Plastics In Personalized Drug Delivery Systems Market Size, Share & Trends Analysis Report By Type (PLA, PLGA, PEG, PU, PEEK), By End Use (Pharmaceuticals & Drug Delivery, Medical Devices & Implants, Healthcare & Clinics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-544-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

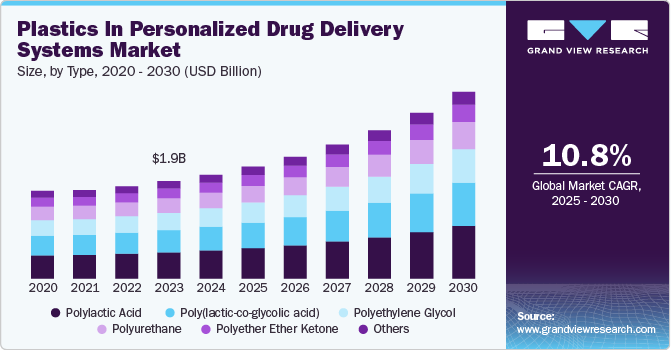

The global plastics in personalized drug delivery systems market size was estimated at USD 1.99 billion in 2024 and expected to grow at a CAGR of 10.79% from 2025 to 2030. Continuous innovations in polymer chemistry are enabling the development of highly functional, biocompatible, and responsive plastics for more efficient and targeted drug delivery. These materials enhance drug stability, controlled release, and patient compliance, driving market growth.

The plastics in personalized drug delivery systems industry is witnessing a significant shift towards smart polymer integration, enabling precise, time-controlled drug release mechanisms. These polymers, designed to respond to physiological stimuli such as pH, temperature, and enzymatic activity, are revolutionizing patient-centric treatment approaches. The development of biodegradable and bioresorbable plastic materials is particularly gaining momentum, as they eliminate the need for device retrieval post-administration. This trend aligns with the broader healthcare transition towards precision medicine, ensuring optimized therapeutic outcomes and reducing systemic side effects. Additionally, the convergence of nanotechnology and polymer science is fostering innovations such as polymeric nanoparticles and microneedle patches, further strengthening the role of plastics in next-generation personalized drug delivery systems.

Drivers, Opportunities & Restraints

The growing demand for tailor-made drug formulations is a critical driver accelerating the adoption of plastics in personalized drug delivery systems. Advances in pharmacogenomics and 3D printing of medical devices have enabled manufacturers to design polymer-based drug carriers that align with an individual’s genetic profile, metabolism, and disease characteristics. Plastics offer unmatched versatility in fabricating biocompatible, flexible, and functionalized drug carriers, allowing for improved bioavailability and site-specific drug release. Additionally, the rise in chronic disease prevalence, including cancer, diabetes, and neurological disorders, has reinforced the need for patient-centered drug delivery models, where plastics play a pivotal role in creating sophisticated, adaptable, and minimally invasive systems.

The increasing regulatory and environmental focus on sustainable healthcare materials presents a lucrative opportunity for manufacturers developing biocompatible and biodegradable polymers for personalized drug delivery. The demand for PLA (polylactic acid), PCL (polycaprolactone), and PHA (polyhydroxyalkanoates)-based drug carriers is surging, as these materials support prolonged drug stability while minimizing adverse environmental impact. This shift is further driven by government incentives and R&D funding aimed at reducing medical plastic waste and enhancing patient safety. Companies investing in next-generation polymer composites-integrating biodegradability with advanced drug encapsulation techniques-stand to gain a competitive advantage, particularly as pharmaceutical firms seek sustainable solutions in compliance with global healthcare regulations.

Despite its promising potential, the Plastics in Personalized Drug Delivery Systems Market faces significant regulatory hurdles that can slow product development and commercialization. The complexity of FDA, EMA, and other regional regulatory approvals for polymer-based drug delivery platforms requires rigorous testing for biocompatibility, degradation behaviour, and toxicity profiles. Many novel plastic formulations must undergo extensive clinical evaluations and post-market surveillance, leading to extended timelines and increased compliance costs for manufacturers. Furthermore, concerns over microplastic contamination and long-term polymer interactions with human tissues have intensified scrutiny, compelling industry players to invest heavily in safety validation and material innovation, thereby posing a restraint to market scalability.

Type Insights & Trends

Polylactic acid (PLA) dominated the plastics in personalized drug delivery systems industry in terms of revenue, accounting for a market share of 27.16% in 2024. This growth can be attributed to the rising regulatory emphasis on sustainable medical materials. As a biodegradable and bioabsorbable polymer, PLA aligns with global sustainability goals, addressing both environmental concerns and patient safety.

The increasing need for single-use, biocompatible drug carriers-especially in applications such as injectable nanoparticles, microspheres, and transdermal patches-is accelerating PLA’s integration into advanced drug delivery mechanisms. Furthermore, leading pharmaceutical firms and medical device manufacturers are investing in PLA-based solutions to comply with stringent EU MDR (Medical Device Regulation) and FDA biocompatibility standards, reinforcing its market growth.

The rising prevalence of chronic diseases, such as diabetes, cancer, and autoimmune disorders, is driving the demand for Poly(lactic-co-glycolic acid) (PLGA)-based drug delivery systems that enable long-acting injectable (LAI) therapies. PLGA’s excellent biodegradability, controlled drug-release properties, and regulatory approval by the FDA make it the preferred polymer for formulating sustained-release drugs, protein therapeutics, and vaccine carriers.

The ongoing expansion of mRNA-based vaccines and monoclonal antibody therapies has further positioned PLGA as a critical material for precise, controlled, and patient-friendly drug administration. With major pharmaceutical players intensifying their focus on reducing dosing frequency and improving treatment adherence, PLGA-based formulations continue to gain momentum in next-generation personalized drug delivery.

End Use Insights & Trends

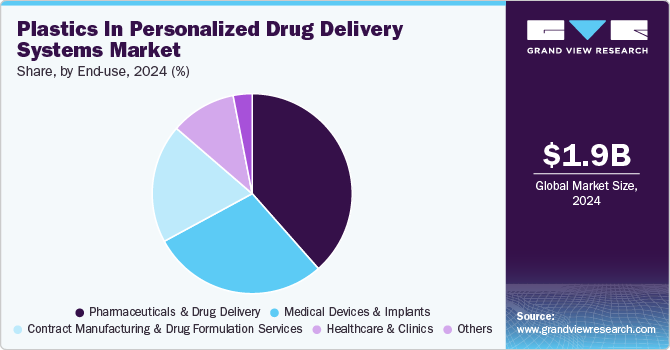

Pharmaceuticals & drug delivery dominated the plastics in personalized drug delivery systems industry across the end use segmentation in terms of revenue, accounting for a market share of 38.49% in 2024. This is attributable to the growing shift towards nano-enabled drug delivery systems. Advances in polymeric nanocarriers, including liposomes, dendrimers, and polymeric micelles, are transforming drug bioavailability, solubility, and cellular uptake.

Leading biotech firms are actively investing in smart polymeric matrices, leveraging plastics to improve drug encapsulation, site-specific release, and patient compliance. Additionally, strategic partnerships between pharma giants and material science companies are accelerating the commercialization of plastic-based nano-formulations, positioning this segment for rapid expansion amid the demand for precision medicine and biologics.

The increasing adoption of biodegradable polymer-based implants for localized and sustained drug delivery is a major growth driver within the Medical Devices & Implants segment. Advanced polymer-based implants-such as drug-eluting stents, intraocular lenses, and orthopedic scaffolds-are gaining traction due to their ability to enhance therapeutic efficacy while eliminating the need for secondary surgical removal.

The integration of 3D printing technologies with polymeric biomaterials is further enabling the customization of implantable drug delivery systems tailored to individual patient needs. As regulatory bodies push for safer, more effective implant materials, medical device manufacturers are increasingly shifting towards biodegradable polymer solutions that provide controlled, localized treatment while improving patient outcomes.

Regional Insights & Trends

Asia Pacific dominated the global plastics in personalized drug delivery systems industry and accounted for the largest revenue share of 40.40% in 2024. Asia Pacific is emerging as a high-growth region for polymer-based personalized drug delivery, driven by the increasing adoption of precision medicine and advancements in polymer engineering.

The region's rapidly evolving pharmaceutical and biotech sectors, particularly in India, Japan, and South Korea, are fostering innovations in smart, stimuli-responsive polymeric drug carriers for targeted and controlled drug release applications. The rising burden of chronic diseases, an aging population, and government-backed healthcare digitization programs have fueled investments in next-generation polymeric drug delivery technologies, including self-regulating polymeric implants and microfluidic polymer drug dispensers.

North America Plastics In Personalized Drug Delivery Systems Market Trends

North America is experiencing a significant rise in biopharmaceutical research and polymer-based drug delivery innovations, driven by strong funding in precision medicine and advanced material sciences. The region's well-established healthcare infrastructure, coupled with high R&D investments from pharmaceutical giants such as Pfizer, Moderna, and Johnson & Johnson, is fueling the adoption of biodegradable and bioresponsive plastics in personalized drug delivery.

U.S. Plastics In Personalized Drug Delivery Systems Market Trends

In the U.S., the regulatory landscape is a key driver accelerating the adoption of plastics in personalized drug delivery systems, particularly due to the FDA’s progressive stance on innovative polymer-based drug carriers. The expedited approval pathways for novel drug delivery technologies, such as 3D-printed polymer-based implants and biodegradable polymeric nanoparticles, have encouraged pharmaceutical companies to explore cutting-edge polymer formulations. The presence of leading biotech startups and material science companies specializing in biodegradable polymers for sustained and targeted drug release is further fueling market expansion.

Europe Plastics In Personalized Drug Delivery Systems Market Trends

Europe is witnessing a strong push toward sustainability in healthcare, which is significantly driving the adoption of bio-based and biodegradable plastics in personalized drug delivery systems. With the EU Medical Device Regulation (MDR) tightening safety and environmental standards, pharmaceutical and medical device manufacturers are investing in biocompatible, eco-friendly polymer materials such as polyhydroxyalkanoates (PHAs) and polylactic acid (PLA) for drug encapsulation and controlled-release applications. The region’s strong biotechnology ecosystem, particularly in Germany, France, and the Netherlands, is fostering advancements in polymeric nanomedicine and biodegradable polymeric scaffolds for targeted therapies.

China plastics In personalized drug delivery systems market is expected to grow during the forecast period. China is actively driving the adoption of polymer-based personalized drug delivery solutions through strategic government initiatives, local biotech advancements, and regulatory reforms supporting high-tech pharmaceutical manufacturing. The Made in China 2025 policy has prioritized biopolymer research and innovation, encouraging the development of biodegradable, bioresorbable, and intelligent polymer materials for long-acting injectables, targeted therapies, and transdermal drug patches. With the China National Medical Products Administration (NMPA) accelerating approvals for novel polymer-based drug delivery systems, domestic pharmaceutical giants and biotech startups are rapidly investing in polymeric nanocarriers, smart hydrogel-based drug release systems, and personalized polymer implants.

Key Plastics In Personalized Drug Delivery Systems Company Insights

The plastics in personalized drug delivery systems market is highly competitive, with several key players dominating the landscape. Major companies include BASF SE; Evonik Industries; Corbion; Eastman Chemical Company; DuPont de Nemours, Inc.; DSM; Lubrizol Corporation; Arkema; Celanese Corporation; and Avient Corporation. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Plastics In Personalized Drug Delivery Systems Companies:

The following are the leading companies in the plastics in personalized drug delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Evonik Industries

- Corbion

- Eastman Chemical Company

- DuPont de Nemours, Inc.

- DSM

- Lubrizol Corporation

- Arkema

- Celanese Corporation

- Avient Corporation

Recent Developments

-

In November 2024, Avantium and SCGC strengthened their partnership to advance the development of PLGA polyester, a biodegradable and recyclable material. They signed a multi-year agreement to pilot PLGA production using Avantium's Volta Technology, which converts CO2 into glycolic acid, a key component of PLGA.

-

In July 2023, CD Bioparticles, a company experienced in pharmaceuticals and life sciences, recently launched a new line of PLGA-based drug delivery systems. These systems are designed for both in vitro and in vivo applications and include biocompatible and biodegradable PLGA nanoparticles with various surface modifications. These nanoparticles can transport different types of drugs, protect them from degradation, and enhance interaction with biological materials. The new product line includes Streptavidin Coated PLGA Nanoparticles, Functionalized PLGA Nanoparticles, and Functionalized Fluorescent Magnetic PLGA Nanoparticles.

Plastics In Personalized Drug Delivery Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.15 billion |

|

Revenue forecast in 2030 |

USD 3.59 billion |

|

Growth rate |

CAGR of 10.79% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

|

Key companies profiled |

BASF SE; Evonik Industries; Corbion; Eastman Chemical Company; DuPont de Nemours, Inc.; DSM; Lubrizol Corporation; Arkema; Celanese Corporation; Avient Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Plastics In Personalized Drug Delivery Systems Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented plastics in personalized drug delivery systems market report based on type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polylactic Acid (PLA)

-

Poly(lactic-co-glycolic acid) (PLGA)

-

Polyethylene Glycol (PEG)

-

Polyurethane (PU)

-

Polyether Ether Ketone (PEEK)

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals & Drug Delivery

-

Medical Devices & Implants

-

Contract Manufacturing & Drug Formulation Services

-

Healthcare & Clinics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastics in personalized drug delivery systems market size was estimated at USD 1.99 billion in 2024 and is expected to reach USD 2.15 billion in 2025.

b. The global plastics in personalized drug delivery systems market is expected to grow at a compound annual growth rate of 10.79% from 2025 to 2030 to reach USD 3.59 billion by 2030.

b. Polylactic acid (PLA) dominated the plastics in personalized drug delivery systems market across the type segmentation in terms of revenue, accounting for a market share of 27.16% in 2024, driven the by rising regulatory emphasis on sustainable medical materials. As a biodegradable and bioabsorbable polymer, PLA aligns with global sustainability goals, addressing both environmental concerns and patient safety.

b. Some key players operating in the plastics in personalized drug delivery systems market include BASF SE, Evonik Industries, Corbion, Eastman Chemical Company, DuPont de Nemours, Inc., DSM, Lubrizol Corporation, Arkema, Celanese Corporation, and Avient Corporation

b. Continuous innovations in polymer chemistry are enabling the development of highly functional, biocompatible, and responsive plastics for more efficient and targeted drug delivery. These materials enhance drug stability, controlled release, and patient compliance, driving market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."