- Home

- »

- Plastics, Polymers & Resins

- »

-

Point Of Purchase Packaging Market Size Report, 2030GVR Report cover

![Point Of Purchase Packaging Market Size, Share & Trends Report]()

Point Of Purchase Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Paper, Foam, Plastic, Glass, Metal), By Product, By Distribution Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-158-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Point Of Purchase Packaging Market Trends

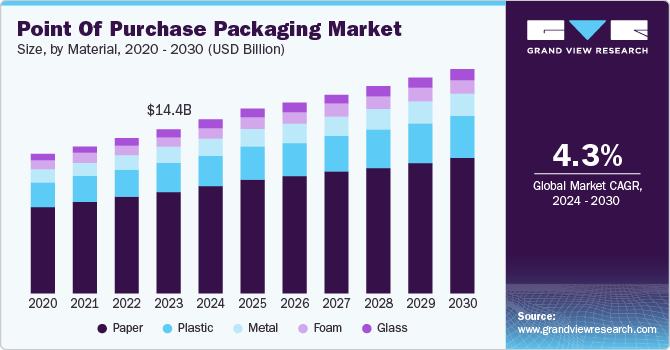

The global point-of-purchase packaging market size was valued at USD 14.43 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. This growth can be attributed to the rising retail sector, changing consumer behavior trends, technological advancement, sustainability concerns in the packaging industry, and growing e-commerce. In highly competitive markets, brands seek unique ways to differentiate themselves. Innovative point-of-purchase packaging serves as a means for brands to convey their identity and values directly at the point of purchase.

Point of Purchase Packaging refers to the packaging that is specifically designed to attract customers’ attention at the point of sale. This type of packaging is strategically placed in retail environments, such as stores or supermarkets, to encourage impulse buying and enhance product visibility. Point-of-purchase packaging can take various forms, including displays, promotional boxes, and shelf-ready packaging. The design often incorporates eye-catching graphics, vibrant colors, and innovative shapes to draw consumers' attention and communicate key product information effectively.

The primary goal of point-of-purchase packaging is to influence consumer behavior when they make purchasing decisions. It serves not only as a container for the product but also as a marketing tool that can significantly impact sales. Effective point-of-purchase packaging can increase brand recognition and customer loyalty by creating a memorable shopping experience. Expanding retail outlets globally has increased the demand for effective point-of-purchase solutions. As more brands compete for consumer attention in crowded marketplaces, businesses invest in innovative packaging designs that stand out. In addition, modern consumers are increasingly influenced by visual stimuli when making purchasing decisions, propelling the market growth for point-of-purchase packaging.

Material Insights

The paper segment dominated the market and accounted for a revenue share of 61.9% in 2023, owing to aesthetic appeal and customization, sustainability concerns, and shifting consumer preferences towards sustainable point-of-purchase packaging options. The paper offers a versatile surface on which brands can develop artful graphics to capture consumer’s attention and can be printed. It allows printing excellent-quality graphics, bright colors, and detailed patterns that make point-of-purchase displays irresistible. Also, due to environmental consciousness and regulatory requirements, there has been a growing emphasis on sustainable packaging, especially in the current society. Paper has been considered more eco-friendly than plastic or any other synthetic material, and it is biodegradable and recyclable.

The plastic segment is expected to grow at the fastest CAGR from 2024 to 2030. This growth can be attributed to cost-effectiveness, durability and protection, consumer preferences, and technological advancement. Innovations in polymer science have led to the development of new types of plastics with enhanced properties, such as increased strength-to-weight ratios and improved sustainability against oxygen and moisture.

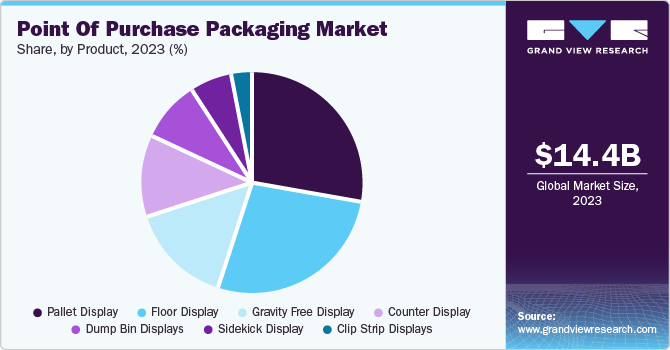

Product Insights

The pallet display segment dominated the market and accounted for the largest revenue share in 2023. The rapid expansion of retail chains, particularly in emerging markets, has significantly boosted the demand for pallet displays as an effective merchandising solution. As these markets witness the proliferation of large-format stores such as supermarkets and hypermarkets, there is an increasing need for efficient and attractive product presentation methods that can handle high volumes and diverse product ranges. Pallet displays offer a versatile and scalable solution that enables retailers to showcase products prominently while maximizing floor space utilization. Additionally, they facilitate easier stocking and replenishment processes, reducing labor costs and improving overall operational efficiency. This growing trend is further propelled by rising consumer spending and urbanization in these regions, making pallet displays an indispensable tool for retailers aiming to enhance customer engagement and drive sales in competitive retail environments.

The sidekick display segment is expected to grow at the fastest CAGR from 2024 to 2030. Sidekick displays are strategically placed in high-traffic areas, often near checkout counters, making them highly visible to customers. This placement captures the attention of shoppers who may have not initially intended to purchase additional items, thus increasing impulse buying opportunities. These displays are usually more economical compared to the large multisegmented display applications. Retailers can adopt sidekick displays without a significant degree of cost implication, making it easy for retailers to optimize their available budgets while ensuring maximum visibility of the products.

End Use Insights

The food & beverages segment dominated the market and accounted for the largest revenue share in 2023. This dominance can be attributed to changing consumer behavior & impulse buying, visual appeal & branding, convenience for consumers & visibility for brands, and seasonal promotions & limited editions. Many of the products in the food and beverage industry are promoted seasonally or as limited editions, and they require to be advertised as soon as possible to capitalize. Point-of-purchase packaging displays are particularly useful in getting visibility for these products as they are often time-based, thus creating a sense of urgency with buyers. For example, a change in packaging designs, such as holiday packaging or promotional campaigns, can be easily conveyed through the proper placement of point-of-purchase packaging displays, increasing sales during the festive seasons.

The pharmaceuticals segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to increased competition, consumer behavior trends, and focus on patient-centric marketing. There is a growing emphasis on patient-centric marketing strategies within the pharmaceutical industry. Companies recognize that understanding patient needs and preferences is crucial for successful product adoption. Point-of-purchase packaging displays can be tailored to address specific patient demographics or conditions, making them more relevant and appealing to targeted audiences.

Distribution Channel Insights

The hypermarket segment dominated the market and accounted for a revenue share in 2023 due to high foot traffic, diverse product offerings, strategic product placement opportunities, promotional activities, consumer behavior insights, collaboration between brands and retailers, seasonal events, and technological advancements that enhance visibility and drive impulse purchases. Many brands collaborate with hypermarket chains to create customized point-of-purchase displays tailored specifically for their target audience within those stores, ensuring relevance and maximizing impact.

The convenience stores segment is expected to grow fastest from 2024 to 2030. Consumers today lead busy lives and often prioritize convenience when shopping. The convenient segment caters to this need by offering products that can be purchased quickly without extensive searching or deliberation. Point-of-purchase packaging displays enhance visibility and accessibility, allowing consumers to make swift decisions. Research indicates that impulse purchases significantly increase when products are displayed prominently at the point of sale, capitalizing on the consumer’s immediate needs.

Regional Insights

North America point-of-purchase packaging market held the largest market share of 30.5% in the global market in 2023 due to increasing retail competition, evolving consumer preferences towards aesthetics and functionality, growth in e-commerce necessitating enhanced in-store experiences, and technological advancements allowing for innovative product designs. Competition in the retail sector in North America is high, and many brands are in the market to capture consumers' attention. Retailers choose point-of-purchase packaging displays to stand out from other similar products in the market. It increases visibility and competition, making brands put more effort into collaborations with retailers to allow placement of their products on point-of-purchase packaging displays that are very attractive and functional.

U.S. Point Of Purchase Packaging Market Trends

The U.S. point-of-purchase packaging market held a substantial market share in 2023. The demand for point-of-purchase packaging is significantly influenced by the rising retail landscape with increasing competition in supermarket chain companies such as Walmart Inc., Costco Wholesale Corporation, and others. Point-of-purchase packaging displays serve as an extension of brand identity and messaging. Companies utilize these displays not only to promote products but also to communicate brand values effectively. This branding aspect is crucial for building customer loyalty.

Europe Point Of Purchase Packaging Market Trends

Europe point of purchase packaging market held a significant market share in 2023, driven by increased competition among retailers, evolving consumer preferences towards visually appealing merchandising, sustainability initiatives, technological advancements, promotional activities, branding strategies, regulatory changes, globalization trends, and the evolution of retail businesses such as departmental stores, supermarkets, specialty stores. The shift towards experiential retail formats necessitates unique and engaging point-of-purchase displays that enhance store customer experiences.

The UK point-of-purchase packaging market held a significant market share in 2023. Retail consumer behavior has significantly changed due to the need for better and more attractive packaging that is more appealing, interactive, and fascinating to shoppers. Stores are also looking to design eye-catching point-of-purchase packaging displays to capture consumers' attention.

Asia Pacific Point Of Purchase Packaging Market Trends

The Asia Pacific point-of-purchase packaging market is expected to experience significant growth due to Rapid urbanization across Asian nations, which leads to changing consumer lifestyles and shopping habits. Urban consumers tend to prefer organized retail environments where point-of-purchase packaging displays are crucial in influencing purchasing decisions—the expansion of the retail sector in Asia, particularly in countries like China and India. The increase in modern retail formats such as supermarkets, hypermarkets, and convenience stores has created a demand for effective point-of-purchase packaging displays.

The point-of-purchase packaging market in India is expected to grow significantly as the expansion of organized retail chains and supermarkets increases. Retailers invest in innovative display solutions to enhance product visibility and customer engagement. Changing consumer preferences towards convenience and instant gratification have led brands to adopt more eye-catching packaging solutions that quickly convey product benefits.

MEA Point Of Purchase Packaging Market Trends

Point of purchase packaging market in MEA is projected to experience the fastest CAGR from 2024 to 2030. The expansion of retail outlets, including supermarkets and hypermarkets, has increased the demand for effective point-of-purchase displays. As more brands seek to differentiate themselves, innovative packaging solutions become essential. Increased competition among brands increases the demand for unique and eye-catching displays that can effectively communicate brand messages and promotions at the point of sale.

South Africa point-of-purchase packaging market is expected to grow significantly owing to the adoption of advanced printing technologies and sustainable materials in Point of Purchase (POP) packaging is transforming the market by enabling more innovative and eco-friendly display solutions. These technological advancements allow brands to create visually striking and customizable POP displays that not only capture consumer attention but also resonate with the increasing demand for sustainability. The use of biodegradable, recyclable, and renewable materials in packaging is becoming a key differentiator, as environmentally conscious consumers are more likely to engage with brands that demonstrate a commitment to reducing their carbon footprint.

Key Point Of Purchase Packaging Company Insights

Some of the key companies in the point-of-purchase packaging market include DS Smith, Felbro, Inc., Georgia-Pacific, WestRock Company, Sonoco Products Company, and others. Organizations in the market are focusing on innovative point-of-purchase packaging to enhance consumer experience. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

DS Smith focuses on point-of-sale display strategic solutions to provide a competitive advantage to businesses. It specializes in floor and free-standing displays, modular displays, pallet boxes, life-size and experience displays, countertop displays, dump/impulse bin displays, and shelf and corrugated tray displays to cater to the demand of the retail sector.

-

Felbro, Inc. specializes in creating retail displays. Their offerings include floor displays, modular displays, pallet boxes, life-size displays, countertop displays, and more. By maximizing in-store impact, it helps brands engage customers effectively, especially in the fashion industry.

Key Point Of Purchase Packaging Companies:

The following are the leading companies in the point of purchase packaging market. These companies collectively hold the largest market share and dictate industry trends.

- DS Smith

- Felbro, Inc.

- Georgia-Pacific

- Marketing Alliance Group

- Creative Displays Now

- Swisstribe Ltd

- Smurfit Kappa

- siffron, Inc.

- International Paper

- Fencor Packaging Group Limited

- Menasha Packaging Company, LLC.

- Hawver Display

- WestRock Company

- Sonoco Products Company

Recent Developments

-

In July 2024, Smurfit Kappa acquired WestRock Company, creating Smurfit Westrock, now one of the largest packaging companies globally. The newly formed entity, with its main headquarters in Dublin and American headquarters in Atlanta, is focused on becoming a leader in sustainable, paper-based packaging solutions.

Point Of Purchase Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.27 billion

Revenue forecast in 2030

USD 19.65 billion

Growth Rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Product, Distribution Channel, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia and UAE.

Key companies profiled

DS Smith; Felbro, Inc.; Georgia-Pacific; Marketing Alliance Group; Creative Displays Now; Swisstribe Ltd; Smurfit Kappa; siffron, Inc.; International Paper; Fencor Packaging Group Limited; Menasha Packaging Company, LLC.; Hawver Display; WestRock Company and Sonoco Products Company.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Purchase Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the point-of-purchase packaging report based on material, product, distribution channel, end use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Foam

-

Plastic

-

Glass

-

Metal

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Counter display

-

Floor display

-

Gravity free display

-

Pallet display

-

Sidekick display

-

Dump bin displays

-

Clip Strip Displays

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket

-

Supermarket

-

Departmental stores

-

Specialty stores

-

Convenience Store

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal care

-

Pharmaceuticals

-

Electronics

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.