- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Compounds Market Size, Share, Industry Report 2030GVR Report cover

![Plastic Compounds Market Size, Share & Trends Report]()

Plastic Compounds Market (2025 - 2030) Size, Share & Trends Analysis Report By Resin (PE, PP, TPE), By End-use (Automotive, Appliances), By Technology (Injection Molding, Extrusion), By Filler, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-378-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Compounds Market Summary

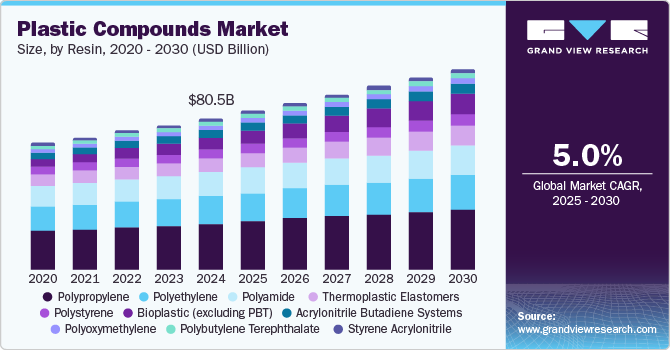

The global plastic compounds market size was estimated at USD 80.5 billion in 2024 and is projected to reach USD 108.2 billion by 2030, growing at a CAGR of 5.0% from 2025 to 2030. driven by the expansion of the automotive industry, coupled with advancements in plastic compounding technology.

Key Market Trends & Insights

- The Asia Pacific plastic compounds market held the largest market share of 49.2% in 2024.

- The North America plastic compounds market is set to emerge as the fastest-growing region, recording a CAGR of 4.6% from 2025 to 2030.

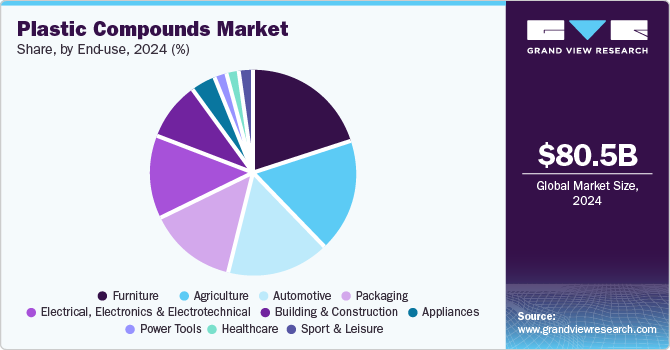

- The automotive end-use segment held the largest share of 23.2% in 2024, owing to the growing demand for lightweight, durable, and cost-effective materials in vehicle manufacturing.

- Based on technology, the injection molding segment registered the largest revenue share of 35.0% in 2024.

- The calcium carbonate (CaCO3) filled filler segment dominated the plastic compounds industry with the largest revenue share of 24.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 80.5 Billion

- 2030 Projected Market USD 108.2 Billion

- CAGR (2025-2030): 5.0%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

As automakers strive for lighter and fuel-efficient vehicles, they increasingly rely on high-performance plastic compounds for components such as bumpers, dashboards, and under-the-hood parts.

Innovations in compounding technology enable the creation of stronger and durable materials with enhanced properties such as heat resistance and impact strength. This enables the automotive sector to meet evolving standards for safety, performance, and sustainability, thereby propelling demand for advanced plastic compounds globally. The increasing adoption of biodegradable plastics and growing consumer demand for lightweight materials are set to contribute to the growth of the plastic compounds industry.

As environmental concerns rise, biodegradable plastics offer a sustainable alternative and assist in reducing long-term waste. Consumers' preference for lightweight materials, especially in packaging, automotive, and electronics sectors, is pushing manufacturers in the plastic compounds market to innovate with advanced plastic compounds that deliver durability and strength without adding weight. This shift toward eco-friendly and lightweight solutions is expected to boost the market, driving growth in both production and demand for new, specialized plastic compounds.

Resin Insights

The polypropylene (PP) resin segment recorded the largest revenue share of 27.8% in 2024, fueled by the versatility, cost-effectiveness, and wide application scope of PP. Polypropylene is a preferred choice for automotive, packaging, and textile industries owing to its excellent chemical resistance, durability, and ease of processing. Its lightweight nature and recyclability further enhance its appeal as a sustainable option. As demand for high-performance, eco-friendly materials surges, the PP resin segment continues to dominate the market, fueling innovation and adoption across various sectors.

The bioplastic (excluding PBT) segment is anticipated to emerge as the fastest growing segment and grow at a CAGR of 10.4% over the forecast period, attributed to rising environmental concerns and surging demand for sustainable materials. Bioplastics, derived from renewable resources, offer a promising alternative to traditional petroleum-based plastics, providing both biodegradability and reduced carbon footprints. With industries focusing on eco-friendly solutions, bioplastics are gaining popularity across packaging, automotive, and consumer goods sectors. As technological advancements help improve the performance of bioplastics, their adoption is expected to surge, accelerating substantial growth in this segment of the plastic compounds industry.

End Use Insights

The automotive end-use segment held the largest share of 23.2% in 2024, owing to the growing demand for lightweight, durable, and cost-effective materials in vehicle manufacturing. Plastic compounds offer automotive manufacturers the ability to reduce vehicle weight. Reduced vehicular weight helps improve fuel efficiency and performance. Plastics are essential in enhancing safety, comfort, and design flexibility in modern vehicles. With the rise of electric vehicles and the need for sustainable solutions, plastic compounds continue to play a critical role in meeting industry requirements, driving substantial market growth.

The electrical, electronics, and electrotechnical segment is projected to record the highest CAGR of 6.1% over the forecast period, attributed to the escalating demand for advanced materials that offer high performance, durability, and electrical insulation. Plastics in this sector are used in a wide range of applications, from consumer electronics to industrial equipment, due to their excellent electrical properties, heat resistance, and ease of molding. As technology continues to advance with the growth of smart devices and electric systems, the demand for specialized plastic compounds in electrical and electronics applications is expected to rise significantly.

Technology Insights

The injection molding segment registered the largest revenue share of 35.0% in 2024, owing to its ability to produce high-quality, complex, and precise parts at a rapid pace. This versatile manufacturing process is widely used across various industries, including automotive, packaging, and consumer goods, to create components with intricate designs and excellent surface finishes. The efficiency, cost-effectiveness, and ability to handle a wide range of materials make injection molding the preferred choice for producing plastic parts, driving its dominant position in the market.

The extrusion segment is expected to emerge as the fastest growing segment and record a CAGR of 4.6% during the forecast period, propelled by its ability to produce a wide range of complex shapes and sizes with high efficiency. Extrusion allows for the continuous processing of plastic compounds into products such as pipes, profiles, films, and sheets, making it essential for construction, packaging, and automotive industries. The surging demand for customized, high-quality plastic products, coupled with advancements in extrusion technology, is propelling the growth of this segment, positioning it for significant expansion in the market.

Filler Insights

The calcium carbonate (CaCO3) filled filler segment dominated the plastic compounds industry with the largest revenue share of 24.8% in 2024, driven by its cost-effectiveness and ability to enhance the properties of plastic materials. These fillers improve the mechanical strength, stiffness, and impact resistance of plastics while reducing production costs. Calcium carbonate (CaCO3) filled fillers are widely used in various applications, including automotive, packaging, and construction. Furthermore, CaCO3 is abundant, environment-friendly, and easily incorporated into plastic compounding, making it a preferred choice for manufacturers seeking to balance performance with cost efficiency, driving its dominance in the market.

The talcum filled fillers segment is projected to emerge as the fastest-growing segment and record a CAGR of 5.5% over the forecast period, due to its ability to enhance the properties of plastics, such as stiffness, strength, and heat resistance. Talcum fillers improve the ease of processing and reduce production costs, making them ideal for use in automotive, packaging, and consumer goods. As manufacturers look for lightweight and durable materials and cost-efficient solutions, the demand for talcum-filled compounds is anticipated to increase, accelerating the growth of this segment.

Regional Insights

North America plastic compounds market is set to emerge as the fastest-growing region, recording a CAGR of 4.6% from 2025 to 2030. The rising demand in automotive and packaging industries and innovations in compounding processes are expected to favor market growth in the coming years. The automotive sector is increasingly using plastic compounds for lightweight, durable, and cost-efficient components that improve vehicle performance and fuel efficiency. Also, the packaging industry is adopting advanced plastic materials to meet sustainability goals while maintaining product integrity. Innovations in compounding processes are enhancing material properties and production efficiency, further fueling demand for high-performance plastic compounds in the region and ensuring continued market growth.

Asia Pacific Plastic Compounds Market Trends

Asia Pacific plastic compounds market held the largest market share of 49.2% in 2024, fueled by the demand for lightweight and performance materials and an increasing emphasis on recycling and circular economy practices. Industries, particularly automotive, packaging, and consumer electronics, are seeking lightweight materials to enhance efficiency and reduce emissions. Moreover, growing environmental concerns have led to a shift toward recyclable plastic compounds, promoting sustainability. As countries in the region implement stricter environmental regulations and adopt circular economy principles, the market for eco-friendly, high-performance plastic compounds is expected to expand rapidly.

Europe Plastic Compounds Market Trends

The adoption of smart manufacturing and the burgeoning demand for plastic compounds in the electronics sector are anticipated to propel the growth of the Europe plastic compounds industry. Smart manufacturing technologies, including automation and IoT integration, are enhancing production efficiency and the ability to create specialized plastic compounds for electronic components. The need for high-performance plastic compounds is rising as the electronics industry demands advanced materials with superior electrical properties, heat resistance, and lightweight features. This trend, coupled with the focus on innovation in Europe, is projected to propel market growth in the region.

Key Plastic Compounds Company Insights

Some of the key companies in the plastic compounds market include Adell Plastics Inc.; Asahi Kasei Corporation; BASF; Chevron Phillips Chemical Company LLC; China XD Plastics Company Limited; Covestro AG; Dow; DuPont; Qingdao Gon Plastics Co., Ltd.; and Foster, LLC.

-

Covestro AG provides high-performance polymers and innovative materials for industries such as automotive, construction, electronics, and healthcare. Its products, including polyurethanes and polycarbonates, focus on sustainability, efficiency, and enhancing everyday products and technologies.

-

DuPont offers innovative solutions across various industries, including electronics, materials science, agriculture, and biotechnology. Its products range from advanced materials and specialty chemicals to sustainable agricultural solutions, driving performance, efficiency, and environmental responsibility.

Key Plastic Compounds Companies:

The following are the leading companies in the plastic compounds market. These companies collectively hold the largest market share and dictate industry trends.

- Adell Plastics Inc.

- Asahi Kasei Corporation

- BASF

- Chevron Phillips Chemical Company LLC

- China XD Plastics Company Limited

- Covestro AG

- Dow

- DuPont

- Qingdao Gon Plastics Co., Ltd

- Foster, LLC

Recent Developments

-

In September 2024, Dow introduced REVOLOOP recycled plastic resins for cable jackets, incorporating post-consumer recycled material to meet customer needs and circularity goals across the globe. These resins offer similar performance as virgin plastics for cable jackets, while offering sustainability benefits.

-

In July 2024, LyondellBasell launched Schulamid ET100, a new line of polyamide compounds for automotive interior applications, such as door and window frames. These grades feature excellent melt flow, enabling efficient injection molding of complex, thin-wall parts.

Plastic Compounds Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.6 billion

Revenue forecast in 2030

USD 108.2 billion

Growth Rate

CAGR of 5.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, end use, technology, filler, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Key companies profiled

Adell Plastics Inc; Asahi Kasei Corporation; BASF; Chevron Phillips Chemical Company LLC; China XD Plastics Company Limited; Covestro AG; Dow; DuPont; Qingdao Gon Plastics Co.,Ltd; Foster, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Compounds Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plastic compounds market report based on resin, end use, technology, filler, and region:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyethylene (PE)

-

Thermoplastic Elastomers (TPE)

-

TPS

-

Saturated

-

Unsaturated

-

-

Thermoplastic Polyolefins (TPO)

-

Thermoplastic Vulcanizates (TPV)

-

-

Polystyrene (PS)

-

Polybutylene Terephthalate (PBT)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Acrylonitrile Butadiene Systems (ABS)

-

Bioplastic (excluding PBT)

-

Acrylonitrile Styrene Acrylate (ASA)

-

Styrene Acrylonitrile (SAN)

-

Polymethyl Methacrylate (PMMA)

-

Polyoxymethylene (POM)

-

Blends (PC/ABS, ABS/PBT, PS/PP)

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Appliances

-

Electrical, Electronics & Electrotechnical

-

Building & Construction

-

Furniture

-

Power Tools

-

Packaging

-

Agriculture

-

Sport & Leisure

-

Healthcare

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Extrusion

-

Blow Molding

-

Others

-

-

Filler Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Unfilled

-

Carbon Fiber Reinforced

-

Flame Retardant

-

Glass Fiber Reinforced

-

Long Glass Fiber Filled

-

Calcium Carbonate Filled

-

Talcum Filled

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.