Arkema

- NIPPON SHOKUBAI CO., LTD.

- Evonik Industries AG

- Ashland

- Toagosei Co., LTD.

- SNF Group

- SUMITOMO SEIKA CHEMICALS CO., LTD.

- Kao Corporation

- LG Chem

- Merck KGaA

- Kemira

- Sanyo Chemical America Incorporated

Recent Developments

-

In May 2024, NIPPON SHOKUBAI INDONESIA (NSI), the Indonesian subsidiary of NIPPON SHOKUBAI CO., LTD. was certified with ISCC PLUS for Acrylates, Acrylic acid, and Superabsorbent polymers. The company has confirmed a global supply chain to produce these products in Japan, Indonesia, and Belgium, using biomass-enhanced raw materials.

-

In April 2023, Arkema advanced its position with a comprehensive range of complementary “Inside The Cell” solutions with Incellion which includes advanced acrylic-based binders, dispersants, and rheology additives. These innovations enable battery manufacturers to optimize their formulations for electrode and separator solutions.

Polyacrylic Acid Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.52 billion

Revenue forecast in 2030

USD 3.74 billion

Growth Rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

BASF SE; Dow; The Lubrizol Corporation; Arkema; NIPPON SHOKUBAI CO., LTD.; Evonik Industries AG; Ashland; Toagosei Co., LTD.; SNF Group; SUMITOMO SEIKA CHEMICALS CO., LTD.; Kao Corporation; LG Chem; Merck KGaA; Kemira; Sanyo Chemical America Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyacrylic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyacrylic acid market report based on application and region.

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Water & Wastewater Treatment

-

Detergents & Cleaners

-

Paints, Coatings, & Inks

-

Superabsorbent Polymers

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.