Point of Use Water Treatment Systems Market Size, Share & Trends Analysis Report By Technology (Reverse Osmosis), By Device (Tabletop Pitchers), By Application (Residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-638-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global point of use water treatment systems market size was estimated at USD 28.94 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.0% from 2024 to 2030. Rising concerns over different waterborne infections, such as E. coli and cholera, have augmented the popularity and demand for point of use water treatment systems globally. These aforementioned factors are anticipated to propel the demand for point of use water treatment systems over the forecast period.

The Safe Drinking Water Act, of 1974, the Environment Protection Agency (EPA) has set standards for the quality of drinking water supply, and along with its partners, the agency implements numerous financial and technical programs to safeguard drinking water quality. Furthermore, The Clean Water Act establishes the fundamental framework for controlling the discharge of pollutants into waters and for regulating surface water quality standards.

Growing emphasis on the quality of water will drive the market for point of use water treatment systems in the U.S. In addition, to encourage investments in upgrading current domestic water purification facilities and establishing new ones, the U.S. passed a new Public-Private Partnership (PPP) law. Over the forecast period, the favorable initiative to encourage domestic investments in the point of use water treatment systems industry is anticipated to positively affect market growth.

The growing industrial activities and commercial agricultural practices are releasing new pollutants in the water and affecting the health of individuals. According to the U.S. Department of Health & Human Services 2023 report, there are about 7.2 million Americans who contract diseases caused by contaminated water each year. Additionally, with 6,630 deaths per year, the country has consistently had some of the highest death rates among developed countries. China also, tackles extensive water pollution challenges, with up to 90% of the nation's groundwater contaminated by hazardous human and industrial waste disposal, along with agricultural fertilizers. This contamination renders approximately 70% of rivers and lakes unsuitable for human use. The demand for point of use water treatment systems is significantly influenced by the grade of water quality.

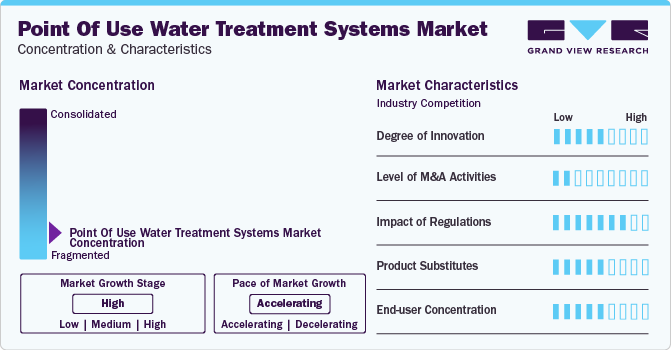

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation in water filters, UV water disinfection technology, integration of more technologies, and increasing innovative product launches.

The market is also characterized by a moderate to high level of product launches and innovation activity by the leading players. This is due to several factors, including the desire to gain improved water treatment capabilities and removal of emerging pollutants from water source for safe use at residential, commercial, and industrial settings. As well as increasing product launches likely to help acquire new customers and increase existing customer engagement.

The global market is also subject to increasing regulatory compliance. In public assemblies, educational institutions, health & fitness facilities, etc. these regulations play a vital role in the increasing demand for point of use water treatment systems for safe drinking water.

There are a limited number of direct product substitutes for point of use water treatment systems. Indirect product substitutes or methods used for the treatment of water before using them include traditional methods such as boiling water, alum treatment, etc.

End-user concentration is a significant factor in the global market. Since there are a number of residential, commercial, and industrial end-users that are driving demand for point of use water treatment systems solutions. The increasing awareness among residential customers and strict compliance among the commercial and industrial application also expected to increase the end-user concentration.

Technology Insights

Reverse osmosis systems technology dominated the market and accounted for a share of 32.1% in 2023. The driving factors for the adoption of reverse osmosis point of use water treatment systems include their effectiveness in removing contaminants, energy efficiency, compact design, and versatility in treating various water sources. Additionally, the growing awareness of waterborne diseases and the need for safe drinking water contribute to the increasing popularity of reverse osmosis point of use systems.

The technology's ability to address specific contaminants like bacteria, viruses, and dissolved solids further enhances its appeal, making it a preferred choice for households and communities aiming to ensure access to clean and potable water. A point of use reverse osmosis system is a type of water filtration device linked to a specific fixture, like beneath the kitchen sink. RO (reverse osmosis) systems are capable of potentially eliminating various water contaminants, including volatile organic compounds (VOCs), lead, arsenic, PFAS, etc.

Furthermore, product innovations and new added features in reverse osmosis systems are facilitating the demand for new installations for effective water treatment at the point of use. For instance, in December 2023 Samyang Corporation introduced reverse osmosis membrane to build ultrapure water treatment systems. The company has released a new product TRILITE RO, within the industrial water treatment brand TRILITE. The ultrapure water produced by this system can be used for displays, semiconductors, and other electronic products.

Device Insights

Tabletop pitchers accounted for the largest market revenue share in 2023. This is attributable to the growing adoption of tabletop pitchers owing to their attractive features and characteristics. Tabletop pitchers are compact household water purification devices that sit on tables, providing a convenient and portable solution for treating water at the point of consumption. The ease of use and portability of tabletop pitchers make them a popular choice.

Under-the-sink filters is expected to register the second-fastest CAGR during the forecast period. These systems are designed to purify water at the point of use, providing a dedicated solution for enhancing the quality of drinking and cooking water within a specific faucet. Under-the-sink filters are known for their ability to provide comprehensive filtration, targeting a wide range of contaminants such as sediments, chlorine, heavy metals, and various impurities.This level of filtration ensures that users have access to clean and safe drinking water directly from their kitchen faucet. One driving factor is the utilization of space beneath the sink. As these filtration systems are installed discreetly, they don't occupy valuable counter space, which makes them a suitable choice for those who prioritize a clutter-free kitchen.

Application Insights

The industrial segment dominated the market in 2023. The market demand for point of use water treatment systems in the residential segment is anticipated to be driven by concerns about new contaminants along with the rising demand for high-quality drinking water. Consumers are becoming more aware of contaminants like polyfluoroalkyl substances (PFAS), poor water quality, and waterborne illnesses, such as cholera, typhoid, acute diarrhea, viral hepatitis, boil water advisories, and other issues. Additionally, it is projected that the market demand will grow swiftly because of the demand for drinking water that has been treated to withdraw risky germs, biodegradable organics, discoloration, bad taste, and odor.

The commercial sector is projected to grow at the fastest CAGR over the forecast period. Point-of-use water treatment systems for commercial applications are designed to provide localized purification at specific water outlets. These systems ensure that water used for various purposes, such as drinking, cooking, or cleaning, meets quality standards. Common technologies include reverse osmosis, UV disinfection, and filtration. They offer convenience and targeted treatment and can be tailored to specific contaminants present in the water source, making them suitable for non-residential settings with diverse water needs. The demand for point of use water treatment systems in hotels has been on the rise, driven by various factors that cater to both guest satisfaction and operational efficiency. These systems play a crucial role in ensuring the quality and safety of water supply within hotel establishments.

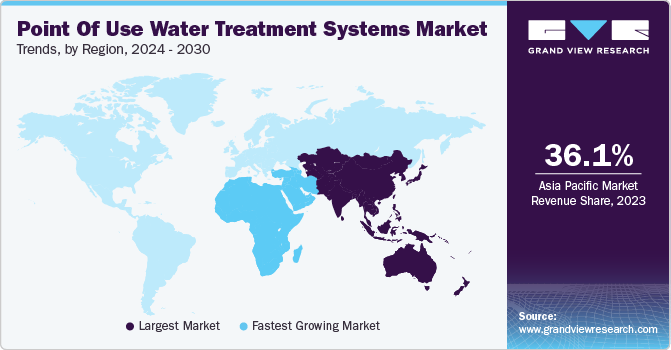

Regional Insights

Asia Pacific dominated the market and accounted for a 36.1% share in 2023. This high share is attributable to high awareness about the point of use of water treatment systems and favorable government regulations for water treatment.Various regulations, such as the Clean Water Act, advise U.S. states to designate surface waters for drinking and establish water quality standards. This legislation also institutes programs to prevent pollution in these waters. Furthermore, the Safe Drinking Water Act (SDWA) ensures the safety of public drinking water supplies in the U.S.

Middle East & Africa is anticipated to witness significant growth in the market. The increasing pace of globalization and exposure to global health standards have influenced consumer preferences toward safer and cleaner water sources in the region. Evolving lifestyles and preferences, coupled with a growing understanding of the importance of clean water for overall well-being, contribute to the demand for point of use water treatment systems. Point of use water treatment systems cater to this demand by providing a more direct and individualized solution for ensuring water safety.

Key Companies & Market Share Insights

Some of the key players operating in the market include 3M, Pentair, LG Electronics, A. O. Smith.

-

3M offers range of point of use water treatment systems such as under-the-sink filtration, reverse osmosis systems providing consistent high quality water for commercial applications.

-

LG Electronics offers water purifiers such as faucet mounted filters and tabletop pitchers designed with energy efficient characteristics.

EcoWater Systems LLC, Amway Corp. are some of the emerging market participants in the global market.

-

EcoWater Systems LLC offers a complete line of water treatment solutions, including water softeners, filtration, and drinking water systems.

-

Amway Corp, a subsidiary of Alticor Global Holdings Inc, offers water disinfection systems with UV disinfection method.

Key Point Of Use Water Treatment Systems Companies:

- 3M

- Koninklijke Philips N.V.

- Pentair

- Panasonic Holdings Corporation

- Unilever

- LG Electronics

- EcoWater Systems LLC

- A. O. Smith

- Culligan

- Amway Corp.

Recent Developments

-

In July 2023, Hindustan Unilever, a subsidiary of Unilever, launched the Pureit Revito range of water purifiers. The newly launched purifiers save up to 70% of the water and enrich it with essential minerals like magnesium and calcium. Moreover, it comes with additional features, such as an improved external sediment filter and UV-in-tank sterilization.

-

In January 2023, Philips partnered with Aquaporin, a water technology company to deliver clean drinking water to customers in China. With the partnership, Aquaporin will be the membrane technology provider in most of Philips Water Solutions range of water purifiers.

Point of Use Water Treatment Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 31.90 billion |

|

Revenue forecast in 2030 |

USD 53.56 billion |

|

Growth rate |

CAGR of 9.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, device, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; U.K.; Spain; Italy; Russia; China; Japan; South Korea; India; Australia; Brazil; Argentina; Saudi Arabia; UAE |

|

Key companies profiled |

3M; Koninklijke Philips N. V.; Pentair; Panasonic Holdings Corporation; Unilever; LG Electronics; EcoWater Systems LLC; A. O. Smith; Culligan; Amway Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Point of Use Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of use water treatment systems market report based on technology, device, application, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reverse Osmosis Systems

-

Distillation Systems

-

Disinfection Methods

-

Filtration Methods

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tabletop Pitchers

-

Faucet-Mounted Filters

-

Counter-top Units

-

Under-the-sink Filters

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Other

-

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global point of use water treatment systems market size was estimated at USD 28.94 billion in 2023 and is expected to be USD 31.90 billion in 2024.

b. The global point of use water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 53.56 billion by 2030.

b. Asia Pacific region dominated the market and accounted for 36.1% share in 2023. The region has been experiencing a surge in demand for safe drinking water, driven by factors such as population growth, rising health awareness, and increasing disposable income.

b. Some of the key players operating in the point of use water treatment systems market include 3M, Koninklijke Philips N.V., Pentair, Panasonic Holdings Corporation, Unilever, LG Electronics, EcoWater Systems LLC, A. O. Smith, Culligan, and Amway Corp.

b. The market is anticipated to be driven by the growing product launches, regional expansion strategies by manufacturers, rising population, lack of safe drinking water, and increasing health awareness.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."