- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastomers Market Size, Share, Growth Analysis Report 2030GVR Report cover

![Plastomers Market Size, Share & Trends Report]()

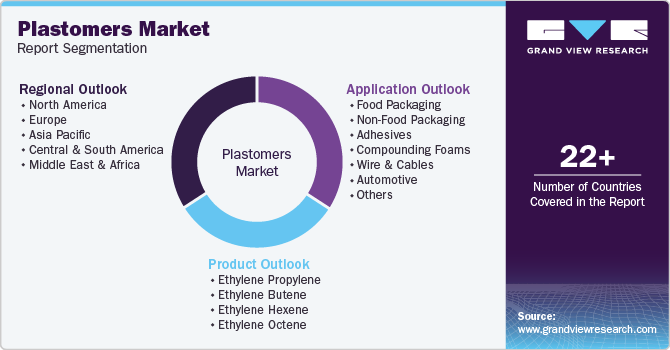

Plastomers Market Size, Share & Trends Analysis Report By Product (Ethylene Propylene, Ethylene Butene), By Application (Food Packaging, Non-food Packaging), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-414-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Plastomers Market Size & Trends

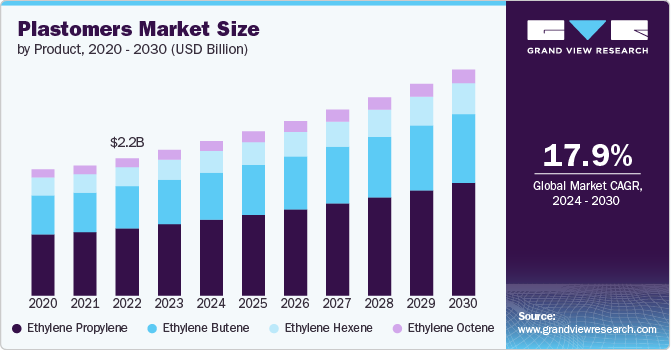

The global plastomers market size was estimated at USD 2.30 billion in 2023 and is projected to grow at a CAGR of 6.56% from 2024 to 2030. Growing demand from the packaging industry owing to the emergence of e-commerce industry in developing as well as developed countries is driving the demand for plastomers in the market.

The growing demand for flexible and lightweight packaging solutions is fueling the plastomers market. As industries such as food and beverage, personal care, and pharmaceuticals continue to evolve, there is an increasing need for packaging materials that offer enhanced durability, sealability, and ease of processing. Plastomers, with their unique properties of flexibility, low density, and high impact resistance, are becoming the material of choice for manufacturers aiming to meet consumer preferences for convenient and sustainable packaging. Moreover, the rise of e-commerce has further fueled this demand, as packaging must be both protective and lightweight to reduce shipping costs and environmental impact.

Drivers, Opportunities & Restraints

The shift towards eco-friendly and recyclable materials is one of the prominent trends in the plastomers industry. With growing awareness of environmental issues, both consumers and regulatory bodies are putting pressure on manufacturers to adopt sustainable practices. Plastomers are increasingly being developed to be compatible with recycling processes, which is in line with the global movement towards a circular economy. In addition, innovations in bio-based plastomers, derived from renewable resources, are gaining traction as companies seek to reduce their carbon footprint and offer greener alternatives to traditional plastic materials.

The automotive industry presents a significant opportunity for the expansion of the market. As the automotive sector increasingly prioritizes fuel efficiency and reduced emissions, there is a rising demand for materials that are lightweight yet durable. Plastomers, with their ability to replace heavier, more rigid plastics and even metal components, are well-positioned to capitalize on this trend. Their application in automotive interiors, exteriors, and under-the-hood components can lead to weight reduction, improved vehicle performance, and compliance with stringent environmental regulations. This opens up a lucrative market segment for plastomer manufacturers, especially as electric vehicles (EVs) continue to grow in popularity.

Despite its potential, the market for plastomers faces challenges that could hinder its growth. One of the primary restraints for the market is the volatility in raw material prices. Plastomers are derived from petrochemical feedstocks, which are subject to fluctuations in oil and gas prices. These fluctuations can lead to unpredictable manufacturing costs, which in turn affect the pricing and profitability of plastomers. In addition, the increasing focus on sustainability has led to stricter regulations around the use of petrochemical-based products, further complicating the market landscape. Companies may need to invest in research and development to create alternative feedstocks or more efficient production processes, which could require significant capital and time.

Product Insights

Based on product, the ethylene propylene segment led the market with the largest revenue share of 49.04% in 2023. The demand for ethylene propylene plastomers is primarily driven by their versatile applications in the packaging and automotive industries. These plastomers offer a unique combination of flexibility, toughness, and excellent heat seal properties, making them ideal for use in flexible packaging solutions. With the rise of consumer demand for convenient, resealable packaging in food, beverages, and personal care products, manufacturers are increasingly turning to ethylene propylene plastomers to meet these requirements.

Ethylene butene plastomers are gaining significant traction due to their superior mechanical properties and cost-effectiveness. One of the primary drivers for these materials is their use in the production of stretch films and shrink films, which are essential in various packaging applications, including pallet wrapping, food packaging, and industrial packaging. The growing demand for efficient and durable packaging solutions in logistics and transportation is propelling the need for ethylene butene plastomers, as they offer excellent puncture resistance, clarity, and elasticity. Moreover, the material’s ability to enhance the performance of flexible packaging structures, such as those used in liquid packaging and pouches, further boosts its demand.

Application Insights

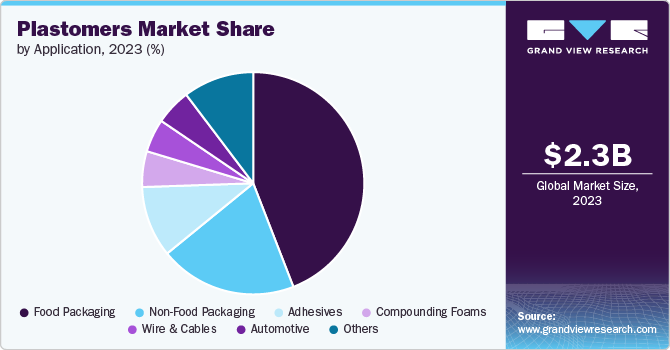

Based on application, the food packaging segment led the market with the largest revenue share of 44.11% in 2023. This can be attributed to the rapid expansion of the food delivery industry due to the increasing popularity of online food ordering platforms and the convenience they offer. In addition, the rising demand for packaged foods, particularly among the working population, has further fueled the growth of this segment. With more people leading busy lifestyles, there is a growing preference for ready-to-eat meals and convenient, pre-packaged food options that save time. This trend has led to a surge in demand for reliable, durable, and safe packaging solutions that ensure the freshness and quality of food products, driving the overall revenue growth in the food packaging segment.

The non-food packaging segment is expected to grow significantly through the forecast period, fueled by the rise of e-commerce and the subsequent need for secure, lightweight packaging for a wide range of products. This is also expected to further propel the demand for plastomers in non-food packaging. The versatility of plastomers, with their ability to enhance the performance of packaging films, labels, and wraps, makes them an attractive choice for manufacturers looking to improve product safety and reduce environmental impact through downgauging and recyclability.

Regional Insights

The North America plastomers market growth is driven by the growing emphasis on sustainable packaging solutions. As consumers and businesses alike become more environmentally conscious, there is a strong push towards reducing plastic waste and adopting materials that can be easily recycled or downgauged without compromising performance. Plastomers, with their ability to enhance the recyclability of packaging and reduce material usage, are increasingly being adopted by manufacturers aiming to meet stringent environmental regulations and cater to the eco-friendly preferences of consumers. This trend is particularly strong in the packaging and automotive industries, where the demand for sustainable materials is driving market growth.

U.S. Plastomers Market Trends

The plastomers market in the U.S. is driven by the expanding healthcare and pharmaceutical sectors. With an aging population and increasing healthcare needs, there is a rising demand for medical devices, pharmaceutical packaging, and hygiene products that require materials with excellent flexibility, clarity, and chemical resistance. Plastomers are ideally suited for these applications, offering the necessary properties to ensure product safety and performance.

Europe Plastomers Market Trends

The plastomers market in Europe is driven by the stringent regulatory environment that is focused on reducing carbon emissions and promoting circular economy. The European Union's regulations on plastic usage and waste management are encouraging manufacturers to adopt materials that are not only high-performing but also recyclable and environmentally friendly. Plastomers, with their ability to enhance the sustainability of packaging and automotive components, are becoming increasingly popular as companies seek to comply with these regulations while maintaining product performance.

Asia Pacific Plastomers Market Trends

The Asia Pacific plastomers market dominated globally in 2023 with the largest revenue share of 39.83%. This large share is driven by rapid industrialization and urbanization, coupled with the growing middle-class population. As more people migrate to urban areas, the demand for consumer goods, packaged foods, and personal care products is soaring. This surge in consumerism has led to an increased need for advanced packaging solutions that offer flexibility, durability, and sustainability, which are key attributes of plastomers.

In the Asia Pacific region, the growing demand for advanced wire and cable solutions is a significant driver for the market growth. With the rapid expansion of infrastructure projects, urbanization, and the ongoing electrification efforts in countries like China, India, and Southeast Asia, there is a heightened need for high-performance materials in the wire and cable industry. Plastomers are increasingly being used in the insulation and jacketing of wires and cables due to their superior flexibility, durability, and resistance to harsh environmental conditions.

Key Plastomers Company Insights

The market for Plastomers is highly competitive, with several key players dominating the landscape. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Plastomers Companies:

The following are the leading companies in the plastomers market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- ExxonMobil Chemical

- Borealis AG

- SABIC

- Mitsui Chemicals

- LG Chem

- LyondellBasell Industries

- Sumitomo Chemical

- Westlake Chemical Corporation

- Reliance Industries Limited

- SK Global Chemical

- Chevron Phillips Chemical

- Ineos Group

- BASF SE

- Braskem

Recent Developments

-

In June 2023, SABIC announced its plans to expand the capacity of its NEXLENE plant in Ulsan, South Korea, through its joint venture, SABIC SK NEXLENE Company. This expansion is set to be operational by the second quarter of 2024 and aims to meet the increasing demand for advanced polyolefin materials, such as SUPEER mLLDPE, COHERE metallocene polyolefin plastomers (POP), and FORTIFY POE. The decision to expand is driven by the growing need for NEXLENE-based solutions in high-end markets, including photovoltaics, new mobility, footwear, and advanced packaging.

-

In May 2023, Borealis launched a new line of circular plastomers and elastomers called Bornewables, produced from renewable feedstock. This initiative aims to meet the growing demand for sustainable materials that maintain high performance while reducing carbon emissions.

Plastomers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.44 billion

Revenue forecast in 2030

USD 3.57 billion

Growth rate

CAGR of 6.56% from 2024 to 2030

Base year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Dow; ExxonMobil Chemical; Borealis AG; SABIC; Mitsui Chemicals; LG Chem; LyondellBasell Industries; Sumitomo Chemical; Westlake Chemical Corporation; Reliance Industries Limited; SK Global Chemical; Chevron Phillips Chemical; Ineos Group; BASF SE; Braskem

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastomers Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastomers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene Propylene

-

Ethylene Butene

-

Ethylene Hexene

-

Ethylene Octene

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food Packaging

-

Non-Food Packaging

-

Adhesives

-

Compounding Foams

-

Wire & Cables

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plastomers market size was valued at USD 2.30 billion in 2023 and is expected to reach USD 2.44 billion in 2024.

b. The global plastomers market is expected to grow at a CAGR of 6.56% from 2024 to 2030, reaching USD 3.57 billion by 2030.

b. Based on application, the food packaging segment led the market with the largest revenue share of 44.11% in 2023. This can be attributed to the rapid expansion of the food delivery industry due to the increasing popularity of online food ordering platforms and the convenience they offer.

b. Key players operating in the plastomers market include Dow; ExxonMobil Chemical; Borealis AG; SABIC; Mitsui Chemicals; LG Chem; LyondellBasell Industries; Sumitomo Chemical; Westlake Chemical Corporation, among others

b. Growing demand from the packaging industry owing to the emergence of e-commerce industry in developing as well as developed countries is driving the demand for plastomers in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."