- Home

- »

- Advanced Interior Materials

- »

-

Pneumatic Actuators Market Size And Share Report, 2030GVR Report cover

![Pneumatic Actuators Market Size, Share & Trends Report]()

Pneumatic Actuators Market (2024 - 2030) Size, Share & Trends Analysis Report By Motion Type (Chopped Strand, Continuous Filament), By Application (Construction, Automotive, Marine), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-349-1

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pneumatic Actuators Market Summary

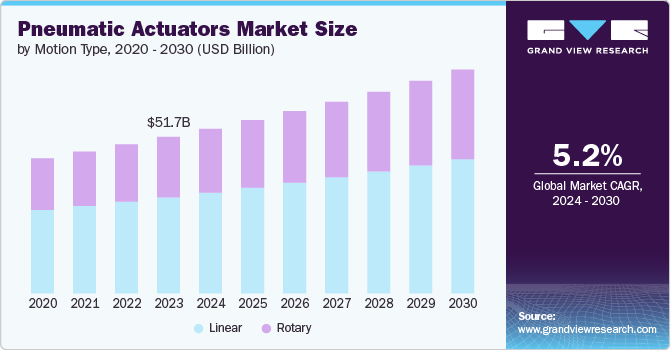

The global pneumatic actuators market size was estimated at USD 51.71 billion in 2023 and is projected to reach USD 73.83 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030. This growth is attributed to the increasing adoption of automation in various end use industries including automotive, food & beverage, manufacturing, and oil & gas in order to achieve efficiency, improve precision in operations, and reduce downtime in industrial facilities.

Key Market Trends & Insights

- The pneumatic actuators market in North America is growing at a CAGR of 23.2% from 2024 to 2030.

- The demand for pneumatic actuators in Asia Pacific is expected to grow at a higher rate of 40.0% from 2024 to 2030.

- Based on motion type, the linear motion segment dominated the market with a revenue share of 61.4% in 2023.

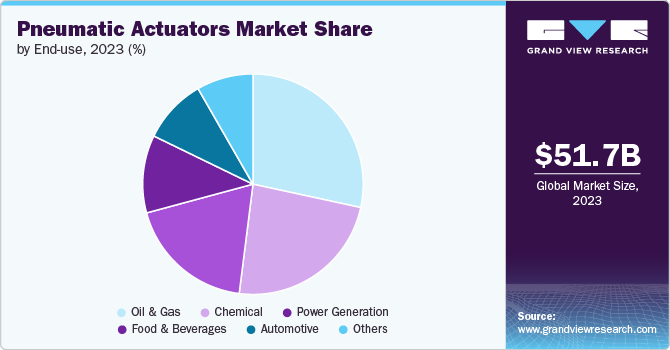

- Based on end use, the oil & gas segment accounted for the largest revenue share of 28.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 51.71 Billion

- 2030 Projected Market USD 73.83 Billion

- CAGR (2024-2030): 5.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Furthermore, this product is considered to be cost-effective when compared to electric and hydraulic actuators. Therefore, making them an attractive option for industries.

Pneumatic actuators have the ability to operate in harsh industrial environments on account of their robustness. This makes them an ideal option for industries where durability and reliability are important factors such as chemical processing and the oil & gas sector. Various end use industries such as automotive, healthcare, aerospace, and food & beverage are witnessing growth owing to the development of countries and increasing per capita income of consumers. This is expected to create new growth opportunities for the pneumatic actuator manufacturers as these products play crucial role in many applications in these industries.

The industry is witnessing continuous technological advancements in terms of the product manufacturing process. Manufacturers are involving control systems and smart sensors in the production to enhance the appeal and performance of pneumatic actuators. In addition, the development of energy-efficient pneumatic systems is further contributing to the rising demand for pneumatic actuators over the coming years.

Although, a few factors such as the requirement of regular maintenance in order to ensure performance and the vibration & noise generated by the product may act as a restraining factor for the market growth. Moreover, when used in continuous operations, pneumatic actuators can be less energy efficient when compared to electric actuators. However, stringent standards and regulations by various governments of countries related to the use of pneumatic actuators in industries that require contaminant-free and clean operations are expected to drive the market growth.

Motion Type Insights

The linear motion segment dominated the market with a revenue share of 61.4% in 2023 on account of the cost efficiency of this type in terms of maintenance and initial cost when compared to electric and hydraulic actuators. Additionally, linear pneumatic actuators have a simple design which allows easy operations, maintenance, and installation, thereby, reducing operational cost and downtime. This product is highly used in applications that require powerful and quick movements as it has the ability to deliver significant force and rapid linear motions.

The rotary motion type segment is expected to grow at the fastest CAGR over the forecast period. The durable and straightforward construction of pneumatic actuators with rotary motion type ensures durability and reliability even in a harsh industrial environment which includes humidity and dust. Furthermore, as they can offer significant torque, they are highly used in applications requiring powerful rotational force.

End Use Insights

The oil & gas end use segment accounted for the largest revenue share of 28.3% in 2023 and is expected to grow at a significant CAGR from 2024 to 2030. Pneumatic actuators play a crucial role in the operations of the oil & gas industry on account of their durability, robustness, and cost efficiency. They find applications in valve automation, drilling operations, pipeline operations, facility processing, and offshore platforms.

The use of pneumatic actuators in chemical end use is expected to grow at the fastest CAGR from 2024 to 2030. This product is used in chemical industry in safety systems, blending, mixing, filling, packaging, HVAC systems, and ventilation systems. Furthermore, in the automotive sector, this product finds applications in assembly line automation, quality control & testing systems, manufacturing processes, and vehicle assembly to maintain safety and take advantage of the quick responsiveness of the product.

Regional Insights

The pneumatic actuators market in North America is growing at a CAGR of 23.2% from 2024 to 2030. This is due to the region’s robust industrial sector which is increasingly emphasizing the automation and advanced manufacturing technologies to improve productivity and efficiency. Major industries including chemical, oil and gas, and power generation are investing in modernizing their operations to meet stringent environmental regulations and improve energy efficiency. These factors are anticipated to fuel the demand for pneumatic actuators over the coming years.

U.S. Pneumatic Actuators Market Trends

The U.S. pneumatic actuators market dominated North America with a revenue share of 81.6% in 2023. The ongoing infrastructure development and the rising need for upgrading industrial facilities are expected to drive the adoption of pneumatic actuators. Moreover, these actuators are highly utilized due to their safety, reliability, and ability to operate in harsh conditions, making them a preferable choice for applications in related sectors. In addition, Advancement in technology including the integration of pneumatic actuators with IoT and smart systems is further likely to boost the consumption of pneumatic actuators in industrial applications over the coming years.

Europe Pneumatic Actuators Market Trends

The pneumatic actuators market in Europe is expected to grow significantly over the forecast period. European industries, particularly in sectors such as food and beverage, automotive, and chemical processing, are adopting automation and advanced manufacturing technologies to enhance productivity and meet stringent environmental regulations. Moreover, the integration of smart technologies in manufacturing processes is expected to drive the demand for pneumatic actuators over the forecast period.

Asia Pacific Pneumatic Actuators Market Trends

The demand for pneumatic actuators in Asia Pacific is expected to grow at a higher rate of 40.0% from 2024 to 2030. Rapid urbanization and industrialization in emerging countries like China, India, and Japan are driving the need for automation and efficient manufacturing processes. In addition, the expansion of the various industries including automotive, food and beverage, and oil and gas industries in this region also contributes to the growing demand for pneumatic actuators, which are essential for various applications in these sectors.

Key Pneumatic Actuators Company Insights

Some of the key players operating in the market include ABB and ALFA LAVAL

-

ABB is a Switzerland-based technology leader in automation and electrification. The company offers products under the industries & utility category. Its product line includes control room solutions, drivers, electric drivetrains, low voltage products and systems, measurement & analytics, metallurgy products, motors and generators, medium voltage products, PLC automation, power converters and inverters, and robotics. The company has approximately 105,000 employees across the world.

-

ALFA LAVAL is a leading provider of various products used in separation and fluid handling and heat transfer applications. The company has a diverse product portfolio which includes boilers, decanters, heat exchangers, separators, exhaust gas cleaning, fluid handling equipment, and ballast water treatment systems.

AIRA EURO AUTOMATION PVT. LTD and Unflow Automation are some of the emerging participants in market.

-

AIRA EURO AUTOMATION PVT. LTD is an India-based manufacturer of quality valves for a wide range of application industries including fertilizers, petrochemicals, chemicals, refineries, pharmaceuticals, textiles & dyes, paints, breweries & distilleries, thermal power stations, and nuclear & atomic power stations. The company product line includes manual and pneumatic valves.

-

Unflow Automation, headquartered in India was established in 2008. It is a leading manufacturer of valves and actuators. The company has a vast product line which includes solenoid vales, pneumatic valves, angle seat valves, pneumatic actuators, ball valves, butterfly valves, pulse jet valves, solenoid coil, limit switch, gas solenoid valve, roto seal coupling, medical oxygen equipment, poppet valves, one touch fittings, polyurethane tubes, air cylinders, and air preparation unit.

Key Pneumatic Actuators Companies:

The following are the leading companies in the pneumatic actuators market. These companies collectively hold the largest market share and dictate industry trends.

- AIRA EURO AUTOMATION PVT. LTD

- Unflow Automation

- ABB

- ALFA LAVAL

- Rotork

- PARKER HANNIFIN CORP

- SMC Corporation of America

- Emerson Electric Co.

- Flowserve

- Festo India Private Limited

Recent Developments

-

In December 2022, OMAL launched its new wireless pneumatic actuator named Rackon-X. This product is equipped with a data tracking system which could be used for storing and monitoring key operating data. This innovation is in line with the trend of integrating overall systems for predictive maintenance and data tracking and will help end users update their facilities as per future trends.

Pneumatic Actuators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 54.37 billion

Revenue forecast in 2030

USD 73.83 billion

Growth rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Motion type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

AIRA EURO AUTOMATION PVT. LTD; Unflow Automation; ABB; ALFA LAVAL; Rotork; PARKER HANNIFIN CORP; SMC Corporation of America; Emerson Electric Co.; Flowserve; Festo India Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumatic Actuators Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the pneumatic actuators market report based on motion type, end use, and region:

-

Motion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Linear

-

Rotary

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Oil & Gas

-

Food & Beverages

-

Power Generation

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global pneumatic actuator market size was estimated at USD 51.71 million in 2023 and is expected to reach USD 54.37 billion in 2024.

b. The global pneumatic actuator market is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030 to reach USD 73.83 billion by 2030.

b. Linear pneumatic actuator accounted for the largest revenue share of over 61.4% in 2023. This market growth is attributed to its cost efficiency in terms of maintenance and initial cost when compared to electric and hydraulic actuators. This product is highly used in applications that require powerful and quick movements, as it has the ability to deliver significant force and rapid linear motions.

b. Some key players operating in the pneumatic actuator market include AIRA EURO AUTOMATION PVT. LTD, Unflow Automation, ABB, ALFA LAVAL, Rotork, PARKER HANNIFIN CORP, SMC Corporation of America, Emerson Electric Co., Flowserve, and Festo India Private Limited.

b. The key factors that are driving the market growth are the rising use of pneumatic actuator in various end-use industries including oil & gas, automotive, chemical, power generation, and food and beverages due to the benefits provided by the product such as robustness, durability, and cost efficiency.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.