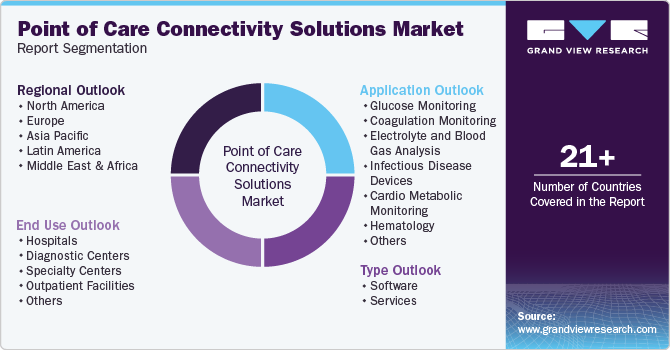

Point Of Care Connectivity Solutions Market Size, Share & Trends Analysis Report By Type (Software, Services), By Application, By End Use (Hospitals, Diagnostic Centers, Specialty Centers, Outpatient Facilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-455-7

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

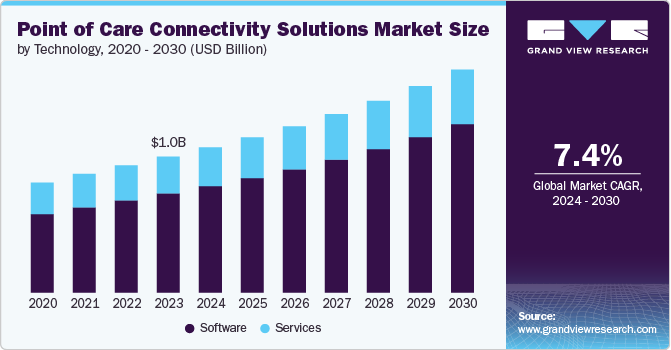

The global point of care connectivity solutions market was estimated at USD 1.02 billion in 2023 and is projected to grow at a CAGR of 7.40% from 2024 to 2030. The market growth is driven by several factors, including the growing need for real-time data integration from medical devices to electronic health records (EHRs), which enhances patient care and decision-making.

Technological advancements, such as integrating POC devices with cloud-based platforms, are improving healthcare efficiency, while government initiatives promoting medical device integration with health IT systems support market growth. In addition, healthcare facilities focus on reducing costs and improving operational efficiency, which drives the adoption of POC connectivity solutions.

The COVID-19 pandemic accelerated the adoption of remote patient monitoring and telemedicine, highlighting the need for seamless data connectivity between patients and healthcare providers. POC connectivity solutions enable the continuous transmission of vital health data from patients' wearable devices and home monitors to healthcare professionals in real-time, facilitating timely interventions. This shift has been crucial for managing chronic conditions remotely and expanding access to care through telemedicine. The reliance on these solutions has driven the growth of the POC connectivity market as healthcare providers seek more efficient and secure ways to manage patient care remotely.

The increasing adoption of EHRs significantly contributes to the market growth by enabling seamless patient data integration across healthcare settings. EHR systems centralize a patient's medical history, diagnoses, medications, and test results, making real-time access to this information essential for clinicians to make informed decisions. POC connectivity solutions allow medical devices and diagnostic tools to transmit data directly into EHRs, streamlining workflows and enhancing the accuracy of patient records.

As healthcare systems increasingly digitize, the demand for interoperable systems capable of integrating medical devices with EHR platforms is driving the growth of POC connectivity solutions. This integration optimizes workflows by automating data transfer, reducing manual input, and minimizing errors. It also enhances care coordination, particularly in complex environments such as hospitals and diagnostic centers. Furthermore, government regulations and incentives promoting EHR adoption are accelerating the need for real-time data exchange between medical devices and digital records, further supporting the expansion of POC connectivity solutions in the healthcare sector.

Case Study Insights: Digitalizing Healthcare Across Queensland, Australia

Title: Digitalizing Healthcare Across Queensland, Australia

Challenge: Managing a vast, rural healthcare network with over 250 sites, Queensland Health faced difficulties ensuring quality control, training operators, and effectively utilizing POCT devices in remote areas.

Solution: Queensland Health implemented Siemens' POCcelerator Data Management System to remotely manage operator training, track device usage, and integrate diverse POCT systems.

Result:

-

Improved quality control and testing accuracy.

-

Reduced operator errors through centralized remote management.

-

Enhanced efficiency in managing POCT devices across multiple locations.

-

Increased access to healthcare services, particularly in remote areas.

-

Achieved a 5% increase in cost recovery through reimbursement for testing services.

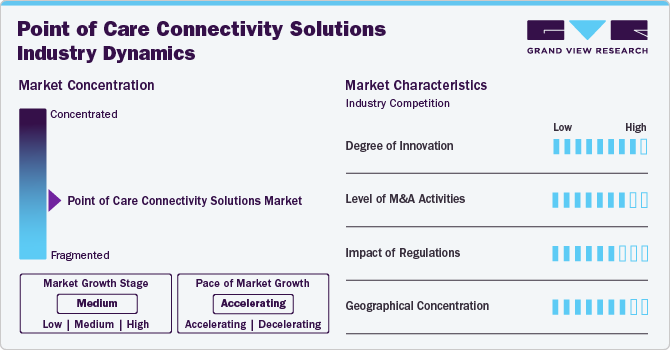

Market Concentration & Characteristics

The degree of innovation in the POC connectivity solutions industry is high. Technological advancements in point-of-care (POC) connectivity solutions enable seamless data integration between POC devices and EHR. Innovations in wireless technology and cloud-based platforms facilitate real-time data sharing and remote monitoring, while AI-powered analytics improve diagnostic accuracy. Enhanced security measures safeguard patient data privacy, resulting in more efficient workflows and improved clinical decision-making.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in January 2021, Koninklijke Philips N.V. announced its plan to acquire Capsule Technologies, Inc., a key player in the POC connectivity solutions industry. The strategic move expanded the presence of Koninklijke Philips N.V. in the POC connectivity solutions industry.

The regulatory framework for the POC connectivity solutions industry is shaped by guidelines ensuring data security, device interoperability, and compliance with healthcare standards such as HIPAA and GDPR. Regulatory bodies like the FDA, EMA, and regional health authorities oversee the approval and integration of POC devices into healthcare systems. These frameworks require adherence to standards like the CLSI POCT1-A2 for seamless connectivity. In addition, regulations emphasize patient data privacy and the secure exchange of diagnostic information across healthcare platforms.

Geographical expansion drives market growth by broadening market reach and increasing adoption in emerging regions. It allows providers to address diverse healthcare needs and regulatory environments, fostering innovation and tailored solutions. Expanding into new regions also opens opportunities for partnerships and collaborations, enhancing market penetration. In addition, it helps address global disparities in healthcare access and quality.

Type Insights

Based on type, the software segment led the market with the largest revenue share of 72.97% in 2023. The growth is attributed to its role in integrating multiple devices, enabling seamless data exchange with healthcare systems like EMRs, LISs, and other platforms. Software solutions also enhance workflow automation, data security, and remote device management, which are critical for efficient POC operations. These factors drive higher demand, encouraging market players to develop solutions to meet the growing demand. For instance, in May 2024, BroadcastMed launched Conexiant, a unified platform combining content from Digitell, Aegis, Harborside, Texere Publishing, PentaVision, and BroadcastMed. This consolidation creates a centralized clinical connectivity and knowledge-sharing network, integrating trusted medical content and engagement. Conexiant aims to enhance interdisciplinary access and foster continuous professional development within the healthcare community.

The services segment is expected to grow at a significant CAGR over the forecast period. The growth is attributed to the increasing demand for comprehensive system integration, maintenance, training, and consulting support. Healthcare providers rely on these services to ensure seamless device connectivity, data management, and compliance with regulatory standards. Hence, various market players offer these services in their product portfolio. For instance, NXGN Management, LLC. offers Mirth Connect Training and Certification to skillfully operate Mirth Connect from the comfort of home.

Application Insights

Based on application, the hematology segment led the market with the largest revenue share of 16.78% in 2023. The market growth is due to the high demand for real-time blood analysis to diagnose and manage conditions like anemia and leukemia. Quick turnaround for hematology tests is crucial for timely treatment, driving the need for seamless connectivity with laboratory systems. For instance, NHS England reports 130 million hematology tests annually, while in the U.S., 2 billion blood tests are performed each year, influencing 80% of medical decisions in hospitals and primary care settings. Furthermore, advancements in portable hematology devices and the increasing prevalence of blood-related disorders have further contributed to the segment's prominence in the market.

The glucose monitoring segment is expected to grow at a significant CAGR over the forecast period. The growth is driven by the rising prevalence of diabetes and the increasing demand for continuous glucose monitoring systems. For instance, an article from the University of Alabama at Birmingham, published in March 2023, reported approximately 2.4 million users of continuous glucose monitors in the U.S., with millions more globally. This growing adoption highlights the expanding need for real-time monitoring solutions to improve diabetes management.

Connectivity solutions offer real-time data integration with healthcare systems, enhancing patient management and enabling timely interventions. In addition, advancements in wearable devices and remote monitoring technology make glucose monitoring more accessible, driving adoption among both patients and healthcare providers for improved outcomes and better disease management.

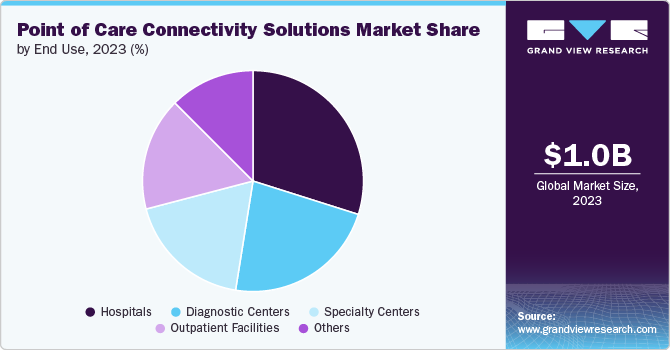

End-use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 29.88% in 2023. The hospital segment dominated the market due to hospitals' need for seamless integration of POC devices with centralized systems like EMRs, LISs, and HISs. Hospitals require real-time access to diagnostic data for immediate decision-making, improved patient outcomes, and streamlined workflows. In addition, the high patient volume and complexity of care in hospital settings drive the adoption of connectivity solutions to manage multiple devices and ensure data accuracy, compliance, and security across various departments.

The diagnostic centers segment is expected to grow at a significant CAGR over the forecast period. The segment growth is attributed to the increasing demand for efficient diagnostic services outside hospitals. These centers often require advanced connectivity solutions to streamline operations, manage diverse diagnostic devices, and ensure real-time integration with healthcare information systems. Furthermore, the growing demand for early diagnosis drives the need for connectivity solutions that enhance workflow efficiency and improve patient outcomes in diagnostic centers.

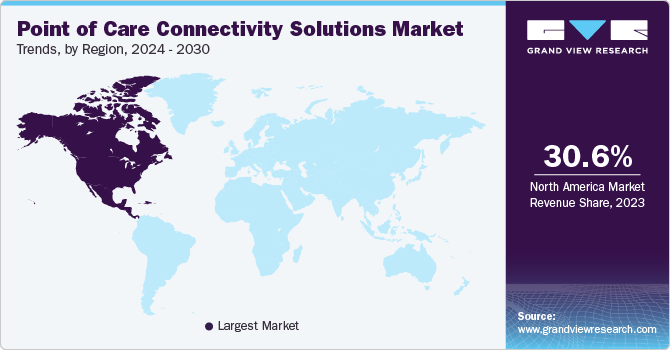

Regional Insights

North America dominated the point of care (POC) connectivity solutions market with the largest revenue share of 30.63% in 2023. The market growth is driven by advancements in healthcare technology and the increasing adoption of electronic health records (EHRs). The emphasis on value-based care and improving patient outcomes propels the demand for efficient and integrated diagnostic solutions. The expansion of telemedicine and remote monitoring capabilities also supports market growth. In addition, integrating cloud services with healthcare facilities further fuels the adoption of POC connectivity solutions. For instance, the HIPAA Journal reported in September 2023 that healthcare organizations utilized an average of 19 public cloud services in 2019, which increased to 24 services by 2022.

U.S. Point of Care Connectivity Solutions Market Trends

The point of care connectivity solutions market in the U.S. accounted for the largest market share in North America in 2023. The market growth is driven by the increasing prevalence of chronic diseases, particularly diabetes, requiring continuous monitoring. Moreover, advancements in healthcare IT infrastructure and the growing demand for real-time data integration across Electronic Medical Records (EMRs) drive the adoption. The shift toward remote patient management and home care solutions further accelerates the market, alongside favorable regulatory policies supporting connectivity solutions in healthcare settings.

Europe Point of Care Connectivity Solutions Market Trends

The point of care connectivity solutions market in Europe is growing significantly. The market growth in Europe is driven by the increasing demand for real-time data access and integration, which improves patient outcomes through timely diagnostics. Advances in cloud integration enhance data accessibility and management within healthcare facilities, supporting efficient decision-making and streamlined operations. Regulatory support and a focus on reducing healthcare costs also expand the market.

The UK point of care connectivity solutions market is fueled by the push for digital transformation in healthcare to enhance patient care and operational efficiency. Adopting cloud-based technologies within healthcare facilities facilitates seamless data integration and real-time access to patient information. Increased government investment in healthcare infrastructure and emphasis on personalized medicine are key drivers.

Asia Pacific Point of Care Connectivity Solutions Market Trends

The point of care connectivity solutions market in the Asia Pacific is expected to exhibit at the fastest CAGR over the forecast period. The market growth is driven by the rapid expansion of healthcare infrastructure and increasing healthcare spending across the region. One of the significant growth factors is the rising demand for efficient and accessible diagnostic solutions driven by large and diverse populations. Advancements in cloud technology enhance data management and connectivity within healthcare settings. In addition, government initiatives and investments in healthcare digitization support market growth. The prevalence of chronic diseases further accelerates the need for effective POC solutions.

The India point of care (POC) connectivity solutions market is driven by various government initiatives. For instance, in January 2023, the National Health Authority's (NHA) incentives for digital health records. The NHA offered up to Rs 40 million (approximately USD 500,000) to healthcare facilities, diagnostic centers, and digital solution providers based on creating and linking digital health records to the Ayushman Bharat Health Account. This initiative, part of the Ayushman Bharat Digital Mission (ABDM) program, aims to enhance India's digital health ecosystem by fostering connections among health stakeholders and developing a comprehensive digital platform with registries, unique health identities, and universal access to health services.

Key Point of Care Connectivity Solutions Company Insights

Some of the prominent market players in the global market include F. Hoffmann-La Roche Ltd.; Siemens Healthineers ; Abbott; GE HealthCare; NXGN Management, LLC.; and EKF Diagnostics Holdings plc, among others. The companies undertake several strategic initiatives to grow and sustain in the market.

Key Point of Care Connectivity Solutions Companies:

The following are the leading companies in the point of care connectivity solutions market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers

- Abbott

- GE HealthCare

- Masimo

- Capsule Technologies, Inc. (Koninklijke Philips N.V.)

- Spacelabs Healthcare (OSI Systems, Inc.)

- Honeywell International Inc

- NXGN Management, LLC.

- EKF Diagnostics Holdings plc

Recent Developments

-

In February 2023, EKF Diagnostics participated in Medlab Middle East 2023 in Dubai. At the event, the company presented EKF Link, a centralized platform for managing point-of-care (POC) analyzers and data integration. This solution enhances the efficiency of POC testing by enabling seamless device management and data sharing across healthcare systems

-

In May 2022, EKF Diagnostics launched its POC Connect middleware solution to improve data connectivity between POC testing devices and healthcare systems. POC Connect facilitates seamless integration of diagnostic instruments with laboratory information systems (LIS) and electronic medical records (EMR), ensuring real-time transfer of patient data

Point of Care Connectivity Solutions Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.09 billion |

|

Revenue forecast in 2030 |

USD 1.68 billion |

|

Growth rate |

CAGR of 7.40% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

F. Hoffmann-La Roche Ltd.; Siemens Healthineers; Abbott; GE HealthCare; Masimo; Capsule Technologies, Inc. (Koninklijke Philips N.V.); Spacelabs Healthcare (OSI Systems, Inc.); Honeywell International Inc; NXGN Management, LLC.; EKF Diagnostics Holdings plc |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Point of Care Connectivity Solutions Market Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global point of care (POC) connectivity solutions market report based on type, application, end use, and region:

-

Type Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Application Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Glucose Monitoring

-

Coagulation Monitoring

-

Electrolyte and Blood Gas Analysis

-

Infectious Disease Devices

-

Cardio metabolic Monitoring

-

Hematology

-

Others

-

-

End Use Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Specialty Centers

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global point of care connectivity solutions market size was estimated at USD 1.02 billion in 2023 and is expected to reach USD 1.09 billion in 2024.

b. The global point of care connectivity solutions market is expected to grow at a compound annual growth rate of 7.40% from 2024 to 2030 to reach USD 1.68 billion by 2030.

b. North America dominated the PoC connectivity solutions market with a share of 28.9% in 2019. The market growth is driven by advancements in healthcare technology and the increasing adoption of electronic health records (EHRs). In addition, the emphasis on value-based care and improving patient outcomes propels the demand for efficient and integrated diagnostic solutions.

b. Some key players operating in the point of care connectivity solutions market include F. Hoffmann-La Roche Ltd.; Siemens Healthineers; Abbott; GE HealthCare; Masimo; Capsule Technologies, Inc. (Koninklijke Philips N.V.); Spacelabs Healthcare (OSI Systems, Inc.); Honeywell International Inc; NXGN Management, LLC.; EKF Diagnostics Holdings plc.

b. Key factors that are driving the market growth include including the growing need for real-time data integration from medical devices to electronic health records (EHRs), which enhances patient care and decision-making. Technological advancements, such as integrating POC devices with cloud-based platforms, are improving healthcare efficiency, while government initiatives promoting medical device integration with health IT systems support market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."