Plastic Container Market Size, Share & Trends Analysis Report By Material (PET, HDPE, PP), By Application (Beverages, Industrial, Food, Cosmetic, Household Care, Pharmaceutical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-327-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Plastic Container Market Size & Trends

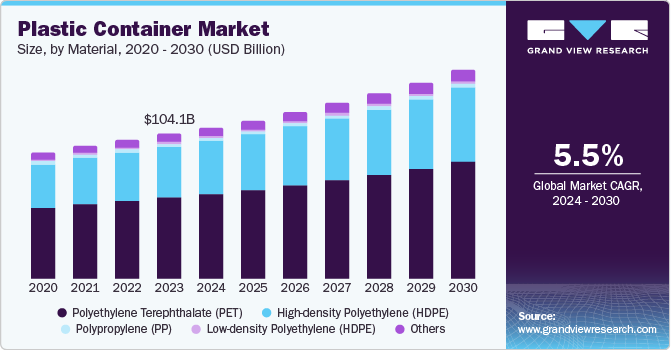

The global plastic container market size was valued at USD 104.1 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The increasing demand for plastic containers in the cosmetics & personal care, growing demand for rigid packaging from food and beverage packaging, and increased need for lightweight, durable, and cost effective packaging in industries such as pharmaceuticals, and personal care are the factors driving market growth worldwide.

The demand for plastic packaging has been escalating due to its convenience, creative visual appeal, and innovative eco-friendly options. The plastic container market is witnessing significant growth, driven by the availability of advanced, affordable, and sustainable packaging solutions. The excellent barrier properties of plastic packaging play a crucial role in market development, effectively protecting products from air and moisture, which is particularly important in industries such as cosmetics and personal care.

In the cosmetics and personal care sector, polypropylene is widely used to manufacture bottles and jars for packaging creams, powders, and other cosmetic products. The compact size and durability of these containers provide protection from air, light, moisture, dust, and dirt, ensuring the integrity of the packaged products. The increasing demand for skin care products has contributed to the growth of the cosmetics and personal care market, which is expected to drive the plastic containers market share over the forecast period.

The versatility of plastic containers makes them an attractive option for packaging a wide range of products, including foods, beverages, office supplies, and chemicals. Their lightweight and portable design allows for easy transportation and storage. Moreover, plastic containers can be molded in various sizes, shapes, and colors to accommodate brand identities and differentiate products. As industries continue to prioritize recycling and sustainability, the market for plastic containers is expected to expand in the future, with a focus on recyclable materials and biodegradable packaging solutions.

Material Insights

Polyethylene Terephthalate (PET) dominated the market and accounted for a share of 55.6% in 2023. PET is the preferred packaging material for carbonated drinks, bottled water, and juice due to its light weight, durability, and recyclability. With PET bottles used for 70% of mineral water, soft drinks, and juice transportation, its market share is expected to grow alongside rising demand for bottled water and juice.

High-density Polyethylene (HDPE) is expected to register the fastest CAGR of 5.7% during the forecast period. HDPE is a robust and stiff material renowned for its exceptional stress, crack resistance, and melt strength. Its properties provide a superior barrier against moisture and make it an ideal choice for packaging in personal care, beverages, food, and chemical industries, offering a durable and rigid solution for container manufacturing.

Application Insights

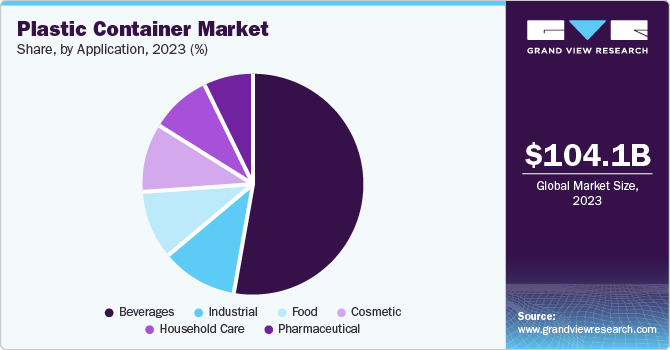

Beverages accounted for the largest market revenue share of 52.7% in 2023. Beverage containers, primarily bottles and jars, play a critical role in the supply chain, ensuring product safety and extended shelf life while protecting against leakage, moisture, and chemical exposure. As demand for convenience and ready-to-drink products increases, particularly plastic bottles for carbonated soft drinks, juices, and milk & dairy drinks, the industry’s growth will drive demand for packaging materials.

Cosmetic application of plastic containers is projected to grow at the fastest CAGR of 6.2% over the forecast period. The cosmetic industry relies heavily on plastic containers for flexible packaging solutions, catering to the rapid release of new products. Plastic containers offer portability, light weight, and durability, making them an ideal choice. Notably, China is a significant consumer of plastic containers globally, driven by the growing demand for beauty products within the country.

Regional Insights

Asia Pacific Plastic Container Market Trends

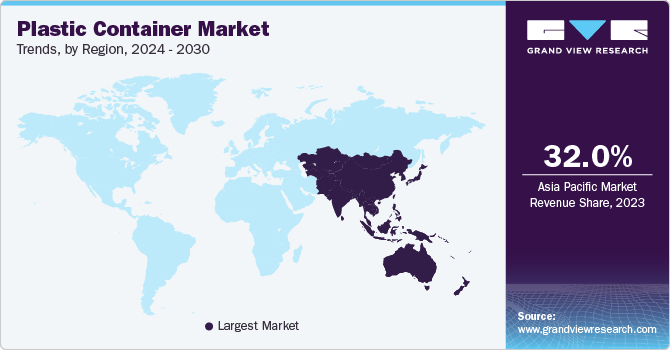

Asia Pacific plastic container market led the global plastic container market with a revenue share of 32.0% in 2023. The region is poised for significant growth in the plastic container industry, driven by the rising demand for plastic bottles for bottled water and carbonated beverages. PET is the dominant material used for beverage packaging. China and India are key drivers of this demand, underscoring the region’s importance in the global plastic container market.

The plastic container market in China dominated Asia Pacific in 2023. The cosmetic industry’s escalating demand for plastic protective packaging is expected to propel market growth in the future. In addition, the growing presence of automotive manufacturers in China is boosting the need for automotive lubricants and greases, thereby increasing the usage of plastic containers, driving demand and expansion in the region.

Europe Plastic Container Market Trends

Europe plastic container market was identified as a lucrative region in the global plastic container market in 2023. The FMCG and automotive sectors are driving market growth. The region’s high demand for liquid FMCGs, such as detergents and cleaners, and the presence of luxury car brands, necessitates a significant supply of automotive fluids. As a result, the demand for plastic packaging of lubricants, oil, coolants, and other fluids is increasing, fueling market expansion.

The plastic container market in Germany is expected to grow rapidly in the coming years owing to robust demand-supply dynamics, increasing demand for convenient food consumption among busy professionals, and the thriving food and beverage sector. In Germany, the market is particularly buoyed by a significant surge in demand for single-use plastic containers for water and carbonated beverages, fueling expansion.

North America Plastic Container Market Trends

North America plastic container market is anticipated to witness significant growth in the global plastic container market. The food industry relies heavily on rigid plastic bottles and jars to prevent leakage and contamination, while pharmaceuticals utilize plastic containers for storing medicines and healthcare products due to their lightweight and strength characteristics, enabling efficient storage and transportation. This demand drives the growth of the plastic container market.

U.S. Plastic Container Market Trends

The plastic container market in the U.S. held the largest market share of 80.9% in the North America plastic container market in 2023. Industry growth in the country remains highly lucrative due to the growing food and pharmaceutical industries. Plastic bottles and jars are widely used in the food industry to securely store fluids and foods, while pharmaceuticals demand them for their strength and portability. The rise in demand for home cleaners, driven by consumer emphasis on health and hygiene, further boosts market growth.

Key Plastic Container Company Insights

Some key companies in the plastic container market include Alpha Packaging, Inc.; Amcor plc; Bemis Manufacturing Company; and others. While market players adopt strategies such as mergers and acquisitions to increase product offerings, their focus remains on expanding their production capacity by adopting innovative technologies in order to meet consumer demand.

-

CKS Packaging is a manufacturer and supplier of plastic packaging solutions, catering to diverse industries, including food, beverage, health, beauty, personal care, automotive, medical, chemicals, and solutions.

-

Plastipak Holdings, Inc. is a manufacturer and designer of rigid plastic packaging solutions for the food, beverage, and consumer goods industries. The company provides a comprehensive range of services, including design, labeling, filling, delivery, and specialty services such as thermoshaping and direct printing.

Key Plastic Container Companies:

The following are the leading companies in the plastic container market. These companies collectively hold the largest market share and dictate industry trends.

- Alpha Packaging, Inc.

- Amcor plc

- Bemis Manufacturing Company

- CKS Packaging

- Constar Inernational Inc.

- Huhtamaki

- Klöckner Pentaplast

- Sonoco Products Company

- Plastipak Holdings, Inc.

Recent Developments

-

In May 2024, Plastipak Holdings, Inc., collaborated with Kraft Heinz to convert containers of KRAFT Real Mayo and MIRACLE WHIP to rPET material, successfully implementing a sustainable packaging initiative.

-

In April 2024, Klöckner Pentaplast launched the first 100% rPET food packaging tray, derived from recycled tray material, marking a significant industry milestone, showcasing the company’s Tray2Tray initiative and closed-loop PET flake recycling system.

Plastic Container Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 108.7 billion |

|

Revenue forecast in 2030 |

USD 149.9 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Thailand, Indonesia, Malaysia, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Alpha Packaging, Inc.; Amcor plc; Bemis Manufacturing Company; CKS Packaging; Huhtamaki; Klöckner Pentaplast; Sonoco; Plastipak Holdings, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Plastic Container Market Report Segmentation

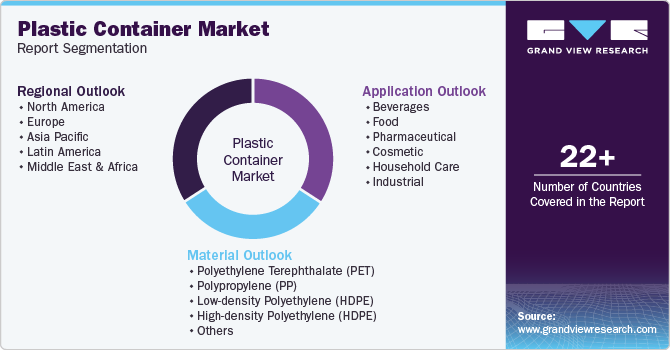

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic container market report based on material, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene Terephthalate (PET)

-

Polypropylene (PP)

-

Low-density Polyethylene (HDPE)

-

High-density Polyethylene (HDPE)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Food

-

Pharmaceutical

-

Cosmetic

-

Household Care

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."