- Home

- »

- Pharmaceuticals

- »

-

Plasma Protease C1-inhibitor Market Size Report, 2030GVR Report cover

![Plasma Protease C1-inhibitor Market Size, Share & Trends Report]()

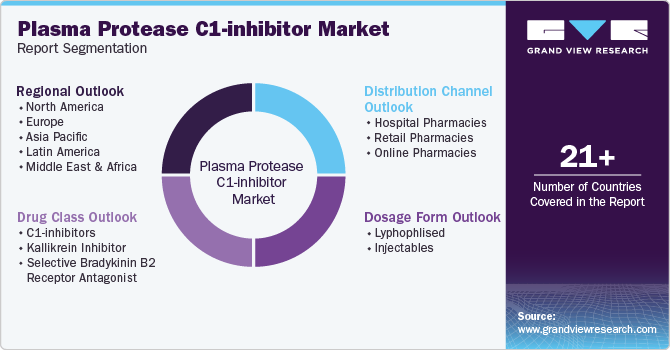

Plasma Protease C1-inhibitor Market Size, Share & Trends Analysis Report By Drug Class (C1-inhibitors, Kallikrein Inhibitor), By Dosage Form (Lyphophlised, Injectables), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Plasma Protease C1-inhibitor Market Trends

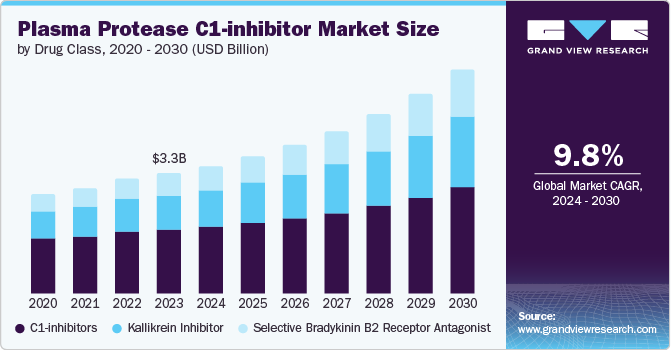

The global plasma protease C1-inhibitor market size was estimated at USD 3.33 billion in 2023 and is projected to grow at a CAGR of 9.79% from 2024 to 2030. The market growth can be attributed to the critical role of plasma protease C1-inhibitor (C1-INH) in the treatment of hereditary angioedema (HAE). Plasma Protease C1-inhibitor therapy helps manage and prevent these debilitating attacks by restoring proper regulation of the complement system, which is dysfunctional in individuals with HAE. As awareness of HAE increases and more patients are diagnosed and treated, the demand for Plasma Protease C1-inhibitor products is expected to grow, thereby driving the market growth.

Hereditary Angioedema (HAE) serves as a significant driver for the market due to its rare yet impactful nature. Affecting about 1 in 50,000 individuals globally, HAE is an autosomal dominant inherited condition characterized by episodes of swelling. The rarity and severity of HAE highlights the need for effective treatments, spurring innovation and investment in the development of C1 esterase inhibitors. As awareness grows and diagnostic capabilities improve, the demand for targeted therapies like those in industry is expected to increase, highlighting the importance of this market segment.

Expanding regulatory approvals play a pivotal role in shaping the market, which is primarily driven by the treatment of hereditary angioedema (HAE). Regulatory agencies worldwide, including the FDA in the U.S., EMA in Europe, and other national authorities, continually evaluate and approve new indications and formulations for these therapies. These expansions include approvals for pediatric use, on-demand treatments, and novel administration routes such as subcutaneous formulations, enhancing treatment options and patient convenience.

In September 2022, CSL Behring's approval of Berinert S.C. Injection 2000 in Japan marks a significant advancement in hereditary angioedema (HAE) treatment. This subcutaneous formulation, based on human C1-esterase inhibitor, allows self-administration at home twice weekly. Supported by global and domestic Phase III studies showing reduced HAE attack rates, it promises improved prophylactic care. With approximately 300 diagnosed HAE patients in Japan, CSL's commitment extends through community support initiatives and educational resources, enhancing patient care and quality of life while reinforcing its long-standing dedication to rare disease management. Such regulatory milestones broaden market access but also stimulate innovation among manufacturers, leading to improved therapeutic outcomes and potentially higher patient adherence. As a result, expanding regulatory approvals are pivotal in catalyzing growth and evolution within the industry, ensuring that patients with HAE have access to effective and tailored treatment solutions.

Additionally, ongoing research focuses on exploring novel mechanisms of action and delivery systems, aiming to enhance treatment efficacy and durability. These advancements expand the therapeutic options available but also foster competition among manufacturers, potentially lowering costs and increasing accessibility for patients globally. For instance, in June 2024, BioCryst Pharmaceuticals presented berotralstat, an oral, once-daily prophylactic treatment for hereditary angioedema (HAE) patients with normal C1-inhibitor levels, led to a significant reduction in monthly attack rates. Six patients included in the analysis demonstrated a 75 to 100 percent decrease in HAE attacks after six months of berotralstat treatment, with minimal adverse events noted.

Concurrently, a comprehensive review highlighted significant adverse health outcomes associated with attenuated androgen use in HAE, emphasizing the need for safer and more tolerable prophylactic options. Furthermore, advancements in treatment options within market are pivotal in meeting the evolving needs of HAE patients. By combining efficacy with enhanced safety and convenience, these innovations continue to redefine standards of care, promising a brighter future for those affected by this challenging condition.

Industry Dynamics

The degree of innovation in the market is high, based on the advancements in formulation, safety, therapeutic efficacy, and expanded indications observed in recent years. The transition from intravenous to subcutaneous administration, improvements in purification processes, and the exploration of novel mechanisms of action all contribute to a dynamic and evolving market. These innovations have improved patient outcomes and broadened the scope of treatment options available, indicating a high level of innovation within the field.

The level of merger and acquisition (M&A) activities within the market remains limited. Unlike sectors experiencing frequent consolidations, such as technology or pharmaceuticals, the market primarily sees organic growth and strategic partnerships rather than large-scale mergers or acquisitions. Companies typically focus on internal research and development efforts to enhance product efficacy, safety, and market access. This approach reflects a stable landscape with a concentration on expanding treatment options and obtaining regulatory approvals rather than significant consolidation activities among market players.

The impact of regulation on the market is high. Compliance with stringent regulatory standards set by authorities such as the FDA and EMA is essential for gaining approvals and maintaining product safety and efficacy. Regulations affect operational costs and market competitiveness, making regulatory adherence a significant factor in the strategic planning and commercialization of plasma protease C1-inhibitor therapies.

There are currently no direct substitutes for plasma protease C1-inhibitor in the treatment of hereditary angioedema (HAE), other therapeutic approaches exist. These include attenuated androgens and bradykinin receptor antagonists, though they serve different roles in managing HAE symptoms. Attenuated androgens are used for long-term prophylaxis but have associated adverse effects, while bradykinin receptor antagonists target acute attacks. However, plasma protease C1-inhibitor remains unique in its mechanism as a replacement therapy, highlighting its distinct role in addressing both prophylaxis and acute treatment needs in HAE patients.

Specialized nature of Plasma Protease C1-inhibitor therapies and the complexities of regulatory approvals in different regions, the market experiences limited regional expansion. Companies primarily focus on established markets like the U.S., Europe, and Japan, where regulatory pathways are clearer and healthcare infrastructures support advanced therapies. Emerging markets may present opportunities in the future but require significant investment in regulatory compliance and market education. Thus, while there is potential for growth, the current level of regional expansion for Plasma Protease C1-inhibitor remains low.

Drug Class Insights

Based on drug class, C1-inhibitors led the market and accounted for 53.14% of the global revenue in 2023. Advancements in medical technology led to increased demand for treatments targeting the complement system, where C1-Inhibitors play a critical role. In addition, the rise in chronic inflammatory diseases and hereditary angioedema cases necessitated more effective therapies, leading to a higher demand. Furthermore, the development of recombinant human C1-Inhibitors offered safer and more reliable treatment options, further boosting market growth. Lastly, increased investment in research and development by pharmaceutical companies focused on improving the efficacy and accessibility of C1-Inhibitor-based therapies contributed to the market's expansion.

The selective bradykinin B2 receptor antagonist segment is projected to witness the fastest growth rate over the forecast period.The segment benefits from extensive R&D efforts by key players aiming to develop new drugs for C1-inhibitor deficiency, particularly those that can be administered subcutaneously. This focus aligns with the growing demand for convenient and efficient treatment options for conditions like hereditary angioedema (HAE). The development of drugs like Firazyr has shown promise in managing HAE symptoms, driving interest and investment in this area. Additionally, the segment's growth is fueled by strategic partnerships and collaborations among pharmaceutical companies, aimed at advancing innovative treatments for protease C1-inhibitor deficiencies.

Distribution Channel Insights

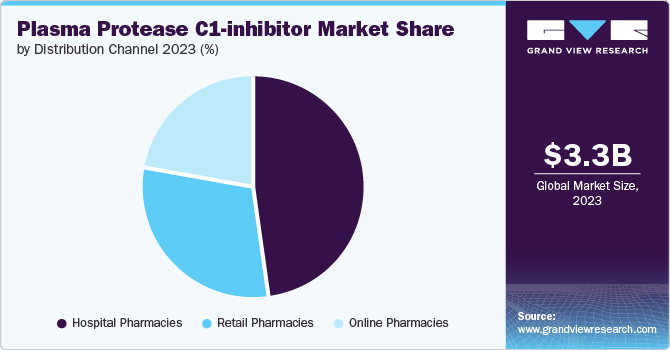

Based on distribution channel, hospital pharmacies led the market with the largest share in 2023 due to their role as primary centers for acute care and specialist treatment of hereditary angioedema (HAE). These pharmacies are equipped to handle specialized medications and ensure timely availability during emergency situations, crucial for managing HAE attacks. Moreover, hospital pharmacies facilitate direct oversight by healthcare professionals, ensuring appropriate administration and monitoring of patients receiving C1-inhibitors. This direct oversight and specialized care contribute to the preference for hospital pharmacies as the primary distribution channel, reflecting their critical role in providing comprehensive and immediate medical care to HAE patients.

Online pharmacies are expected to grow at the fastest CAGR over the forecast period due to their convenience and accessibility. They enable patients with hereditary angioedema (HAE) to procure medications from the comfort of their homes, eliminating the need for physical visits to traditional pharmacies. This convenience is particularly advantageous for patients managing chronic conditions like HAE, providing them with uninterrupted access to essential treatments. Online pharmacies also offer a wide range of products and competitive pricing, further driving their popularity among consumers seeking efficient and discreet medication procurement options. As digital healthcare continues to expand, online pharmacies are poised for sustained growth in the Plasma Protease C1-inhibitor market.

Dosage form Insights

Based on dosage form, the lyophilized segment led the market with a revenue share of 57.75% in 2023. Lyophilization, or freeze-drying, enhances the stability and extends the shelf life of medications, making them easier to store and transport. This process is particularly beneficial for plasma protease C1 inhibitors, which are used in the treatment of Hereditary Angioedema (HAE). The lyophilized form ensures that these medications remain potent and effective even under varying storage conditions, thus improving their availability and usability for patients. Furthermore, the development of lyophilized formulations reflects the pharmaceutical industry's commitment to addressing unmet medical needs and improving the quality of life for patients with rare genetic disorders like HAE. This commitment drives innovation and investment in the lyophilized segment of the market, contributing to its growth.

The injectable segment is projected to witness a significant growth rate over the forecast period due to their direct administration into the bloodstream, ensuring rapid onset of action and effective management of acute hereditary angioedema (HAE) attacks. This dosage form offers convenience in emergency settings and outpatient treatments, enhancing patient compliance and therapeutic outcomes. Additionally, injectables are preferred for their precise dosing and consistent bioavailability, factors that contribute to their increasing adoption in clinical practice. As demand for immediate symptom relief and efficient drug delivery continues to rise, injectables are poised to maintain their rapid growth trajectory in the market.

Regional Insights

North America plasma protease C1-inhibitor market accounted for 37.67% share in 2023.The region has a high prevalence of hereditary angioedema (HAE), necessitating effective treatment options like C1-inhibitors. Its advanced healthcare infrastructure and robust regulatory environment facilitate rapid approvals and widespread adoption of new therapies. Moreover, North American pharmaceutical firms lead in research and development for HAE treatments, fostering innovation and industry leadership. Additionally, strong awareness among healthcare providers and patients about HAE and its management further solidifies North America's prominent position in the market.

U.S. Plasma Protease C1-inhibitor Market Trends

The plasma protease C1-inhibitor market in the U.S. is growing significantly due to the high prevalence of Hereditary Angioedema (HAE). This condition requires specialized treatment with C1-Inhibitors, contributing significantly to the industry's growth in the region. Additionally, the U.S. leads in investments in research and development activities, fostering innovation and the development of new treatments. The country's robust healthcare infrastructure and regulatory environment also facilitate the swift introduction and adoption of advanced therapies, further solidifying its position as a leader in the industry.

Europe Plasma Protease C1-inhibitor Market Trends

The plasma protease C1-inhibitor market of Europe is poised for significant growth, driven by several key factors such as increasing attention from biopharmaceutical companies focusing on developing effective treatments for conditions like Hereditary Angioedema (HAE) and Diabetic Macular Edema (DME). This focus is evident in the advancement of several kallikrein inhibitor medicines through preclinical and clinical stages of development. For instance, in March 2022, KalVista Pharmaceuticals initiated the KVD900 Phase 3 trial for HAE, highlighting the sector's commitment to innovation.

The UK plasma protease C1-inhibitor market is characterized by significant growth, driven by advancements in medical technology and the rising prevalence of conditions treated with C1-Inhibitors. Key contributors include the development of recombinant human C1-Inhibitors, offering safer and more effective treatment options, and the expansion of research and development efforts by pharmaceutical companies. Furthermore, the industry is bolstered by increased investment in gene therapy and antisense oligonucleotides, which aim to modulate the activity of proteases similar to C1-Inhibitors.

The plasma protease C1-inhibitor market in France is poised for growth, driven by rising healthcare expenditure, technological advancements in treatment methods, and increased awareness of rare diseases.

Germany plasma protease C1-inhibitor market is driven by advancements in medical technology, increasing prevalence of chronic inflammatory diseases, and the development of novel therapy. Pharmaceutical investments in research and development contribute to expanding treatment options and market expansion.

Asia Pacific Plasma Protease C1-inhibitor Market Trends

The plasma protease C1-inhibitor market in Asia Pacific is experiencing significant growth, driven by the rising prevalence of chronic inflammatory diseases and the increasing demand for advanced therapeutic options. Key factors contributing to this growth include the development of novel recombinant human Inhibitors, which offer improved safety and efficacy profiles over traditional treatments. Additionally, the region's rapidly aging population increases the incidence of age-related conditions that benefit from C1-Inhibitor therapy. Furthermore, the industry expansion is facilitated by the entry of new players offering innovative formulations and delivery methods, catering to the evolving healthcare needs of the region.

China plasma protease C1-inhibitor market is driven by rising healthcare expenditure, increasing awareness of rare diseases, and government support for advanced medical research. Pharmaceutical companies are investing in R&D to develop novel treatments, contributing to industry expansion.

The plasma protease C1-inhibitor market in Japan expanded significantly due to advancements in medical technology, increased investment in research and development, and the development of recombinant human Inhibitors offering safer, more reliable treatment options.

Latin America Plasma Protease C1-inhibitor Market Trends

The plasma protease C1-inhibitor market in Latin America is influenced by healthcare policies, regulatory environment, and pharmaceutical innovations. Strategic investments in research and development by pharmaceutical companies contributed to industry growth, focusing on treating conditions beyond Hereditary Angioedema and Diabetic Macular Edema.

Brazil plasma protease C1-inhibitor market is driven by increasing healthcare awareness and infrastructure development. The country benefits from growing pharmaceutical investments and regulatory advancements, facilitating access to advanced treatments.

MEA Plasma Protease C1-inhibitor Market Trends

The plasma protease C1-inhibitor market in the Middle East & Africa (MEA) is emerging with improved healthcare infrastructure and rising investment in pharmaceuticals. Regulatory enhancements and increased access to advanced therapies are driving growth, positioning the region as a pivotal hub for expanding treatment options.

Saudi Arabia plasma protease C1-inhibitor market shows significant growth with advancements in healthcare facilities and pharmaceutical investments. Regulatory developments and improved availability of advanced therapies are pivotal in expanding treatment options within the region.

Key Plasma Protease C1-Inhibitor Company Insights

Some of the leading players operating in the plasma protease C1-inhibitor market Takeda Pharmaceutical Company, CSL. and Pharming among others dominate the industry with their contributions to the development of new treatments. Sanquin And BioCryst Pharmaceuticals, Inc. are some of the emerging industry participants in the plasma protease C1-inhibitor market. These companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Plasma Protease C1-Inhibitor Companies:

The following are the leading companies in the plasma protease C1-inhibitor market. These companies collectively hold the largest market share and dictate industry trends.

- CSL.

- Takeda Pharmaceutical Company Limited

- Pharming

- KalVista Pharmaceuticals.

- Sanquin.

- BioCryst Pharmaceuticals, Inc.

- CENTOGENE N.V.

Recent Developments

-

In May 2024, KalVista Pharmaceuticals plans strategic initiatives for fiscal year 2025, focusing on sebetralstat, their oral plasma kallikrein inhibitor for HAE. Regulatory filings are scheduled across major markets with potential launches in 2025-2026. Plans include pediatric trials and lifecycle extension activities.

-

In February 2023, Takeda's TAKHZYRO received FDA approval for prophylactic treatment of hereditary angioedema (HAE) in pediatric patients aged 2 to <12 years old, filling a critical gap for children aged 2 to <6 who previously lacked approved options. This expands its use beyond adults and older children, offering a longer dosing interval compared to existing therapies. TAKHZYRO aims to improve quality of life by providing effective, less frequent dosing for pediatric HAE patients.

-

In June 2024, BioCryst Pharmaceuticals presented berotralstat, an oral, once-daily prophylactic treatment for hereditary angioedema (HAE) patients with normal C1-inhibitor levels, led to a significant reduction in monthly attack rates.

Plasma Protease C1-inhibitor Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.54 billion

Revenue forecast in 2030

USD 6.21 billion

Growth Rate

CAGR of 9.79% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

CSL.; Takeda Pharmaceutical Company; Pharming; KalVista Pharmaceuticals.; BioCryst Pharmaceuticals, Inc.; BioCryst Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plasma Protease C1-inhibitor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plasma protease C1-inhibitor market report based on drug class, dosage form, distribution channel and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

C1-inhibitors

-

C1-esterase Inhibitor

-

Recombinant Inhibitor

-

-

Kallikrein Inhibitor

-

Selective Bradykinin B2 Receptor Antagonist

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Lyphophlised

-

Injectables

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plasma protease C1-inhibitor market size was estimated at USD 3.33 billion in 2023 and is expected to reach USD 3.54 billion in 2024.

b. The global plasma protease C1-inhibitor market is expected to grow at a compound annual growth rate of 9.79% from 2024 to 2030 to reach USD 6.21 billion by 2030.

b. C1-inhibitors dominated the Drug Class segment accounted for the largest share of 53.14% in 2023 and selective bradykinin B2 receptor antagonist anticipated to grow at fastest growth rate over the forecast period owing to undergoing R&D initiatives being undertaken by major players.

b. Market players operating in plasma protease C1-inhibitor market include CSL Behring LLC., Takeda Pharmaceutical Company, Pharming Technologies B.V., KalVista Pharmaceuticals, Inc., Shire plc., CSL Limited, Sanquin, Pharming Group N.V.).

b. Key factors that are driving the market growth include the rising incidence of hereditary angioedema (HAE), and robust product pipeline.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."