- Home

- »

- Medical Devices

- »

-

Podiatry Chairs Market Size, Share And Trends Report, 2030GVR Report cover

![Podiatry Chairs Market Size, Share & Trends Report]()

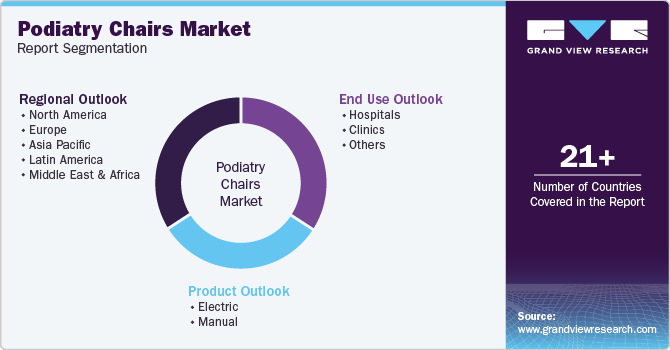

Podiatry Chairs Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Manual, Electric), By End Use (Hospitals, Clinics, Others) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-419-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Podiatry Chairs Market Summary

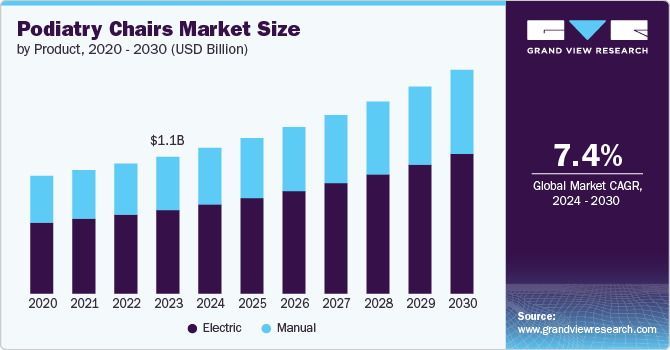

The global podiatry chairs market size was estimated at USD 1.1 billion in 2023 and is projected to reach USD 1.8 billion by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The increasing prevalence of foot disorders, technological advancements in podiatry chairs, rising demand for diabetic foot care, and the increased focus on foot health awareness are factors boosting market growth.

Key Market Trends & Insights

- North America dominated the podiatry chairs market with a share of 34.5% in 2023.

- The U.S. accounted for the largest share of North America's podiatry chairs market 2023.

- By product, the electric segment held the largest share of over 61.0% in 2023.

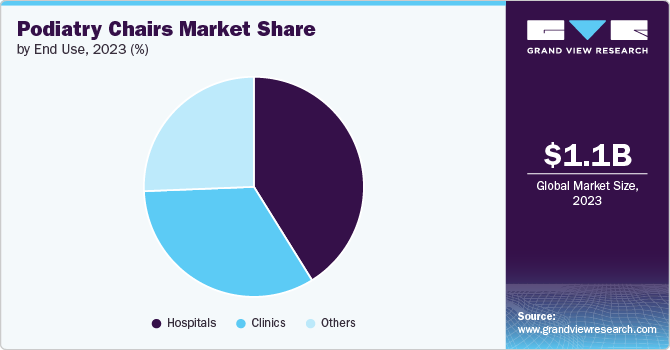

- By end use, the hospitals segment held the largest share of over 41.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.1 Billion

- 2030 Projected Market Size: USD 1.8 Billion

- CAGR (2024-2030): 7.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to an article published by AGS Health in Aging Foundation in February 2023, foot pain is a significant issue that can hinder mobility, leading to complications such as weight gain, muscle weakness, and weakening heart health. It’s estimated that up to 87% of people experience foot pain at some point in their lives due to various causes. Among older adults, about one-third suffer from foot pain, stiffness, or aching feet.

Rising demand for diabetic foot care fuels the growth of the market. According to the American Medical Association article published in November 2023, diabetic foot ulcers are a common complication for individuals with type 1 or type 2 diabetes, affecting about one-third of diabetic patients over their lifetime. Globally, around 18.6 million people, including 1.6 million in the U.S. each year, suffer from these ulcers. With nearly half of these ulcers becoming infected and around 20% of those infections leading to partial or full foot amputations, the demand for specialized diabetic foot care is on the rise. This growing need is driving the market for podiatry chairs, as healthcare providers seek advanced equipment to effectively manage and treat diabetic foot conditions.

Adherence to recommended foot care practices is critical for individuals with diabetes. Yet studies have shown that many patients fall short in this area, leading to potentially severe complications. According to the NCBI article published in October 2023, research indicates that about 44.3% of diabetic individuals do not adequately follow the advised foot care routines. This lack of adherence can contribute to the development of serious issues such as infections, ulcers, and even amputations. The findings highlight a significant gap in the management of diabetic foot care, emphasizing the urgent need for continuous education and support. These aspects drive the demand for the podiatry chairs market.

Number of Podiatrists in the U.S.

State/Territory

Number of licensed podiatrists (August, 2022)

Alabama

166

California

2,260

Florida

2,096

Illinois

1,169

New Jersey

1,220

New York

2,448

Ohio

1,011

Pennsylvania

1,504

Texas

1,152

Total USA

22,868

Increased focus on foot health awareness drives the growth of the market. According to the Whittier Street Health Center article, April 2024 marks National Foot Health Awareness Month, an initiative by the American Podiatric Medical Association (AMPA) to emphasize the importance of maintaining good foot health. This campaign highlights that foot health is crucial for well-being and an active lifestyle. With growing awareness of the need for proper footwear and foot care practices, more people seek professional advice for foot-related issues. As awareness rises, the demand for podiatric services and equipment, such as specialized podiatry chairs, is expected to increase, driving market growth.

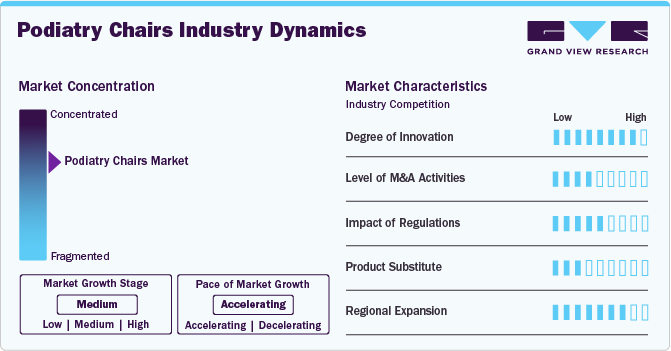

Market Concentration & Characteristics

The market is witnessing a high degree of innovation, with companies introducing devices that enhance patient comfort, accessibility, and treatment efficiency. Modern podiatry chairs now feature electric and hydraulic adjustments, ergonomic designs, and integrated technology to improve the precision and ease of podiatric procedures. These innovations are not only improving patient outcomes but also streamlining workflows for healthcare providers, making them a key driver of market growth.

Several market players, such as Angelus Medical and Optical, Medline, and Midmark Corporation, are involved in merger and acquisition activities. Through M&A activity, these companies employ key strategies such as type innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive cardiovascular interventions.

Regulations significantly impact the podiatry chairs market. Compliance with stringent healthcare standards, such as FDA approval in the U.S. or CE marking in Europe, impacts the design, manufacturing, and distribution of podiatry chairs. These regulations drive manufacturers to invest in research and development to meet the required standards, which can lead to higher costs but also foster innovation and improved product quality. Non-compliance, result in penalties, recalls, and damage to brand reputation, making adherence to regulations essential for market players.

There are currently no direct substitutes. Potential substitutes include multi-purpose examination chairs and adjustable treatment tables used in various medical settings. These alternatives can sometimes be adapted for podiatric use, especially in smaller clinics with budget constraints. However, they may lack the specialized features and ergonomic design of dedicated podiatry chairs, such as precise positioning capabilities and enhanced patient comfort, which are critical for effective podiatric care. The availability of these substitutes can affect the demand for specialized podiatry chairs, particularly in cost-sensitive markets.

Market players in the podiatry chairs sector are increasing their reach by exploring new geographic regions, establishing strategic alliances with local distributors, and customizing their products to meet the unique healthcare needs of different areas.

Product Insights

The electric segment held the largest share of over 61.0% in 2023 due to technological advances, strategic initiatives by key players, and increasing foot disorders. Electric chairs offer advanced features and greater flexibility, allowing for easy height adjustment, backrest, and leg support with the push of a button. They provide enhanced comfort for both the practitioner and the patient and are favored in clinics prioritizing convenience, efficiency, and patient experience. For instance, in April 2021, Tronwind introduced the TEP04 electric podiatry chair, featuring motorized multi-functionality that enables effortless height adjustment at the touch of a button. The chair's independent adjustment capabilities streamline treatment, enhancing patient and healthcare staff comfort. In addition, durable upholstery ensures maximum comfort for patients throughout their treatment.

The manual segment is expected to show lucrative growth during the forecast period. Manual podiatry chairs are often more affordable than their electric counterparts, making them a preferred choice for small and medium-sized clinics operating on tighter budgets. These clinics prioritize cost-effective solutions while still requiring reliable equipment for routine podiatric treatments. For instance, manual podiatry chairs are sufficient for clinics and hospitals that offer basic foot care services, such as toenail trimming, callus removal, and other non-invasive treatments. Their simplicity meets the needs of providers who do not require the advanced features of electric chairs.

End Use Insights

The hospitals segment held the largest share of over 41.1% in 2023. Hospitals are seeing an uptick in patients with complex foot conditions, such as diabetic foot ulcers, severe arthritis, and vascular issues, which require advanced treatment options. This trend drives the demand for high-quality podiatry chairs that can accommodate specialized procedures in hospital settings. For instance, in February 2024, with a growing number of patients referred for surgical treatment of foot and ankle conditions, hospitals are facing increased demand for specialized podiatric care. This has led to a greater need for advanced podiatry chairs in hospitals to accommodate the rising volume of surgeries. Workforce shortages among orthopedic surgeons and long hospital waiting lists are leading to delays in surgical care. As a result, hospitals are investing in podiatry chairs to improve the efficiency and capacity of their podiatric surgical services, helping to manage patient flow and reduce waiting times.

The clinics segment is expected to show lucrative growth during the forecast period. The growth of private podiatry clinics, driven by an increase in foot health awareness and demand for specialized care, is a significant market driver. Clinics are investing in modern podiatry chairs that offer enhanced comfort and functionality to improve patient care and attract more clients. According to the NCBI article published in December 2023, clinics increasingly offer non-invasive and preventative foot care services, which are becoming popular among patients seeking early intervention and routine check-ups. To meet this demand, clinics are equipping their facilities with state-of-the-art podiatry chairs that provide comfort and ease of use for both practitioners and patients.

Regional Insights

North America dominated the podiatry chairs market with a share of 34.5% in 2023, owing to the rising cases of foot disorders, increasing prevalence of diabetic foot ulcers (DFU), product launches, regulatory approvals, and advanced healthcare infrastructure drives the demand for podiatry chairs in North America. According to the American Diabetes Association article published in January 2024, out of 144,564 individuals with diabetes who were treated, 2,252 cases were complicated by infections resulting from diabetic foot ulcers (DFUs). This high incidence of DFU infections highlights the increasing need for specialized podiatric care, which in turn boosts the demand for advanced podiatry chairs in healthcare facilities.

U.S. Podiatry Chairs Market Trends

The U.S. accounted for the largest share of North America's podiatry chairs market 2023. The key factors for the market's growth are the increasing prevalence of foot cases and related conditions and the high incidence of foot injuries in sports in the U.S. drives the market's growth. According to the Medscape article published in October 2023, 15% of sports-related injuries are estimated to affect the foot alone. This statistic highlights the significant proportion of athletic injuries involving the foot, emphasizing the need for effective foot care and treatment solutions in sports medicine.

Europe Podiatry Chairs Market Trends

The podiatry chairs market in Europe held the second-largest revenue market share in 2023. This can be attributed to the increasing number of foot injuries in sports and diabetic foot care cases. The podiatry chairs market dominated the Europe region in 2023. The factors contributing to this large share are the presence of key market players, rising diabetic foot care disorders, and advanced healthcare infrastructure. According to the Booking health article published in June 2024, 25% of patients in Germany are affected by diabetic foot conditions. This significant prevalence underscores the critical need for targeted care and management strategies for diabetic foot issues, highlighting the importance of specialized treatment and preventive measures within the healthcare system.

The UK podiatry chairs market held the second-largest market share in 2023. The rise in foot disorders and the increasing diabetic foot care highlight the need for continued innovation and healthcare technology advancements to reduce this trend effectively. According to a JMIR research protocols article published in January 2024, over 4.3 million people are affected by diabetes in the UK. Among these individuals, between 19% and 34% are likely to develop diabetic foot ulcers (DFUs) at some point in their lives. These ulcers can sometimes progress to severe conditions requiring amputation, highlighting the critical need for effective management and preventive strategies for diabetic foot complications.

The podiatry chairs market in France is anticipated to witness a significant CAGR over the forecast period. The rising number of foot disorders and increased demand for podiatry chairs are boosting the market's growth. According to the NCBI article published in October 2023, France reported 3,403 cases of hand, foot, and mouth disease (HFMD), representing a 47% increase compared to 2018-2019. This rise in HFMD cases highlights a growing need for effective foot care solutions, driving demand for specialized podiatry chairs in the French healthcare market.

Asia Pacific Podiatry Chairs Market Trends

The Asia Pacific region is expected to grow fastest during the forecast period. Growing research and development (R&D) investments, rising foot disorders, and technological advancements in diabetic foot care are significant market expansion drivers. For instance, in March 2024, In Singapore, researchers introduced a mobile application named WellFeet designed to educate diabetic patients about diabetic foot ulcers and self-care techniques. The app features animations in multiple languages and includes tools for tracking medication and physical activity. This development underscores the growing role of technology in enhancing foot health awareness and supporting better self-care practices among individuals with diabetes in the Asia Pacific region.

The Japan podiatry chairs market held the largest market share in the Asia Pacific region. The rising foot disorders, rising demand for diabetic foot care, increased focus on foot health awareness, and technological advancements. For instance, in April 2022, Juntendo University launched Japan's inaugural Foot Disease Center, marking a significant advancement in the integration of multiple medical specialties to tackle foot health comprehensively. The center is dedicated to educating both healthcare professionals and the public about foot diseases, highlighting the critical role of maintaining foot health as an essential component of overall well-being.

The podiatry chairs market in China held second largest share in 2023 due to the increasing prevalence of foot disorders and the high incidence of diabetic foot conditions among adults in China. According to the John Wiley & Sons, Inc. article published in March 2023, in China, approximately 116.4 million adults live with diabetes. Of these individuals, the incidence of diabetic foot conditions (DF) is notably high, affecting around 30% of this population. This significant prevalence underscores the urgent need for effective foot care solutions and highlights the importance of targeted interventions to manage and prevent diabetic foot complications.

The India podiatry chairs market is experiencing significant growth, driven by several key factors: increasing prevalence of foot disorders, rising prevalence of diabetic foot care, and expanding healthcare infrastructure. According to an article published in John Wiley & Sons, Inc. in March 2024, Population-based studies reveal that the annual incidence of diabetic foot ulcers (DFUs) ranges from 1% to 4.1%, with prevalence rates between 4.5% and 10%. Over a lifetime, up to 25% of individuals with diabetes may develop DFUs. In India, this statistic is particularly concerning, as 25% of people with diabetes experience DFUs, with 50% of these cases leading to infections that necessitate hospitalization. In addition, 20% of DFU cases may progress to the point where amputation is required, highlighting the critical need for effective prevention and treatment strategies.

Latin America Podiatry Chairs Market Trends

The Latin American podiatry chairs market is growing due to several factors. The growing awareness about cardiovascular-related mortality & increasing regulatory frameworks and support fuels the market's growth.

The Brazil podiatry chairs market is expanding due to several distinct growth drivers. Rising demand for diabetic foot care and increased focus on foot health awareness. For instance, in September 2023, In Brazil, the population affected by diabetes is substantial, with estimates indicating that between 9.1 million and 26.1 million individuals may develop diabetic foot ulcers annually. This concerning statistic underscores the pressing need for enhanced diabetic foot care services to address and manage these potentially severe complications effectively.

The Middle East & Africa Podiatry Chairs Market Trends

The MEA podiatry chairs market is expected to grow at a lucrative rate, driven by the rising prevalence of foot disorders and the increased focus on foot health awareness in the region.

The South African podiatry chairs market dominated the MEA region in 2023. Increasing foot disorder cases, increased focus on foot health awareness, rising healthcare expenditure, and the increasing number of hospitals in the country contribute to the market expansion. According to the South African Journal of Science article published in March 2024, in South Africa's public healthcare sector, 28% of diabetic patients visit primary healthcare clinics with diabetic foot ulcers (DFUs). These ulcers frequently present in advanced stages of severity, indicating a significant need for improved early detection and management strategies within the healthcare system.

Key Podiatry Chairs Company Insights

Some of the key players operating in the industry include Medtronic, Abbott, and Boston Scientific Corporation. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Lepu Medical and Microport Scientific Corporation are some of the emerging players in podiatry chairs.

Key Podiatry Chairs Companies:

The following are the leading companies in the podiatry chairs market. These companies collectively hold the largest market share and dictate industry trends.

- Angelus Medical and Optical

- Medline

- Midmark Corporation

- Hill Laboratories

- ARIA Chairs

- Soma Tech Intl.

- Lemi MD

- Gharieni Group

- TitanMed

- Namrol Medical S.L.

Recent Developments

-

In January 2024, Atrium Health Wake Forest Baptist has launched a new clinic in Kernersville, specializing in orthopaedics, sports medicine, and podiatry. This new facility aims to provide comprehensive care for musculoskeletal and foot health issues, enhancing accessibility to specialized treatment in the region.

-

In October 2022, Aria Care Partners, a top provider of integrated medical services for skilled nursing facilities, recently acquired PrevMed, Mission Dental, and Perspective Vision Care (PVC). These acquisitions will enable Aria Care Partners to expand access to dental, audiology, optometry, and podiatry care for more residents and families.

-

In October 2022, Gharieni Group has acquired Bentlon, a Dutch company known for manufacturing high-end beauty equipment specializing in podiatry, cosmetics, and wellness.

Podiatry Chairs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.2 billion

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Angelus Medical and Optical; Medline; Midmark Corporation; Hill Laboratories; ARIA Chairs; Soma Tech Intl.; Lemi MD; Gharieni Group; TitanMed; Namrol Medical S.L.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Podiatry Chairs Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global podiatry chairs market report on the basis of product, end use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Manual

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global podiatry chairs market size was estimated at USD 1.1 billion in 2023 and is expected to reach USD 1.2 billion in 2024.

b. The global podiatry chairs market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 1.8 billion by 2030.

b. North America dominated the podiatry chairs market with a share of 34.6% in 2023. This is attributable to the growing diabetes cases, increasing adoption of advanced podiatry chairs, and rising disabled population.

b. Some of the players operating in this market are Angelus Medical and Optical, Medline, Midmark Corporation, Hill Laboratories, ARIA Chairs, Soma Tech Intl., Lemi MD, Gharieni Group, TitanMed, and Namrol Medical S.L.

b. Key factors that are driving the podiatry chairs market growth include the increasing prevalence of foot disorders, technological advancements in podiatry chairs, rising demand for diabetic foot care, and the increased focus on foot health awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.