- Home

- »

- Next Generation Technologies

- »

-

Pocket Printer Market Size, Share And Trends Report, 2030GVR Report cover

![Pocket Printer Market Size, Share & Trends Report]()

Pocket Printer Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Inkjet, Thermal, Impact), By Application (Healthcare, Retail, Telecom), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pocket Printer Market Size & Trends

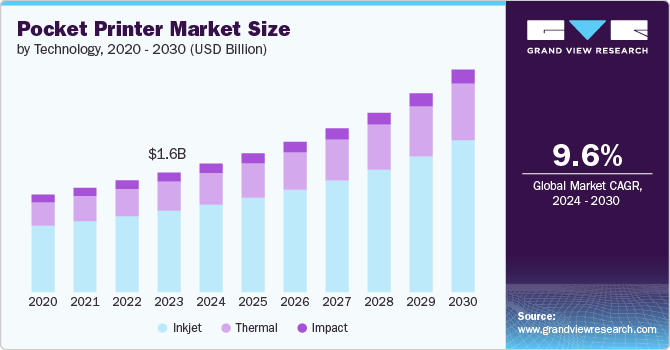

The global pocket printer market size was estimated at USD 1.62 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030. Compact and portable devices, including pocket printers designed for on-the-go printing, have witnessed increasing demand driven by several key market drivers. One of the primary factors contributing to their popularity is the growing trend towards mobility and convenience in the workplace and personal lifestyles. These printers cater to professionals and consumers who require the ability to print documents, photos, and labels directly from their mobile devices without the constraints of traditional desktop printers.

Additionally, the growth of the consumer electronics and gadgets market further fuels innovation in pocket printer technology. Manufacturers continually improve features such as battery life, print speed, connectivity options, and compatibility with a wide range of mobile devices. This competitive landscape drives product development and ensures that pocket printers remain relevant and competitive in meeting the evolving needs of users.

The latest technological trends in pocket printers reflect a convergence of advancements aimed at improving functionality, user experience, and overall performance. One of the prominent trends is the integration of robust wireless connectivity options. Modern pocket printers predominantly feature Bluetooth and Wi-Fi connectivity, allowing seamless printing from smartphones, tablets, and laptops. This wireless capability eliminates the need for physical connections, offering users greater flexibility and convenience to print on the go without being tethered to a specific location or device.

Additionally, advancements in print technology have led to significant improvements in print resolution and quality within pocket printers. There is a noticeable trend towards higher-resolution printing, enabling these compact devices to produce sharper text and more vibrant colors in documents and photos. This capability is crucial for users who require professional-grade output while traveling or working remotely, aligning pocket printers more closely with traditional desktop printers in terms of print fidelity.

However, the physical constraints of pocket printers restrict the size and format of prints they can produce. Pocket printers are typically designed for small-scale prints such as photos, labels, receipts, and documents of limited dimensions. This restricts their utility for tasks requiring larger prints or specific formats commonly used in professional settings. The inability to handle larger documents or specialized printing needs may deter potential users who require more versatile printing capabilities.

Additionally, the speed of printing is another consideration that hinders the widespread adoption of pocket printers. While efforts have been made to improve printing efficiency, these devices generally have slower print speeds compared to larger desktop counterparts. This can be a drawback in environments where rapid printing is essential, such as in busy offices or retail settings. Users accustomed to faster printing speeds may find the pace of pocket printers insufficient for their needs, impacting their practicality in high-demand scenarios.

Technology Insights

The inkjet segment held the largest market share of 68.1% in 2023. Based on the technology, the market is segmented into inkjet, thermal, and impact. Inkjet printers are known for their ability to produce high-quality prints with vibrant colors and sharp details. This capability is crucial for applications such as printing photos, graphics, and documents where print quality is a priority. In the context of pocket printers, which often cater to users who require on-the-go printing of photos and documents, inkjet technology offers superior output compared to other printing technologies like thermal or laser printing.

The thermal segment registered the highest CAGR of 10.2% over the forecast period. Thermal printers are known for their compact size and lightweight design, making them ideal for integration into portable devices such as pocket printers. The inherent simplicity of thermal printing technology, which does not require ink cartridges or toners, allows manufacturers to design smaller and more portable printers without compromising on print quality or functionality. Additionally, thermal printers have fewer moving parts compared to inkjet or laser printers, resulting in lower maintenance requirements and operational reliability. This aspect is particularly advantageous for pocket printers, where users prioritize hassle-free operation and minimal upkeep while on the move.

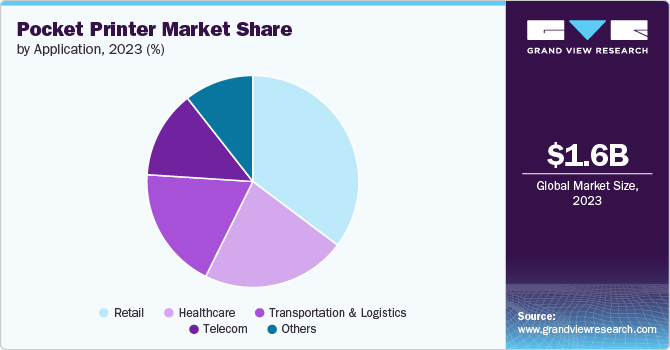

Application Insights

The retail segment dominated the market with a revenue share of 35.3% in 2023. Based on application, the market is segmented into healthcare, retail, telecom, transportation & logistics, and others. The dominance of the retail segment in the market can be attributed to several pragmatic factors that align closely with the operational requirements and consumer dynamics within the retail industry. Pocket printers, characterized by their compact size and portability, have found significant adoption among retailers due to their ability to meet specific operational needs effectively.

One of the primary reasons for the retail sector's preference for pocket printers is their capability to fulfill on-demand printing requirements. In retail environments, there is a constant need for immediate printing of receipts, labels, price tags, and promotional materials. Pocket printers equipped with thermal or inkjet technology enable store personnel to generate these documents swiftly and conveniently directly at the point of sale (POS) or within the store premises. This capability enhances operational efficiency by reducing transaction times and improving customer service.

The transportation & logistics segment is anticipated to register the highest CAGR of 11.2% over the forecast period in the target market. The transportation and logistics industry operates in diverse and often remote environments where mobile printing capabilities are crucial. Pocket printers enable logistics personnel, including drivers, warehouse staff, and delivery personnel, to print essential documents such as shipping labels, receipts, invoices, and packing slips directly on-site.

This capability eliminates the need for centralized printing facilities and allows for immediate documentation and labeling, thereby enhancing operational efficiency and reducing turnaround times. Additionally, pocket printers facilitate real-time data management and documentation within the logistics supply chain. By integrating with mobile devices and enterprise systems, these printers enable quick and accurate printing of critical information related to inventory management, order fulfillment, and shipment tracking.

Regional Insights

The pocket printer market of North America accounted for the largest revenue share of 34.8% in 2023 and is expected to continue its dominance over the forecast period. North America has been at the forefront of technological innovation and adoption, particularly in mobile and portable technologies. The region's strong emphasis on innovation has led to the early development and commercialization of pocket printers equipped with advanced printing technologies such as thermal and inkjet. These innovations have catered to the growing demand for portable printing solutions among tech-savvy consumers and professionals.

Additionally, the region's relatively high per capita income and strong purchasing power contribute to a consumer base willing to invest in advanced and convenient technologies like pocket printers. Affluent consumers and businesses in North America often prioritize products that offer both technological sophistication and practical utility, driving demand for pocket printers as versatile and efficient printing solutions.

U.S. Pocket Printer Market Trends

The U.S. pocket printer market held the largest share of 73.3% in 2023 in the North America region. The versatility of pocket printers meets a wide range of application scenarios prevalent in the U.S. These include printing photos, documents, labels, receipts, and other materials for personal, business, and educational purposes. Industries such as retail, logistics, healthcare, and entertainment find pocket printers invaluable for tasks ranging from mobile ticketing and event management to inventory management and on-site documentation.

Additionally, the U.S. benefits from robust retail distribution networks that facilitate the widespread availability of pocket printers across various channels, including electronics stores, online platforms, and specialty retailers. This accessibility enhances market penetration and consumer awareness, making pocket printers readily accessible to a broad demographic of consumers and businesses.

Asia Pacific Pocket Printer Market Trends

The pocket printer market of Asia Pacific is projected to grow at the highest CAGR of 10.6% over the forecast period. Asia Pacific is experiencing rapid urbanization and digitization, driven by expanding urban populations, increasing internet penetration, and widespread adoption of mobile devices such as smartphones and tablets. These trends create a conducive environment for the adoption of portable and mobile printing solutions like pocket printers, which cater to the growing demand for convenient and on-the-go printing capabilities in both urban and rural settings. Additionally, many countries in the Asia Pacific, including China, India, Southeast Asian nations, and Australia, are witnessing robust economic growth and rising disposable incomes. This economic prosperity translates into increased consumer spending on consumer electronics, including portable printing devices.

Europe Pocket Printer Market Trends

Europe pocket printer market has witnessed a significant shift towards a mobile workforce and remote work arrangements, driven by advancements in technology and changing workplace dynamics. Pocket printers offer a practical solution for professionals who require portable printing capabilities to support their flexible work environments. These devices enable the printing of documents, reports, invoices, and presentations directly from mobile devices, enhancing productivity and efficiency while on the move.

Additionally, pocket printers are increasingly adopted in educational settings across Europe, catering to the needs of students, teachers, and educational institutions. These devices facilitate on-the-go printing of lecture notes, study materials, assignments, and presentations, supporting flexible learning environments and collaborative study sessions.

Key Pocket Printer Company Insights

Some of the key companies operating in the global market include Seiko Epson Corporation, HP Development Company, L.P., among others.

-

HP Development Company, L.P. is a multinational technology company headquartered in California, U.S. The company operates through three segments, namely personal systems, printing, and corporate investments. The printing segment provides consumer and commercial printer hardware, supplies, services, and solutions. This segment is also focused on graphics 3D, printing, and personalization in the commercial and industrial markets. HP Development Company, L.P. has product development and manufacturing facilities in North America, Europe, the Middle East & Africa, and Asia Pacific. The company operates globally, serving consumers, businesses, and institutions by delivering reliable and efficient computing solutions.

PeriPage and Polaroid are some of the emerging market companies in the target market.

-

PeriPage is a China-based company that focuses on developing creative printers and offers a range of portable mini printers. These printers are compact and designed for mobile use, allowing users to print documents, photos, labels, and other content on the go. The company’s printers utilize thermal printing technology, which does not require ink cartridges, making them cost-effective and convenient for various applications such as note-taking, labeling, and creating instant photo prints.

Key Pocket Printer Companies:

The following are the leading companies in the pocket printer market. These companies collectively hold the largest market share and dictate industry trends.

- Seiko Epson Corporation

- Eastman Kodak Company

- HP Development Company, L.P.

- LG electronics

- FUJIFILM Corporation

- Life Print Photos

- Polaroid

- Canon Inc.

- Phomemo

- PeriPage

Recent Developments

-

In April 2024, Polaroid announced the launch of Polaroid Go Generation 2. It offers improved image quality with a precise light sensor, a large aperture range, and on-point exposure settings. The camera offers a built-in flash and self-timer function while introducing updated materials and design elements to enhance durability and user experience.

-

In May 2023, Eastman Kodak Company acquired Graphic Systems Services (GSS), a provider of digital printing equipment and services. This acquisition expands Eastman Kodak Company's portfolio in the digital printing market, enhancing its capabilities in areas such as packaging, commercial print, and labels. GSS brings expertise in digital printing technology and a strong customer base, which would strengthen Eastman Kodak Company's position in the industry and broaden its offerings to meet evolving market demands. The acquisition is part of Eastman Kodak Company's strategy to drive growth and innovation in digital printing solutions, leveraging GSS's capabilities to deliver enhanced value and service to customers worldwide.

Pocket Printer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.74 billion

Revenue forecast in 2030

USD 3.01 billion

Growth rate

CAGR of 9.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Seiko Epson Corporation; Eastman Kodak Company; HP Development Company; L.P.; LG Electronics; FUJIFILM Corporation; Life Print Photos; Polaroid; Canon Inc.; Phomemo; PeriPage

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pocket Printer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global pocket printer market report based on technology, application, and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Inkjet

-

Thermal

-

Impact

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Retail

-

Telecom

-

Transport & Logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pocket printer market size was estimated at USD 1.62 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global pocket printer market is expected to grow at a compound annual growth rate of 9.6% from 2024 to 2030 to reach USD 3.01 billion by 2030.

b. The inkjet segment claimed the largest market share of 68.1% in 2023 in the pocket printer market, driven by superior print quality, versatility, portability, ease of use, affordability, and ongoing technological advancements. These factors collectively make inkjet pocket printers a preferred choice for many consumers and businesses seeking convenient printing solutions in compact form factors.

b. Some of the prominent players in the pocket printer market are Seiko Epson Corporation, Eastman Kodak Company, HP Development Company, L.P., LG electronics, FUJIFILM Corporation, Life Print Photos, Polaroid, Canon Inc., Phomemo, and PeriPage.

b. The pocket printer market is driven by factors such as increasing demand for portable printing solutions that cater to mobile lifestyles and professional needs. These printers are designed to be compact and lightweight, making them convenient for users who require on-the-go printing capabilities. Integration with mobile devices through wireless connectivity, including Wi-Fi and Bluetooth, enhances usability, allowing users to print directly from smartphones, tablets, and laptops without the need for a wired connection or traditional computer setup.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.