- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Vacuum Forming Market Share & Share Report, 2030GVR Report cover

![Plastic Vacuum Forming Market Size, Share & Trends Report]()

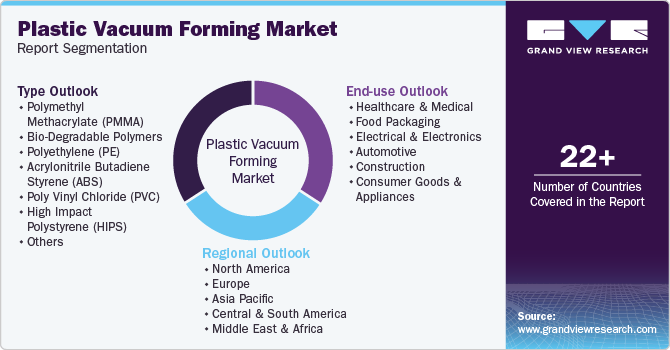

Plastic Vacuum Forming Market Size, Share & Trends Analysis Report By Product (PMMA, Bio-Degradable, PE, ABS, PVC, HIPS, PS, PP), By End Use (Healthcare & Medical, Food Packaging, Electrical & Electronics, Automotive), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-451-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Plastic Vacuum Forming Market Trends

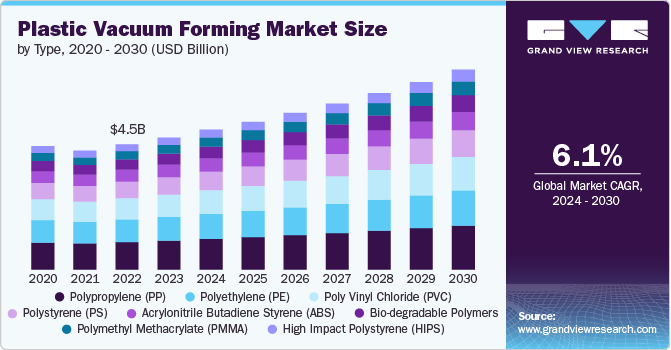

The global plastic vacuum forming market size was estimated at USD 4.79 billion in 2023 and expected to expand at a CAGR of 6.15% from 2024 to 2030. Rising demand from various expanding industries such as automotive, consumer electronics, food packaging and others globally is driving the demand for plastic vacuum forming solutions.

In the plastic vacuum forming market, there is a growing trend toward the use of eco-friendly materials and sustainable production processes. As consumer awareness around environmental impact rises, manufacturers are increasingly focusing on incorporating biodegradable and recyclable plastics in vacuum-formed products. This shift is particularly evident in packaging industries where brands aim to reduce their carbon footprint. In addition, innovations in vacuum forming technology are enabling more efficient use of raw materials, minimizing waste during the production process. This trend reflects the broader move toward sustainability across manufacturing sectors and is expected to shape the future of plastic vacuum forming.

Drivers, Opportunities & Restraints

The increasing demand for lightweight and cost-effective components in various industries is a major driver for the plastic vacuum forming market. Sectors such as automotive, aerospace, and consumer electronics are increasingly relying on vacuum-formed plastics for their ability to offer high precision at a lower cost compared to other manufacturing methods such as injection molding. The versatility of vacuum forming, allowing for the production of large and complex shapes with minimal tooling costs, is particularly attractive to industries looking to enhance efficiency while maintaining product quality. This is expected to drive consistent growth in the market as industries prioritize cost-effective production methods.

There is a significant growth opportunity in the medical device and healthcare packaging sectors for the plastic vacuum forming market. The increasing demand for sterile, customized packaging solutions for medical devices, instruments, and pharmaceuticals has created a lucrative avenue for vacuum-formed plastic products. Vacuum forming offers flexibility in design, allowing manufacturers to produce highly specialized trays, containers, and enclosures that meet the stringent hygiene and safety requirements of the healthcare industry. As healthcare markets expand globally, particularly in emerging economies, the demand for innovative and cost-efficient packaging solutions will present a promising opportunity for vacuum forming manufacturers.

Despite its potential, the plastic vacuum forming market faces challenges that could hinder its growth. One of the key restraints facing the plastic vacuum forming market is the volatility in raw material prices, particularly petroleum-based plastics. Since the production of plastics is heavily reliant on crude oil derivatives, fluctuations in oil prices directly impact the cost of raw materials, creating uncertainty for manufacturers. In additionally, rising concerns over the environmental impact of plastic waste and the increasing push for regulatory measures to reduce plastic usage further challenge the market. These factors can increase operational costs and complicate long-term planning, potentially limiting market growth in regions with strict environmental regulations or where raw material supply chains are unstable.

Type Insights

Based on type, the polypropylene (PP) segment led the market with the largest revenue share of 21.97% in 2023, which can be attributed to the rising demand for durable and heat-resistant packaging solutions across various industries. Polypropylene’s superior properties, including its high melting point, chemical resistance, and flexibility, make it an ideal material for applications requiring robust performance, such as in food packaging, medical trays, and automotive components. As industries seek lightweight yet strong materials that can withstand extreme temperatures and maintain product integrity, PP plastic vacuum forming has become increasingly popular. The cost-effectiveness and recyclability of polypropylene further enhances its appeal, driving growth in markets where sustainability and material performance are crucial factors.

The polymethyl methacrylate (PMMA) segment is expected to grow at a significant rate over the forecast period. The segment is driven by the growing demand for high-clarity and aesthetically appealing products in industries such as signage, retail displays, and automotive. PMMA, also known as acrylic, offers excellent optical properties, including transparency and UV resistance, making it a preferred material for applications where visual quality and durability are essential. In sectors such as architecture and interior design, vacuum-formed PMMA components are increasingly used to create lightweight, impact-resistant panels and fixtures. The material’s ease of fabrication and ability to retain a polished, glossy finish after forming further contribute to its rising demand, particularly as industries emphasize both performance and visual appeal.

End-use Insights

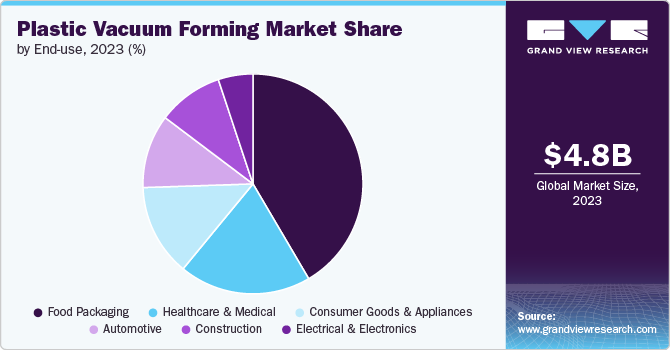

Based on end use, the food packaging segment dominated the market with the largest revenue share of 41.50% in 2023, driven by the increasing demand for custom, hygienic, and cost-effective packaging solutions. Vacuum forming allows for the efficient production of lightweight, durable, and sealed packaging that meets stringent food safety standards while ensuring extended shelf life for perishable goods. The ability to quickly mold plastics into specific shapes tailored to different food products-such as trays, containers, and blister packs-offers significant advantages to food manufacturers.

In addition, the versatility of vacuum forming enables the use of various food-grade plastics, such as PET and PP, which are widely accepted for their recyclability and protective properties, further driving demand in the market as sustainability and food safety become central concerns for consumers and producers alike.

The automotive segment is poised to grow at the fastest rate from 2024 to 2030. This can be attributed to the growing demand for lightweight and cost-efficient components that enhance fuel efficiency and vehicle performance. Automotive manufacturers are increasingly utilizing vacuum-formed plastic parts such as interior panels, dashboards, and trunk liners due to their ability to reduce vehicle weight without compromising durability or functionality. The flexibility of vacuum forming allows for the production of large, complex components with precise detailing, which is critical for modern vehicle designs. In addition, the process is more cost-effective compared to other manufacturing methods, particularly for low-to-medium volume production, making it an ideal solution for automakers looking to optimize costs while meeting stringent environmental and safety standards. As the automotive industry continues to prioritize fuel efficiency and sustainability, the demand for vacuum-formed plastic components is expected to grow significantly.

Regional Insights

In North America, the Plastic Vacuum Forming market is driven by the increasing focus on sustainability and recyclable materials, particularly in the packaging and consumer goods sectors. Companies are adopting vacuum-formed plastics as an environmentally friendly alternative, given their ability to be molded into a variety of shapes using recycled materials. In addition, the automotive industry in North America is looking to vacuum-formed components as a cost-effective solution for reducing vehicle weight, contributing to better fuel efficiency and lower emissions, which aligns with regulatory requirements in the region.

U.S. Plastic Vacuum Forming Market Trends

The U.S. market for plastic vacuum forming is seeing strong growth due to the increasing demand for high-quality medical devices and packaging. The healthcare sector in the U.S. is adopting vacuum-formed plastics for sterile packaging solutions that meet stringent regulatory standards. In addition, the vacuum forming process is widely used in the production of medical trays and enclosures, making it an essential part of the medical device manufacturing chain. The versatility of the process allows for customization, which is critical in meeting the specific needs of the healthcare industry.

Asia Pacific Plastic Vacuum Forming Market Trends

Asia Pacific dominated the global Plastic Vacuum Forming market and accounted for largest revenue share of 40.71% in 2023, owing to the rapid expansion of the automotive and consumer electronics industries. Countries such as China, India, and Japan are experiencing increased demand for lightweight and durable plastic components that can be easily molded into complex shapes, particularly for vehicle interiors and electronic device housings. The growing trend towards electric vehicles (EVs) further boosts the demand for vacuum-formed plastic parts as manufacturers prioritize weight reduction to improve energy efficiency.

Europe Plastic Vacuum Forming Market Trends

In Europe, the plastic vacuum forming market is driven by the stringent regulations around sustainable packaging and the rising demand for eco-friendly materials. The European Union’s focus on reducing plastic waste has encouraged manufacturers to adopt vacuum forming technologies that minimize material usage and waste during production. This is particularly important in the food and beverage packaging industry, where there is a growing need for recyclable and biodegradable packaging solutions. Moreover, the automotive sector in Europe is increasingly adopting vacuum-formed plastics to comply with the region’s strict emissions regulations, focusing on lightweight materials to reduce fuel consumption and CO2 emissions.

Asia Pacific Plastic Vacuum Forming Market Trends

The Asia Pacific region is further driven by the robust growth of the packaging industry, especially in food and pharmaceuticals, where there is rising demand for protective and customized packaging solutions. The vacuum forming process allows for the production of cost-effective, high-quality plastic packaging that meets the needs of these industries. This demand is amplified by the region's expanding e-commerce sector, where efficient, lightweight packaging is essential for transportation and product safety.

Key Plastic Vacuum Forming Company Insights

The Plastic Vacuum Forming market is highly competitive, with several key players dominating the landscape. Major companies include Conlet Plastics, Profile Plastics, Engineered Plastic Products, Arrowhead, SAY Plastics, Robinson Industries, BCJ Plastic Products, Emco, Multiplastics, Advanced Plastiform, Walton Plastics, Plastic Ingenuity, SWP, and DynaFlex. The plastic vacuum forming market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Plastic Vacuum Forming Companies:

The following are the leading companies in the plastic vacuum forming market. These companies collectively hold the largest market share and dictate industry trends.

- Conlet Plastics

- Profile Plastics

- Engineered Plastic Products

- Arrowhead

- SAY Plastics

- Robinson Industries

- BCJ Plastic Products

- Emco

- Multiplastics

- Advanced Plastiform

- Walton Plastics

- Plastic Ingenuity

- SWP

- DynaFlex

Recent Developments

-

In March 2024, National Composites acquired Northern Plastics, a plastic vacuum thermoformer based in Michigan. This purchase is part of National Composites' strategy to expand its capabilities in producing composite materials. The acquisition will enhance their product offerings and allow for more efficient manufacturing processes. Northern Plastics is known for its expertise in thermoforming, which involves shaping plastic sheets into various products. This deal is expected to benefit both companies by combining resources and expertise in the plastics industry.

-

In March 2020, Good Nature Products Inc., a key manufacturer of plant-based products, announced the acquisition of Shepherd Thermoforming & Packaging Inc., a prominent vacuum thermoforming packaging company. This strategic move will allow Good Nature Products to expand its production capabilities and better serve its customers. The acquisition will enable Good Nature Products to integrate Shepherd Thermoforming & Packaging's expertise in thermoforming packaging into its own operations. This will result in increased efficiency, cost savings, and improved product quality for Good Nature Products' customers.

Plastic Vacuum Forming Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.06 billion

Revenue forecast in 2030

USD 7.24 billion

Growth rate

CAGR of 6.15% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Indonesia, Vietnam, Brazil; Argentina; Saudi Arabia; South Africa, UAE, Kuwait

Key companies profiled

Conlet Plastics; Profile Plastics; Engineered Plastic Products; Arrowhead; SAY Plastics; Robinson Industries; BCJ Plastic Products; Emco; Multiplastics; Advanced Plastiform; Walton Plastics; Plastic Ingenuity; SWP; DynaFlex

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Vacuum Forming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented plastic vacuum forming market report on the basis of type, end use, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polymethyl Methacrylate (PMMA)

-

Bio-Degradable Polymers

-

Polyethylene (PE)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Poly Vinyl Chloride (PVC)

-

High Impact Polystyrene (HIPS)

-

Polystyrene (PS)

-

Polypropylene (PP)

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Healthcare & Medical

-

Food Packaging

-

Electrical & Electronics

-

Automotive

-

Construction

-

Consumer Goods & Appliances

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plastic vacuum forming market size was estimated at USD 4.79 billion in 2023 and is expected to reach USD 5.06 billion in 2024.

b. The global plastic vacuum forming market is expected to expand at a compound annual growth rate (CAGR) of 6.15% from 2024 to 2030 to reach USD 7.24 billion by 2030.

b. Based on type, the polypropylene (PP) segment led the market with the largest revenue share of 21.97% in 2023, which can be attributed to the rising demand for durable and heat-resistant packaging solutions across various industries.

b. The plastic vacuum forming market is highly competitive, with several key players dominating the landscape. Major companies include Conlet Plastics, Profile Plastics, Engineered Plastic Products, Arrowhead, SAY Plastics, Robinson Industries, BCJ Plastic Products, Emco, Multiplastics, and Advanced Plastiform.

b. The increasing demand for lightweight and cost-effective components in various industries is a major driver for the plastic vacuum forming market. Sectors such as automotive, aerospace, and consumer electronics are increasingly relying on vacuum-formed plastics for their ability to offer high precision at a lower cost compared to other manufacturing methods like injection molding.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."