- Home

- »

- Pharmaceuticals

- »

-

Plasma Protein Therapeutic Market Size, Share Report, 2030GVR Report cover

![Plasma Protein Therapeutics Market Size, Share & Trends Report]()

Plasma Protein Therapeutics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Albumin, Immunoglobulin, Plasma-derived Factor VIII), By Application (Hemophilia, PID, ITP), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-664-6

- Number of Report Pages: 86

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

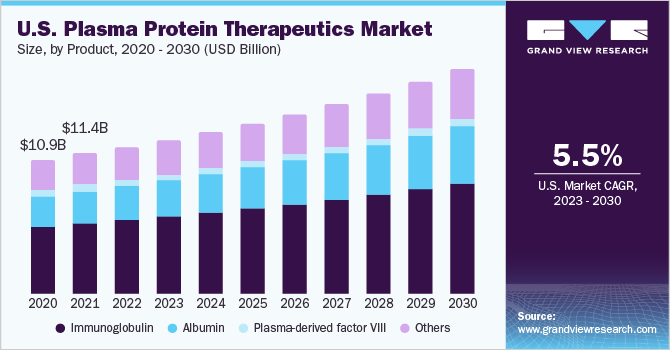

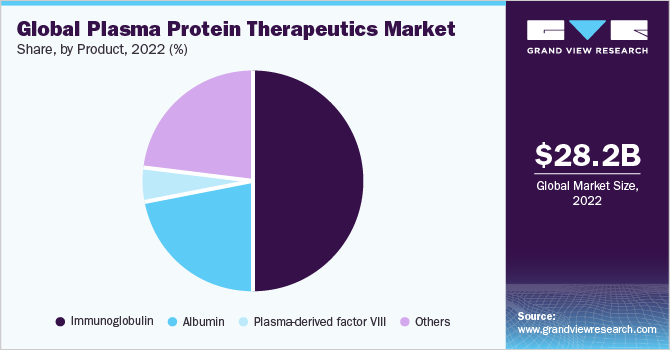

The global plasma protein therapeutics market size was estimated at USD 28.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% from 2023 to 2030. Approval of plasma products across multiple indications, increasing R & D activities, and high demand for advanced therapeutic options are anticipated to drive the growth. Technological advancements, favourable reimbursement policies, and improved standard of living have led to increased life expectancy, contributing to a rise in the geriatric population. Aging is considered the greatest risk factor for the development of cardiovascular and neurological diseases. According to statistics from the Centers for Disease Control and Prevention (CDC), 17.0% of adults aged 65 and over suffer from coronary heart disease (CHD). This increase in heart disease among the aging population is expected to further fuel the market growth.

Plasma proteins are extensively used in replacement therapies for treating conditions, such as deficiency of a coagulation factor in the field of hemostasis. This deficiency can be genetic or can occur due to an autoimmune disorder. It can also occur as a complication of cancer. Fibrinogen is a replacement therapy for treating hemorrhagic diathesis in diseases such as dysfibrinogenemia, afibrinogenemia, and hypofibrinogenemia.

The development of novel products that offer clinical benefits, such as improved efficacy and easy sample plasma extraction techniques, is expected to increase the penetration of plasma proteins in the market. Strong demand for albumin in Asia Pacific and higher volume of immunoglobulin usage in developed countries are projected to drive the market over the forecast period.

Manufacturers focus on innovation to produce plasma-derived products for the treatment of several neurological diseases, such as neuropathic pain, Myasthenia gravis, and post-polio syndrome, among others. Albumin is also under clinical investigation for the treatment of liver disease, malaria, sepsis, and Alzheimer’s disease. Moreover, the higher doses required for the subcutaneous use of immunoglobulins are also anticipated to propel growth in developed economies, such as the U.S., where the annual cost of Subcutaneous Immunoglobulin (SCIG) treatment is approximately USD 40,000.

Product Insights

Based on product, the market is segmented into albumin, Immunoglobulins (IG), plasma-derived factor VIII, and others. The immunoglobulin segment accounted for the largest revenue share of 50.3% in 2022. The large share can be attributed to the approval of biologics across multiple indications, ease of administration, and treatment cost.

The collaborations between key players and the launch of new and advanced products are further expected to boost market growth. For instance, in March 2022, Sanofi announced a partnership with IGM Bioscience to develop and commercialize six immunoglobulin M (IgM) antibody agonists against oncology and immunology.

The albumin segment is anticipated to grow at the fastest CAGR of 7.3% over the forecast period, driven by the improved diagnosis of hypoalbuminemia caused by liver cirrhosis and hepatitis B. High demand and usage in China, which is the largest market for albumin, is anticipated to fuel the growth further. Patients suffering from moderate to severe hemophilia A require clotting factor VIII as a preventive or on-demand therapy. However, approximately 70.0% of hemophilia patients receive none no or inadequate treatment. The factor VIII market is expected to witness a decline in sales due to increasing competition from recombinant and other long-term therapies.

The others segment includes alpha-1 antitrypsin, hyperimmune immunoglobulins, coagulation factors, fibrogammin, and c1 esterase inhibitors. Alpha-1 Antitrypsin (AAT) is a replacement therapy for treating rare hereditary emphysema. The deficiency causes conditions such as Chronic Obstructive Pulmonary Disease (COPD), bronchitis, and neonatal hepatitis. Currently, only about 10.0% to 15.0% of AAT-deficient patients receive treatment in the U.S. and Europe, thus creating room for market growth. The overall segment is anticipated to exhibit lucrative growth driven by improvement in diagnosis rate and product launches.

Application Insights

Based on application, the market for plasma protein therapeutics is segmented into Hemophilia, Primary Immunodeficiency Diseases (PID), Idiopathic Thrombocytopenic Purpura (ITP), and others. Primary immunodeficiency diseases include more than 200 rare, chronic diseases resulting from an immune system defect.

Globally, more than 6.0 million individuals live with a PID, of which less than 60,000 cases are reported annually. The PID segment captured the largest market share of 26.5% in 2022 and is expected to exhibit substantial growth with a CAGR of 6.2% through the forecast period from 2023 to 2030. Increasing expansion of clinical applications for immunoglobulins, approval of SCIGs, and high treatment costs are contributing to segment growth.

The others segmented is expected to grow at the fastest CAGR of 6.6% over the forecast period from 2023 to 2030. The increasing use of plasma protein therapeutics in the treatment of various diseases and their increasing prevalence are expected to add to the growth of this segment.

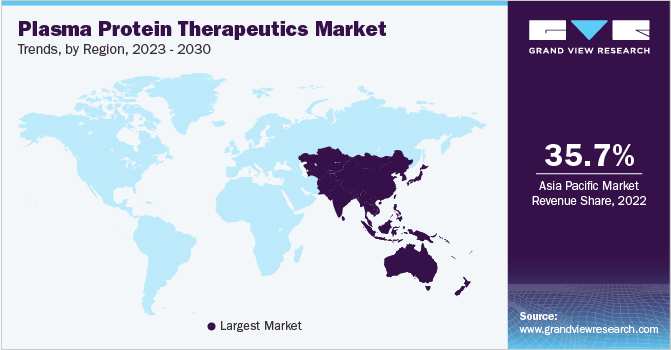

Regional Insights

Asia Pacific accounted for the largest market share of 35.7% in 2022 and is expected to exhibit the fastest CAGR of 8.6% over the forecast period from 2023 to 2030. China ranks first in the global albumin market, supported by high demand and usage of albumin. In addition, factors like increasing demand for advanced treatment options, developing economies, and increasing per capita income are anticipated to create growth avenues for market players in emerging countries over the forecast period.

Approximately 50.0% of the market is concentrated in North America and Europe. The U.S. also accounted for a significant market share in 2022. The presence of a large patient base, a growing geriatric population, availability of well-developed infrastructure for storing and maintaining high-quality source plasma are some of the key regional drivers. Increased adoption of novel therapeutics and rising disease prevalence are other key factors contributing to regional growth.

Key Companies & Market Share Insights

Key players are opting for strategies such as increasing investment in R&D, new product developments, and strategic alliances to strengthen their market position. In May 2020, Bio Products Laboratory (BPL), a company engaged in the manufacturing of plasma-derived protein therapies, announced the launch of ALBUMINEX 5% solution and ALBUMINEX 25% solution for injection in the U.S. In March 2018, the Food and Drug Administration (FDA) approved CSL’s Hizentra, the first and only subcutaneous immunoglobulin therapy to treat Chronic Inflammatory Demyelinating Polyneuropathy (CIDP). Differentiated product profiles, an increasing number of plasma donor centers, and abundant fractionation capacity combined are all expected to support the market growth.

The market is expected to remain competitive, with players focusing on novel drug development and expanding plasma collection networks. In August 2018, Grifols S.A. acquired 24 plasma donor centers in the U.S. operated by Biotest AG. Companies are focusing on collaborations to broaden their product portfolio & regional presence and conducting clinical trials to increase their market share.

In May 2023, Biotest AG received marketing authorizations to market Cytotect, a CMV-hyper immunoglobulin, in five additional markets, including the Czech Republic, Slovakia, Lituania, Ireland, and Romania, increasing its market to 28 countries. Furthermore, in April 2020, Kedrion Biopharma and Kamada Ltd. announced a collaboration for the development, production, and supply of human plasma-derived COVID-19 polyclonal immunoglobulin (IgG) products for the treatment of COVID-19 patients. The initial focus of the collaboration is to distribute the product in Italy, Israel, and the U.S. Further plans involve expansion into additional markets. These developments are expected to boost the development of the market. Some prominent players in the global plasma protein therapeutics market include:

-

CSL

-

Grifols, S.A.

-

Takeda

-

Octapharma AG

-

Biotest AG

-

Kedrion S.p.A

Plasma Protein Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.8 billion

Revenue forecast in 2030

USD 45.1 billion

Growth rate

CAGR of 6.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

CSL; Grifols, S.A; Takeda; Octapharma AG; Biotest AG; Kedrion S.p.A

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

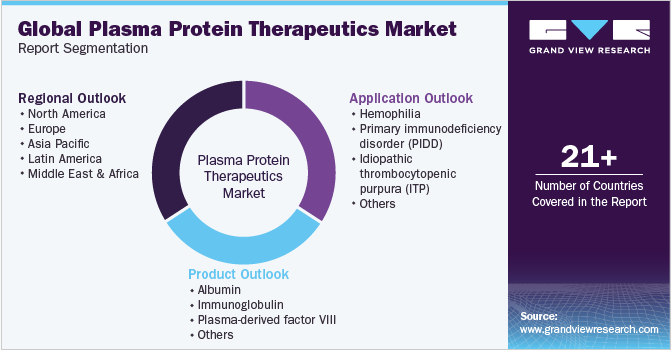

Global Plasma Protein Therapeutic Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global plasma protein therapeutics market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Albumin

-

Immunoglobulin

-

Plasma-derived Factor VIII

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemophilia

-

Primary Immunodeficiency Disorder (PIDD)

-

Idiopathic Thrombocytopenic Purpura (ITP)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plasma protein therapeutics market size was estimated at USD 28.2 billion in 2022 and is expected to reach USD 29.7 billion in 2023.

b. The global plasma protein therapeutics market is expected to grow at a compound annual growth rate of 6.1% from 2023 to 2030 to reach USD 45.1 billion by 2030.

b. Immunoglobulins dominated the plasma protein therapeutic market with a share of 50.3% in 2022. This is attributable to the approval of biologics across multiple indications, ease of administration, and treatment cost.

b. Some key players operating in the plasma protein therapeutic market include CSL Behring LLC, Octapharma AG, Grifols S.A., Shire Plc, Bayer AG, Biotest AG, and Kedrion S.P.A. CSL Behring LLC.

b. Key factors that are driving the market growth include approval of plasma products across multiple indications, increasing R&D activities, and high demand for advanced therapeutic options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.