- Home

- »

- Biotechnology

- »

-

Plasmid DNA Manufacturing Market Size, Share Report, 2030GVR Report cover

![Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

Plasmid DNA Manufacturing Market (2025 - 2030) Size, Share & Trends Analysis Report By Disease (Cancer, Infectious Diseases), By Grade (R&D, GMP), By Application, By Development Phase, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-977-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plasmid DNA Manufacturing Market Summary

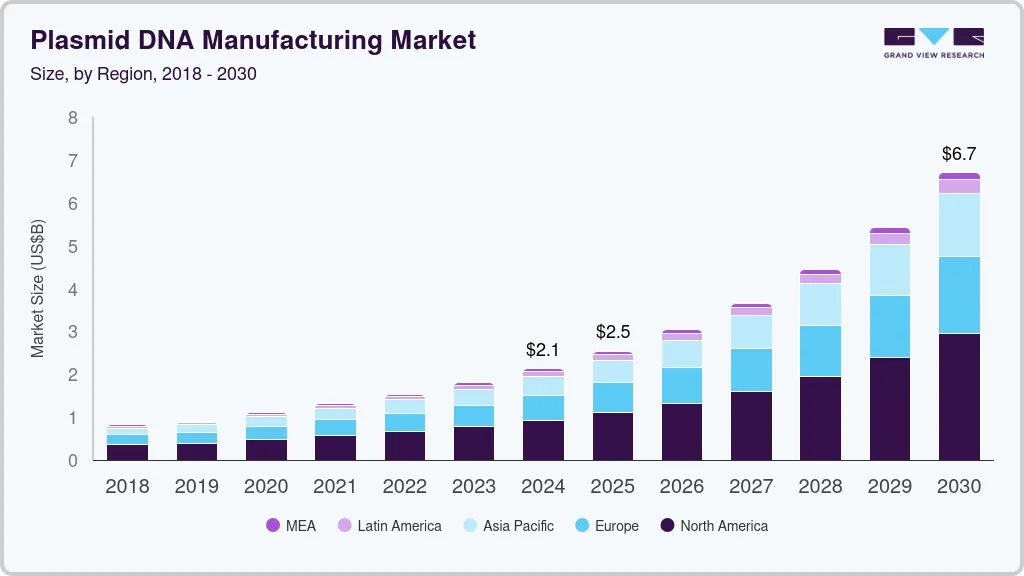

The global plasmid DNA manufacturing market size was estimated at USD 2.13 billion in 2024 and is projected to reach USD 6.70 billion by 2030, growing at a CAGR of 21.4% from 2025 to 2030. Plasmid DNA plays an important role in the healthcare industry. Today, it is crucial for the development of vaccines and next-generation cell and gene therapies.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of grade, the GMP-grade plasmid DNA manufacturing dominated the market in 2024 with a share of 86.29%.

Market Size & Forecast

- 2024 Market Size: USD 2.13 Billion

- 2030 Projected Market Size: USD 6.70 Billion

- CAGR (2025-2030): 21.44%

- North America: Largest market in 2024

New plasmid DNA vaccines are now being developed, leading to more efficient and clean manufacturing processes. In the production of vaccines and gene therapies, plasmids are more attractive than recombinant viruses as they can deliver significant amounts of DNA with a low risk of oncogenesis or immunogenicity. Such factors are expected to propel industry growth.

Increasing awareness about cell and gene therapy boosts industry growth. This is mainly due to a rise in cell and gene therapy products accepted to treat various diseases globally and the availability of approved gene therapy products. Plasmid DNA is the base for gene therapies and vaccines for several infectious, genetic, and acquired diseases, enteric pathogens, and influenza. With the rising demand for robust disease treatment therapies, various companies and research organizations are accelerating R&D efforts for advanced therapies that target the cause of disease at a genomic level, resulting in increased demand for plasmid DNA.

For instance, in October 2021, the National Institutes of Health, the FDA, five nonprofit organizations, and ten pharmaceutical companies entered into a partnership to ramp up the development of gene therapies for 30 million individuals in the U.S. who suffer from rare disorders. The outbreak of the COVID-19 pandemic led to an increase in the use of plasmid DNA. The COVID-19 pandemic resulted in extensive research efforts for the development of vaccines against the infection. For instance, in November 2021, Enzychem entered into a Manufacturing License and Technology Transfer Agreement with Zydus Cadila to develop a COVID-19 plasmid DNA vaccine in South Korea.

Under this initiative, Zydus provided its technical assistance and manufacturing technology to Enzychem. Increased prevalence of cancer is anticipated to boost the production of plasmid DNA. Plasmid DNA is used in gene therapy to identify and treat illnesses in patients. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 is approximately 1,958,310 and estimated cancer deaths of 609,820 in the U.S. The most common cancers are lung, breast, prostate, colon, and rectum cancers. In 2020, around 2.26 million cases of breast cancer were reported.

Moreover, the requirement for innovation in established manufacturing technologies to fulfill the demand for acceptable products and their volume is predicted to generate enormous growth prospects for industry players. For instance, in January 2020, GenScript announced the signing of a strategic cooperation agreement with Genopis, Inc. This firm specializes in plasmid DNA-based research and offers contract development & manufacturing organization (CDMO) services for the manufacturing of GMP Plasmids. Through this strategic collaboration agreement, GenScript & Genopis developed a revenue-sharing arrangement for the global promotion, sale, and manufacturing of GMP plasmids.

Grade Insights

GMP-grade plasmid DNA manufacturing dominated the market in 2024 with a share of 86.29% and is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the surge in clinical development of cell & gene therapy and DNA vaccinations, as well as ongoing approval of newly marketed therapies, which has created a major global demand for GMP-grade plasmid DNA. Furthermore, with growing regulatory restraints pertaining to the quality of plasmids used in biomanufacturing, the GMP-grade segment is expected to grow rapidly in the near future.

Another factor is the shift toward advanced therapeutic modalities, such as CAR-T cell therapies and gene-editing technologies, which require high-quality plasmid DNA as a foundation. The complexity of these therapies necessitates precise and consistent manufacturing processes that only GMP standards can provide. In addition, the growing trend of outsourcing manufacturing to specialized facilities is contributing to the demand for GMP-grade plasmids. Biopharmaceutical companies are increasingly turning to Contract Manufacturing Organizations (CMOs) that can meet stringent GMP requirements, allowing them to focus on R&D.

Development Phase Insights

The clinical therapeutics segment held the largest market share of 54.6% in 2024. Plasmid DNA is currently increasing in importance for clinical research applications in genetic vaccination and gene therapy. Particularly, plasmid DNA gene therapy is utilized for cardiovascular disorders as the plasmid DNA transfer is possible for skeletal or cardiac muscle. Patients with peripheral artery disease have undergone clinical angiogenic gene therapy employing plasmid DNA gene transfer, hence propelling the segment growth.

The pre-clinical therapeutics segment is expected to witness the fastest CAGR from 2025 to 2030. Increased numbers of clinical trials with promising results, the incidence of chronic diseases, and increased gene therapy development efforts are the main drivers of market expansion. The clinical transformation and industrialization of gene therapy continue to progress across Asian countries steadily. For instance, in June 2021, Aldevron and Aruvant Sciences announced that Aldevron will contribute to developing ARU-1801, Aruvant's investigational gene therapies for sickle cell disease (SCD), including ARU-2801, gene therapies for hypophosphatasia (HPP). Furthermore, for Aruvant's planned ARU-1801 pivotal study, Aldevron will supply a plasmid that meets good manufacturing practice (GMP) standards.

Application Insights

The cell & gene therapy segment held the largest market share of 54.4% in 2024. This high share can be attributed to the fact that gene therapy is broadly applied in the treatment of several inherited and genetic diseases. Moreover, continuous technological improvements in developing a safe and reliable treatment for various disorders are propelling the segment's growth.

The DNA vaccines segment is expected to witness the fastest CAGR from 2025 to 2030. The high prevalence of chronic diseases and the COVID-19 pandemic have led to an increase in R&D activities for the development of novel therapies and vaccines, thus creating a high demand for pDNA manufacturing solutions for research purposes. For instance, in May 2020, Takara Bio contracted AGC Biologics to produce an intermediate COVID-19 DNA vaccine (a circular DNA (plasmid DNA) that includes the target pathogen's protein). Osaka University & AnGes Inc. developed this vaccination by combining their findings from producing DNA plasmid products. This is expected to increase the revenue share of DNA vaccines in the market.

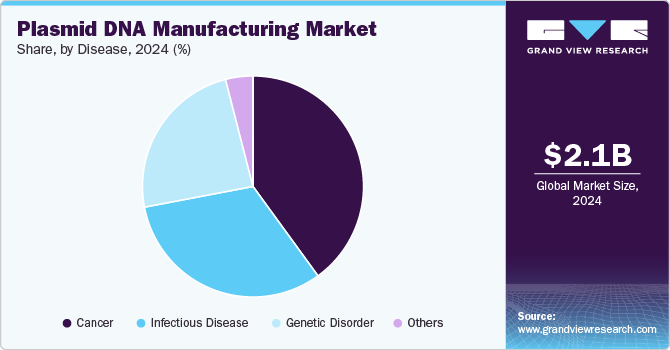

Disease Insights

The cancer segment held the largest market share of 40.0% in 2024 and is expected to witness the fastest CAGR from 2025 to 2030. The rising use of DNA plasmids for the development of cancer treatment therapies is propelling the growth of this segment. Various gene therapy strategies have been used for cancer, such as genetic manipulation of apoptotic, gene therapy-based immune modulation, and oncolytic virotherapy. These factors have increased the demand for plasmid DNA and further boosted the segment growth.

The growing prevalence of cancer is expected to positively influence the regional market throughout the forecast period. Furthermore, as vaccine production expands & technology progresses, the requirement for plasmid DNA manufacturing will rise. According to the American Cancer Society estimate, the overall number of new cancer cases in 2023 will be approximately 1,958,310 in the U.S ., with estimated cancer deaths of 609,820. This factor is likely to increase the demand for plasmid DNA, thereby resulting in market growth.

Regional Insights

The North America Plasmid DNA manufacturing market held the largest revenue share of 43.43% of the global market in 2024. Some of the major factors that have contributed to the large share of this region are the presence of a substantial number of centers and institutes that are engaged in the R&D of advanced therapies. Moreover, the establishment of the Recombinant DNA Advisory Committee by NIH to monitor scientific, ethical, and legal issues pertaining to the use of rDNA techniques is playing a significant role in driving the adoption of these techniques. The major role of the body is to review human gene transfer research.

U.S. Plasmid DNA Manufacturing Market Trends

The Plasmid DNA manufacturing market in the U.S. held the largest revenue share in the North America region. This large share is attributed to the presence of key market players, including Contract Development and Manufacturing Organizations (CDMOs) offering GMP manufacturing services and the adoption of highly innovative manufacturing technologies for production.

Europe Plasmid DNA Manufacturing Market Trends

The Europe Plasmid DNA manufacturing market growth can be attributed to an increase in research funding and the presence of local key market players in this region. The number of biopharmaceutical companies is growing in Europe owing to increasing investments. For instance, in February 2022, the UK pledged around USD 192 million to the Coalition for Epidemic Preparedness Innovations to boost vaccine development.

The Plasmid DNA manufacturing market in the UK is anticipated to grow lucratively over the forecast period. Strategic expansion efforts by leading CDMOs are anticipated to create valuable growth opportunities in the coming years. For example, in June 2022, Charles River Laboratories International, Inc. launched a 16,000-square-foot, state-of-the-art plasmid DNA center of excellence in the UK, strengthening its comprehensive capabilities in gene and cell therapy development. In addition, the high prevalence of life-threatening diseases has prompted UK health authorities to invest in cell and gene therapies.

The Plasmid DNA manufacturing market in France has been driven by the growing number of biopharmaceutical companies in France over the past few decades. French biopharmaceutical players, such as Sanofi, Servier, Pierre Fabre, and Ipsen, are focused on developing advanced therapeutics for hematological disorders, cancer, and cardiovascular diseases, among others. Such developments can significantly boost the demand for plasmid DNA manufacturing in the country in the coming years. In addition, increasing genetic research, robust demand for gene therapies, and rising demand for innovative biopharmaceutical products are projected to drive the country’s market.

The Plasmid DNA manufacturing market in Germany is anticipated to grow significantly over the forecast period. A substantial number of companies have their facilities set up in Germany, which is anticipated to support the rapid commercialization of drugs. Germany is the first country where the recently approved gene therapy treatment has been utilized. It is expected to witness significant growth in the number of trials and approval of drugs in the coming years, owing to an increase in the number of companies being set up and the support provided by governments in finding feasible treatment options for genetic disorders & various cancers.

Asia Pacific Plasmid DNA Manufacturing Market Trends

Asia Pacific Plasmid DNA manufacturing market is expected to experience the fastest CAGR of 22.99% from 2025 to 2030. Key factors such as the presence of untapped opportunities, economic development, improving healthcare infrastructure, and favorable initiatives by the government and manufacturers in the biotechnology sector are some factors accounting for this rapid growth. Moreover, this region offers relatively inexpensive operating and manufacturing units for conducting research. Japan is leading the Asian market as it is considered a hub for regenerative medicine research. Moreover, according to the Japanese prime minister, regenerative medicine and cell therapy are key to the economic growth of the country. Japan is geared to establishing itself as a global leader in the development and marketing of stem cells, which in turn is driving market growth in the Asia Pacific region.

China’s plasmid DNA manufacturing market is expected to grow at a lucrative rate over the forecast period owing to advancements in the regulatory framework for cell-based research activities in the country. Furthermore, several biopharmaceutical companies are shifting their focus toward these advanced therapies with increasing investment in the field of cell & gene therapy. For instance, in April 2022, VectorBuilder announced an investment of USD 500 million to build a new cell research and gene therapy research & manufacturing facility in Guangzhou, China.

Japan accounted for a significant share of the Asia Pacific market in 2024, as it has one of the most developed pharmaceutical and biotechnology sectors in the region. Moreover, the high prevalence of chronic diseases and rare genetic disorders has led to an increase in R&D activities for the development of novel therapies and vaccines, creating a high demand for plasmid DNA manufacturing solutions for research purposes.

MEA Plasmid DNA Manufacturing Market Trends

The MEA Plasmid DNA manufacturing market is anticipated to grow over the forecast period. The incidence of cancer is expected to increase significantly in the Middle East in the coming years. The presence of unmet medical needs has fueled the demand for robust cancer management, which in turn increases the demand for viral vectors and plasmid DNA. Rising demand for effective therapeutics for cancer is anticipated to boost developments in cell-based oncology landscape in African countries.

The plasmid DNA manufacturing market in Saudi Arabia is relatively small compared to other countries, and there are only a few local companies that are involved in the manufacturing and distribution of plasmid DNA. Companies that are involved in plasmid DNA manufacturing in Saudi Arabia include SaudiVax, BioVac, Theraclion, and Tamer Group. Moreover, collaborations between companies are common to leverage each other's strengths and capabilities. For instance, MilliporeSigma supports SaudiVax in becoming Saudi Arabia's first investigator and manufacturing of Halal vaccines and biotherapeutics.

Kuwait's plasmid DNA manufacturing market is highly competitive due to the presence of established and mid-tier companies. Several growth strategies employed by these companies, such as strategic partnerships and collaborations with biotechnology and pharmaceutical companies, are fueling market expansion.

Key Plasmid DNA Manufacturing Company Insights

The market players operating in the plasmid DNA manufacturing industry are adopting new product approvals to increase the reach of their products in the market and improve the availability of their products, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Plasmid DNA Manufacturing Companies:

The following are the leading companies in the plasmid DNA manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Kaneka Corp.

- Nature Technology

- Cell and Gene Therapy Catapult

- Eurofins Genomics

- Lonza

- Luminous BioSciences, LLC

- Akron Biotech

Recent Development

-

In February 2023, BioNTech SE announced that it had built a new plasmid DNA manufacturing unit in Marburg, Germany. The company intends to establish an independent facility to produce plasmid DNA for clinical product candidates along with commercial products with the opening of a new manufacturing unit.

-

In January 2023, KromaTiD, a provider of one-of-a-kind molecular tools & services, announced the extension of its plasmid services. The company has increased its portfolio with the addition of plasmid production facilities. The company's expansion intends to support the commercialization of regenerative medicine.

-

In January 2022, Samsung Biologics, a contract development & manufacturing organization (CDMO), intends to begin construction on a new facility (named Plant 5) at Songdo in Incheon, South Korea. The facility will provide multi-modal product manufacturing, including C>s (cell and gene therapies) and viral, plasmid, and mRNA-based next-generation vaccines.

-

In February 2022, GenScript ProBio and the National Cancer Center for Japan entered into a research collaboration to develop a lentiviral and plasmid vector for CMC. This collaboration is anticipated to boost the R&D of novel viral vectors and Plasmid DNA.

-

In December 2020, Thermo Fisher Scientific disclosed the plans to establish a new GMP plasmid DNA production unit in California.

Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.54 billion

Revenue forecast in 2030

USD 6.70 billion

Growth rate

CAGR of 21.44% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, development phase, application, disease, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Kaneka Corp.; Nature Technology; Cell and Gene Therapy Catapult; Eurofins Genomics; Lonza; Luminous BioSciences, LLC; Akron Biotech.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plasmid DNA manufacturing market report based on grade, development phase, application, disease, and region:

-

Grade Outlook (Revenue, USD Million, 2018 - 2030)

-

R&D Grade

-

Viral Vector Development

-

AAV

-

Lentivirus

-

Adenovirus

-

Retrovirus

-

Others

-

-

mRNA Development

-

Antibody Development

-

DNA Vaccine Development

-

Others

-

-

GMP Grade

-

-

Development Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Clinical Therapeutics

-

Clinical Therapeutics

-

Marketed Therapeutics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Vaccines

-

Cell & Gene Therapy

-

Immunotherapy

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Disease

-

Cancer

-

Genetic Disorder

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plasmid DNA manufacturing market size was estimated at USD 2.13 billion in 2024 and is expected to reach USD 2.54 billion in 2025.

b. The global plasmid DNA manufacturing market is expected to grow at a compound annual growth rate of 21.44% from 2025 to 2030 to reach USD 6.70 billion by 2030.

b. North America dominated the plasmid DNA manufacturing market with a share of 43.4% in 2024. This is attributable to technological advancements, and the presence of a substantial number of centers and institutes that are engaged in the R&D of advanced therapies.

b. Some key players operating in the plasmid DNA manufacturing market include Charles River Laboratories, VGXI, Inc., Aldevron, KANEKA CORPORATION, Nature Technology, Cell and Gene Therapy Catapult, Eurofins Genomics, Lonza, and others.

b. Key factors that are driving the market growth include increasing awareness about cell and gene therapy. Moreover, increasing demand for plasmid DNA is also estimated to accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.