- Home

- »

- Medical Devices

- »

-

Poly-L-lactic Acid Filler Market Size & Share Report, 2030GVR Report cover

![Poly-L-lactic Acid Filler Market Size, Share & Trends Report]()

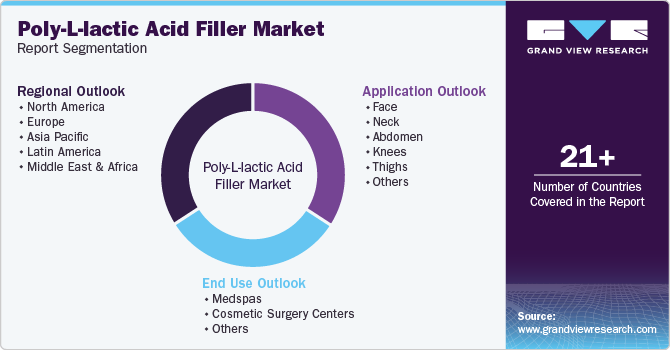

Poly-L-lactic Acid Filler Market Size, Share & Trends Analysis Report By Application (Face, Neck), By End Use (Medspas, Cosmetic Surgery Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-364-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Poly-L-lactic Acid Filler Market Size & Trends

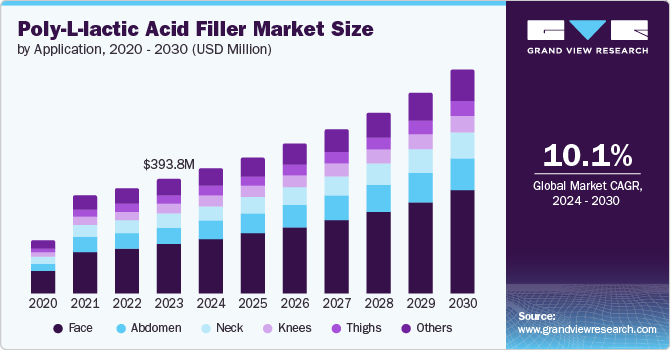

The global poly-l-lactic acid filler market size was valued at USD 393.8 million in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. Increasing demand for minimally invasive cosmetic procedures is a major factor boosting market growth. According to the American Society of Plastic Surgeons (ASPS) article published in 2022, in the U.S., 23,672,269 minimally invasive cosmetic procedures were performed freshly.

Among these procedures, non-HA fillers such as Sculptra and Bellafill accounted for 852,905 treatments. This data highlights the significant use of poly-lactic acid (PLLA) filler in aesthetic treatments to restore facial volume and reduce wrinkles. The aging population, rising focus on anti-aging solutions, technological advancements, product innovations, and the growing awareness and acceptance of cosmetic enhancements are the drivers boosting the market's growth over the forecast period.

The aging population and rising focus on anti-aging solutions are boosting the market's growth. According to a United Nations article published in 2022, the global proportion of individuals aged 65 and older is increasing more rapidly than the younger population. This demographic is expected to grow from 10% in 2022 to 16% by 2050, marking a significant shift in the age structure globally. Moreover, according to the NCBI article published in March 2024, PLLA has become widely popular globally, especially in China, where a domestic version received approval from the Chinese National Medical Products Administration in 2021. This reflects a widespread international acknowledgment of PLLA fillers' effectiveness in anti-aging treatments, meeting the demands of aging populations globally.

Technological advancements and product innovations drive the growth of the market. According to the NCBI article published in August 2023, recent developments in modifying PLA have created new biomaterials derived from biopolymers to enhance treatments for diverse medical conditions. These innovations harness PLA's unique qualities, like biocompatibility and biodegradability, focusing on tissue engineering and regenerative medicine applications. Research into PLA nanocomposites has progressed significantly by integrating various nanofillers to enhance PLA's properties for specific uses such as drug delivery, food packaging, and biomedical devices. This approach aims to customize PLA-based materials to improve mechanical strength, thermal stability, and barrier properties, broadening their potential applications in these fields.

Growing awareness and acceptance of cosmetic enhancements are among the major factors driving the market growth. According to an NCBI article published in March 2024, several clinical trials and studies have confirmed the safety and efficacy of PLLA in skin rejuvenation. PLLA treatments have been shown to notably increase skin thickness and improve texture, particularly in refining static wrinkles. For instance, a study involving 54 patients in the U.S. demonstrated a 54.9% increase in skin thickness after 12 months of PLLA treatment. Other research has indicated that repeated PLLA treatments can effectively address contour defects and enhance overall skin quality.

Market Characteristics

The market is witnessing a high degree of innovation through advanced formulations that enhance biocompatibility and longevity, ensuring safer and more effective treatments. PLLA's unique ability to stimulate natural collagen production results in long-lasting, natural-looking outcomes.

Several market players, such as Galderma, GANA R&D, and Sinclair Pharma, are involved in mergers and acquisitions. Through M&A activity, these companies employ key strategies such as application innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive interventions.

Regulations in the market have a significant impact, ensuring product safety and efficacy through stringent approvals. Regulatory compliance boosts consumer confidence and market acceptance. However, the lengthy approval processes can delay market entry and increase development costs for manufacturers.

Potential product substitutes in the industry include hyaluronic acid (HA) fillers, calcium hydroxylapatite (CaHA) fillers, polymethyl methacrylate (PMMA) fillers, and autologous fat grafting. These alternatives offer different mechanisms of action, longevity, and application techniques for soft tissue augmentation and wrinkle reduction.

Market players are expanding their presence regionally by entering untapped geographical markets, forging strategic partnerships with local distributors, and modifying product applications to accommodate specific healthcare demands within each region.

Application Insights

The face segment held the largest share, over 43.8%, in 2023, owing to the rising popularity of facial rejuvenation procedures, technological advancements in fillers, and the expanding middle-aged and elderly population. For instance, in May 2024, recent advancements in PLLA filler technology aimed to develop more refined formulations. For example, Devolux Injectable Filler employs advanced granular technology to produce ultra-fine particle sizes (3-5µm), enabling faster dissolution and dispersion within five minutes. This improvement minimizes the risk of post-treatment issues like nodules and papules, resulting in a smoother and safer treatment experience. These advancements contribute to the growing popularity and trust in PLLA treatments for facial applications.

The neck segment is expected to show lucrative growth during the forecast period. The key aspects are rising awareness of neck aging, technological advancements in injection techniques, and a growing preference for non-surgical options. PLLA fillers, notably Sculptra, are primarily used to address signs of aging in the neck area. For instance, in February 2022, Sculptra was primarily approved for treating nasolabial folds and other moderate-to-severe facial wrinkles; it is frequently used off-label to enhance and smooth the skin on the neck. This off-label use demonstrates the versatility and adaptability of PLLA fillers in treating various aesthetic concerns beyond their original indications. One of the significant advantages of PLLA fillers is their ability to produce natural-looking results. The gradual collagen-stimulating action of PLLA fillers offers a more subtle and natural enhancement compared to immediate fillers. This gradual improvement is especially desirable for neck rejuvenation, where a subtle and harmonious enhancement that complements the face's natural contours is often preferred.

End Use Insights

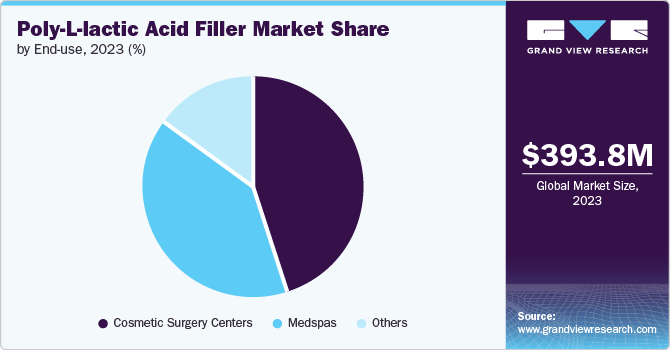

The cosmetic surgery centers segment held the largest share, 44.6%, in 2023 due to an increasing patient base seeking minimally invasive alternatives to traditional surgical procedures. Cosmetic surgery centers are well-equipped with advanced technologies and skilled professionals who can effectively administer PLLA fillers. Moreover, the integration of PLLA fillers into the treatment protocols at cosmetic surgery centers is supported by continuous advancements in product formulations and injection techniques. These innovations improve the safety, efficacy, and patient satisfaction of PLLA filler treatments, making them a reliable option for practitioners and patients. In addition, the growing strategic initiatives adopted by key players are anticipated to fuel segment growth over the forecast period. For instance, in February 2023, Athenix, a leading plastic surgery practice in the U.S., acquired Marina Plastic Surgery and Medspa, a renowned cosmetic surgery center in California, U.S. By this acquisition, Athenix would operate from six locations in the U.S. Similarly, in June 2023, Kortesis Bharti Management Group, LLC acquired Lowcountry Plastic Surgery Center. Post acquisition, the latter company’s name will be H/K/B Mount Pleasant.

The medspas segment is expected to show lucrative growth during the forecast period due to its several factors increasing consumer confidence in the safety and efficacy of non-invasive treatments offered in these settings, supported by stringent regulatory oversight and advancements in injection techniques. Moreover, medspas are strategically positioned to offer consumers who value personalized care and a complete approach to beauty and wellness. Medspas, which combines medical expertise with a spa-like environment, offers a range of non-surgical cosmetic procedures that appeal to a broad demographic seeking rejuvenation and enhancement without the downtime associated with surgical options. In 2022, the American Med Spa Association reported that over 8,841 Med spas were operational in the U.S., which has increased by 62% since 2018. According to the American Med Spa Association’s 2022 Medical Spa State of the Industry Report, an average medical spa generates more than USD 1.9 million annually.

Regional Insights

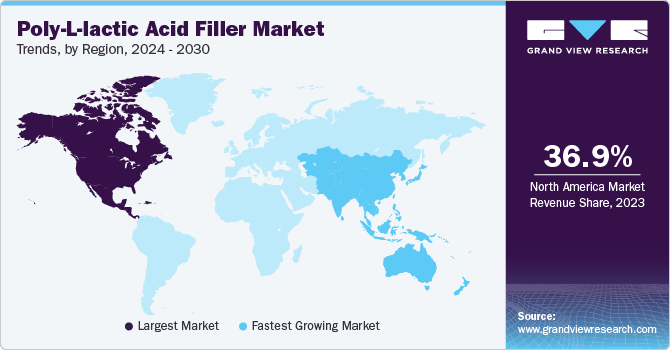

North America poly-l-lactic acid (PLLA) filler market dominated globally with a revenue share of 36.89% in 2023, owing to advanced healthcare infrastructure, increasing adoption of aesthetic procedures, huge research and development activities, continuous technological advancements in cosmetic treatments, growing geriatric population and a strong presence of key market players. The growing geriatric population in the U.S., susceptible to skin imperfections or diseases, is expected to increase the demand for cosmetic procedures, thereby significantly contributing to the market growth over the forecast period. Moreover, according to a U.S. Census Bureau article published in May 2023, the geriatric population in the region is about 1 in 6 people above 65. Furthermore, the country has the most plastic surgeons, fueling market growth. Furthermore, the country has the highest number of plastic surgeons, which is expected to boost market growth. For instance, the ISAPS 2022 report estimates that nearly 7,461 plastic surgeons are practicing in the country.

U.S. Poly-L-Lactic Acid (PLLA) Filler Market Trends

The U.S. poly-l-lactic acid (PLLA) filler market accounted for the largest revenue share in the North American region in 2023. This market dominance can be attributed to several key factors, including highly developed healthcare infrastructure and the advanced cosmetic industry, which facilitate widespread availability and adoption of PLLA fillers among consumers and healthcare providers. Moreover, the economy and high disposable incomes enable greater affordability and accessibility to aesthetic treatments like PLLA fillers, and technological advancements boost the market's growth. According to the American Society of Plastic Surgeons (ASPS) article published in September 2023, in 2022, there was a significant increase of 19% in cosmetic surgeries and procedures in the U.S. as compared to 2019, totaling 26.2 million. This indicates that more people are now open to and choosing aesthetic enhancements. The article also revealed that nearly 23.7 million less invasive cosmetic procedures were performed in 2022.

Europe Poly-L-Lactic Acid (PLLA) Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in Europe held a significant share in 2023 due to the presence of skilled professionals and the rise in the geriatric population. Rising demand for advanced treatment tools in Europe is a major factor anticipated to propel the market growth.

Germany poly-l-lactic acid (PLLA) filler market dominated with the largest revenue share of 26.4% in 2023 in the Europe region. Various factors, such as an increase in the popularity of cosmetic procedures, an aging population, technological advancements, and a rise in beauty consciousness, are driving the market growth. The aging population's interest in maintaining a youthful appearance drives market growth as individuals seek nonsurgical solutions like dermal fillers, emphasizing the relevance & potential growth within the market in Germany. According to the Trading Economics article, the prevalence of individuals aged 65 and above, constituting 22.41% of the total population in Germany as of 2022, is a significant growth driver for the poly-l-lactic acid (PLLA) filler industry.

Poly-l-lactic acid (PLLA) filler market in the UK held the second largest market share in 2023. The country's growing number of nonsurgical procedures is expected to boost the market growth over the forecast period. According to the ISAPS 2022 report, nearly 77,924 nonsurgical procedures were performed nationwide. Moreover, it was estimated that nearly 600 surgeons were registered in the country. Moreover, the country is rapidly changing its regulations for poly-l-lactic acid (PLLA) filler due to practitioner malpractices. For instance, in September 2023, a government consultation program was launched to improve the clinical practices related to dermal fillers and Botox procedures.

France poly-l-lactic acid (PLLA) filler market is anticipated to witness a significant CAGR of 9.1% over the forecast period. Increased awareness among customers about the potential benefits of aesthetic procedures and the growing adoption of minimally invasive procedures are boosting the market growth in France. Furthermore, rising purchasing power, growing involvement of international players, increasing spending on cosmetics and personal care, and rising number of beauty clinics are among the factors fueling the market growth in France. According to the ISAPS 2019 report, around 423,085 minimally invasive aesthetic treatments were performed in the country.

Asia Pacific Poly-L-Lactic Acid (PLLA) Filler Market Trends

The Asia Pacific poly-l-lactic acid (PLLA) filler market is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the rising medical tourism industry, especially in Southeast Asia. According to the ISAPS 2022 report, 29% of patients who underwent aesthetic treatments in Thailand were foreign nationals, while in Japan, the figure was 4%. The growing preference among foreign nationals to undergo treatments in Thailand can be attributed to the availability of advanced techniques and cost-effective treatment options.

The poly-l-lactic acid (PLLA) filler market in China accounted for the largest revenue share in the Asia Pacific region in 2023 due to increasing demand for antiaging procedures. According to WHO, 28% of the country’s population is projected to be above 65 by 2040, which in turn is expected to boost the adoption of noninvasive aesthetic treatments. Moreover, according to the ISAPS in 2022, China has a surgical workforce of 3,000 surgeons, constituting 5.6% of the total number of surgeons.

Japan poly-l-lactic acid (PLLA) filler market held the second largest market share in the Asia Pacific region. Japan is one of the most rapidly aging countries in the world. The National Institute of Population and Social Security Research projects that by 2040, individuals aged 65 & older will make up 34.8% of Japan's total population. The rapidly aging population in the country is also anticipated to boost the market demand, as the geriatric population is more susceptible to fine lines, wrinkles, saggy skin, and other signs of aging.

The poly-l-lactic acid (PLLA) filler market in India is experiencing significant growth, driven by several key factors: increasing affordability of aesthetic procedures along with growing disposable income & awareness about these procedures. Moreover, lower treatment costs in the country are expected to contribute to the growing medical tourism. According to the Times of India article published in May 2023, India witnesses an annual arrival of around 800,000 to 1 million cosmetic procedure patients, 10% of whom come from foreign countries. This positions India as the sixth most favored global destination for medical tourism in cosmetic procedures.

Latin America Poly-L-Lactic Acid (PLLA) Filler Market Trends

The poly-L-lactic acid (PLLA) filler market in Latin America is growing due to several factors. These countries are preferred for medical tourism due to the availability of treatments at lower cost (30% to 70% discount) compared to North American and European countries. In addition, a stronger emphasis on physical beauty coupled with extensive acceptance of facial surgeries has led to the high demand for poly-l-lactic acid filler in Brazil.

The Brazil poly-l-lactic acid filler market is expanding due to several distinct growth drivers. Brazil has a strong culture of beauty & aesthetics, emphasizing youthful appearances and physical attractiveness. This cultural focus on beauty has contributed to the widespread acceptance and use of poly-l-lactic acid filler to enhance or maintain one's appearance. According to the ISAPS report, in 2022, 2,049,257 surgical procedures were conducted in Brazil, alongside 971,294 nonsurgical procedures.

MEA Poly-L-Lactic Acid (PLLA) Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in MEA is expected to grow at a lucrative growth over the forecast period. The MEA region is witnessing a rising preference among consumers for non-surgical cosmetic treatments, driven by increasing disposable incomes and a growing awareness of aesthetic procedures. Moreover, MEA countries invest in healthcare infrastructure and adopt advanced aesthetic technologies, facilitating greater accessibility to cosmetic procedures, including PLLA fillers.

South Africa poly-l-lactic acid (PLLA) filler market held the 35% share in MEA region. The growing demand for hyaluronic acid-based dermal fillers from the geriatric population is expected to boost market growth. According to an article by Statistics South Africa, in 2022, nearly 9.2% of the total country’s population was aged over 60.

Key Poly-L-Lactic Acid Filler Company Insights

Some of the key players operating in the industry include Galderma, GANA R&D and Sinclair Pharma. Company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, PRP Science and EPRUI Biotech are some of the emerging players in the poly-l-lactic acid (PLLA) filler. These industry players continuously focused on leveraging specialized technologies to differentiate themselves.

Key Poly-L-Lactic Acid Filler Companies:

The following are the leading companies in the poly-l-lactic acid filler market. These companies collectively hold the largest market share and dictate industry trends.

- Galderma

- GANA R&D

- Sinclair Pharma

- PRP Science

- EPRUI Biotech

- Hyamax

Recent Developments

-

In February 2024, Praj Industries revealed that its polylactic acid (PLA) pilot plant was nearing completion and would convert to operation by April 2024. The facility, designed to manufacture bioplastics, was part of the company’s R&D push to develop renewable chemicals like biodegradable polymers using feedstocks.

-

In April 2023, Galderma revealed that the U.S. FDA has launched Sculptra (injectable poly-L-lactic acid) for treating fine lines and wrinkles in the cheek area. Sculptra, the first FDA-launched PLLA collagen stimulator, enhances collagen production to smooth wrinkles and improve skin firmness and glow, with effects lasting up to 2 years.

-

In March 2021, Galderma recently revealed the re-launch of Sculptra (injectable poly-L-lactic acid) in Europe, featuring an updated administration protocol. This new protocol allows quicker preparation after reconstitution and offers enhanced patient comfort.

Poly-L-lactic Acid (PLLA) Filler Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 429.4 million

Revenue forecast in 2030

USD 764.8 million

Growth Rate

CAGR of 10.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Galderma, GANA R&D, Sinclair Pharma, PRP Science, ELASTEM, EPRUI Biotech, Hyamax

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poly-L-lactic Acid (PLLA) Filler Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global poly-l-lactic acid (PLLA) filler market report based on application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Face

-

Neck

-

Abdomen

-

Knees

-

Thighs

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medspas

-

Cosmetic Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

- Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global poly-l-lactic acid filler market size was estimated at USD 393.8 million in 2023 and is expected to reach USD 429.4 million in 2024.

b. The global poly-l-lactic acid filler market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 764.8 million by 2030.

b. North America dominated the poly-lactic acid (PLLA) filler market with a share of 36.9% in 2023, owing to advanced healthcare infrastructure, increasing adoption of aesthetic procedures, huge research and development activities, and continuous technological advancements in cosmetic treatments.

b. Some key players operating in the poly-l-lactic acid filler market include Galderma, GANA R&D, Sinclair Pharma, PRP Science, EPRUI Biotech, and Hyamax,

b. The primary factors driving the market are the rising demand for minimally invasive cosmetic procedures, the growing aging population, and technological advancements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."