- Home

- »

- Medical Devices

- »

-

Plastic Surgery Instruments Market Size, Share Report, 2030GVR Report cover

![Plastic Surgery Instruments Market Size, Share & Trends Report]()

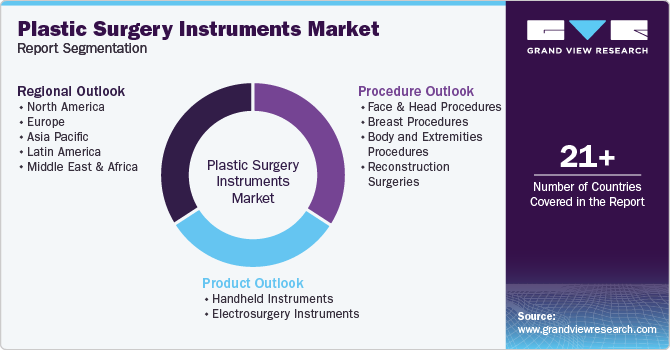

Plastic Surgery Instruments Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Handheld instruments, Electrosurgery Instruments), By Procedure (Face and Head Procedures), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-508-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Surgery Instruments Market Trends

The global plastic surgery instruments market size was estimated at USD 1.51 billion in 2024 and is projected to reach USD 2.36 billion by 2030, growing at a CAGR of 7.9% from 2025 to 2030. Increased awareness of cosmetic procedures is the main factor contributing to the market's growth. The global demand for cosmetic procedures is on the rise, with cosmetic surgery enhancing the body's appearance and plastic surgery repairing tissues damaged by burns or trauma. As per the American Society of Plastic Surgeons (ASPS), there was a 6 percent increase in overall cosmetic procedures performed on men. Body procedures experienced an 18 percent increase, while face and neck procedures grew by 15 percent, in 2023. In addition, the implementation of minimally invasive techniques is driving a beneficial impact on the revenue expansion of the market. Moreover, overall growth in cosmetic surgery procedures witnessed a 5 percent increase year over year according to the 2023 ASPS Procedural Statistics.

Furthermore, technological advancements play a crucial role in the growth of the plastic surgery equipment market. The advancement of minimally invasive surgical methods and new robotic systems, providing patients with shorter recovery periods and minimal scarring are boosting the transformation of this field.

Moreover, the increasing popularity and acceptance of cosmetic procedures also impact the market dynamics. More people, including men and younger individuals, are choosing to undergo plastic surgery due to the growing impact of social media and the wish to maintain a youthful appearance. This trend is not limited to Western countries; developing economies in Latin America and Asia are experiencing a significant increase in the need for aesthetic treatments, thus growing the international market presence.

Despite experiencing strong growth, the plastic surgery instruments market is hindered by obstacles like strict regulatory requirements and expensive advanced instruments. Regulatory agencies set strict criteria to guarantee the safety and effectiveness of surgical instruments, leading to potential delays in product release and higher compliance expenses for producers. Moreover, the expensive price of advanced surgical tools could hinder their use, especially in healthcare systems with limited funding and in low-income areas. Yet, continuous research and development, along with strategic partnerships among important market participants, are projected to address these restraints and maintain the market growth.

Product Insights

Handheld surgical devices dominated the market in 2023 with a share of 71.9% due to its wide variety of tools essential for different plastic surgery procedures. These tools include retractors, forceps, auxiliary instruments, graspers, elevators, and cutter instruments. These tools are essential in a variety of surgical procedures, ranging from simple cuts to complex reconstructions. Advancements in design and materials, along with the versatility of tools, have led to their widespread use in plastic surgery. Forceps and retractors are crucial for surgeons to maintain precision and control during operations in this dominant field. Cutter tools and lifts, used for cutting and reshaping tissues, play a key role in the sector's leadership. The ongoing implementation of ergonomic designs and advanced materials solidifies the handheld surgical instruments segment's top position.

The electrosurgery segment is projected to grow at the fastest CAGR over the forecast period. The segment includes bipolar and monopolar instruments. These tools are essential for processes that demand great accuracy and minimal intrusion. Instruments with bipolar technology, valued for their precise coagulation abilities, are the top choice for procedures that require careful control of bleeding. Monopolar devices, known for their flexibility and effectiveness, are commonly used for tissue cutting and sealing. Technological advancements that improve safety and efficacy, like better energy delivery systems and advanced control mechanisms, fuel the demand for electrosurgical instruments. Even with a smaller portion of the market, these tools play a crucial role in contemporary plastic surgery techniques, particularly in surgeries that need precise shaping and minimal tissue damage

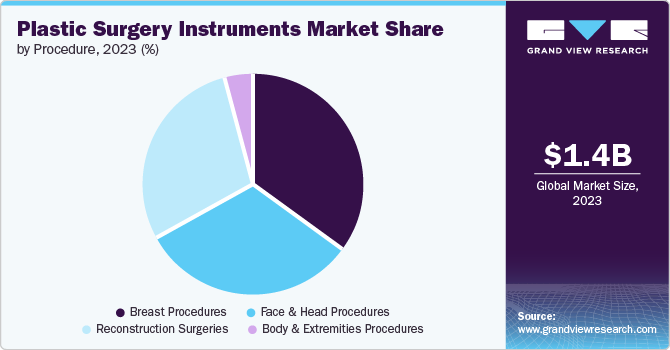

Procedure Insights

Breast procedures dominated the market in 2023 due to the rising number of body image concerns and the desire for enhanced physical appearance among women. This has led to an increased demand for breast surgeries like reduction, augmentation, and reconstruction. For instance, American Plastic Surgery reported that there were a total of 572,498 breast procedures performed on women in 2023, increased by 10% in 2023 as compared to 2022.In addition, improvements in implant technology and minimally invasive techniques, increasing levels of disposable income, along with the increasing popularity of cosmetics are driving market growth even further.

Face & Head procedures are expected to register the fastest CAGR during the forecast period due to the rising emphasis on facial aesthetics and the desire for a youthful appearance. In addition, the increasing occurrence of acne scars, skin aging, and other facial flaws is driving the need for treatments such as blepharoplasty, rhinoplasty, and facelifts. The increasing popularity of less invasive facial treatments, along with improvements in surgical methods and tools, has also contributed to the market's growth. Moreover, the impact of social media and famous individuals in endorsing facial beauty affects consumer choices, leading to an increased demand for procedures on the face and head, along with the necessary tools. Facelifts experienced an 8 percent increase, surpassing 2023 growth by a significant margin.

Regional Insights

North America plastic surgery instruments market dominated the market with a share of 34.63% in 2023. Factors, such as high-income populations, modern healthcare systems, and many expert plastic surgeons and instrument producers in the area, contribute to this dominance. Countries such as Germany, France, and the UK play a significant role in the market. The European market is known for its strict regulatory standards that guarantee safe and high-quality surgical instruments, building trust and demand from healthcare providers and patients.

U.S. Plastic Surgery Instruments Market Trends

The U.S. plastic surgery instruments market dominated North America in 2023. In 2019, around 4.2 million plastic surgery procedures were recorded, solidifying its position as the nation with the most cosmetic surgeries. Moreover, in 2019, the most popular cosmetic surgeries in the U.S. were liposuction, breast augmentation, nose reshaping, tummy tuck procedures, and eyelid surgery. Additionally, about 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were conducted in the U.S. in 2022, a notable 19% rise in cosmetic surgery procedures compared to 2019.

Asia Pacific Plastic Surgery Instruments Market Trends

Asia Pacific's plastic surgery instruments market is anticipated to witness significant growth in the coming years, driven by rising disposable incomes, increasing knowledge about cosmetic treatments, and a growing healthcare industry. Nations such as India, South Korea, and China are emerging as popular destinations for cosmetic surgery, attracting both residents and visitors seeking medical procedures. The market expansion in the area is also boosted by improvements in healthcare facilities and the availability of experienced plastic surgeons.

China's plastic surgery instruments market held a substantial market share in 2023. For instance, in 2019, there were more than 2.9 million surgeries recorded, a 47% rise compared to the prior year. Common cosmetic procedures in China are breast implants, double eyelid surgery, fat removal surgery, and nose jobs.

Europe Plastic Surgery Instruments Market Trends

Europe’s market was identified as a lucrative region in 2023 due to the increasing occurrence of obesity, accidents, and burns is boosting the need for reconstructive procedures. Moreover, the increasing emphasis on body image awareness in younger generations is fueling the demand for cosmetic surgeries.

The UK plastic surgery instruments market is expected to grow rapidly in the coming years. Improvements in surgical methods and the use of minimally invasive techniques have led to a need for specialized tools.

Key Plastic Surgery Instruments Company Insights

Some of the key companies in the plastic surgery instruments market include Zimmer Biomet, B. Braun SE, Blink Medical Ltd., Anthony Product, and other companies. To obtain a competitive advantage in the market, businesses are concentrating on growing their customer base. As a result, important players are pursuing several calculated risks, including partnerships mergers, and acquisitions with other major companies.

Key Plastic Surgery Instruments Companies:

The following are the leading companies in the plastic surgery instruments market. These companies collectively hold the largest market share and dictate industry trends.

- Sklar Surgical Instruments

- Zimmer Biomet

- B. Braun SE

- Blink Medical Ltd.

- Bolton Surgical Ltd.

- Integra LifeSciences Corporation

- TEKNO-MEDICAL Optik-Chirurge GmbH

- Karlz Storz

- BMT Medizintechnik GmbH

- Anthony Product

Recent Developments

-

In July 2024, Dr. Devgan Scientific Beauty announced the launch of surgical instruments which is anticipated to address structural bias in the size of surgical instrument that can hinder the work of surgeons with smaller hands or the female surgeons.

Plastic Surgery Instruments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.61 billion

Revenue forecast in 2030

USD 2.36 billion

Growth rate

CAGR of 7.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, procedure, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, KSA, UAE, South Africa

Key companies profiled

Sklar Surgical Instruments; Zimmer Biomet; Braun SE; Blink Medical Ltd.; Bolton Surgical Ltd.; Integra LifeSciences Corporation; TEKNO-MEDICAL Optik-Chirurge GmbH; Karlz Storz; BMT Medizintechnik GmbH; Anthony Product;

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Surgery Instruments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic surgery instruments market report based on product, procedure, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Handheld Instruments

-

Forceps

-

Retractors

-

Graspers

-

Auxiliary Instruments

-

Cutter Instruments

-

Elevators

-

Chisels and gouges

-

Cannulas

-

Dissectors

-

Sutures and Staplers

-

-

Electrosurgery Instruments

-

Bipolar Instruments

-

Monopolar Instruments

-

-

-

Procedure Outlook (Revenue, USD Billion, 2018 - 2030)

-

Face and Head Procedures

-

Brow Lift

-

Ear Surgery

-

Eyelid Surgery

-

Face Lift and Neck Lift (Rhytidectomy)

-

Face Bone Contouring

-

Rhinoplasty

-

-

Breast Procedures

-

Breast Augmentation

-

Breast Lift

-

Breast Reduction

-

Gynecomastia

-

-

Body and Extremities Procedures

-

Buttock Augmentation

-

Thigh Lift

-

Upper and Lower Body Lift

-

Arm Lift

-

Labiaplasty

-

-

Reconstruction Surgeries

-

Abdominoplasty

-

Liposuction

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

South Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.