- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Caps And Closures Market Size & Share Report, 2030GVR Report cover

![Plastic Caps And Closures Market Size, Share & Trends Report]()

Plastic Caps And Closures Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PP, HDPE, LDPE), By Product (Dispensing Caps, Screw-on Caps), By Technology, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Caps And Closures Market Summary

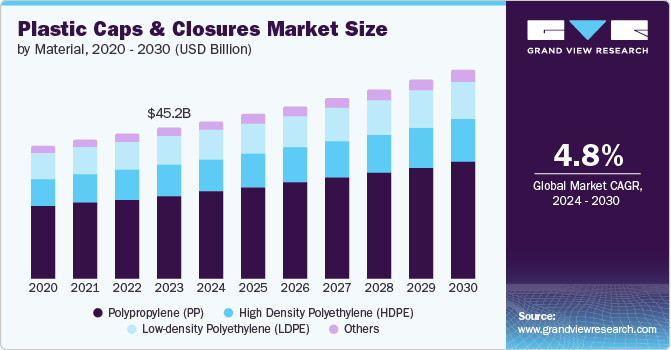

The global plastic caps and closures market size was estimated at USD 45.22 billion in 2023 and is expected to reach USD 62.45 billion by 2030, growing at a CAGR of 4.8% from 2024 to 2030. The market is witnessing significant growth, primarily driven by the rising demand in food, beverage, pharmaceutical, and personal care sectors.

Key Market Trends & Insights

- Asia Pacific is the largest and the fastest-growing market.

- Based on material, polypropylene (PP) held the highest market share in 2023.

- Based on product, the screw-on caps segment held the largest market share in 2023.

- Based on technology, the post-mold TE band segment held the highest market share in 2023.

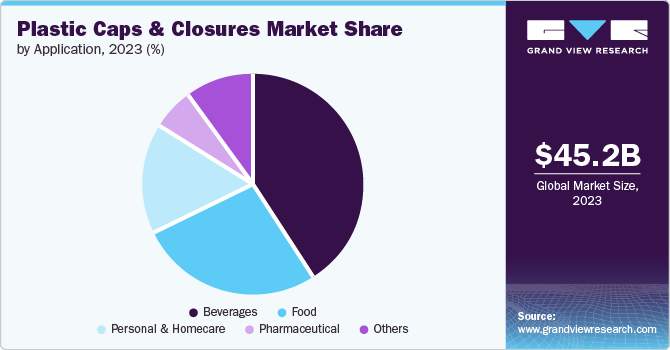

- Based on application, the beverages segment held the largest revenue share of over 41% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 45.22 billion

- 2030 Projected Market Size: USD 62.45 Billion

- CAGR (2024-2030):4.8%

- Asia Pacific: Largest market in 2023

Increasing consumer demand for convenience and safety in packaging fuels the adoption of advanced caps and closures, such as tamper-evident (TE) and dispensing caps. Growing awareness about hygiene and product integrity, especially post-pandemic, has heightened the demand for innovative closures that ensure contamination-free products.

Opportunities in the market are being created by the rising popularity of sustainable materials, with manufacturers focusing on eco-friendly plastics like polypropylene (PP) and high-density polyethylene (HDPE). Several brands are launching new products to align with these trends. For example, companies like Berry Global and Aptar have introduced closures made from post-consumer recycled (PCR) materials, addressing environmental concerns and regulatory pressures.

Additionally, the expanding beverage industry, particularly in emerging markets like Asia-Pacific, continues to drive demand for plastic closures. In the pharmaceutical and personal care sectors, the need for precision dispensing and secure packaging creates growth opportunities for specialized closures, offering improved functionality and consumer experience.

Material Insights

Based on material, polypropylene (PP) held the highest market share in 2023 and is projected to be the fastest-growing material due to its lightweight, versatility, and cost-effectiveness. PP is widely used in beverage and personal care applications because of its chemical resistance and recyclability.

High-density Polyethylene (HDPE) is known for its strength and durability. HDPE caps are commonly used in industrial and household products. It is gaining traction in sectors that require robust packaging, such as pharmaceuticals and chemicals. Low-Density Polyethylene (LDPE) is used in flexible closures and packaging for consumer goods, LDPE has moderate growth potential, particularly in the food and personal care segments.

PET and PVC remain in niche applications but face challenges due to environmental concerns and regulations favoring more sustainable materials like PP and HDPE.

Product Insights

Based on product, the screw-on caps segment held the largest market share in 2023 as it continues to be widely used across multiple industries, offering reliability and ease of use in food and beverage packaging. Specialty closures like sports caps and child-resistant caps find usage in specific applications, driving niche growth.

The market is further divided into screw-on caps, dispensing caps, and other segments. The dispensing caps segment is expected to register the fastest CAGR from 2024 to 2030 due to increased demand for convenience and precise dispensing solutions, especially in personal care, home care, and pharmaceuticals.

Technology Insights

Based on technology, the post-mold TE band segment held the highest market share in 2023 and is expected to be the fastest-growing technology from 2024 to 2030, driven by the need for secure packaging that prevents tampering and ensures product safety, especially in food, beverage, and pharmaceutical applications.

The compression molding segment is known for high-speed production and material efficiency; this technology is widely used in the mass production of caps for beverages and personal care products. Injection Molding continues to be a popular technology for producing high-precision closures, especially in pharmaceutical and specialty products.

Application Insights

Based on application, the beverages segment held the largest revenue share of over 41% in 2023. Growing consumption of non-alcoholic beverages is anticipated to support segment growth. The emergence of functional beverages, including energy and sports drinks, probiotic beverages, meal replacers, and fruit & vegetable-based beverages that can be packaged in glass & plastic bottles is further likely to spur the segment growth.

Rising consumption of packaged food products, Ready-To-Eat (RTE) meals, and on-the-go snacks is anticipated to drive segment growth over the forecast period. Moreover, in the pharmaceuticals segment, plastic caps and closures are used for sealing bottles and cans of drugs, supplements, saline bottles, and vaccine vials, among others. Growing demand for senior-friendly as well as child-resistant closures that minimize incidences of accidental ingestion of over-the-counter (OTC) medications by infants and children is expected to augment demand for plastic caps and closures in this segment over the forecast period.

Regional Insights

North America plastic caps and closures market is mature, driven by stable demand from the food, beverage, and pharmaceutical industries. The U.S. dominates the region, with major players like Amcor and Silgan leading innovations in sustainable packaging solutions. The beverage sector, particularly bottled water, soft drinks, and alcoholic beverages, remains a key driver of demand for plastic closures.

Sustainability is a major trend shaping the market, with an increased focus on recyclable materials and reduced plastic usage. Regulations aimed at minimizing plastic waste are pushing companies to innovate with lightweight and eco-friendly materials like polypropylene (PP) and high-density polyethylene (HDPE). The pharmaceutical industry’s demand for tamper-evident and child-resistant closures also contributes to steady market growth.

Asia Pacific Plastic Caps And Closures Market Trends

The plastic caps and closures market in Asia Pacific is the largest and the fastest-growing market, driven by the rising consumption of packaged food, beverages, and personal care products. Rapid urbanization, increasing disposable income, and the expansion of modern retail channels contribute to the region's growth. The beverage industry, particularly bottled water and soft drinks, sees strong demand for plastic closures, especially in countries like India, Indonesia, and Vietnam.

Sustainability trends are also gaining traction in the region, with growing awareness of recyclable and lightweight materials like polypropylene (PP). Many manufacturers are adopting eco-friendly practices, catering to both regulatory pressures and consumer demand for environmentally responsible packaging. China and India lead the market, while Southeast Asia offers significant growth potential due to emerging consumer markets.

China plastic caps and closures market dominates the region due to its booming beverage, personal care, and pharmaceutical industries. The country's rapid urbanization, growing middle class, and increasing demand for packaged goods drive significant demand for plastic closures. The beverage sector, particularly bottled water and soft drinks, plays a key role in market expansion. Sustainability concerns are prompting Chinese manufacturers to adopt recyclable materials and invest in innovative packaging solutions. Regulatory initiatives supporting plastic reduction and recycling further shape market trends, making China a leading player in both the production and consumption of plastic closures.

Europe Plastic Caps And Closures Market Trends

The plastic caps and closures market in Europe is strongly influenced by sustainability regulations and consumer demand for environmentally friendly packaging. Countries like Germany, France, and the UK lead the way in adopting recyclable and lightweight materials, with polypropylene (PP) being a popular choice due to its eco-friendly properties. Beverage, personal care, and food industries are key drivers of demand, particularly in the bottled water, dairy, and cosmetics segments.

Strict regulations such as the European Union’s Single-Use Plastics Directive are encouraging companies to innovate in recyclable and biodegradable packaging materials. The region's well-established pharmaceutical industry also drives demand for tamper-evident and secure packaging solutions. As sustainability continues to dominate, Europe remains a leading market for advanced and eco-conscious plastic caps and closure solutions.

Key Plastic Caps And Closures Company Insights

The market is characterized by the presence of multinational as well as regional players and several public-listed companies globally, making the market space highly competitive. Key players mainly cater to the demand from food, beverages, pharmaceutical, and beauty products industries.

Key Plastic Caps And Closures Companies:

The following are the leading companies in the plastic caps and closures market. These companies collectively hold the largest market share and dictate industry trends.

- Crown

- Amcor plc

- Closure Systems International

- Ball Corporation

- Silgan Holdings Inc.

- Berry Global Inc.

- Guala Closures S.p.A

- AptarGroup, Inc.

- BERICAP

- Nippon Closures Co., Ltd.

- Sonoco Products Company

- Webpac Ltd

- UAB Elmoris

- CL Smith

- PELLICONI & C. SPA

- O. BERK

- UNITED CAPS

Recent Developments

-

On 12 August 2024, Origin Materials partnered with Reed City Group to mass-produce PET caps and closures in North America. In Reed City Group’s Michigan facilities, the companies will operate Origin PET cap and closure commercial manufacturing lines. The lines will convert virgin and recycled PET (rPET) into caps using high-speed equipment and automation. Origin says its caps are positioned to be the first commercially viable PET closures to reach the mass market.

-

On 08 Jul 2024, Berry Global Group outfitted Grillo’s Pickles with twist-top, spill-proof, easy-open jars for its pickles. The custom, nestable, recyclable PP jar and continuous thread closure provide a simple, mess-free opening process. The custom jars were designed for compatibility with Berry’s line of ribbed closures to help prevent leakage during opening and closing. The jars also include pickle-shaped side grips for enhanced user control and clear, in-mold labels to maintain Grillo’s homemade aesthetic.

Plastic Caps And Closures Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.19 billion

Revenue forecast in 2030

USD 62.45 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in million units, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Belgium; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Argentina; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Crown; Amcor plc; Closure Systems International; Ball Corporation; Silgan Holdings Inc.; Berry Global Inc.; Guala Closures S.p.A; AptarGroup, Inc.; BERICAP; Nippon Closures Co., Ltd.; Sonoco Products Company; Webpac Ltd; JELINEK CORK GROUP; UAB Elmoris; CL Smith; PELLICONI & C. SPA; O.BERK; UNITED CAPS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Caps and Closures Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic caps and closures market report based on material, product, technology, application, and region:

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

High Density Polyethylene (HDPE)

-

Low-density Polyethylene (LDPE)

-

Others

-

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Dispensing Caps

-

Screw-on Caps

-

Others

-

-

Technology Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Post-mold TE Band

-

Compression Molding

-

Injection Molding

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Beverages

-

Food

-

Pharmaceuticals

-

Personal & Homecare

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Southeast Asia

-

Central & South America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Frequently Asked Questions About This Report

b. The global plastic caps and closures market was estimated at USD 45.22 billion in 2023 and is expected to reach USD 47.19 billion in 2024.

b. The global plastic caps and closures market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030, reaching around USD 62.45 billion by 2030.

b. The dispensing Caps segment holds the highest market share. It registers the fastest CAGR due to increased demand for convenience and precise dispensing solutions, especially in personal care, home care, and pharmaceuticals.

b. Key players in the market include Crown; Amcor plc; Closure Systems International; Ball Corporation, Silgan Holdings Inc., Berry Global Inc., Guala Closures S.p.A; AptarGroup, Inc., BERICAP; Nippon Closures Co., Ltd.; Sonoco Products Company; Webpac Ltd; JELINEK CORK GROUP; UAB Elmoris; CL Smith; PELLICONI & C. SPA; O.BERK; and UNITED CAPS.

b. The global plastic caps and closures market is witnessing significant growth, primarily driven by the rising demand in the food, beverage, pharmaceutical, and personal care sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.