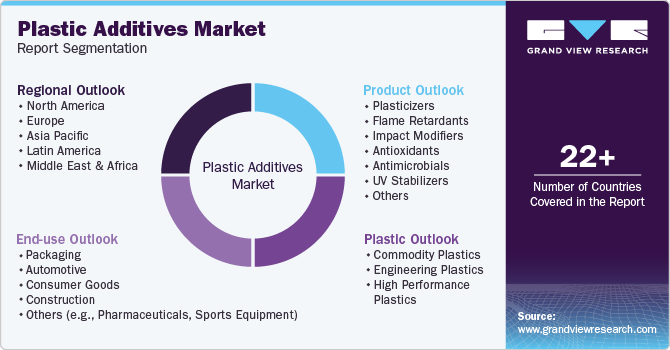

Plastic Additives Market Size, Share & Trends Analysis Report By Product (Plasticizers, Flame Retardants, Impact Modifiers, Antioxidants, Antimicrobials), By Plastic (Commodity, Engineering, High Performance), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-565-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Plastic Additives Market Size & Trends

The global plastic additives market size was valued at USD 48.86 billion in 2023 and is projected to experience a CAGR of 5.6% from 2024 to 2030. Plastic additives are components introduced during manufacturing to enhance the functionality of the material after it has been molded and utilized. The growth of the plastic additives market is experiencing significant growth owing to the usage of plastics in various industries such as industrial manufacturing, construction, automotive, and mechanical engineering. Additionally, the rising cost of natural metals further contributes to this upward trend.

Plastic additives play a vital role in the automotive and construction industries due to their remarkable properties that make them highly desirable. These properties include superior impact strength, enhanced coupling, increased elongation, reduced brittleness, and heightened plasticity. Within the automotive sector, plastic additives have gained significant acceptance, particularly for applications such as enhancing scratch resistance in interior trims or panels and creating glossy panels for central console decoration. As the demand for cost-effective automobile interiors continues to soar, the market for plastic additives is expected to witness substantial growth.

The rising utilization of products in the packaging sector to address changing consumer needs and regulations is a significant driver of growth. Additionally, the incorporation of additives such as antioxidants and barrier enhancers increases the durability and protective features of plastic packaging materials, driving market expansion. Moreover, these additives play a crucial role in improving the thermal and electrical characteristics of plastics used in electronic gadgets, facilitating the creation of lightweight, high-performance components that ensure the dependability of electronic products.

Moreover, the mounting environmental concerns have led to the introduction of biodegradable additives, which offer an eco-friendly solution for the natural degradation of plastics, thereby reducing their environmental footprint and contributing to the market's growth. Additionally, the increasing demand for sustainable packaging solutions, particularly in response to stringent regulations and consumer preferences for eco-conscious products, is propelling the expansion of the market.

Product Insights

In 2023, the plasticizers segment dominated the market, capturing the largest revenue share of 51.52%. Plasticization involves altering the thermal and mechanical characteristics of a specific polymer. Plasticizers, which are small molecules, are incorporated into a polymer solution to enhance its flexibility and plasticity. Its usage in a wide range of applications in different industries such as automotive, construction and packaging is one of the key drivers for its growth. Furthermore, developing countries such as India and China are driving the product growth as rising urbanization and construction demands more efficient and advanced plasticizers.

On the other hand, the flame retardants segment is expected to witness the fastest growing CAGR of 5.9% from 2024 to 2030, owing to the increasingawareness of fire safety risks among consumers. Consumers are increasingly seeking products with fire retardants properties, especially for household items and electronics. Flame retardants help mitigate the risks, enhance the overall safety of plastic products.

Plastic Insights

Commodity plastics dominated the market and accounted for a share of 50.8% in 2023. Commodity plastics are essential building blocks for a wide range of everyday products, including packaging materials like plastic bags and bottles, as well as consumer goods such as toys and household appliances. They play a significant role in driving growth across various industries. Moreover, they are crucial in construction, being used in pipes, fittings, and insulation materials.

The engineering plastics segment is expected to witness a CAGR of 5.9% during the forecast period. Engineering plastics are a class of plastic materials that exhibit exceptional mechanical and thermal properties when compared to commodity plastics. Engineering plastics are valued for their high strength, high resistance and dimensional stability. Engineering plastics are found to be used in diverse sectors including, automotive, aerospace, medical devices, construction and electronics.

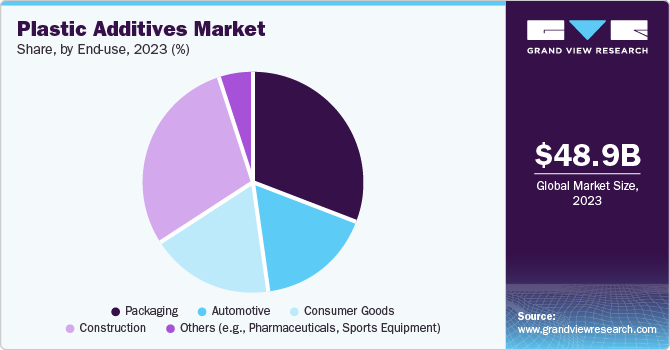

End-use Insights

The packaging segment accounted for the largest market revenue share of 30.8% in 2023. Plastic packaging is the most common type of packaging around the world as plastic packaging is so durable, lightweight and very thin. Growth in the packaging sector is largely attributed to the growing requirement for plastic additives in packaging materials across a range of industries, including food and beverages, pharmaceuticals, and consumer goods, leading to market growth.

The automotive segment is projected to grow at the fastest CAGR of 6.2% over the forecast period. The rising demand for lightweight vehicles has fueled the growth. Automakers are increasingly replacing heavier metal components with light plastics to achieve weight reduction. Moreover, the growing Electric vehicle demand across the globe is another key factor. The upsurge in EV production creates a significant demand for plastic additives. EVs have a higher concentration of plastics components compared to passenger vehicles and light commercial vehicles.

Regional Insights

The plastic additives market in North America is expected to grow at a CAGR of 5.5% during the forecast period. This growth can be attributed to the nation's rapid innovation in electronics, continuous technological advancement, and extensive R&D activities. The nation's substantial aerospace and military sectors make aerospace one of the primary users of plastic additives.

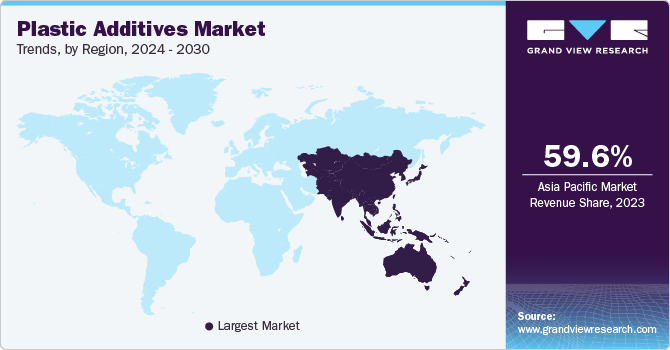

Asia Pacific Plastic Additives Market Trends

In 2023, Asia Pacific plastic additives market emerged as the leader in the market, capturing a significant revenue share of 59.6%, driven by increasing need for plastics in the construction, automotive, packaging, and electronics industries is driving up the demand for this product. Additionally, numerous multinational corporations are relocating their manufacturing operations to the Asia Pacific region to take advantage of its cost benefits and tap into its vast consumer markets. As a result, the demand for plastics is surging across the region.

China plastic additives market is expected to grow lucratively in the coming years owing to low-cost raw materials and labor availability. China is one of the largest producers of plastic materials in the world. At present, plastic is a primary material employed for packaging, and China is witnessing a surge in its packaging sector. The exponential growth of the e-commerce industry is driving the expansion of the local packaging industry, consequently propelling the growth of the regional market.

The plastic additives market in India held a prominent position in 2023 and is expected to grow at a fastest CAGR of 7.7% during the forecast period. The industrial landscape in India is witnessing notable growth, particularly in key sectors such as packaging, automotive, construction, and consumer goods. This surge in growth is creating a higher demand for plastic additives that boost the efficiency and lifespan of plastic materials employed in these industries.

Europe Plastic Additives Insights

The Europe plastic additives market is expected to witness a significant CAGR of 5.2% during the forecast period from 2024 to 2030. Various sectors in Europe, such as automotive, construction, packaging, and electronics, heavily rely on plastics. The growing requirement for high-performance plastics with distinct characteristics like flame retardant, UV resistance, and antimicrobial properties is fueling the demand for advanced additives.

The plastic additives in Germany held a prominent position in the European plastic additives market. The German market is expected to witness a surge in growth as lightweight materials are increasingly utilized in the production of automotive components to enhance vehicle performance. Germany's industrial progress, technological advancement, and dedication to sustainability make it a mainstay and significant contributor to the plastic additives market growth.

Key Plastic Additives Company Insights

Some of the key companies in the Plastic Additives market include Clariant AG; Albemarle Corporation; Songwon Industrial Co., Ltd; Companies in the market are enhancing their international footprint by expanding into emerging markets through partnerships, acquisitions, and establishing manufacturing facilities in regions where there is strong demand for their products.

Key Plastic Additives Companies:

The following are the leading companies in the plastic additives market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co., Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation

Recent Developments

-

In September 2023, BASF launched the first biomass balance plastic additives. The initial product offerings including 1010 BMBcert, 1076 FD BMBcert, Irganox and Irganox are certified Technischer Überwachungsverein ( TÜV ) Nord for mass balance as per the International Sustainability and Carbon Certification.

-

In May 2023, Evonik introduced a wide range of additives, TEGO Cycle, to help its clients enhance the process and increase recycled plastics final quality.

Plastic Additives Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 51.40 billion |

|

Revenue forecast in 2030 |

USD 71.43 billion |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, Plastic, End-use |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Germany; France; Italy; Spain; Russia; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Indonesia; Vietnam; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

BASF SE; Clariant AG; Albemarle Corporation; Songwon Industrial Co., Ltd.; Nouryon; LANXESS AG; Evonik Industries AG; Kaneka Corporation; The Dow Chemical Company; ExxonMobil Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Plastic Additives Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plastic additives market report based on product, plastic, end-use and region.

-

Product Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Plasticizers

-

Flame Retardants

-

Impact Modifiers

-

Antioxidants

-

Antimicrobials

-

UV Stabilizers

-

Others

-

-

Plastic Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Commodity Plastics

-

Engineering Plastics

-

High Performance Plastics

-

-

End-use Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

Packaging

-

Automotive

-

Consumer Goods

-

Construction

-

Others (e.g., Pharmaceuticals, Sports Equipment)

-

-

Regional Outlook (Revenue in USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."