- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Recycling Services Market Size & Share Report, 2030GVR Report cover

![Plastic Recycling Services Market Size, Share & Trends Report]()

Plastic Recycling Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Process (Mechanical Recycling, Chemical Recycling), By Type (Plastic Bottles, Plastic Films, Polymer Foam), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-469-9

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Recycling Services Market Summary

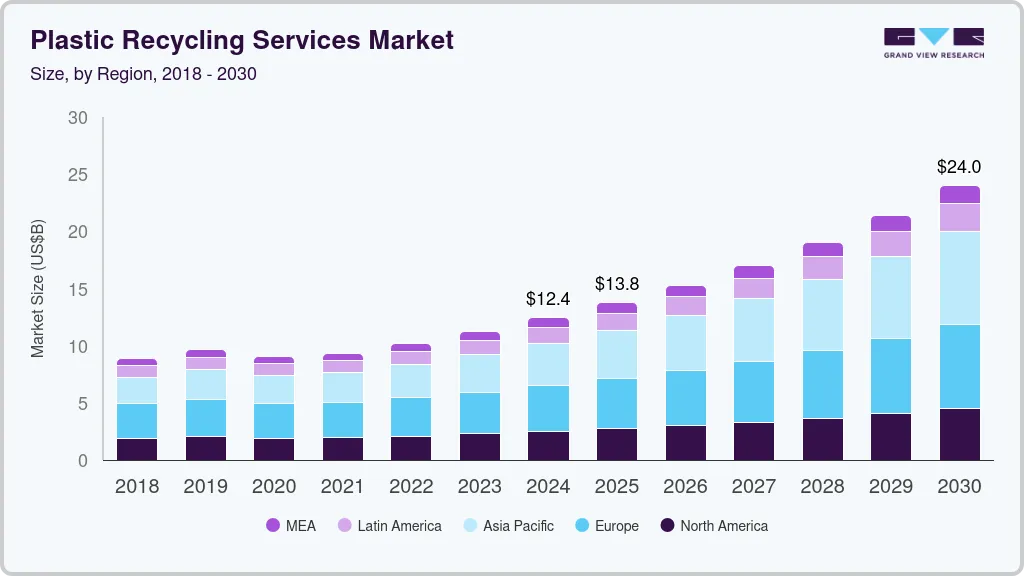

The global plastic recycling services market size was estimated at USD 12,422.1 million in 2024 and is projected to reach USD 24,000.4 million by 2030, growing at a CAGR of 11.8% from 2025 to 2030. Globally the rise of non-degradable plastic pollution is increasing the threat to the environment.

Key Market Trends & Insights

- In terms of region, Europe dominated the global plastic recycling services market and accounted for the largest revenue share of 47.8% in 2023.

- Country-wise, Germany plastic recycling services market is a prominent country in the plastic recycling services market.

- In terms of product, The mechanical recycling segment led the market with a revenue share of 71.35% in 2023.

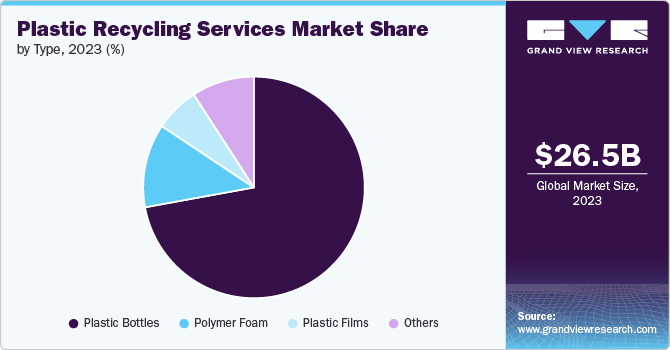

- In terms of type, The plastic bottles segment dominated the market with the largest revenue share of 72.20% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 12,422.1 Million

- 2030 Projected Market Size: USD 24,000.4 Million

- CAGR (2024-2030): 11.8%

- Europe: Largest market in 2023

Such ill effects caused by this pollution lead to a surge the demand for the recycling services to manage plastic pollution effectively. A significant trend in the plastic recycling services market is the growing emphasis on the circular economy. Governments and companies are shifting towards recycling models that help to reduce waste and reuse of plastic materials. This trend is driven by the global sustainability movement, where industries are adopting practices to minimize their carbon footprint. Large corporations, especially in packaging, automotive, and consumer goods, are integrating recycled plastic into their products, driving demand for high-quality recycling services. The adoption of extended producer responsibility (EPR) programs also reflects the increased accountability for plastic waste management, contributing to market growth.

Drivers, Opportunities & Restraints

Stringent regulations imposed by governments worldwide are a critical driver for the plastic recycling services market. Many countries have implemented bans on single-use plastics and mandatory recycling quotas to curb environmental pollution. In regions like the European Union, policies such as the EU Plastics Strategy aim to ensure that all plastic packaging is recyclable by 2030. Similar legislative measures are being introduced in other regions, including North America and Asia, compelling industries to invest in sustainable recycling practices. These regulatory frameworks are creating a steady demand for advanced recycling technologies and services.

Advancements in recycling technologies present a major opportunity in the plastic recycling services market. New innovations, such as chemical recycling, are emerging as effective solutions to process previously non-recyclable plastics. These technologies break down plastic waste into its chemical components, enabling the production of high-quality recycled materials that can be used in a wide range of industries. Furthermore, automation and AI-driven sorting systems improve the efficiency of plastic waste processing, reducing contamination and increasing the volume of recyclable materials. As these technologies continue to develop, they offer businesses the opportunity to expand their recycling capacity and cater to more industries.

Despite its potential, the plastic recycling services market faces challenges that could hinder its growth. One of the primary restraints in the plastic recycling services market is the high operational cost associated with recycling processes. Collecting, sorting, cleaning, and processing plastic waste requires substantial investment in equipment, technology, and labor. In many cases, virgin plastic production remains more cost-effective than recycling, particularly when oil prices are low. Additionally, the infrastructure required for efficient recycling is underdeveloped in many regions, limiting the scale of operations. These financial barriers can slow down the widespread adoption of plastic recycling, especially for smaller companies or regions with limited resources.

Process Insights

The mechanical recycling segment led the market with a revenue share of 71.35% in 2023 owing to the growing demand for recycled plastics in various manufacturing sectors. As industries such as automotive, electronics, and packaging look to reduce their reliance on virgin plastics, they are increasingly turning to mechanically recycled plastics to meet sustainability goals. Many large corporations are incorporating recycled content into their products to align with eco-friendly consumer preferences and corporate social responsibility (CSR) initiatives. Major packaging companies are committing to using a certain percentage of recycled plastics in their products.

The chemical recycling segment is expected to grow at a significant rate over the forecast period. The segment is driven by the growing ability to process complex and contaminated plastics that mechanical recycling cannot handle. Chemical recycling, which breaks down plastics into their original chemical components, is gaining traction because it can recycle mixed, multi-layered, and contaminated plastics-such as food packaging, agricultural films, and medical waste-that typically end up in landfills. Unlike mechanical recycling, which can degrade plastic quality over multiple cycles, chemical recycling restores plastic to its virgin-grade quality, making it highly valuable for industries requiring high-performance materials. This technology also addresses the global challenge of plastic waste pollution by enabling more types of plastic to be recycled.

Type Insights

The plastic bottles segment dominated the market with the largest revenue share of 72.20% in 2023, driven bythe high recycling rates of polyethylene terephthalate (PET) bottles and the growing demand for recycled PET (rPET). PET is widely used for beverage and water bottles, making it one of the most easily collected and recyclable plastics. Many regions have established bottle deposit schemes and curbside collection programs that encourage consumers to return used bottles for recycling. Additionally, the increasing use of rPET in packaging and textiles is propelling demand, as brands seek to meet sustainability goals and reduce plastic waste. Major companies, particularly in the food and beverage sector, are committing to using a significant portion of rPET in their packaging as part of their environmental pledges.

The flame retardants segment is poised to grow at the fastest rate from 2024 to 2030. This can be attributed to the rising need for a safe environment and safe fire-resistant materials in industries such as construction, electronics, and automotive. As traditional flame retardants are often associated with harmful environmental and health effects, the demand for biodegradable alternatives that provide the same fire-resistance properties without toxic by-products is growing. Regulatory pressures to reduce the use of hazardous chemicals, combined with increasing consumer and industry focus on sustainability, are driving the adoption of biodegradable flame retardants. These additives allow manufacturers to meet stringent fire safety standards while aligning with eco-friendly production practices, making them crucial for high-performance, sustainable types.

Regional Insights

In North America, the plastic recycling services market is being driven by increasing corporate sustainability initiatives. Many large companies across various sectors, including retail, packaging, and consumer goods, are committing to ambitious recycling goals and circular economy models. These companies are partnering with recycling service providers to integrate recycled plastic into their products and packaging. Furthermore, growing consumer awareness and preference for eco-friendly products have put pressure on businesses to adopt recycled materials. This has led to a significant increase in demand for plastic recycling services, as companies aim to meet these sustainability standards and reduce their environmental impact.

U.S. Plastic Recycling Services Market Trends

The plastic recycling services market in the U.S. is being driven by government incentives and legislative action aimed at reducing plastic waste. States like California have implemented strict recycling mandates, including bans on single-use plastics and requirements for producers to use recycled content in their packaging. Federal-level initiatives are also gaining momentum, such as the Break Free from Plastic Pollution Act, which seeks to increase recycling rates and reduce plastic waste. These legislative efforts, combined with tax incentives and grants for recycling infrastructure, encourage businesses to invest in and utilize plastic recycling services across the country.

Europe Plastic Recycling Services Market

Europe dominated the global plastic recycling services market and accounted for the largest revenue share of 47. 8% in 2023, owing to the strong regulatory focus on the circular economy and the implementation of Extended Producer Responsibility (EPR) programs. The European Union’s Green Deal and Plastics Strategy have set ambitious recycling targets, requiring all plastic packaging to be recyclable by 2030. EPR programs mandate that manufacturers are responsible for the recycling and disposal of their plastic products, pushing them to collaborate with recycling service providers. This regulatory framework is accelerating investment in advanced recycling technologies and infrastructure across the region, with industries such as packaging, automotive, and consumer goods being key contributors to the demand for plastic recycling services.

Germany plastic recycling services market is a prominent country in the plastic recycling services market, driven by its technological advancements and efficient waste management systems. The country has one of the highest plastic recycling rates in the world, thanks to its comprehensive collection and sorting infrastructure. Germany’s focus on innovation in recycling technologies, such as advanced sorting systems and chemical recycling, enables it to process a wide range of plastic types with minimal contamination. Additionally, Germany’s strong industrial base, including the automotive and packaging sectors, heavily relies on high-quality recycled plastics, further boosting demand for sophisticated recycling services.

Asia Pacific Plastic Recycling Services Market Trends

In the Asia Pacific region, the plastic recycling services market is driven by the growing government focus on improving waste management systems to tackle plastic pollution. Countries like China, Japan, and India have introduced stricter regulations on plastic waste disposal and are investing in recycling infrastructure. China’s ban on the import of foreign plastic waste has shifted attention toward domestic recycling efforts, creating opportunities for local recycling services to expand. Additionally, rapid urbanization and industrial growth in the region are generating large amounts of plastic waste, increasing the need for efficient recycling services. Government campaigns promoting plastic waste reduction and recycling awareness are further stimulating demand for plastic recycling solutions across Asia Pacific.

Key Plastic Recycling Services Company Insights

The plastic recycling services market is highly competitive, with several key players dominating the landscape. The plastic recycling services market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Plastic Recycling Services Companies:

The following are the leading companies in the plastic recycling services market. These companies collectively hold the largest market share and dictate industry trends.

- Deluxe Recycling

- Shakti Plastics Industries

- KW Plastics

- Loop Industries

- Birch Plastics

- PureCycle Technologies

- Mura Technology

- Pellenc ST

- Rekart Innovations Private Limited

- Banyan Nation

Recent Developments

-

In August 2024, Honeywell and Hinergy launched an advanced plastic recycling program to improve the sustainability of plastic waste management. This initiative will utilize innovative technologies to convert plastic waste into valuable materials, thereby reducing environmental impact. The collaboration seeks to enhance the circular economy by ensuring that plastics are recycled more effectively and can be reused in various applications.

-

In August 2023, Polyplastics launched a new recycling service aimed at engineering plastics. This initiative is designed to help companies manage their plastic waste more effectively by providing a solution for recycling materials that are typically difficult to process. The service will allow businesses to send their used engineering plastics to Polyplastics, where they will be recycled and repurposed into new products.

Plastic Recycling Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13758.2 million

Revenue forecast in 2030

USD 24,000.4 million

Growth rate

CAGR of 11.8% from 2025 to 2030

Historical data

2018 - 2022

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Process, type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Deluxe Recycling; Shakti Plastics Industries; KW Plastics; Loop Industries; Birch Plastics; PureCycle Technologies; Mura Technology; Pellenc ST; Rekart Innovations Private Limited; Banyan Nation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Recycling Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented Plastic Recycling Services market report based on process, type, and region:

-

Process Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Mechanical Recycling

-

Chemical Recycling

-

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Plastic Bottles

-

Plastic Films

-

Polymer Foam

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic recycling services market size was estimated at USD 26.55 billion in 2023 and is expected to reach USD 29.49 billion in 2024.

b. The global plastic recycling services market is expected to grow at a compound annual growth rate (CAGR) of 8.11% from 2024 to reach USD 47.08 billion in 2030.

b. Europe dominated the global plastic recycling services market and accounted for largest revenue share of 47.78% in 2023, owing to the strong regulatory focus on the circular economy and the implementation of Extended Producer Responsibility (EPR) programs. The European Union’s Green Deal and Plastics Strategy have set ambitious recycling targets, requiring all plastic packaging to be recyclable by 2030.

b. Some of the key players Deluxe Recycling; Shakti Plastics Industries; KW Plastics; Loop Industries; Birch Plastics; PureCycle Technologies; Mura Technology; Pellenc ST; Rekart Innovations Private Limited; and Banyan Nation.

b. Rising non-degradable plastic pollution globally is increasing the threat of various ill effects caused by this pollution leading to a surge in the demand for recycling services to effectively manage plastic pollution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.