- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastics In Consumer Electronics Market Size Report, 2030GVR Report cover

![Plastics In Consumer Electronics Market Size, Share & Trends Report]()

Plastics In Consumer Electronics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polycarbonate, Liquid Crystal Polymers, PC/ABS Glass Filled Resins), By End-use (TV Frames, Laptop Monitor Enclosures), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-557-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

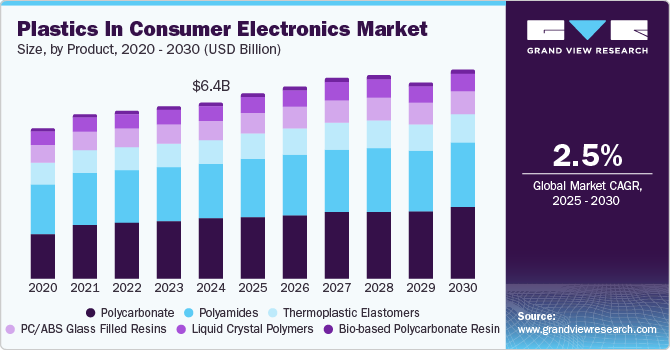

The global plastics in consumer electronics market size was valued at USD 6.4 billion in 2024 and is expected to grow at a CAGR of 2.5% from 2025 to 2030, driven by increasing consumer demand for innovative and high-performance devices. As consumers seek smarter technology, manufacturers are increasingly integrating advanced features into products, necessitating the use of specialized plastics that enhance functionality and aesthetics. This integration facilitates the development of lightweight, durable materials that improve user experience while supporting sleek designs.

As smart devices, including wearables and IoT products, gain popularity, the demand for versatile and high-quality plastics is expected to surge, propelling market growth and innovation. In addition, there is increasing demand for eco-friendly and recyclable plastics, along with a growing preference for personalized, customizable electronics. These trends are projected to significantly impact the plastics in the consumer electronics industry, fueling advancements in sustainability and product design while supporting the development of more innovative and environmentally conscious devices.

As consumers become increasingly environmentally conscious, manufacturers are expected to prioritize sustainable materials that minimize environmental impact. Moreover, the desire for unique and tailored electronic devices is expected to drive innovation in plastic design and production. This synergy of sustainability and customization aligns with consumer preferences, encouraging manufacturers to explore advanced materials. These trends are set to significantly accelerate the growth of plastics in the consumer electronics industry, fostering both innovation and eco-friendly development in product manufacturing.

Product Insights

The polycarbonate (PC) segment recorded the largest revenue share of 33.1% in 2024, driven by its exceptional properties, including high impact resistance, optical clarity, and thermal stability. These characteristics make PC ideal for various applications, such as smartphone casings, LED lighting, and electronic components. Its lightweight nature enhances portability, while its durability ensures longevity, appealing to manufacturers and consumers. The growing demand for eco-friendly materials has led to advancements in PC recycling processes, further strengthening its position in the market as a preferred choice for modern electronics.

The polyamides segment is anticipated to record the highest CAGR of 2.1% over the forecast period, driven by the excellent mechanical strength, thermal resistance, and versatility of polyamides. These materials are increasingly used in high-performance applications, such as connectors, housings, and insulating components, where durability and reliability are crucial. As consumer electronics become more compact and advanced, the demand for lightweight yet robust materials such as polyamides is expected to surge. Besides, innovations in bio-based polyamides align with sustainability trends, making them a compelling choice for environmentally conscious manufacturers and consumers.

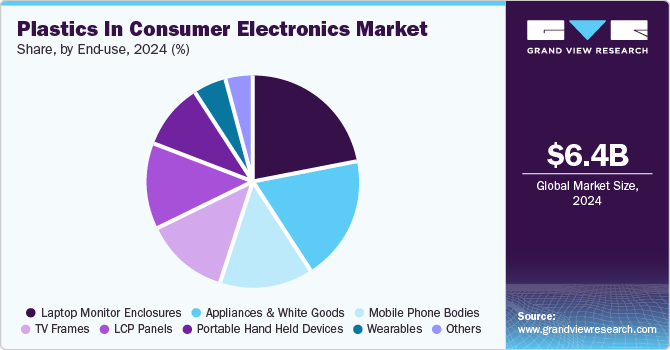

End-use Insights

The laptop monitor enclosures segment held the largest revenue share of 22% in 2024, owing to the burgeoning demand for portable and aesthetically appealing devices. These enclosures, crafted from lightweight yet durable plastics, offer essential protection for sensitive components while enhancing the overall design. With the surge in remote work and online education, manufacturers prioritize developing sleek, functional enclosures that facilitate advanced technology integration. This focus on quality and innovation, combined with consumer preference for stylish, durable products, has strengthened the leading position of the segment in the plastics in consumer electronics industry.

The wearables segment is projected to be the fastest-growing segment and capture a CAGR of 3.8% during the forecast period. The global market is witnessing a rising demand for fitness trackers, smartwatches, and health-monitoring devices. As consumers increasingly prioritize health and wellness, the need for lightweight, comfortable, and durable materials also becomes essential. Plastics provide versatility in design and have the ability to withstand daily wear and tear, making them ideal for wearables. In addition, innovations in eco-friendly and recyclable plastics align with sustainability trends, further enhancing their appeal. This combination of functionality and environmental consciousness positions the wearables segment for substantial growth.

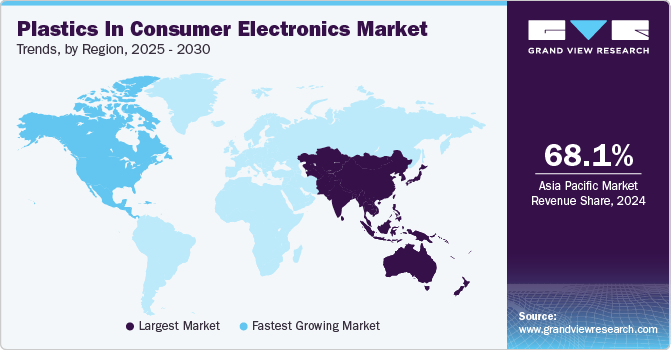

Regional Insights

North America is set to emerge as the fastest-growing region and expand at a CAGR of 2.5% from 2025 to 2030. Key factors favoring the dominance of North America are the increased adoption of bioplastics and advanced polymer formulations in the region. As manufacturers prioritize sustainability, bioplastics offer eco-friendly alternatives that appeal to environmentally conscious consumers. Furthermore, advanced polymer formulations enhance performance characteristics, such as flexibility, strength, and thermal resistance, producing high-quality, durable devices. This shift aligns with regulatory pressures for greener practices and meets the burgeoning demand for innovative solutions in electronics, ultimately driving market growth and attracting investment in sustainable materials.

U.S. Plastics In Consumer Electronics Market Trends

The trend toward more integrated and compact designs in consumer electronics is shaping the U.S. plastics consumer electronics industry. As devices become smaller and multifunctional, manufacturers require specialized plastic materials that facilitate innovative designs while maintaining durability. Moreover, the increased demand for customization and aesthetics compels brands to explore diverse colors, textures, and finishes, further boosting plastic usage. The dual emphasis on compactness and personalized appeal is expected to enhance market growth, leading to new opportunities for plastic manufacturers to meet evolving consumer preferences in the electronics sector.

Canada is projected to grow at a remarkable CAGR over the forecast period due to the escalating demand for eco-friendly materials and the rising integration of smart technology in consumer electronics. Consumers are increasingly seeking sustainable products, prompting manufacturers to adopt biodegradable and recyclable plastics. Besides, integrating smart technology requires advanced materials that are lightweight yet durable, enhancing device functionality and user experience. This focus on sustainability and innovation is aligned with consumer preferences and is expected to drive market growth, thus strengthening the position of Canadian manufacturers in the competitive landscape.

Europe Plastics In Consumer Electronics Market Trends

The growing preference for lightweight and durable plastics is set to propel the growth of plastics in consumer electronics market in Europe. Manufacturers are prioritizing materials that enhance portability and longevity, meeting consumer demand for efficient and robust devices. Also, the emphasis on e-waste recycling and sustainable management practices is driving innovation in the sector, encouraging the use of recyclable plastics and reducing environmental impact. As regulatory frameworks tighten and consumer awareness rises, these trends are expected to propel market growth, fostering a shift toward more responsible production and consumption within the electronics industry.

The rise of 3D printing technology and the development of high-performance polymers and composites are expected to accelerate the market growth in Germany. This innovative manufacturing method allows for rapid prototyping and customization, enabling companies to produce intricate designs that are both lightweight and durable. High-performance materials improve product functionality, offering better heat resistance and mechanical strength. As the demand for advanced, efficient electronic devices grows, these technologies are expected to drive market expansion by facilitating more efficient production processes and enabling the creation of cutting-edge consumer products.

Robust growth in the consumer electronics sector and increasing demand for affordable plastic solutions, is expected to stimulate expansion of the U.K. market. As manufacturers aim to reduce production costs while maintaining quality, plastics offer a versatile and economical alternative to traditional materials. The rapid advancement of technology and the proliferation of smart devices further drive the need for innovative plastic applications. This combination of cost efficiency and consumer electronics expansion positions the U.K. plastics market for substantial growth, meeting the evolving needs of manufacturers and consumers alike.

Asia Pacific Plastics In Consumer Electronics Market Trends

Asia Pacific plastics in consumer electronics industry held the largest market share of 68.1% in 2024 on account of increased collaboration between technology firms and plastic manufacturers. By working together, these entities can innovate more effectively, developing advanced materials that meet the demands of modern devices. In addition, stringent health and safety regulations are compelling manufacturers to prioritize safer, non-toxic plastics, which further enhances product appeal. Market growth in consumer electronics is projected to accelerate due to the combined emphasis on corporate compliance and sustainability, resulting in higher-quality, eco-friendly products.

Growing awareness of e-waste management and the increasing adoption of high-performance plastics are anticipated to accelerate the market growth across China. As environmental concerns rise, manufacturers are prioritizing sustainable practices, focusing on recyclable and eco-friendly materials. High-performance plastics enhance product durability and functionality while supporting compliance with stringent regulatory standards. This shift toward sustainability, along with a growing consumer electronics sector, is projected to propel market growth, fostering innovations that minimize waste and maximize resource efficiency in the industry.

The escalating demand for customized and personalized electronic products and the surging use of lightweight plastics are projected to drive the growth of plastics in consumer electronics market in India. Consumers are increasingly seeking unique, tailored designs that reflect their individual preferences, prompting manufacturers to innovate with versatile plastic materials. Lightweight plastics enhance portability and improve energy efficiency, making devices more appealing. As the electronics sector in India continues to expand, this shift toward personalization and lightweight solutions is anticipated to fuel market growth, catering to evolving consumer needs and preferences.

Key Plastics In Consumer Electronics Company Insights

Some of the key companies in the plastics in consumer electronics industry include Trinseo PLC; Covestro AG; Celanese Corporation.; SABIC; Lotte Chemical Corp.; LG Chem; Mitsubishi Chemical Group Corporation; SAMSUNG SDI Co., Ltd.; DSM-firmenich; Kuraray Co. Ltd.; and Qingdao GON Science & Technology Co., Ltd.

-

Covestro AG specializes in high-performance materials, including sustainable plastics, coatings, and elastomers. It serves industries such as automotive, construction, and healthcare, focusing on innovation, sustainability, and enhancing product functionality for various applications.

-

LG Chem provides a wide range of chemical and materials solutions, including advanced batteries, petrochemicals, electronics, and life sciences products. The company focuses on sustainable innovation, driving advancements in energy, healthcare, and various industrial sectors.

Key Plastics In Consumer Electronics Companies:

The following are the leading companies in the plastics in consumer electronics market. These companies collectively hold the largest market share and dictate industry trends.

- Trinseo PLC

- Covestro AG

- Celanese Corporation

- SABIC

- Lotte Chemical Corp.

- LG Chem

- Mitsubishi Chemical Group Corporation

- SAMSUNG SDI Co., Ltd.

- DSM-firmenich

- Kuraray Co. Ltd.

- Qingdao GON Science & Technology Co., Ltd.

Recent Developments

-

In January 2025,Chandigarh-based start-up PolyCycl launched its patented recycling technology in Bengaluru, which converts hard-to-recycle plastics into food-grade polymers, renewable chemicals, and sustainable fuels, supporting the circular economy.

-

In July 2024,Neste and Mitsubishi Corporation formed a strategic partnership to develop renewable chemicals and plastics for Japanese brands, including those in food, apparel, and consumer electronics, aiming to accelerate the transition to defossilized supply chains.

Plastics In Consumer Electronics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.6 billion

Revenue forecast in 2030

USD 7.5 billion

Growth rate

CAGR of 2.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

Trinseo PLC; Covestro AG; Celanese Corporation; SABIC; Lotte Chemical Corp.; LG Chem; Mitsubishi Chemical Group Corporation; SAMSUNG SDI Co., Ltd.; DSM-firmenich; Kuraray Co. Ltd.; Qingdao GON Science & Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastics In Consumer Electronics Market Segmentation

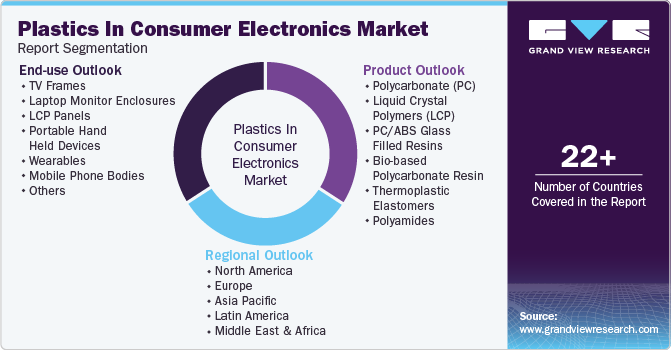

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plastics in consumer electronics market report based on product, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Polycarbonate (PC)

-

Liquid Crystal Polymers (LCP)

-

PC/ABS Glass Filled Resins

-

Bio-based Polycarbonate Resin

-

Thermoplastic Elastomers

-

Polyamides

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

TV Frames

-

Laptop Monitor Enclosures

-

LCP Panels

-

Portable Hand Held Devices

-

Wearables

-

Mobile Phone Bodies

-

Appliances & White Goods

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.