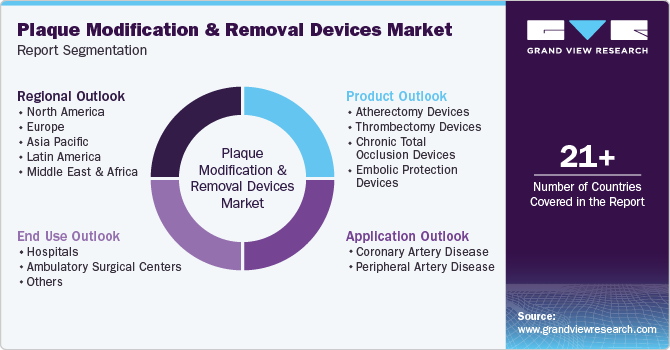

Plaque Modification And Removal Devices Market Size, Share & Trends Analysis Report By Product, By Application (Coronary Artery Disease, Peripheral Artery Disease), By End Use, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-322-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global plaque modification and removal devices market size was estimated at USD 1.86 billion in 2023 and is anticipated to expand at a CAGR of 8.4% from 2024 to 2030. This growth is primarily driven by the increasing prevalence of cardiovascular diseases (CVDs) worldwide, necessitating innovative solutions for the prevention and management of atherosclerosis. The Heart Research Institute highlights that atherosclerosis is common among individuals over 40, with the likelihood of developing severe atherosclerosis rising with age. Most people over 60 have some degree of this condition. As a major underlying cause of cardiovascular diseases, atherosclerosis significantly contributes to the global incidence of heart attacks and strokes, further fueling the demand for plaque modification and removal devices. Additionally, advancements in medical technology and increased healthcare expenditure are also contributing to market expansion.

The advancements in plaque modification and removal devices are poised to revolutionize the market for plaque modification devices. The increasing prevalence of atherosclerosis, growing patient population with coronary, and peripheral conditions, growing elderly demographic, rising incidence of hypertension in adults, introduction of innovative plaque removal techniques, and heightened awareness regarding atherosclerosis and its treatments particularly in emerging economies are projected to drive growth in the global market. The surge in lifestyle-related diseases such as hypertension and smoking contribute to the accumulation of plaque in arteries, thereby boosting the demand for plaque modification devices.

Reimbursement policies play a critical role in the market by influencing the accessibility and affordability of these treatments. In many developed countries, such as the U.S., European nations, and parts of Asia, favorable reimbursement frameworks provided by public and private health insurance programs significantly impact the adoption of these devices. These policies often cover a substantial portion of the costs associated with minimally invasive cardiovascular procedures, including the use of advanced devices including atherectomy tools and drug-eluting stents. This coverage reduces the financial burden on patients and healthcare providers, making these sophisticated treatments more accessible.

Industry Dynamics

The market is consolidated, with a few key players dominating the industry. This consolidation is due to rapid growth in the cardiovascular disease space, attracting significant investment from key players.

Technological advancements in plaque modification and removal devices are also contributing to market growth. For instance, the development of drug-eluting stents (DES) has revolutionized interventional cardiology by reducing restenosis rates significantly compared to bare metal stents. DES release drugs that inhibit neointimal hyperplasia (the formation of new tissue at the site of injury), thereby preventing plaque buildup and re-blockage of the arteries. Similarly, advances in endovascular therapies such as atherectomy devices (which remove plaque mechanically) and intravascular ultrasound (IVUS) systems have improved clinical outcomes by enabling precise diagnosis and treatment of complex coronary artery lesions.

The plaque modification and removal devices industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. Companies operating in the healthcare technology sector have been actively engaging in M&A activities to expand their product portfolios, enhance their technological capabilities, and gain a competitive edge in the market. several key players in the industry acquiring smaller firms specializing in plaque modification and removal devices to strengthen their market position and drive growth. For instance, in April 2023, Abbott acquired Cardiovascular Systems, Inc. With this acquisition Abbott gains a complementary solution for treating vascular disease through the acquisition of CSI, whose leading atherectomy system readies vessels for angioplasty or stenting to restore blood flow.

Regulations play a crucial role in shaping the global market. Regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and the European Medicines Agency (EMA) in Europe play a crucial role in overseeing the approval, marketing, and post-market surveillance of these devices. Manufacturers of plaque modification and removal devices must adhere to specific regulatory requirements related to product design, manufacturing processes, labeling, clinical testing, and quality control. These regulations aim to guarantee that these devices meet high standards of safety, performance, and quality before they are made available for clinical use.

Product innovation is a key strategy employed by companies operating in the global market to cater to diverse clinical needs. Companies operating in this industry continuously invest in research and development to introduce innovative devices that offer improved efficacy, safety, and patient outcomes. Product innovation often involves the introduction of next-generation technologies such as advanced laser systems, atherectomy devices, thrombectomy catheters, and drug-coated balloons. These new products aim to address specific challenges associated with plaque removal, including calcified lesions, complex anatomies, and restenosis.

In recent years, emerging markets in Asia-Pacific, Latin America, and the Middle East have shown significant growth potential for plaque modification and removal devices. These regions are witnessing rapid economic development, leading to increased healthcare spending and improved access to advanced medical technologies. Moreover, the rising awareness about cardiovascular health and the need for preventive care measures have fueled the demand for innovative plaque modification and removal devices in these markets. As regulatory frameworks evolve to support the introduction of new medical devices, companies are increasingly focusing on expanding their presence in these regions through partnerships with local distributors or direct investments in establishing subsidiaries or manufacturing facilities.

Product Insights

The atherectomy devices segment dominated the market and held the largest revenue share of over 32.62% in 2023. The atherectomy devices address the limitations of balloon angioplasty alone, particularly in cases of heavily calcified or fibrous plaque where balloons may not adequately expand the vessel or result in dissections which is driving the segment growth. These devices aid in mechanically reducing and modifying challenging lesions, enhancing procedural success rates, and decreasing the necessity for additional interventions.

Additionally, the rise in complex percutaneous coronary interventions (PCIs) necessitates tools capable of navigating tortuous vessels and tackling eccentric lesions effectively.Additionally, atherectomy procedures aim to minimize vessel trauma, enhance long-term patency rates, and offer alternative solutions for patients who may not be suitable candidates for traditional interventions.

The embolic protection devices (EPDs) segment is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2024 to 2030. These devices are primarily driven by the imperative need to mitigate the risk of embolization. The EPDs facilitate the optimization of procedural outcomes by enhancing the efficacy of plaque modification techniques such as atherectomy, angioplasty, and stent deployment, enabling more thorough plaque. debulking and minimizing the risk of procedural complications.

Moreover, the continuous evolution of EPD technologies is fueled by ongoing efforts to enhance device safety, efficacy, and flexibility, ultimately improving patient outcomes, and expanding the applicability of minimally invasive interventions in the management of atherosclerotic disease. For instance, next-generation EPDs incorporate advanced filter designs that can capture larger debris while maintaining low profile sizes for improved patient comfort and ease of use.

Application Insights

The coronary artery disease segment dominated the market and held the largest revenue share of over 59.83% in 2023. Coronary artery disease (CAD), characterized by the buildup of plaque within the coronary arteries, remains a leading cause of morbidity and mortality worldwide. This has heightened the demand for effective treatment options, including plaque modification and removal devices.

These devices, such as atherectomy systems, balloon angioplasty devices, and laser ablation systems, are designed to remove or modify atherosclerotic plaque, improving blood flow and reducing the risk of heart attacks. The market is further propelled by the rising adoption of minimally invasive procedures, technological innovations that enhance device efficacy and safety, and the growing aging population, which is more susceptible to CAD.

The peripheral artery disease segment is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030. The market for plaque modification and removal devices in the treatment of peripheral artery diseases (PAD) is experiencing significant growth. Peripheral artery diseases, characterized by the narrowing or blockage of arteries outside of the heart and brain, often due to atherosclerosis, require effective intervention to prevent severe complications like limb ischemia.

Technological advancements in medical devices have led to the development of various plaque modification and removal tools, such as atherectomy devices, laser ablation systems, and specialized balloons and stents. These devices are designed to precisely target and eliminate plaque buildup, restoring proper blood flow and reducing the need for more invasive surgical procedures. The increasing prevalence of PAD, driven by factors such as aging populations, rising incidences of diabetes and obesity, and improved diagnostic capabilities, fuels the demand for these advanced treatment options.

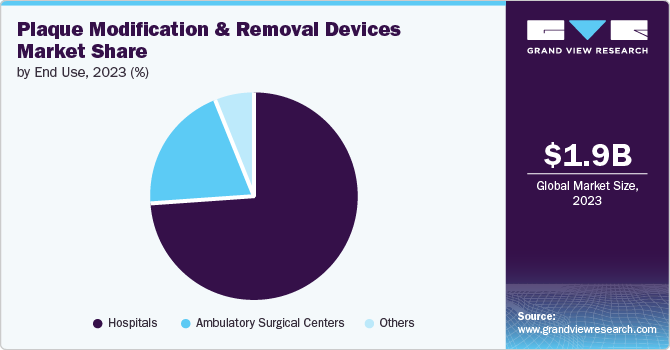

End Use Insights

The hospital segment dominated the market and held the largest revenue share of over 74.23% in 2023. The primary driver for hospitals is patient care and safety. Plaque buildup in arteries can lead to serious conditions such as atherosclerosis, which increases the risk of heart attacks and strokes. Therefore, hospitals prioritize plaque modification and removal to improve patient outcomes and reduce the incidence of cardiovascular events. Hospitals are also motivated by advancements in medical technology.

With the development of minimally invasive techniques such as angioplasty and stenting, hospitals can offer more effective and less invasive treatments for plaque removal, leading to quicker recovery times for patients. Additionally, financial considerations play a role in driving hospitals toward plaque modification procedures.

The ambulatory surgical centers (ASCs) segment is expected to grow at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2030. The growth is attributed to the convenience and efficiency that ASCs offer. Patients can undergo these procedures in a more streamlined and timely manner compared to traditional hospital settings, leading to quicker recovery times, and reduced overall healthcare costs.Furthermore, ASCs are known for their patient-centered approach, offering personalized care and a more comfortable environment for individuals undergoing plaque modification and removal procedures.

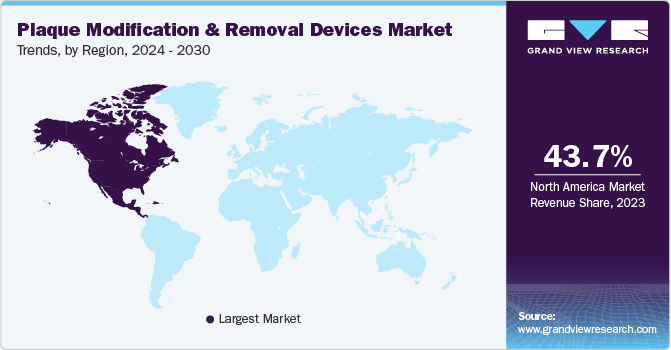

Regional Insights

The plaque modification and removal devices market of North America dominated with a revenue share of 43.69% in 2023. The region’s growth is driven by rising prevalence of chronic diseases, rapid adoption of technological advancements, and rising elderly population. For instance, the CDC reports that each year in the US, over 795,000 people experience a stroke, with ischemic stroke accounting for 87% of cases.

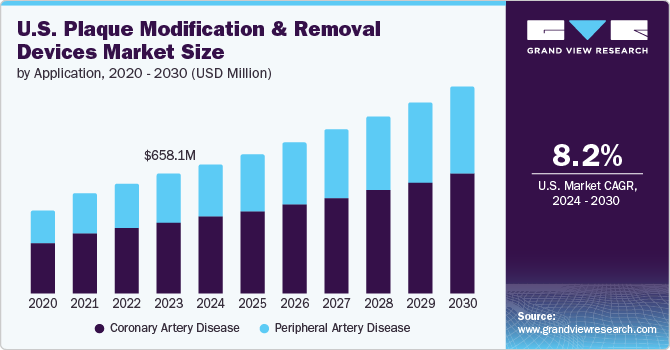

U.S. Plaque Modification And Removal Devices Market Trends

U.S. plaque modification and removal devices marketheld the largest share in 2023, in the North American region, owing to rising aging population. According to a Population Reference Bureau article published in January 2024, the projected growth indicates that the number of Americans aged 65 and older is anticipated to rise from 58 million in 2022 to 82 million by 2050, reflecting a 47% increase. Simultaneously, the share of the total population represented by the 65-and-older age group is expected to rise from 17% to 23%. Moreover, as per the American Heart Association, about 70% of individuals aged 70 and above are anticipated to experience cardiovascular disease (CVD), which is one of the key factors contributing to cognitive disabilities, thereby driving the market.

Europe Plaque Modification And Removal devices Market Trends

The plaque modification and removal devices market of Europe is expected to witness lucrative growth over the forecast period. The growth is driven by the increasing emphasis on personalized and preventive healthcare. Furthermore, government initiatives to improve healthcare infrastructure and accessibility are also boosting the market for plaque modification and removal devices in Europe. For example, the European Union’s Horizon 2020 research program has allocated significant funding towards developing new medical technologies for CVD prevention and treatment. Similarly, the government is investing in healthcare infrastructure projects to improve access to advanced medical treatments for their populations.

UK plaque modification and removal devices market held a significant share in Europe. The drivers for plaque modification and removal devices stem from the rising geriatric population in the UK, coupled with lifestyle factors such as sedentary lifestyles, contribute to the increasing incidence of cardiovascular disorders, further propelling the demand for plaque modification and removal devices. Moreover, favorable reimbursement policies and government initiatives aimed at improving cardiovascular care also play a crucial role in driving market expansion by facilitating patients’ access to advanced treatment options.

The plaque modification and removal devices market in Germany is a major contributor to the European market. The growth is attributed to the rising awareness about the importance of preventive healthcare measures and early intervention strategies has led to an increased adoption of plaque modification devices in Germany. Moreover, technological advancements in the field of interventional cardiology have resulted in the development of more efficient and minimally invasive plaque removal devices, further fueling market growth. Furthermore, favorable reimbursement policies and government initiatives aimed at improving cardiovascular care in Germany are also contributing to the expansion of the market in the country.

Asia Pacific Plaque Modification And Removal Devices Market Trends

Asia Pacific plaque modification and removal devices market is expected to grow at the fastest CAGR of 8.9% during the forecast period. The increasing prevalence of cardiovascular diseases in the region is a significant driver for the growth of this market. As lifestyle changes, such as sedentary habits, become more common in Asia Pacific countries, the incidence of cardiovascular diseases, including atherosclerosis, is on the rise. Moreover, the increasing healthcare expenditure and infrastructure development in countries across Asia Pacific are contributing to the expansion of the market.

The plaque modification and removal devices market of China held the largest revenue share and is expected to grow fastest. The rising awareness among both healthcare providers and patients about the benefits of using advanced medical technologies for cardiovascular care. With increasing access to information and education, there is a growing demand for innovative devices that can offer minimally invasive solutions for treating plaque buildup in arteries. The Chinese government’s focus on improving healthcare infrastructure and expanding access to quality medical services is also playing a significant role in driving the demand for plaque modification and removal devices. Investments in healthcare facilities, training programs for healthcare professionals, and initiatives to promote preventive care are all contributing to the growth of the market by creating a conducive environment for the adoption of advanced medical technologies.

Australia plaque modification and removal devices market is expected to show a lucrative growth. The increasing prevalence of cardiovascular diseases in the country is a significant driver. As heart diseases continue to be a leading cause of mortality in Australia, there is a growing demand for advanced medical devices that can effectively treat conditions such as atherosclerosis. This has led to an increased adoption of plaque modification and removal devices by healthcare providers to improve patient outcomes. Furthermore, favorable government initiatives aimed at improving healthcare infrastructure and access to advanced medical technologies also support the growth of the market in Australia.

The plaque modification and removal devices market of India is expected to show a lucrative growth. The rising prevalence of coronary artery disease, attributed to lifestyle changes, urbanization, and rising rates of risk factors such as hypertension, diabetes, and obesity, significantly boosts the demand for these devices. The aging population further exacerbates the incidence of CVD, necessitating more frequent and advanced medical interventions. Secondly, advancements in healthcare infrastructure and the expanding reach of healthcare services in India enhance access to sophisticated diagnostic and therapeutic options, including plaque modification and removal devices.

Latin America Plaque Modification And Removal Devices Market Trends

Latin America plaque modification and removal devices market is projected to witness substantial growth during the forecast period. The presence of economic development and government initiatives for developing an inclusive infrastructure fuel market expansion. Major players compete in offering innovative, user-friendly, and technologically advanced solutions. However, challenges such as affordability & uneven healthcare access in some regions may hinder widespread adoption. Growing life expectancy & awareness about home healthcare services, and rising demand for medical devices for long-term care are key factors expected to boost the market growth over the forecast period.

The plaque modification and removal devices market of Brazil is expected to grow significantly owing to the growth of plaque modification and removal devices has been steadily increasing in recent years. The growing awareness among healthcare professionals and patients about the benefits of early and aggressive intervention for atherosclerosis is fostering the adoption of these devices. Moreover, supportive government policies and initiatives aimed at improving cardiovascular health, along with collaborations with international medical device manufacturers, enhance the market's growth potential. Lastly, increasing affordability and accessibility of healthcare services, driven by both public and private sector efforts, are making advanced cardiovascular treatments more attainable for a broader segment of the population.

MEA Plaque Modification And Removal Devices Market Trends

The Middle East and Africa (MEA) plaque modification and removal devices market is driven by a combination of factors including the rising prevalence of cardiovascular diseases, increasing healthcare expenditure, and advancements in medical technology. Additionally, governments and private healthcare providers in the MEA region are investing more in healthcare infrastructure and expanding access to advanced medical treatments, further propelling the market. The market is also influenced by the presence of multinational medical device companies that are expanding their operations and distribution networks in the MEA region, thereby improving the availability and adoption of these advanced therapeutic options.

South Africa plaque modification and removal devices market witnessed a significant increase in demand for plaque modification and removal devices. The growing aging population, which is more susceptible to CAD, further propels market growth. Improved healthcare infrastructure and greater access to healthcare services enhance the diagnosis and treatment of cardiovascular diseases. Government initiatives and policies aimed at improving cardiovascular health, along with an increasing number of specialized cardiac care centers, also contribute to market expansion. Furthermore, the rising awareness among healthcare professionals and patients about the benefits of early diagnosis and intervention in managing CAD supports the demand for advanced plaque modification and removal devices.

The plaque modification and removal devices market of Saudi Arabia is growing at a rapid rate. There is a high prevalence of (CVDs) in the region, largely due to lifestyle factors such as poor diet, lack of physical activity, smoking, and a high incidence of diabetes and hypertension. The healthcare infrastructure in Saudi Arabia is rapidly developing, supported by substantial government investments aimed at enhancing healthcare services and accessibility. This development includes the adoption of cutting-edge medical technologies and devices. Additionally, collaborations between local healthcare providers and international medical device manufacturers are facilitating the availability of sophisticated plaque removal technologies in the market.

Key Plaque Modification And Removal Devices Companies Insights

The market is a dynamic and competitive industry with several key players competing for market share. The companies in this market are focusing on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to substantial market share in the market.

Key Plaque Modification And Removal Devices Companies:

The following are the leading companies in the plaque modification and removal devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Abbott

- Medtronic

- Becton, Dickinson, and Company

- Koninklijke Phillips N.V.

- Stryker

- AngioDynamics

- Microvention, Inc. (Terumo Corporation)

- Penumbra, Inc.

- REX MEDICAL

- ARGON MEDICAL

- Soundbite Medical Solutions

Recent Developments

-

In April 2024, The ICE Aspiration System, developed by Expanse ICE, has recently obtained 510(k) clearance from the U.S. Food and Drug Administration (FDA). This approval marks the entry of a new competitor in the peripheral thrombectomy market.

-

Surmodics, Inc. has obtained U.S. Food and Drug Administration (FDA) 510(k) clearance for its Pounce LP (Low Profile) Thrombectomy System.

-

In October 2023, Cardio Flow, Inc., has recently obtained clearance from the U.S. Food and Drug Administration (FDA) for its FreedomFlow Orbital Atherectomy Peripheral Platform.

-

In March 2023, Penumbra launched its latest innovation in arterial thrombectomy systems: the Lightning Bolt 7. This advanced system received clearance from the Food and Drug Administration (FDA) and represents a significant leap forward in the treatment of acute ischemic strokes caused by blood clots.

Plaque Modification And Removal Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.01 billion |

|

Revenue forecast in 2030 |

USD 3.26 billion |

|

Growth rate |

CAGR of 8.4%from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Boston Scientific Corporation; Abbott; Medtronic; Becton, Dickinson, and Company; Koninklijke Phillips N.V.; Stryker; AngioDynamics; Microvention, Inc. (Terumo Corporation); Penumbra, Inc.; REX MEDICAL; ARGON MEDICAL; Soundbite Medical Solutions |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Plaque Modification And Removal Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plaque modification and removal devices market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Atherectomy Devices

-

Thrombectomy Devices

-

Chronic Total Occlusion Devices

-

Embolic Protection Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Coronary Artery Disease

-

Peripheral Artery Disease

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global plaque modification and removal devices market size was estimated at USD 1.86 billion in 2023 and is expected to reach USD 2.01 billion in 2024.

b. The global plaque modification and removal devices market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 3.26 billion by 2030.

b. North America dominated the market with a revenue share of 43.69% in 2023. The region’s growth is driven by rising prevalence of chronic diseases, rapid adoption of technological advancements, and rising elderly population.

b. Some of the players operating in this market are Boston Scientific Corporation; Abbott; Medtronic; Becton, Dickinson, and Company; Koninklijke Phillips N.V.; Stryker, AngioDynamics; Microvention, Inc. (Terumo Corporation); Penumbra, Inc.; REX MEDICAL; ARGON MEDICAL; Soundbite Medical Solutions

b. Key factors that are driving the plaque modification and removal devices market growth include the increasing prevalence of cardiovascular diseases (CVDs) worldwide, necessitating innovative solutions for the prevention and management of atherosclerosis.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."