- Home

- »

- Pharmaceuticals

- »

-

Pneumococcal Vaccine Market Size And Share Report, 2030GVR Report cover

![Pneumococcal Vaccine Market Size, Share & Trends Report]()

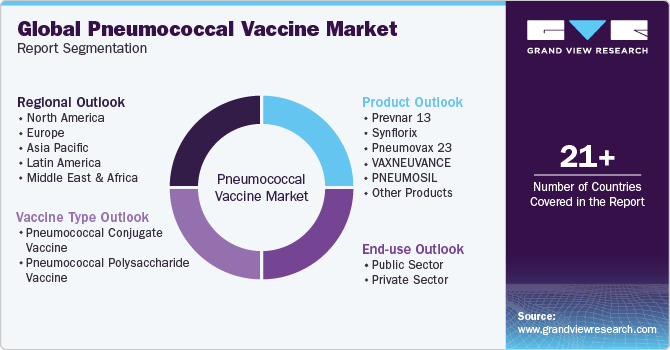

Pneumococcal Vaccine Market Size, Share & Trends Analysis Report By Vaccine Type, By Product (Prevnar 13, VAXNEUVANCE, PNEUMOSIL), By End-use (Public Sector, Private Sector), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-260-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Pneumococcal Vaccine Market Size & Trends

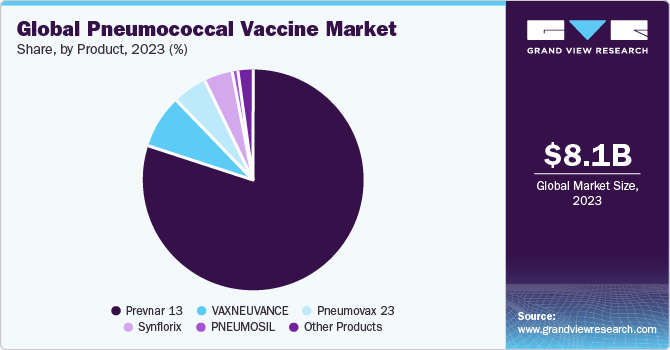

The global pneumococcal vaccine market size was estimated at USD 8.07 billion in 2023 and is projected to grow at a CAGR of 6.21% from 2024 to 2030. The increasing prevalence of target diseases, rising awareness & favorable government initiatives, and growing R&D for developing novel vaccines are the major factors contributing to market growth. According to the WHO 2023 estimates, about 1.6 million people die from pneumococcal infections globally each year, of which around one million are children under the age of 5. WHO lists pneumococcal disease in children as a high priority for vaccination and recommends 13-valent conjugate vaccines.

The development and approval of novel vaccines is expected to drive market growth. For instance, in April 2023, Pfizer's PREVNAR 20, a 20-valent pneumococcal conjugate vaccine, was approved by the FDA for preventing invasive pneumococcal disease in infants and children aged 6 weeks to 17 years and for preventing otitis media in infants aged 6 weeks to 5 years. In addition, in June 2023, Sanofi and SK bioscience declared positive results from the phase II clinical trials of their 21-valent conjugate vaccine candidate, The data indicates that GBP410 could offer broader serotype coverage than current vaccines and is expected to increase market share. Sanofi and SK bioscience plan to proceed to phase III in 2024, aiming to secure final data by 2027.

Rising awareness and favorable government initiatives boost the market growth. According to the NCBI article published in March 2022, the U.S. Department of Health and Human Services has outlined objectives within the Healthy People 2030 initiative to boost vaccination rates among adults aged 19 and above. Among these objectives is promoting pneumococcal vaccines, recognized for their significance in averting these diseases. The key aim is to surpass a vaccination threshold of 90% for vaccines recommended by the Advisory Committee on Immunization Practices (ACIP). Moreover, For instance, in September 2023, the Centers for Disease Control and Prevention (CDC) article has been proactively advocating for the administration of pneumococcal vaccines, particularly targeting adults aged 65 and above, as well as individuals with specific medical conditions that elevate their susceptibility to this disease. These activities disclosed initiatives pitched towards heightening awareness regarding the significance of these vaccines and advancing a culture of vaccination.

The market is witnessing a significant boost due to growing R&D efforts to create innovative vaccines. For instance, in November 2022, the University of Liverpool initiated a spin-out company, ReNewVax Ltd, with the goal of developing next-generation pneumococcal vaccines. The company's approach involves the rational design of vaccine candidates, addressing challenging bacterial infections. Supported by Innovate UK seed funding and the University of Liverpool's Enterprise Investment Fund, ReNewVax aims to produce safe, easy-to-manufacture, and affordable vaccines, with their lead program targeting Streptococcus pneumoniae.

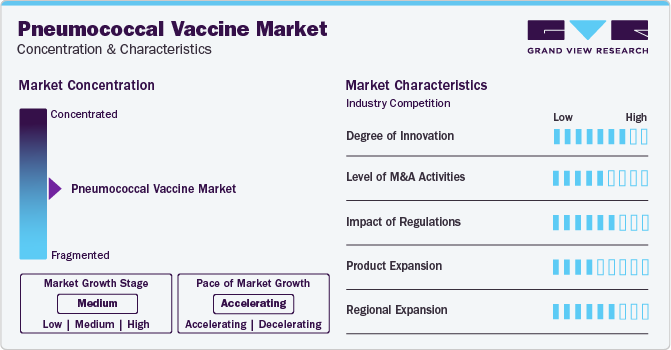

Market Concentration & Characteristics

The vaccine represents a significant innovation in preventive medicine. Developed to combat infections caused by Streptococcus pneumoniae bacteria, it has undergone several duplications to enhance efficacy and broaden its coverage against various strains. The introduction of conjugate vaccines marked a key advancement, particularly in protecting vulnerable populations like infants and the elderly. Continuous research aims to improve vaccine formulations, effectiveness, and accessibility, contributing to the ongoing battle against pneumococcal diseases worldwide.

Several players engage in mergers & acquisitions to strengthen their position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in August 2022, GSK plc acquired Affinivax, Inc, a biopharmaceutical company developing vaccines. With this acquisition, GSK strengthens its portfolio of vaccines, especially the next-generation 24-valent pneumococcal vaccine candidate (AFX3772) currently under phase II development.

Regulation plays a crucial role in shaping the accessibility and distribution of vaccines like pneumococcal. For instance, in many countries, regulatory bodies such as the FDA in the U.S. or the EMA in Europe ensure that vaccines undergo rigorous testing for safety and efficacy before they are approved for public use. One significant impact of regulation is the assurance of quality and safety. Enforcing strict standards, regulators ensure that pneumococcal vaccines are manufactured, stored, and distributed to minimize the risk of adverse effects.

Product expansion involves expanding its application to cover a wider range of strains or demographics. This expansion includes developing vaccines that target additional serotypes of the bacteria responsible for pneumonia or creating formulations suitable for different age groups or high-risk populations, such as the elderly or immunocompromised individuals. For instance, a vaccine initially designed to target the most common serotypes widespread in children could be expanded to include coverage for serotypes more commonly associated with pneumonia in adults.

Regional expansion for involves targeting remote or underserved areas with limited access to traditional healthcare facilities. Mobile vaccination clinics or outreach programs could be established in these regions to bring these vaccines directly to communities. These efforts would involve collaboration with local healthcare providers, community leaders, and government agencies to overcome logistical challenges and ensure widespread vaccine coverage. Expanding into such regions can extend the reach of these vaccination programs, helping protect vulnerable populations against pneumococcal diseases.

Vaccine Type Insights

Based on type, the pneumococcal conjugate vaccine segment led the market and accounted for 93.1% of the global revenue in 2023 and is anticipated to grow at the fastest rate over the forecast period. The Pneumococcal Conjugate Vaccine (PCV) helps protect against pneumococcal disease, a leading cause of death among children under 5 years old. PCVs are designed to protect against the most common serotypes of Streptococcus pneumoniae, the bacterium responsible for pneumonia, meningitis, and other serious infections. According to the CDC article published in December 2023 , the Advisory Committee on Immunization Practices (ACIP) has updated its recommendations for using 15-Valent and 20-Valent PCVs for adults in the U.S. It's crucial to boost vaccination rates to prevent pneumococcal disease. This involves tackling knowledge gaps and obstacles in following vaccination guidelines. Tools like the PneumoRecs VaxAdvisor app, along with other resources from the CDC, offer personalized vaccination guidance to patients and help enhance confidence in vaccines.

Pneumococcal polysaccharide vaccine segment is anticipated to grow at a steady CAGR over the forecast period. PPVs are derived from the capsular polysaccharide of Streptococcus pneumoniae, a bacterium that causes pneumonia and other infections. These vaccines induce specific antibodies that kill the bacteria through opsonization or phagocytosis, making them particularly effective against these infections. Pneumovax 23 (PPSV23) falls under the category of PPV. PPSV23 includes purified preparations of pneumococcal capsular polysaccharide and contains polysaccharide antigens from 23 types of pneumococcal bacteria.

End-use Insights

The public sector segment led the market with the highest revenue share in 2023. The dominance of the public sector in the end-use of pneumococcal vaccines, including hospitals, clinics, and healthcare facilities, can be attributed to several factors. These factors include the high prevalence of the disease, government initiatives to increase vaccination coverage, and the cost-effectiveness of public sector vaccination programs compared to private sector options. The rising prevalence of pneumococcal diseases such as pneumonia, sepsis, and meningitis is a major driving factor. According to the National Foundation for Infectious Diseases in December 2023, pneumococcal pneumonia hospitalizes 150,000 people annually in the U.S., killing 5% to 7% or 1 in 20 people, with higher death rates among older adults and those with medical conditions.

The private sector segment is projected to witness a significant growth rate over the forecast period. Private sector healthcare providers often offer a higher standard of care, including more personalized attention and advanced diagnostic tools. According to the NCBI article published in January 2020, this can lead to better patient outcomes, making the private sector a preferred choice for vaccination. Private sector healthcare facilities are often more conveniently located and offer more flexible scheduling, which can appeal to individuals with busy lifestyles or those who prefer to receive care in a more familiar setting. The private sector can be quicker to adopt new vaccines and treatments, including pneumococcal vaccines. This is because private healthcare providers have more freedom to choose which vaccines to offer, allowing them to be among the first to introduce new options.

Product Insights

Prevnar 13 led the market with the highest revenue share in 2023. The vaccines under the Prevnar brand include Prevnar 13 and Prevnar 20. These are PCVs designed to protect against pneumococcal disease. Prevnar 13, a 13-valent pneumococcal conjugate vaccine, is intended for active immunization in children aged 6 weeks through 5 years and adults aged 18 years and older against invasive diseases caused by specific Streptococcus pneumoniae serotypes. It also protects against otitis media in children of the same age group caused by these serotypes. Approved by the U.S. FDA on August 22, 2017, Prevnar 13's approval history includes updates to its package insert and trial results assessing its use alongside other vaccines. Pfizer's patent for Prevnar 13 is set to expire in 2026. Manufactured by Wyeth Pharmaceuticals Inc., the vaccine is marketed by Pfizer Inc.

The PNEUMOSIL segment is anticipated to grow significantly over the forecast period. According to the NCBI article published in February 2021, PNEUMOSIL obtained regulatory approvals and endorsements starting from December 2018, including Indian Export Notice of Compliance, WHO preapproval, an advance market commitment supply agreement, and Indian Marketing Authorization. It is now available as an option for low- and middle-income countries to consider for these vaccination programs. PNEUMOSIL is designed to target serotypes most likely to cause Invasive Pneumococcal Disease (IPD) in regions such as Africa, Asia, Latin America, and the Caribbean (LAC). This targeted approach aims to meet the specific needs of these high-burden regions by providing an affordable and effective vaccine against prevalent serotypes.

Regional Insights

The pneumococcal vaccine market of North America accounted for a 75.4% share of the global market in 2023. Government health agencies and organizations actively promote vaccination campaigns to stop pneumococcal infections, driving market demand. In addition, the presence of leading pharmaceutical companies, such as Pfizer Inc. and Merck & Co., Inc., competing to develop advanced pneumococcal vaccines intensifies competition. For instance, in December 2023, recent developments, such as Merck & Co., Inc.'s submission of a Biologics License Application (BLA) for its investigational 21-valent PCV and Pfizer Inc.'s approval for PREVNAR 20, highlight the competitive landscape and innovation in the market.

U.S. Pneumococcal Vaccine Market Trends

The pneumococcal vaccine market in the U.S. is expected to grow significantly over the forecast period. As highlighted by the National Foundation of Infectious Diseases report in 2023, pneumococcal meningitis and bloodstream infections, although less common, have higher mortality rates, causing over 3,000 deaths annually among U.S. adults, along with potential lifelong disabilities. This high prevalence of pneumococcal-related diseases underscores the critical need for preventive measures like vaccination, driving demand and growth.

Europe Pneumococcal Vaccine Market Trends

The pneumococcal vaccine market in Europe operates within a diverse healthcare landscape, with varying vaccination policies and practices across different countries. The market is influenced by factors such as government regulations, vaccination coverage rates, and public health initiatives.

The UK pneumococcal vaccine market is expected to grow significantly over the forecast period due to high prevalence of (Invasive Pneumococcal Disease) IPD in different age groups in the UK, emphasizing the significant disease burden and the potential market demand for these vaccines. It emphasizes the need for effective vaccination strategies to address the diverse epidemiological patterns of IPD and reduce its impact on public health.

The pneumococcal vaccine market in France is expected to grow significantly over the forecast period as the ongoing vaccine hesitancy trends also influence the dynamics. Despite the mandate, some segments of the population may still doubt vaccine safety and efficacy, impacting the uptake of pneumococcal vaccines.

The Germany pneumococcal vaccine market indicates efforts to mitigate supply shortages and ensure the availability of essential vaccines to the population. Importing English-labeled Prevenar 13, the market expanded its options for pneumococcal vaccination, potentially increasing accessibility for needy individuals.

Asia Pacific Pneumococcal Vaccine Market Trends

The market in Asia Pacific is driven by rising awareness about the importance of vaccination in preventing pneumococcal diseases. Several countries in the region are experiencing an increase in the prevalence of pneumococcal infections, leading to a higher demand for vaccines. Manufacturers are expanding their presence in the Asia Pacific region, aiming to capitalize on the growing industry opportunity. Local production facilities are being established to cater to the increasing demand for these vaccines and reduce import dependency.

The China pneumococcal vaccine market is expected to grow over the forecast period due the growing focus on improving healthcare R&D aided with development of novel technologies. For instance, In January 2020, China introduced its first domestically produced 13-valent pneumococcal conjugate vaccine, marking a significant milestone in the country's healthcare sector.

The pneumococcal vaccine market in Japan is expected to grow over the forecast period due to the high prevalence of pneumonia and pneumococcal infections in Japan, which directly impacts the demand. With a significant portion of the population at risk, there is a growing need for vaccination to mitigate the impact of these diseases.

Latin America Pneumococcal Vaccine Market Trends

There is a growing demand for vaccines to prevent pneumococcal diseases such as pneumonia, meningitis, and bacteremia. Governments across the region are increasingly investing in vaccination programs to reduce the burden of these diseases, especially among vulnerable populations like children, the elderly, and individuals with underlying health conditions.

The Brazil pneumococcal vaccine market is expected to grow over the forecast period as in Brazil, pneumonia is a significant health concern, especially among children and the elderly.

MEA Pneumococcal Vaccine Market Trends

The MEA was identified as a lucrative region in this industry. The market is influenced by various factors. The prevalence of pneumococcal diseases, such as pneumonia and meningitis, affects the demand for vaccines in the region.

The Saudi Arabia pneumococcal vaccine market is expected to grow over the forecast period as the Saudi government's vaccination policies and procurement strategies shape the market. While Saudi Arabia aims to maintain high immunization coverage for various vaccines, including pneumococcal vaccines, the decision-making process regarding procurement can impact market dynamics.

Key Pneumococcal Vaccine Company Insights

Some of the leading players operating in the market include Serum Institute of India Pvt. Ltd., CSL, Sanofi, Pfizer Inc. and GSK plc Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built trust in the market. These players are heavily investing in advanced products and infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their market presence.

Walvax Biotechnology Co., Ltd and Beijing Minhai Biotechnology Co.,Ltd (Subsidiary of Shenzhen Kangtaneui Biological Products Co. Ltd.) are some of the emerging market participants in the pneumococcal vaccine market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Pneumococcal Vaccine Companies:

The following are the leading companies in the pneumococcal vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- Serum Institute of India Pvt. Ltd.

- CSL

- Sanofi

- GSK plc

- Merck & Co., Inc.

- Pfizer Inc.

- Walvax Biotechnology Co., Ltd

- Beijing Minhai Biotechnology Co.,Ltd (Subsidiary of Shenzhen Kangtai Biological Products Co. Ltd.)

Recent Developments

-

In January 2024, Pfizer Inc. received marketing authorization from the Committee of Medicinal Products designed for Human Use (CHMP) of the European Medicines Agency (EMA) for its 20-valent pneumococcal conjugate vaccine candidate (20vPnC).

-

In October 2023, Vaxcyte, Inc. collaborated with Lonza for a new commercial manufacturing agreement. With this collaboration, Vaxcyte plans to expand its commercial manufacturing capacity for its PCV candidates.

-

In April 2023, Pfizer Inc. received FDA approval for Prevnar 20 to prevent Invasive Pneumococcal Disease (IPD) in infants.

Pneumococcal Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.49 billion

Revenue forecast in 2030

USD 12.19 billion

Growth rate

CAGR of 6.21% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

vaccine type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil Mexico; Argentina; South Africa; UAE; Kuwait; and Saudi Arabia

Key companies profiled

Serum Institute of India Pvt. Ltd.; CSL; Sanofi; GSK plc; Merck & Co., Inc.; Pfizer Inc; Walvax Biotechnology Co., Ltd; Beijing Minhai Biotechnology Co.,Ltd (Subsidiary of Shenzhen Kangtai Biological Products Co. Ltd.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumococcal Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the pneumococcal vaccine market report based on vaccine type, product, end-use, and region:

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pneumococcal Conjugate Vaccine

-

Pneumococcal Polysaccharide Vaccine

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prevnar 13

-

Synflorix

-

Pneumovax 23

-

VAXNEUVANCE

-

PNEUMOSIL

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Sector

-

Private Sector

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pneumococcal vaccine market size was estimated at USD 8.07 billion in 2023 and is expected to reach USD 8.49 billion in 2024.

b. The global pneumococcal vaccine market is expected to grow at a compound annual growth rate of 6.21% from 2024 to 2030 to reach USD 12.19 billion by 2030.

b. North America dominated the market with the majority share of 75.40% in 2023. The region's well-established healthcare infrastructure & North America pneumococcal vaccine market and the growing awareness of the importance of vaccination in preventing pneumococcal disease in the region can be attributed to this share.

b. Some key players operating in the pneumococcal vaccine market include GSK plc, Pfizer Inc., Merck & Co., Inc., Sanofi, Serum Institute of India Pvt. Ltd., CSL, Walvax Biotechnology Co., Ltd, and Beijing Minhai Biological Technology Co., Ltd.

b. Key factors that are driving the pneumococcal vaccine market growth include increasing prevalence of target disease, rising awareness and favorable government initiatives, and growing R&D for developing novel vaccines.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."