- Home

- »

- Water & Sludge Treatment

- »

-

Point Of Entry Water Treatment Systems Market Report, 2030GVR Report cover

![Point Of Entry Water Treatment Systems Market Size, Share & Trends Report]()

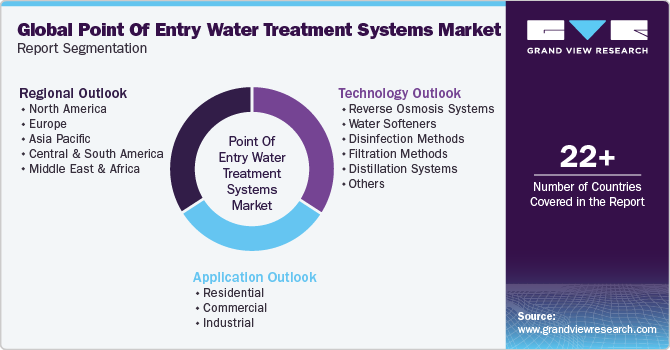

Point Of Entry Water Treatment Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Reverse Osmosis), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-255-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Point Of Entry Water Treatment Systems Market Summary

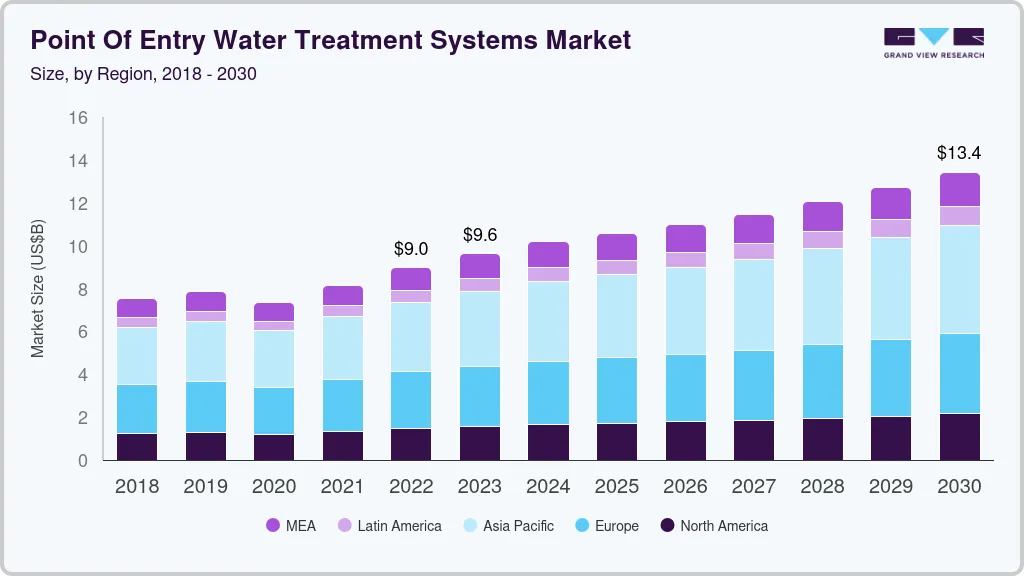

The global point of entry water treatment systems market size was estimated at USD 10.17 billion in 2024 and is projected to reach USD 13.42 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. Increasing demand for water treatment systems due to the growing pollution and population influx in urban areas is expected to have a positive impact on the market growth.

Key Market Trends & Insights

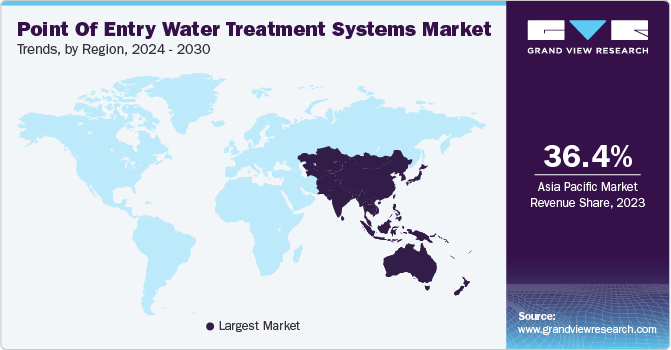

- The Asia Pacific point of entry water treatment systems market dominated with the largest revenue share of 36.5% in 2024.

- The U.S. is expected to grow at the fastest CAGR of 4.8% from 2025 to 2030.

- Based on technology, the reverse osmosis systems led the market with the largest revenue share of 16.1% in 2024.

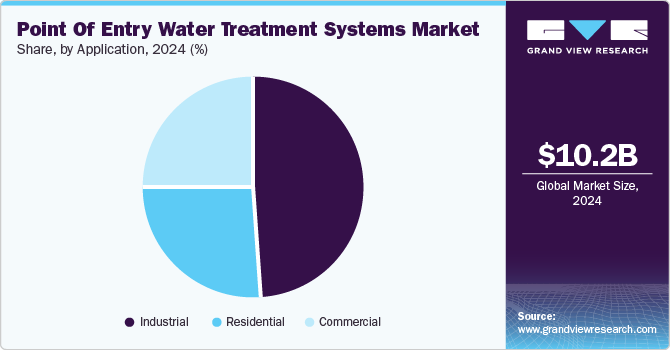

- Based on application, the industrial segment led the market with the largest revenue share of 50.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.17 Billion

- 2030 Projected Market Size: USD 13.42 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

Further, a rise in awareness regarding water contamination due to micro plastic contents, such as lead, bacteria, and chemicals, is expected to fuel the demand for point-of-entry water treatment systems for clean and safe drinking water.

The growing global population, along with heightened health awareness, is significantly driving the demand for point of entry water treatment systems. According to the UN, the global population is projected to grow by nearly 2 billion people in the next 30 years, from 8 billion to 9.7 billion by 2050, potentially peaking at around 10.4 billion by the mid-2080s. The global population, which stood at 3.5 billion in 1970, is also expected to reach 8.5 billion by 2030. This rapid growth and urbanization are putting pressure on water, resulting in an increased demand for water treatment solutions to ensure a sustainable and clean water supply.

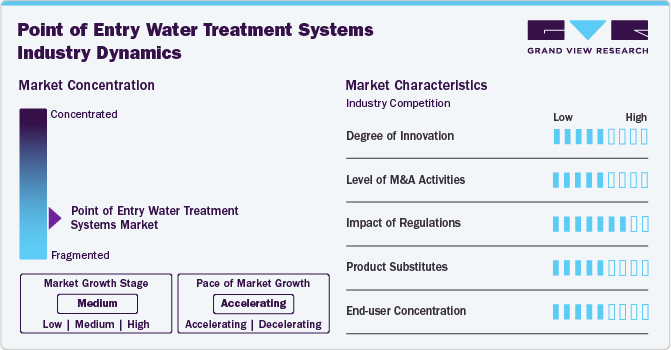

Market Concentration & Characteristics

The point of entry water treatment systems industry is moderately concentrated, with a few global companies holding a substantial share. Leading players like Culligan, Pentair, and Honeywell dominate the market due to their extensive product portfolios, brand recognition, and robust distribution networks. These companies benefit from economies of scale and advanced technologies, allowing them to serve both residential and industrial customers. However, regional manufacturers also compete by offering cost-effective solutions tailored to local needs, adding diversity to the competitive landscape.

The point of entry water treatment systems industry is characterized by a wide range of products designed to address different water quality concerns. Systems typically include water softeners, filtration units, and reverse osmosis systems, each serving distinct needs, such as eliminating contaminants, improving taste, or treating hard water. In addition, the market is influenced by growing consumer awareness of water quality, leading to a rise in demand for point-of-entry solutions that offer comprehensive treatment for households and businesses. The integration of smart technologies, such as IoT-enabled systems for monitoring water quality, is becoming an emerging trend.

Increasing concerns about water pollution and contamination are driving the demand for POE water treatment systems in both residential and commercial sectors. Consumers are seeking effective solutions for removing pollutants like chlorine, lead, and heavy metals from their water supply. The market is also witnessing a shift towards energy-efficient and environmentally friendly solutions that minimize waste and reduce operational costs. Innovations like self-cleaning filters, eco-friendly materials, and system automation are becoming increasingly popular, addressing both health and environmental concerns while providing convenience.

The demand for POE water treatment systems is growing rapidly in regions facing water quality issues, such as parts of North America, Asia-Pacific, and the Middle East. In North America, stringent water quality regulations and increasing health consciousness are driving market growth, while the Asia-Pacific region is experiencing significant demand due to industrial expansion and urbanization. Moreover, the growing middle-class population in developing countries is fueling demand for water treatment systems in households. This regional diversity is pushing manufacturers to adapt their offerings to meet local needs, ensuring a dynamic and evolving market landscape.

Drivers, Opportunities & Restraints

Increasing concern over water contamination and the rising demand for clean, safe water is driving the demand for point of entry water treatment systems industry. As consumers become more aware of waterborne diseases, pollutants, and contaminants such as heavy metals and chlorine, the need for reliable water treatment solutions has grown significantly. In addition, stringent government regulations regarding water quality and safety standards are driving the adoption of POE systems in both residential and commercial sectors. The growing focus on health and wellness is also contributing to the surge in demand for these systems.

A major restraint for the point of entry water treatment systems industry is the high initial installation cost, which can be a barrier for many residential consumers. While these systems provide long-term benefits, the upfront investment required for purchasing and installing complex filtration or reverse osmosis systems can be prohibitive. In addition, the ongoing maintenance and replacement of filters or parts can add to the total cost of ownership, particularly for households with budget constraints. These financial considerations can limit the widespread adoption of POE systems in lower-income regions or among cost-sensitive consumers.

The growing trend of smart home integration presents a significant opportunity for the point of entry water treatment systems industry. As consumers increasingly demand home automation solutions, manufacturers have the chance to integrate IoT technology into water treatment systems for real-time monitoring, maintenance alerts, and efficiency optimization. Moreover, the rising global emphasis on sustainability creates an opportunity for developing eco-friendly, energy-efficient systems that minimize water waste and use sustainable materials. With innovations in smart technologies and eco-conscious designs, manufacturers can cater to both the technological and environmental needs of modern consumers.

Technology Insights

Based on technology, the reverse osmosis systems led the market with the largest revenue share of 16.1% in 2024. This system is typically installed at the main entry point of the water supply to residences, offices, and other facilities. As concerns about water quality continue to rise, the demand for point of entry reverse osmosis systems is expected to grow at the fastest CAGR during the forecast period.

Distillation systems have the ability to effectively remove various protozoa, bacteria, and viruses along with chemical contaminants such as sulfate, sodium, nitrate, lead, chromium, cadmium, barium, arsenic, and other organic chemicals. The whole house water distillers are installed at the entry point of water in the home, and distilled water is used for various purposes such as drinking, cooking, cleaning, bathing, laundry, etc.

Application Insights

Based on application, the industrial segment led the market with the largest revenue share of 50.4% in 2024. Point-of-entry water treatment systems are widely utilized across various industries, including food & beverages, healthcare & hospitality, pharmaceuticals, and manufacturing. Industries such as breweries, bottling plants, beverage production, and food processing require high-quality water, making it essential to implement point-of-entry water treatment systems to ensure proper purification before use.

The commercial segment encompasses a wide range of facilities, including small-scale commercial spaces, educational institutions, recreational venues, healthcare facilities, and transport hubs. Point-of-entry water treatment systems are favored for their larger capacity, as they are installed directly at the water inlet, making them ideal for locations that require large volumes of water. These systems are commonly found in large hotels, shopping malls, golf courses, sports arenas, performing arts venues, metro stations, bus terminals, train stations, and similar high-traffic establishments.

Regional Insights

The point of entry water treatment systems market in North America is witnessing a rise in demand driven by increasing concerns over water contamination, particularly in urban areas. Consumers are opting for advanced filtration systems, including reverse osmosis and UV treatment, to ensure safe drinking water.

U.S. Point of Entry Water Treatment Systems Market

The point of entry water treatment systems market in the U.S. is expected to grow at the fastest CAGR of 4.8% from 2025 to 2030. According to the Centers for Disease Control and Prevention (CDC), over 7.1 million Americans contract illnesses linked to contaminated water each year, resulting in approximately 6,630 deaths annually. The economic burden on the healthcare system is estimated at USD 3.3 billion. Hospitals, being primary sources of waterborne infections, are increasingly adopting POE water treatment systems to mitigate these risks.

The Canada point of entry water treatment systems market is expected to grow at a significant CAGR of 4.1% from 2025 to 2030. In Canada, the demand for POE water treatment systems is growing as consumers become more aware of the risks associated with water contamination, especially in rural areas and older urban infrastructures. The adoption of eco-friendly and energy-efficient systems is rising due to government incentives and environmental concerns.

Asia Pacific Point of Entry Water Treatment Systems Market Trends

Asia Pacific point of entry water treatment systems market dominated with the largest revenue share of 36.5% in 2024. The Asia Pacific market is growing rapidly due to increasing industrialization, urbanization, and concerns about water pollution. Countries like China, India, and Japan are driving demand for water treatment systems, particularly in regions with poor water quality.

The point of entry water treatment systems market in China held a significant share in the Asia Pacific market in 2024. The country is experiencing strong demand for point of entry water treatment systems due to rapid industrial growth, urbanization, and increasing water pollution. Consumers and industries are increasingly adopting POE systems to ensure access to clean, safe water amidst rising environmental concerns.

The India point of entry water treatment systems marketis expected to grow at a CAGR of 5.8% from 2025 to 2030. India's market is growing due to the country’s ongoing industrialization, population growth, and widespread water contamination issues. Urban and rural consumers are investing in water treatment solutions that can tackle problems like bacteria, heavy metals, and hard water.

Europe Point of Entry Water Treatment Systems Market Trends

The point of entry water treatment systems market in Europe is expanding, driven by stringent regulations on water quality and consumer demand for safer drinking water. The market is also influenced by rising awareness about contaminants like chlorine, nitrates, and pesticides in tap water. There is an increasing focus on energy-efficient and sustainable water treatment solutions, as well as a rise in the adoption of smart, IoT-integrated systems.

The Germany point of entry water treatment systems market accounted for the market revenue share of 7.0% in the Europe market in 2024. Germany’s market is experiencing growth, particularly due to stringent regulations and a focus on environmental sustainability. The demand for advanced filtration technologies like reverse osmosis and UV purification systems is rising in both residential and industrial sectors.

The point of entry water treatment systems market in the UK is driven by concerns about hard water, chlorine, and other contaminants in public water supplies. There is increasing demand for both residential and commercial filtration systems that can provide cleaner, healthier water. In addition, sustainability and eco-friendly technologies are playing a significant role in shaping market trends, as consumers seek systems that reduce waste and energy consumption.

Middle East & Africa Point of Entry Water Treatment Systems Market Trends

The point of entry water treatment systems market in the Middle East and Africa is expanding due to water scarcity issues, pollution, and the rising demand for clean water. Countries like the UAE, Saudi Arabia, and South Africa are investing in advanced water treatment solutions, particularly in urban and industrial areas. There is a growing trend toward the adoption of energy-efficient and sustainable water treatment systems that can address both contamination and water scarcity.

The Saudi Arabia point of entry water treatment systems market is growing rapidly due to the country’s extreme climate, water scarcity, and industrial development. The government’s focus on improving water quality and ensuring a sustainable water supply is driving the adoption of advanced filtration systems. There is increasing demand for smart, energy-efficient water treatment solutions, particularly in residential and commercial sectors.

Latin America Point of Entry Water Treatment Systems Market Trends

The point of entry water treatment systems market in Latin America is gaining traction as consumers seek better solutions to address water quality issues, such as contamination and pollution. Countries like Brazil, Mexico, and Argentina are experiencing increased demand for filtration systems in both residential and commercial sectors. The trend toward eco-friendly and sustainable systems is growing, with consumers preferring solutions that reduce waste and minimize energy consumption.

The Brazil point of entry water treatment systems market is expanding due to growing concerns about water contamination from industrial activities, pollution, and poor infrastructure. With rising awareness about waterborne diseases, there is increasing demand for advanced filtration systems, including reverse osmosis and UV treatment.

Key Point of Entry Water Treatment Systems Company Insights

Some of the key players operating in the market include 3M, DuPont, Pentair plc, and BWT Holding GmbH.

-

DuPont, through its business segment, the Safety & construction segment, offers a wide range of products, including water purification technology. Its product lines FilmTec, Amber, TapTec, and MEMCOR offer products for water treatment systems.

-

Pentair plc is a U.S.-based company, that operates through three business segments, namely Aquatic systems, Filtration solutions, and Flow Technologies. Its product offering includes water softeners and whole house systems for water treatment.

Aquasana Inc., EcoWater Systems LLC, and Calgon Carbon Corporation. are some of the emerging market participants in the point of entry water treatment systems industry.

-

Aquasana Inc. is a manufacturer of water filtration systems which include whole-house water treatment systems, under-counter filters, countertop water filters, salt-free water conditions, replacement filters, etc.

-

Calgon Carbon Corporation’s product portfolio includes a wide range of products, including granular activated carbon, powdered activated carbon, activated carbon cloth, pelletized activated carbon, and ultraviolet (UV) technologies.

Key Point of Entry Water Treatment Systems Companies:

The following are the leading companies in the point of entry water treatment systems market. These companies collectively hold the largest market share and dictate industry trends:

- 3M

- DuPont

- Pentair plc

- BWT Holding GmbH

- Culligan

- Watts

- Aquasana, Inc.

- Calgon Carbon Corporation

- EcoWater Systems LLC

- GE Appliances

Recent Developments

-

In February 2025, GE Appliances, a Haier company, Air & Water Solutions, unveiled an advanced water filtration solution as part of its GE Profile lineup. The GE Profile Smart Water Valve with Integrated Filtration delivers cleaner, clearer water throughout the home, while offering homeowners enhanced peace of mind with built-in leak detection and remote water shutoff capabilities, all conveniently controlled through a smartphone app.

-

In January 2024, Culligan completed the acquisition of the majority of Primo Water Corporation’s operations in the EMEA region, excluding Portugal, UK, and Israel. This strategic move strengthens the company’s presence in 12 countries where it already operates and marks its expansion into new markets in Poland, Lithuania, Latvia, and Estonia.

Point of Entry Water Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.56 billion

Revenue forecast in 2030

USD 13.42 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; Poland; Croatia; China; Japan; Taiwan; Indonesia; India; Australia; Brazil; Argentina; Saudi Arabia; and UAE

Key companies profiled

3M; DuPont; Pentair plc; BWT Holding GmbH; Culligan; Watts; Aquasana, Inc.; Calgon Carbon Corporation; EcoWater Systems LLC; GE Appliances.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point of Entry Water Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of entry water treatment systems market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Reverse osmosis systems

-

Water softeners

-

Disinfection methods

-

Filtration methods

-

Sediment Filters

-

Granular Activated Carbon (GAC) Filters

-

Carbon Block Filters

-

Ion Exchange Filters

-

-

Distillation Systems

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Offices

-

Hotels

-

Restaurants

-

Café

-

Hospitals

-

Schools

-

Other

-

-

Industrial

-

Food & Beverage

-

Electronics & Semiconductor Manufacturing

-

Pharmaceuticals & Biotechnology

-

Chemical & Petrochemical

-

Power Generation

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

Poland

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The point of entry water treatment systems market size was estimated at USD 10.17 billion in 2024 and is expected to be USD 10.56 billion in 2025.

b. The point of entry water treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 13.42 billion by 2030.

b. Reverse osmosis systems technology held significant share of the market and accounted for a share of 16.1% in 2024. This system is typically installed at the main entry point of the water supply to residences, offices, and other facilities. As concerns about water quality continue to rise, the demand for point of entry reverse osmosis systems is expected to grow in the coming year.

b. Some of the key players operating in the point of entry water treatment systems market include 3M, Dupont, Pentair plc, BWT Holding GmbH, Culligan, Watts, Aquasana, Inc., Clagon Carbon Corporation, EcoWater Systems LLC, and GE Appliances.

b. The growth of the market is anticipated to be propelled by the increasing water stress regions, rising government initiatives and regulations & policies to facilitate the use of water treatment solutions, and increasing concentration of emerging pollutants in the water bodies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.