- Home

- »

- Advanced Interior Materials

- »

-

Platinum Group Metals Market Size & Share Report, 2030GVR Report cover

![Platinum Group Metals Market Size, Share & Trends Report]()

Platinum Group Metals Market (2024 - 2030) Size, Share & Trends Analysis Report By Metal Type (Platinum, Palladium, Rhodium, Ruthenium), By Application (Automotive, Chemical, Jewellery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-448-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Platinum Group Metals Market Summary

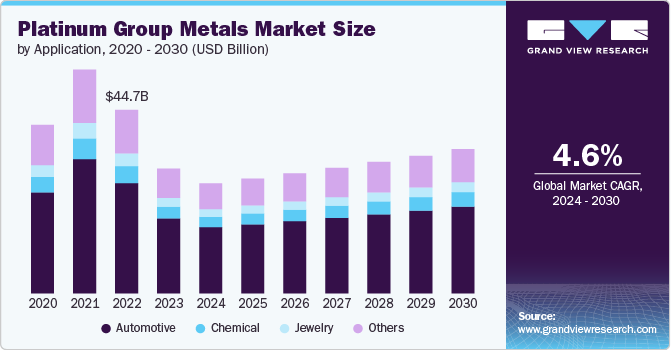

The global platinum group metals market size was estimated at USD 30.41 billion in 2023 and is projected to reach USD 35.14 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The market is primarily driven by the rising demand for these metals in automotive catalytic converters and the growing chemical industry.

Key Market Trends & Insights

- North America platinum group metals market holds a significant share.

- The platinum group metals market in Asia Pacific is growing due to rapid industrialization and the expanding automotive sector.

- The platinum group metals market in Europe holds a significant share.

- Based on application, the automotive sector remains the largest application segment for platinum group metals.

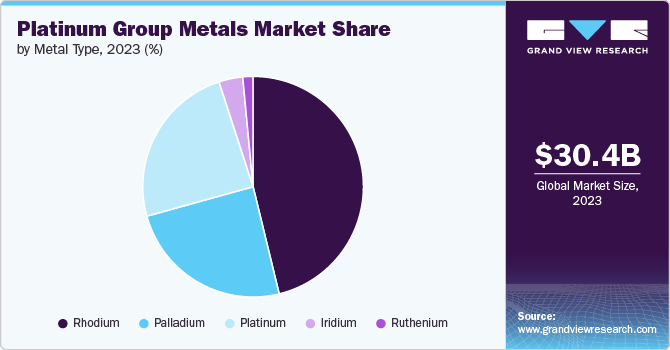

- In terms of metal type, palladium dominated the platinum group metals market in 2023, accounting for the largest revenue share.

Market Size & Forecast

- 2023 Market Size: USD 30.41 billion

- 2030 Projected Market Size: USD 35.14 billion

- CAGR (2024-2030): 4.6%

Palladium, holding the largest market share, plays a critical role in automotive applications, particularly in reducing vehicle emissions, while rhodium is emerging as the fastest-growing segment due to its increasing usage in chemical applications.

Drivers, Opportunities & Restraints

The global platinum group metals (PGMs) market is primarily driven by the automotive industry's increasing demand for platinum-based catalytic converters, which are essential for reducing vehicle emissions. As stringent environmental regulations, such as the Euro standards in Europe and the China standards, continue to tighten, automakers must use more PGMs to meet these requirements. For instance, the International Energy Agency (IEA) reports that vehicle emission regulations significantly drive platinum demand, reflecting its crucial role in cleaner automotive technologies.

A major restraint on the PGMs market is the high cost and limited supply of these metals, which can create price volatility and impact their adoption in various applications. For example, the World Platinum Investment Council (WPIC) has highlighted how the supply of platinum is constrained due to geopolitical issues and mining challenges in major producing countries like South Africa. This supply constraint can lead to elevated prices, limiting the widespread use of PGMs in less critical applications and hindering market growth.

One notable opportunity for the global PGMs market lies in the growing adoption of PGMs in hydrogen fuel cells, which are becoming increasingly important in the renewable energy sector. As governments and industries push for cleaner energy solutions, the demand for hydrogen fuel cells is expected to rise.

Application Insights

“Automotive segment held the largest revenue share of platinum group metals market in 2023.”

The automotive sector remains the largest application segment for platinum group metals, driven by stringent environmental regulations and the increasing demand for fuel-efficient and low-emission vehicles. Palladium and platinum are widely used in catalytic converters, ensuring cleaner emissions. As automakers worldwide adopt these metals in response to growing environmental concerns, the automotive sector is expected to maintain its dominance.

The chemical industry is projected to grow at the fastest rate over the forecast period. The growing demand for platinum group metals, particularly rhodium, in chemical catalysis is fueling this growth. PGMs are critical in various industrial processes, including hydrogenation, oxidation, and polymerization, making them indispensable for chemical manufacturing.

Metal Type Insights

“Palladium segment held the largest revenue share of platinum group metals market in 2023.”

Palladium dominated the platinum group metals market in 2023, accounting for the largest revenue share. Its wide application in the automotive sector, particularly in catalytic converters for gasoline vehicles, has positioned it as a critical metal in emission control technologies. The increasing global push towards reducing vehicle emissions is expected to sustain this trend in the coming years.

Rhodium is poised to be the fastest-growing metal segment, driven by its use in the chemical industry as a catalyst for chemical reactions, especially in the production of acetic and nitric acids. Rhodium's rare availability and unique properties make it a high-demand metal for chemical applications, driving its rapid market expansion.

Regional Insights

“Asia Pacific dominated the global platinum group metals market with the largest revenue share.”

North America platinum group metals market holds a significant share in the platinum group metals market due to its advanced automotive industry and stringent emission control regulations. The region's strong presence in automotive production, coupled with a growing focus on clean technologies, has solidified its position as a leader in PGM consumption.

U.S. Platinum Group Metals Market Trends

The platinum group metals market in the U.S. is primarily driven by stringent environmental regulations and the demand for advanced automotive technologies. For example, the adoption of tighter emission standards like the EPA’s Tier 3 regulations (2014) has increased the need for platinum in catalytic converters, which are essential for reducing vehicle pollutants. Additionally, the growing interest in hydrogen fuel cell technology, supported by initiatives such as the U.S. Department of Energy's Hydrogen and Fuel Cell Technologies Office, is creating new opportunities for platinum.

Asia Pacific Platinum Group Metals Market Trends

The platinum group metals market in Asia Pacific is growing due to rapid industrialization and the expanding automotive sector. China and India, with their burgeoning automotive markets, are leading the growth in this region, supported by government initiatives promoting low-emission vehicles.

Europe Platinum Group Metals Market Trends

The platinum group metals market in Europe holds a significant share, driven by the region's strict environmental policies and the strong presence of automotive manufacturers. The European Union's focus on reducing carbon emissions and promoting green technologies continues to bolster the demand for PGMs in this region.

Key Platinum Group Metals Company Insights

Some of the key players operating in the market include AngloAmerican, Norilsk Nickel, and Impala Platinum Holdings Limited.

-

Anglo American Platinum is one of the largest producers of platinum group metals, with extensive mining operations in South Africa. The company specializes in the production of platinum, palladium, rhodium, and other PGMs, catering to various industries, including automotive and chemical sectors.

-

Norilsk Nickel is a major player in the PGM market, with a strong focus on palladium production. The company operates large-scale mining and refining facilities in Russia and is crucial in supplying palladium to the global automotive industry.

-

Impala Platinum Holdings Limited is a leading producer of platinum and other PGMs, with significant mining operations in Southern Africa. The company's products are used extensively in automotive catalytic converters and the chemical industry, driving demand for platinum and rhodium.

Key Platinum Group Metals Companies:

The following are the leading companies in the platinum group metals market. These companies collectively hold the largest market share and dictate industry trends.

- African Rainbow Minerals Limited

- AngloAmerican

- Impala Platinum Holdings Limited

- Glencore

- Platinum Group Metals Limited

- Johnson Matthey

- Vale

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Sibanye-Stillwater

Recent Developments

-

In September 2024, Sibanye-Stillwater integrated Abington Reldan Metals, LLC into its operations following the USD 211.5 million acquisition announced in November 2023. The acquisition includes Reldan's U.S. operations along with joint ventures in Mexico and India. This step aligns with Sibanye-Stillwater’s broader strategy to diversify its portfolio beyond mining and enhance its platinum group metals (PGMs) business by incorporating sustainable recycling practices.

-

In February 2024, Implats initiated a group-wide review of capital expenditures due to weak platinum group metals (PGMs) market conditions. The company plans to cut production by up to 14% between 2025 and 2027, halt expansions at Mimosa and Marula mines, and reduce output at Impala Canada. These steps aim to save R10-11 billion over five years and cut 300,000 ounces of PGMs from 2024 forecasts, driven by declining profits amid a 32% drop in basket prices.

Platinum Group Metals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.81 billion

Revenue forecast in 2030

USD 35.14 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons; revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Metal type, application, and region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, France, Italy, China, India, Japan, South Korea, Brazil, Saudi Arabia, UAE

Key companies profiled

Glencore, Norilsk Nickel, African Rainbow Minerals Limited, AngloAmerican, Impala Platinum Holdings Limited, Johnson Matthey PLC, Platinum Group Metals Limited, Sibanye-Stillwater, Northam Platinum Holdings Limited, Vale

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Platinum Group Metals Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global platinum group metals market report on the basis of metal type, application, and region.

-

Metal Type Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Platinum

-

Palladium

-

Rhodium

-

Ruthenium

-

Iridium

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Jewellery

-

Chemical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global platinum group metals market size was estimated at USD 30.41 billion in 2023 and is expected to reach USD 26.81 billion in 2024.

b. The global platinum group metals market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 35.14 billion by 2030.

b. By metal type, palladium dominated the market with a revenue share of over 41.0% in 2023.

b. Some of the key vendors in the global platinum group metals market are Glencore, Norilsk Nickel, African Rainbow Minerals Limited, AngloAmerican, Impala Platinum Holdings Limited, Johnson Matthey, Platinum Group Metals Limited, Sibanye-Stillwater, Northam Platinum Holdings Limited, Vale, among others.

b. The key factor driving the growth of the global platinum group metals market is attributed to the rising demand for these metals in automotive catalytic converters and the growing chemical industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.